Just how much you owe in tax on Social Security benefits can be a huge shock if you’re unprepared.

I vividly remember the fact that the amount of tax on Social Security benefits was one of my Dad’s biggest retirement surprises.

He didn’t expect to pay so much in taxes, so in his first year of retirement (and first year claiming his benefits) it came as a nasty surprise when he found out that up to 85% of his Social Security benefit could be counted as taxable income!

My dad wasn’t alone. A lot of retirees have no idea of the big tax bill that could be waiting for them in their first spring after retirement.

What to Expect from Taxes on Social Security Income

Ultimately, in my dad’s situation, we were able to mitigate some of his tax burden. But for a good part of it, he was stuck.

As you can imagine, he didn’t like this one bit. And you might not either if you find yourself in the same position.

Every year individuals retire and are faced with sticker shock when they find out how much they’ll have to pay in taxes on Social Security income.

To some, it doesn’t seem fair. You’ve worked for years and paid your Social Security tax as the admission ticket to a Social Security benefit.

Now that you’re collecting that benefit, you have to pay taxes? Again?

Taxes on Social Security Income Are a Relatively New Thing

At first, Social Security benefits were not taxable. That all changed with the passage of 1983 Amendments to the Social Security Act.

Under this new rule, up to 50% of Social Security benefits became taxable for certain individuals. 10 years later, the Deficit Reduction Act of 1993 expanded the taxation of Social Security benefits.

Under this Act, an additional bracket was added where up to 85% of Social Security benefits could be taxable above certain thresholds.

The combination of these laws left us with the current tax structure on Social Security benefits. Today, somewhere between 0% and 85% of your Social Security payment will be included as taxable income.

Since those brackets have been added, they’ve never been changed! As far as I know, there are no plans to change them in the future. This means that as the general income levels rise, more individuals will be subject to taxation on their social security benefits.

For proof of this, look at what’s already happened. Since taxes on SS benefits were introduced, the revenue coming in from these taxes have skyrocketed. Here’s an example: In 2008, taxes were slightly above 15 billion dollars. In 2017, this amount was 130% higher!

How to Know How Much of Your Benefit Is Subject to Taxes

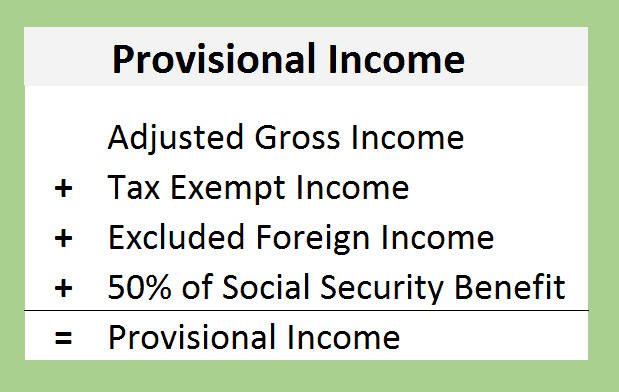

In order to determine how much of your Social Security benefits will be taxable, you first have to calculate “combined income.”

I’m not a tax professional, but to my knowledge, the only place this term is found is when it relates to Social Security benefits. It’s a formula by which the IRS determines how much of those benefits you receive should be included as ordinary income on your tax return.

Combined income can be roughly calculated as your total income from taxable sources, plus any tax-exempt interest (such as interest from tax free bonds), plus any excluded foreign income, plus 50% of your Social Security benefits.

Once you’ve calculated your “combined income” you can apply it to the threshold tables to determine what percentage of your Social Security will be included as taxable income.

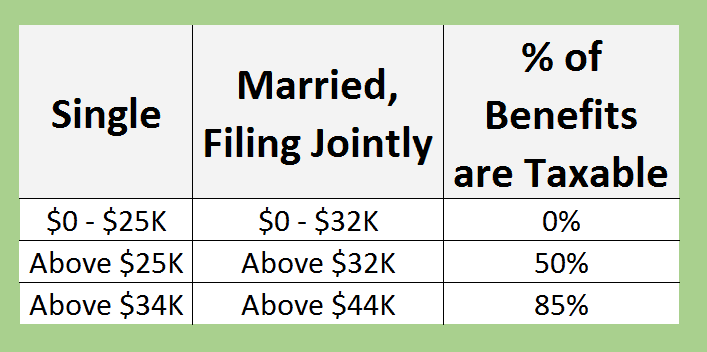

If your total “combined income” is less than $32,000 (or $25,000 if you’re single), none of your Social Security benefits will be taxable.

However, if you are married and your total combined income exceeds $32,000 (and $25,000 for singles), then 50% of the excess is the amount of Social Security benefits that must be included in taxable income.

If your combined income exceeds $44,000 (or $34,000 for singles), then 85% of the excess amount is included in income.

An Example of How Combined Income Calculations Work

That can seem really confusing when we’re just talking about things in theory. Let’s look at a more tangible example so you can better understand how taxes on Social Security benefits are calculated.

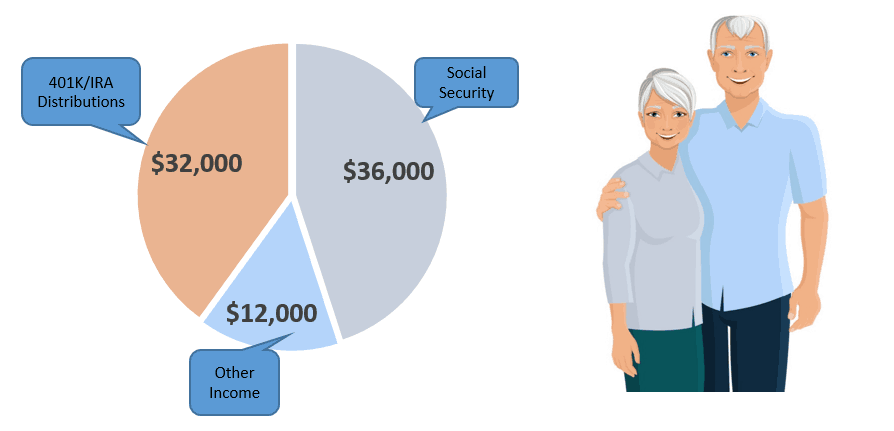

Imagine that Tim and Donna have recently retired. They have some rental property that generally averages $12,000 in net annual income.

Their combined Social Security benefit will be $3,000 per month, which equals $36,000 per year. In addition to this income, they will take an annual distribution from their IRA in the amount of $32,000.

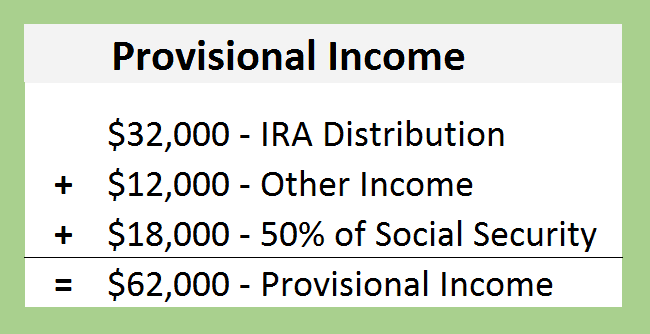

Using the income from those sources, here’s how the combined income would be calculated — and remember that only half of the Social Security income is counted in the calculation:

From this, we can see that Tim and Donna have $62,000 worth of combined income. From here, we can see how much of their Social Security benefit is taxable.

How Your Combined Income Impacts the Tax You Pay on Social Security Benefits

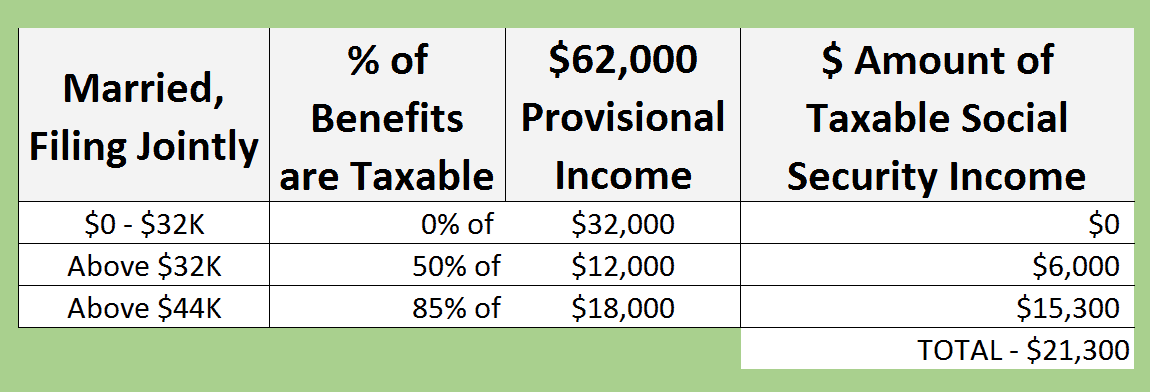

Based on a married couple with a combined income of $62,000, we can return to the thresholds to determine how much in tax on Social Security benefits they might fact.

The first $32,000 of combined income has no impact on whether or not a Social Security benefit is taxable. 50% of the amounts between $32,000 and $44,000 will be added and then 85% of the amount in excess of $44,000 will be added.

As a rough calculation, a married couple with a combined income of $62,000 would have about $21,300 of taxable Social Security income:

Since you can only spend the dollars you keep, you need to be familiar with the rules about when and how much you may pay in taxes on Social Security benefits.

You don’t have to be a tax expert; I know I’m not. But I do understand enough to know how to roughly calculate the amount of tax on Social Security benefits — and you should too.

If you need to dig deeper and get specific advice on your situation, please consult your tax advisor or CPA.

Need More Information on Social Security?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group.

It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the 326,000+ subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing that you don’t want to miss: Be sure to get your FREE copy of my Social Security Cheat Sheet. This handy guide takes all of the most important rules from the massive Social Security website and condenses it all down to just one page.

For SS taxation purposes, nearly ALL of your income is counted. This includes distributions from a retirement account. What you may be thinking of is the SS earnings limit. Distributions from a retirement plan do not count as “income” for that purpose.

Devin,

I’m a little confused by the Provisional income chart above. I thought 401k/IRA weren’t included in provisional income and your chart social security basics says 401K/IRA are not considered part of provisional calculations for taxable social security income. Help me understand if 401K/IRA are part of provisional calculations.

thanks

Kevin

Or would it be just taxable of both your social sercuity and your Pension added together if this amount would be between 28,000-29,000?

For example if I take social sercuity at age 65 for a single would my pension be included to the total of what I would make per yr? Example at I had a total of what I made last at work with my earnings& my pension totally between 28,000-29,000.How much taxable would I pay on the entire 28-29,000?Or what would be over 25,000? So how much percentage should I have social sercuity with hold? Around 7%? Thank you so very much!!