Whenever I’m asked about how Social Security survivor benefits work, I have a simple answer:

At death of the first spouse, surviving spouses receive the higher of:

- Their own monthly benefit, or

- The monthly benefit of the deceased.

That’s the clean and straightforward answer, but it’s not quite that simple. Although Social Security survivor benefits really are pretty simple, every family is different. Unique situations and variables can introduce some complexity.

Lump Sum Death Benefit

First, let’s deal with the one-time payment formerly called a “funeral benefit.” Upon the death of a Social Security beneficiary, the Social Security Administration pays a lump-sum death payment of $255. Needless to say, the $255 one time payment doesn’t quite cover the cost of a funeral. It’s been stuck at that level for several years and inflation has significantly eroded its useful value.

There are three categories of people who may receive the death payment:

- A surviving spouse, who was residing with the deceased spouse, or

- A surviving spouse, who was not residing with the deceased, but was receiving benefits based upon the work record of the deceased spouse, or who becomes eligible for benefits after the death of the spouse, or

- A surviving child, who was receiving benefits based upon the work records of the deceased parent, or who becomes eligible for benefit after the death of the parent. The payment is divided evenly among all eligible children.

If there are no eligible survivors in either of these three categories, then no death benefit is paid.

Even though $255 isn’t a lot, who wants to pass on money that’s rightfully theirs? If the eligible spouse or child is not receiving benefits at the time of death, they must apply for benefits within two years in order to receive the death payment.

Who Is Eligible For Spouse Survivor Benefits?

Many surviving spouses are eligible for monthly benefits from Social Security, based upon their age, disability, children at home, or some combination thereof. In general, spouse survivor benefits are available to:

- Surviving spouses, who were married at least 9 months, beginning at age 60. Benefit amount may depend on the age at which you file for benefits. Note: there are multiple exceptions to the 9 month requirement.

- Disabled surviving spouses, who were married at least 9 months, beginning at age 50. Benefit amount may depend on the age at which you file for benefits. Note: there are multiple exceptions to the 9 month requirement.

- Surviving spouses, of any age, caring for the deceased’s child aged 16 or younger or disabled.

- Former spouses, who were married at least 10 years, beginning at age 60. Benefit amount may depend on the age at which you file for benefits.

Calculating the Benefit Amount

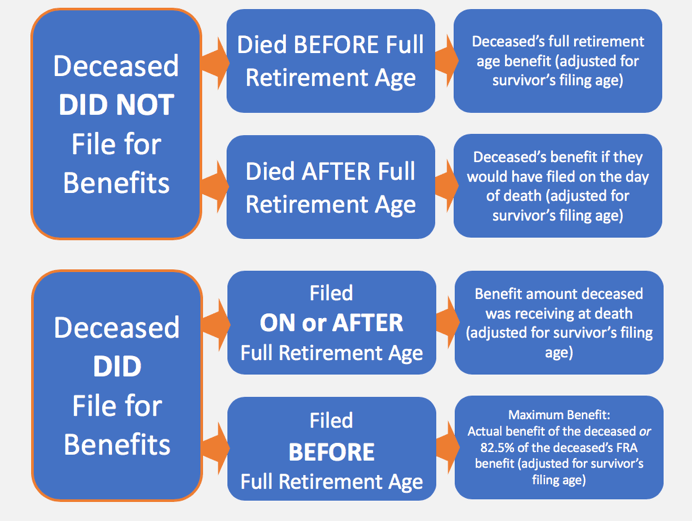

Figuring out how much you’ll receive in Social Security survivor benefits requires a little math. The simple explanation is that at the death of the first spouse, surviving spouses receives the higher of their own benefit, or the benefit of the deceased. But this simple explanation doesn’t consider (a) what age the deceased filed for benefits, if they did at all, and (b) when the surviving spouse decides to file.

If the Deceased DID NOT File for Benefits

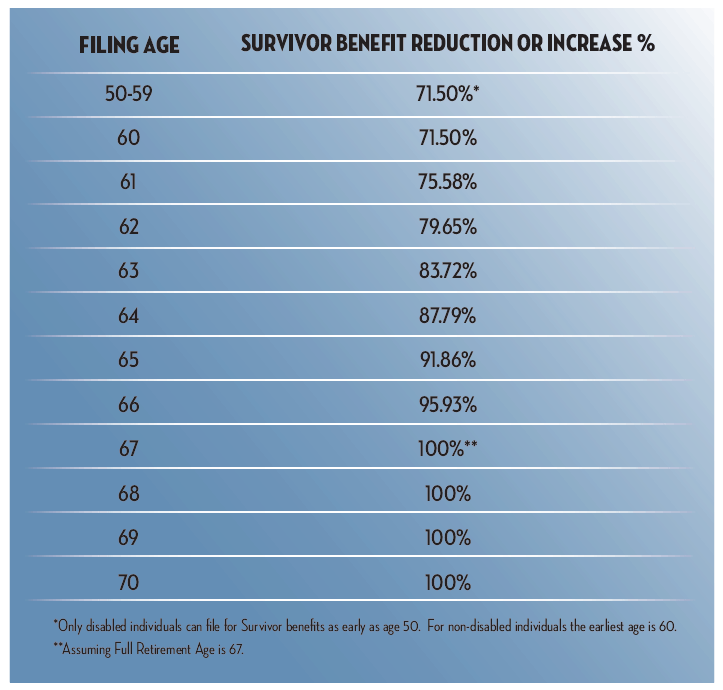

If the deceased spouse never filed for benefits, but died on or before their full retirement age, the calculation is relatively easy. The survivor receives the deceased’s full retirement age benefit, adjusted for the survivor’s filing age (see chart below).

If the deceased spouse never filed for benefits, and died after their full retirement age, the survivor receives the deceased’s benefit in the same amount it would have been on the date of the deceased’s death (including delayed retirement credits) reduced for the filing age of the survivor. You can see the next chart for more information on age-based reductions that come into play in both cases.

But what if the deceased spouse filed for benefits before he passed away? If this is the case, it could get a little more confusing.

If the Deceased DID File for Benefits

If the deceased spouse filed for benefit on or after their full retirement age, and the surviving spouse is at full retirement age, the benefit amount payable to the survivor will remain unchanged. If the surviving spouse is less than full retirement age, the amount the deceased spouse was receiving would be reduced by the filing age of the survivor.

If the deceased filed for benefits before their full retirement age, the surviving spouse is entitled to the full retirement age benefit of the deceased (reduced for survivors filing age) but will always be limited to the larger of the actual benefit of the deceased or 82.5% of the deceased’s full retirement age benefit.

This 82.5% limit is a special rule often called the “Widows Limit” but the technical name is the RIB-LIM. It’s meant to offer some protection for surviving spouses when the deceased spouse filed at, or near, the earliest age possible. This rule states that if your deceased spouse filed early, you’ll be forever limited to either the amount they were drawing, or 82.5% of their full retirement age benefit. This rule has been a real lifesaver for some widows!

When it doesn’t pay to delay

Here’s where this gets really interesting. If your deceased spouse filed early for benefits, and you are also under full retirement age, there may be no reason to delay your filing beyond a certain age. It may be possible that your survivor benefit will not increase beyond your age 62 and 9 months!

For example, let’s assume Jim’s full retirement age benefit was $2,000. However, he filed at 62 and began receiving and age-based reduced benefit of $1,500. He died two years later. Because of his early filing, the most his surviving spouse will receive is the greater of his actual benefit ($1,500) or 82.5% of his full retirement age benefit ($2,000 x 82.5% = $1,650).

Based on the reductions for her filing age, she’d hit the 82.5% ($1,650) of his benefit right in between age 62 and 63. Once she was was at this age, there would be no benefit to continuing to delay filing for benefits. Further delay will not increase the survivors benefit!

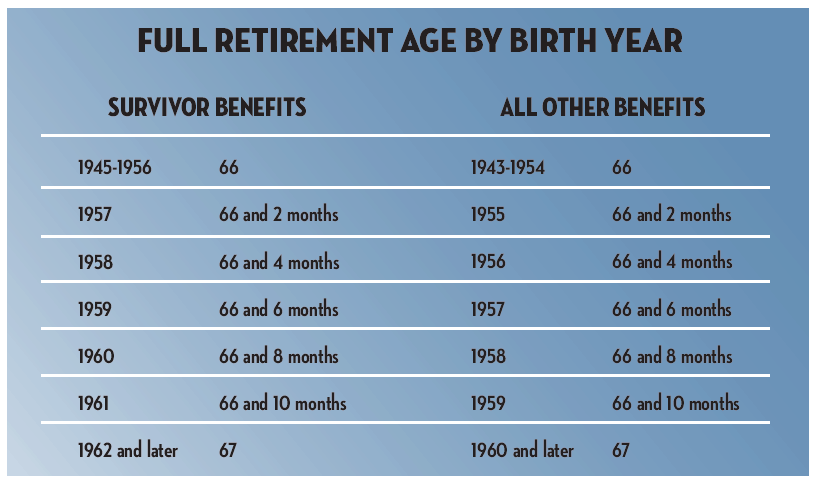

FULL RETIREMENT AGE FOR SURVIVOR BENEFITS

If you were born before 1962, you need to understand that the definition of “full retirement age” is different for survivor benefits than it is for all other benefits.

Knowing exactly when you are full retirement age is important when filing for your survivor’s benefits. Why? Because if the survivor benefit is the highest benefit you’ll be entitled to, there is generally no benefit to delaying your filing beyond that age.

Advanced Filing Strategies for Survivors

In early 2018 the Office of the Inspector General released a report with some shocking news. 82% of widows and widowers who are receiving Social Security survivors benefits are actually entitled to a higher monthly benefit payment. The only problem is, the SSA never made them aware of this. This affected an estimated 9,224 widows and widowers 70 and older who could have received an additional $131.8 million in Social Security benefits had they been told they could delay filing for retirement benefits until reaching age 70.

There’s no need to wait for them to tell you about it…let’s jump in right now.

Prior to 2016 there were several popular Social Security filing strategies that would allow an individual to file for certain benefits and later switch back to their own benefits. The benefit of this was to allow their own benefits to grow with the 8% per year delayed retirement credits (from chapter xx) However, law changes in 2016 did away with many of the Social Security filing strategies. The one that remains belongs to survivors and it can be powerful. Here’s how it works.

If you have a benefit based on your own work history, it could make sense to file for a reduced survivor’s benefit as early as 60. While you are drawing your survivor benefit, your own benefit grows every month you delay filing for it. Generally, these adjustments could grow your benefit by 77% from age 62 to age 70. At age 70, you simply switch back to your own benefit (which is now higher).

Let’s say Paula has her own benefit of $1,500 per month that she could take at 67, her full retirement age. Her husband passed away and she is eligible for a survivor benefit of $1,200 per month. If she restricts her application to a survivor benefit only, she can collect benefits while letting her own benefit grow.

From age 62 to 69, she could receive $1,200 per month as a survivor’s benefit. Once her own benefit has grown to the maximum, at age 70 and beyond, she can simply take that and receive $1,860 per month for the rest of her life.

The Social Security Administration discusses this strategy at this link.

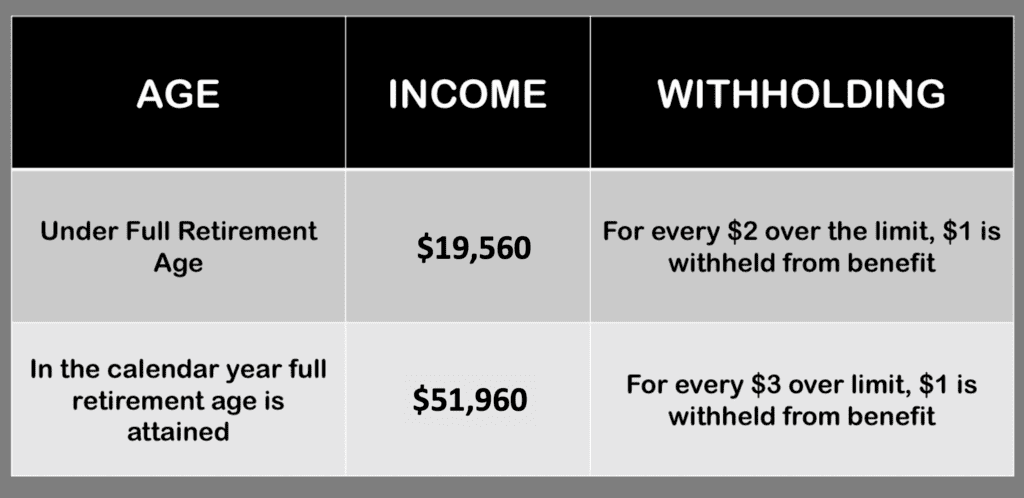

Earnings Limit On Survivor Benefits

If you file for any Social Security retirement benefit (your own, spousal or survivor’s) before your full retirement age, there is a limit to how much you can earn. The fact that this also applies to survivor benefits will often catch individuals by surprise.

If you are under full retirement age you are limited to $19,560 in wages or net earnings from self employment. If you exceed that limit, your benefit will be reduced by $1 for every $2 you go over. The one exception is the calendar year you turn full retirement age. For that period, your limit is a much higher $51,960. The amount they’ll reduce your benefit by is more generous as well.

Once you are full retirement age, there is no limit to the amount you can earn while drawing Social Security. You can read my article on the Social Security earnings limit or watch my video.

NOTE: Although the SSA uses a slightly different table for determining FRA for survivor benefits, the earnings limit is always tied to FRA for retirement benefits.

Benefits Available to Children & Parents

Eligible spouses aren’t the only ones that can receive Social Security survivor benefits. Dependent children and parents may also be entitled.

If you want to learn more, here are the best resources on the topic:

Children’s Benefits:

Social Security Benefits for Children: The 4 Most Important Things You Should Know

Social Security Benefits for Grandchildren

Parent’s Benefits

Social Security Benefits for Dependent Parents -Article by Mike Piper, the author of “Social Security Made Simple.”

How To Claim Survivor’s Benefits

To begin receiving survivor’s benefits, you must make a claim with the Social Security Administration. Survivor’s benefit’s claims may not be made online. You can start the claims process over the telephone, 1-800-772-1213, or go to your local Social Security office. Making an appointment may reduce your wait time.

The death should be reported to the Social Security Administration as soon as possible. In many cases, the funeral home can make that notification. You will have to provide the funeral home with the deceased’s Social Security number.

Documents To File A Social Security Survivor Claim

The Social Security claims process may require the following documents. While each document may not be required, it is easier to come prepared than to have to make several trips or follow-up appointments.

- Proof of death—either from a funeral home or death certificate;

- Your Social Security number, as well as the deceased worker’s;

- Your birth certificate;

- Your marriage certificate, if you are a widow or widower;

- Dependent children’s Social Security numbers, if available, and birth certificates;

- Deceased worker’s W-2 forms or federal self-employment tax return for the most recent year; and

- The name of your bank and your account number so your benefits can be deposited directly into your account.

If you don’t have all the documents you need, start the claims process anyway. In many cases, your local Social Security office can contact your state Bureau of Vital Statistics and verify your information online at no cost to you. If they can’t verify your information online, they have other ways to help you get the information you need.

Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. Also…if you haven’t already, you should join the 100,000+ subscribers on my YouTube channel!

My mom passed away and she drew more social security than dad. Can he draw hers instead of his

Filed spousal Survivor support in October 2021. Just received a letter stating I will receive the benefits. Also said social security will not pay from Oc2021 to October 2022. Does this means no back pay

I just found out I am eligible to receive Survivor benefits. I have an appt with SS the middle of next month.

If I take survivor benefits now and switch to my own benefits at my full retirement age (which will be more than the survivor benefits), will I be allowed to earn as much as I want or will I be locked in at the lower rate of approx $19K per year?

what do you mean filed for benefits

My daughter and I get $940 that we split every month since my wife passed almost 3 years ago. My daughter turns 16 in August, we will still get the benefits?

My husband passed away June 15 2020 at a young age of 34 yrs old and we didn’t have any children biologically together or adopted either. We weren’t legally separated though the courts at all but did live in separate households the last couple yrs he was alive. Do I still qualify for survivor’s benefits since he and I were still legally married when he passed away and when would I be able to receive those benefits?

What is the average wait time for approval of survivor’s benefits? No kids, deceased had not filed for any retirement benefits and no divorced spouse involved.

My friend’s husband passed away young with only 36 social security credits. Can the widow collect any social security benefits? He did, after all pay social security taxes for those 36 credits.

If a man have multiple children is the SS benefit split between all the legitimate children?

My late husband passed in 1994..he was disabled..we was married 11 years..I received social security survivors benefits on my 3 children ..until they turned 18..I received widows benefits until I remarried..I am now 60..Am I entitled to my late husbands benefits now?

Thank you so much. Great summary! Very helpful.

My sister is 62. Her 62 year old husband died in 2020. she started collecting survivor benefits at 61because she was out of work. Now 10 months later she has an opportunity for a $40,000 per year job. she would stop her survivor payment but was told by SS that she would have to pay back what she had collected in the last year. Approximately $10,000 in a lump sum payment. Is that correct?

My grandson passed away suddenly at 32 yrs old he left a wife and a baby behind the last year he worked he made $130,000 can his daughter collect his social security ?0

My husband and father of two children died several years ago and the children get survivors benefits checks , I am now remarried , if my now husband were to legally adopted my two children would they lose their survivors benefits ?

I’m 53yr been in supliment disability for 17yr I live in New York, my mom lived in Nevada she died feb.2,2021 at 73yrs im her beneficiary of life insurance policy she was not married im only daughter .am I entitled to receive surviors benefits and or her stimulus check and her money in bank accounts?

First question, am I able to create a “mysocialsecurityaccount” for my late husband? I would like to know who all is collecting benefits under his account. He was married once before me for over ten years and has a daughter by that marriage. I’ve been told that his ex-wife is collecting benefits for herself and she is remarried. Also, I believe his father is fraudently collecting a parents benefit so I would like to know is there a way for me to access his benefits? Also, if his child , his ex-wife, and his father are all collecting benefits now,… Read more »

Both my children have not received their benefits for this month and it usually come in for them the 3rd week. Any help as to why they haven’t received it yet? Any advice would work. Thank you.

My spouse on disability died 2006. At the time I was told to apply for widows benefits when I turned 60, which I did. I was told I should apply for survivors widows benefits from ss disablity when I turn 62, but I was told by social security that I was misinformed that widows benefits was all I was entitled to. Which is correct?

MY DAD PASSED AWAY IN 2017 MY MOM WAS HIS SOLE CAREGIVER AND HASNT WORKED IN YEARS SHE IS ONLY 53 ARE THERE ANY BENEFITS THAT SHE CAN CLAIM SINCE SHES NOT DISABLED

I’m on Ssi have been since 1991 also my dad passed a few years ago maybe 5 yes but he was drawing disability benefits not Ssi he worked made good money all his life so just reg disability strokes heart attacks etc started drawing his check so My time on Ssi meets the 22 yr requirement for survivors bennifits and all however I applied couple years ago etc they turn me down cause said ok I was married divorced while on Ssi Married again lost my Ssi due to my new husband made to much money yeah rite we struggled… Read more »

If my boyfriend named me as his beneficiary and he was on social security how does that benefit please up after the death

I’m receiving survivorship benefits along with my 13 year old son. When he turns 18 and loses his benefits, will lose mine as well I’m 45

Survivorship benefits for parents of children who turned 18

My Dad died on 12/25/2020. When will I receive his Social Security Benefit. As of 02/02/2021 I have not received my Dad’s death benefit.

Can I draw off mine social security now going on 65 in April would it be more than I’m drawing now off widow benefits just wandering thanks

If you have two full retirement ages, survivor and individual, which one is used to determine your benefits? Individual retirement age is in Jan 2022 but survivor is Nov 2021.

I am 67…my husband dies July 2020….full s…..I filed ____. Website just says processing for these months..no other word..no 250…..trying to live on 800……mouse car and all about to go into default…..does s pay the months they did not pay for along with the re payment s?????,,…any one know????

Can I draw more off my earnings now at 64 if I switch

I applied for spouse benefits in July 2 and is October no answer. I called SS and they said is approved but no money is coming. I keep calling but no answer. What should I do?

I keep getting calls bout my s.s disability! Had a heart attack and died but the doctor brought me back in 2014 can you draw anything had 2 stents

My wife just passed leaving me with our 2 children. She was a stay at home mom. We were not officially married but together for 16 years. Our children are 7 and 11. Are we eligible for anything?

How long does it take to start receiving survivor benefit payments once the claim has been adjudicated?

My son father passed away at the beginning of May. We just applied for his benefits today. They said he would get a check every weds of the month. Will he get any back paid or will his first payment be the third weds of July?

I am born 3-9-1940,,,,,,,, was widowed 1st time, at 37, continued to work, and 12/1969 at I remarried, he had cancer on day 1, died 9-2000, I was 60, took his ss, don’t know if he ever took his wife’s benefits (she died in 1985), so when he died 9-2000, I applied for social security benefits….(received $800.00, now receive 1292.00). I would like to know if I will receive a check from the government now because of this coronavirus?

I am now 80 years old.

My son will receive benefits for about 6 more months but would like to get a job. Will this affect his benefits? He i 8 now but benefits have been extended to July 31 when he finishes school.

My wife just died and I just filed for my SS early and just got my 1st check. Now I will have to go back to work. Can I collect her survivors benefit until I collect mine later now that I just starting getting mine? I will have to stop mine now.

I am 74 years old and was on disability at age 42 which changed to full retirement automatically at age 67. My spouse is 40 years of age. Should I pre-decease my spouse before her age of 67. What will be the formula of her SSA Widows benefit. Will she draw what I am being paid at my death or what I would have been paid had I survived until she reached full retirement age.

My husband of 38 years died 10 years ago at age 55. I remarried at age 56. I started collecting my own benefit at age 62 which was only $235 per month because I was mostly a stay at home mom for most of our married life together. I am now 65 years old. Now with Medicare deduction I get $29 per month. Is there any way I can collect my deceased husbands benefits now at age 65? It seems unfair that you are disqualified just because of the age you remarry at.

My 16 year old is quitting school. In Georgia can she still get her survivors benefits from her deceased father,?

I am 76 yrs old and receive S/S plus a PERS from Nevada. I lost part of my S/S when I retired because of the “windfall”. My husband died in Sept. I called S/S in Oct to do a phone interview and it never happened, so I went to the main office here and filed. That was Nov 7. To date I have never heard a word on any of the benefits due me, we were married 27 years. I went to another office today and was told I should keep my S/S income as it was more than I… Read more »

My sister x husband Died two years ago and I want to know if there’s any survivor benefits for a divorce it’s a surviving spouse when that can be collected how long you would have to been married for etc. etc.

I started drawing ss at 62. Husband was 11 years younger than me. I only recieve $925 per month. He made a lot more money but he passed away at 53. Can I get any SS from him or not, or do I have to wait would have been his retirement age?

How soon after filing for survivor benefits do they take effect

My husband died Sept. 4th, we applied for survivor benefits Oct. 29 and got the approved favorable decision on Nov. 6th for lump sum and monthly payments for 2 kids and myself. Will I get the direct deposit amount this month…November? I heard it is normally 3rd Wednesday of each month but did not know when I would actually get the back pay and lump sum amount and then the ongoing monthly amount?

My husband died at 56 iam 36 . He was trying to get his disability.

If I get disability and your childs fathers dies and he apply for survivor benefits will it effect my disability check?

i recieve survivors benefits from the va will my social security survivors benefits be deducted from that

I am currently 42 and have been receiving SSD since 2006. My late husband was in the military and died while active duty in 2012 at age 39. Would I be eligible for survivor’s benefits from SSA? If so, at what age would I be eligible to file for his SSA SB’s? I currently receive VA DIC, Military SB’s (less than $200), and my own Disability benefits. We were married for a little over 2 years when he died, and I have not remarried (and never will). So what or when should I seek benefits, if any, from SSA?

If I was considered disabled before the age of 22 by the social security department and my Dad passed away would I of had to be living under his roof at the time of death to collect survivors benefits?I’m 28 now and I’m on both SSI and SSDI so I know if approved I would take the greater of the 2 but there would be no more SSI.Second question,if I’m approved for survivor benefits do I still get to make unlimited income in retirement without affecting my survivor benefits.and if I decide to try and go back to work after… Read more »

Friend’s wife died at 81 and he is 86 what does he needed to do from a social security stand point want me to take him to the social office