Not too long ago, I saw a participant in the Texas ORP make a massive mistake.

Texas ORP is the Texas Optional Retirement Program. It’s something that, when initially hired, teachers can choose to opt into. Alternatively, teachers may be able to choose the Teacher’s Retirement System (TRS) instead.

This is a big decision if you have the choice, because you only get once chance to make it.

Most teachers are automatically enrolled in TRS. However, certain employees of public colleges are eligible to choose the Texas ORP instead of the TRS pension plan.

Although both of these accounts are meant to be for retirement savings and income, they each approach this goal using two distinctly different paths.

I’ll tell you more about the teacher who made a simple little move — on the recommendation of her financial advisor! — within Texas ORP that cost her thousands of dollars. She’s not the only one I’ve seen make this mistake, either.

But first, let me explain a little bit more about both programs and how they work.

What Is Texas ORP?

The Texas Higher Education Coordinating Board describes the Optional Retirement Program in the following way:

“The Optional Retirement Program (ORP) is available as an alternative to the Teacher Retirement System (TRS) for full-time faculty, librarians, and certain administrators and professionals employed by Texas public institutions of higher education.”

Essentially, certain higher-education employees can opt out of the Teachers Retirement System in favor of a plan that allows them to make their own contributions and get a match from their employer.

The dollars in the Texas ORP can be invested in a variety of ways. On the surface it works much like a 401(k) or some other employer sponsored retirement plan. This intent of creating this plan was to give these employees a choice of how they saved for their retirement needs.

The Difference Between Texas ORP and TRS

TRS is a defined benefit program, whereas the ORP is a defined contribution program:

- A defined benefit plan, like TRS, specifies the benefit that will be payable to you on a monthly basis when you retire. This amount is based on a formula that includes factors such as years of service and average salary.

- A defined contribution plan, like the ORP, specifies what percentage or dollar amount of your paycheck is withheld and saved in an investment account. In addition to your salary deferrals, your employer will often match your salary up to certain limits. The amount you have in this plan at retirement is not set. It is usually determined by factors such as investment performance and how much you saved in the plan. The ORP falls under this category.

The TRS plan is set up to provide you a specified income stream in retirement. The ORP, on the other hand, is set up to provide you an unspecified lump sum at retirement.

How Do You Decide Between the ORP and TRS If You Have the Choice?

The obvious follow-up question here is, which program is better for you if you have the ability to choose between them?

The Texas Higher Education Coordinating Board, like most states, takes a hands-off approach to recommending one plan over the other. In their handout “An Overview of TRS and ORP,” they suggest you talk to your employee benefits office or your authorized ORP company representative.

But you need to beware. Your employee benefits office is not going to give you specific advice on choosing a plan. This leaves you with one suggestion for help on this decision: your authorized ORP representative.

And that’s a problem, because this “ORP representative” is usually an investment or insurance salesperson. They get paid only if you choose to enroll in ORP instead of TRS. Do not expect unbiased advice.

Many of these ORP providers are from insurance companies who use products with heavy fees and heavier advertising language. Consider this language from one of the larger authorized ORP providers in Texas:

“The Texas ORP gives you the significant advantages of portability, tax deferral for contributions, interest and earnings and flexible investment options.”

That statement is problematic for me. Why? First, none of those “significant advantages” are all that significant. Second, most financial services companies like this have gotten really good at changing the retirement equation.

Over time, they’ve used some great marketing to convince individuals that retirement planning should be about accumulating a lump sum amount. The idea is that this lump sum amount will be able to generate an income for retirement.

The problem is, it takes a large lump sum to generate the same income you could receive from a pension like TRS. For this reason I usually recommend TRS over ORP. For retirement income purposes, I simply can’t make the numbers work in favor of the ORP.

How the Math Works When You Compare TRS and ORP

Here’s an example of how the math works out. For this story, we’ll talk about a fictional set of teachers named Mich and Katie, and we’ll use the contribution rates currently used in Texas.

Mitch and Katie began teaching at a Texas university on the same day in 2016. They each started with a salary of $45,000 per year.

With funding shortfalls, they figured they could only expect an average cost of living increase of 1% per year throughout their career. Both of them planned to work for the next 30 years until they would be age 65.

After weighing their options, they each came to a different conclusion about which plan would best fit their retirement needs. Mitch chose the Optional Retirement Plan. Katie’s choice was to participate in the Texas Teacher’s Retirement System.

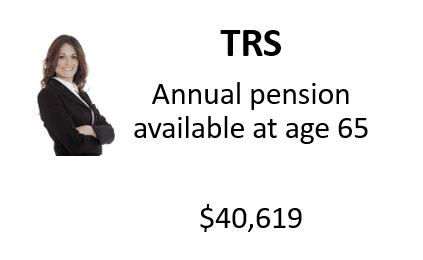

Katie wanted to work and enjoy life. The thought of managing investments did not appeal to her. After running her numbers she calculated that her pension amount would be approximately $40,619 per year.

Katie wanted to work and enjoy life. The thought of managing investments did not appeal to her. After running her numbers she calculated that her pension amount would be approximately $40,619 per year.

Since she was conservative, she didn’t see how she would ever beat that with an investment portfolio on her own.

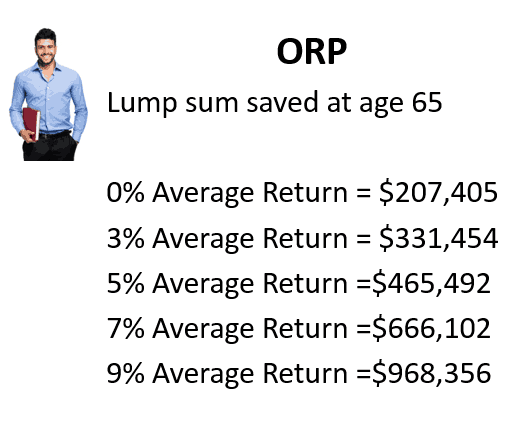

But Mitch was different. He loved the idea of a little risk and controlling his investment options. His thought was that he should be able to substantially increase his retirement income by managing his own portfolio.

He ran a hypothetical future value calculator that showed he could grow his account to nearly a million dollars if he could achieve an average annual return of 9%!

It’s hard to argue with nearly a million dollars, but here’s the important question:

How much retirement income could he expect if he would have actually averaged a 9% rate of return?

It’s not as much as you think.

A Quick Side Note on the 4 Percent Rule

Many financial planners follow what’s called the “4% rule.” This rule says that if you withdraw 4% of your retirement savings each year, and adjust for inflation, your money should safely last 30 years.

(There are some really smart people who think it should be less and really smart people who think this rule could be adjusted higher. In other words, take the 4% rule with a grain of salt either way!)

Using the 4% rule rule, Mitch could expect $38,734 in his first year of retirement. The first thing to notice is that he is not even getting the amount of income that Katie is receiving. It’s also assuming that everything goes right for him!

The fact is, Mitch probably wouldn’t even get that amount of income. The big flaw in the calculation is the same flaw that your ORP company representative will probably repeat.

Here it is: You’re not going to get a 9% return! Sure, the total stock market has averaged that over the past 30 years… but you’re not the market. You’re an investor like me.

We have emotions and occasionally make irrational decisions about our investments, usually at the worst possible time. If you don’t believe me, look at this study by Dalbar.

They found that the 20-year return for the average mutual fund investor was 5.19% (over the same period the stock market averaged 9.85% annually).

Even if you’re more disciplined than the average investor, you still have to consider the performance drag from investment and management fees. If you are using annuity products, which are really popular in these plans, these fees can get really high! I’ve seen them as much as 3% per year.

So what can you expect as an annual rate of return if you choose the ORP? Personally, I wouldn’t project much more than a 5% average annual return.

While that would still leave you with a substantial $465,492 at retirement, it simply could not safely produce the same amount of income as the teacher’s retirement pension. In fact, your income would be cut in half!

Using the same “4% rule,” you could only generate approximately $18,619 in annual income. That’s a long way from the $40,619 that Katie will receive.

If you’re in the middle of choosing between ORP and TRS, you may want to consider going with TRS.

But what if you’ve already made your choice, and you’re stuck with ORP? Don’t despair! Your retirement may not be in jeopardy… but you need to avoid making the big mistake the teacher at the beginning of this article that I was telling you about made with hers.

Watch Out for Social Security Reductions…

Many employees of Texas colleges do not pay Social Security taxes. If they have never paid this tax at a prior job, they are not eligible for a Social Security benefit.

But many of these employees have worked in other jobs where they have paid these taxes and earned the required 40 quarters for Social Security benefit eligibility.

In a situation where there are both covered (Social Security taxes paid) and non-covered (no Social Security taxes paid) earnings, the Social Security Administration has some funny rules about how they reduce benefits.

I won’t use the space this article provides to go into a full discussion of the Social Security rules, but you should learn more about the Windfall Elimination Provision (WEP).

The Basics of the WEP is that your benefit can be reduced by up to $413 (for 2015) every month if you held a job where you did not pay Social Security tax.

…And Avoid That BIG Mistake

Now, on to that big mistake that I’ve seen so many teachers make. It’s not due to how the funds are invested, but in what happens when the funds begin to be distributed.

For those workers who are also eligible for Social Security, there is often a blanket assumption that those benefits will automatically be subject to the reduction from the Windfall Elimination Provision.

That’s just simply not true.

You can get a Social Security benefit that is not reduced by the Windfall Elimination Provision into your early 70s if you avoid the triggering events.

The Social Security Administration has a great piece on Texas ORP and Social Security on their website. The rules found there on how the Texas ORP triggers the WEP can be boiled down to these points:

- The trigger for the WEP reduction does not occur until you become entitled to benefits from your Texas ORP.

- Entitlement does not occur until you take a distribution

- For purposes of the WEP trigger, a distribution is

- A rollover of any type

- A lump sum distribution

- Periodic Payments

- For purposes of the WEP trigger, a distribution is

- Entitlement does not occur until you take a distribution

- Distributions are required no later than April 1 of the year following the year you attain age 70 1/2.

So, as long as you don’t meet the triggers, you are not “entitled” to your Texas ORP and thus are not subject to the Windfall Elimination Provision.

This could mean several years of a Social Security benefit with no reduction.

Here’s how those rules apply in real life.

$46,000 More?

Depending on when your birthday falls, on average, you have 113 months between your age 62 and April 1st of the year following the year you attain age 70 1/2.

The current maximum WEP reduction is $413 per month. You could file for Social Security benefits at age 62 and have all those months with no deduction as long as you don’t become “entitled” to your Texas ORP.

That could mean an additional $46,000 in Social Security benefits ($413 per month x 113 months). I should point out that those figures do not include increases from the cost of living adjustment.

For some, this may not be an option. It’s possible that you will rely on the income created by these savings to provide your retirement income.

However, some strategic retirement income planning may allow you pull income from other sources and eliminate the need for touching those Texas ORP dollars until you are required to take a distribution.

Remember that your Texas ORP account can stay where it is when you retire. If your financial advisor tells you that you need to do a rollover (or anything else) with your Texas ORP, be very inquisitive. There could be $46,000 at stake.

Have More Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the 100,000+ subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing that you don’t want to miss: Be sure to get your FREE copy of my Social Security Cheat Sheet. This handy guide takes all of the most important rules from the massive Social Security website and condenses it all down to just one page.

I am a participant in the Louisiana Optional Retirement Plan and visited the local Social Security Administration Office to discuss if the WEP reduction would be triggered when entitlement, i.e. the first ORP distribution, occurs. My intent is to satisfy all of the criteria set forth in Social Security POMS RS DAL00605.364 Determining Pension Applicability, Eligibility Date and Monthly Amount and, therefore, delay the WEP trigger until April 1 of the year following the year I attain 70 ½. I was directed to speak with a supervisor at the local Social Security Administration Office and was told that the WEP… Read more »