Social Security benefits are changing forever at the end of 2020.

Here’s what’s going on.

Let’s Start with a Critical Factor: Your Full Retirement Age

Under the original Social Security Act of 1935, workers had to reach age 65 to receive a full retirement benefit.

This “full retirement age” was actually simply based on the fact that many state pension systems and the Railroad Retirement Benefit system used age 65, so, the Committee on Economic Security – the group that designed the US SS system – decided to go with an age that was already commonly used.

They also considered using age 70, but ultimately decided that age 65 was more reasonable. Bottom line? Their choice was pretty subjective!

This full retirement age didn’t change from the beginnings of Social Security all the way until 1983.

This was the other time in history where, like today, the Social Security trust fund faced a crisis and nearly ran out of money! To keep this from happening, The NATIONAL COMMISSION ON SOCIAL SECURITY REFORM (which is more commonly referred to as the Greenspan Commission) made a series of recommendations to Congress about how to keep the program solvent for the next 50 years.

How Changes to FRA Impact Your Ability to Get Full Social Security Benefits

One of the Greenspan Commission’s big recommendations was to increase the full retirement age to age 67. To make this change a little easier to digest, they recommended that the change only impact those who were more than 20 years away from full retirement age and that the change would gradually phase in over a period of 22 years.

The first changes began by changing the age from 65 to 66. It stayed at 66 for 11 years. But now… it’s going up again.

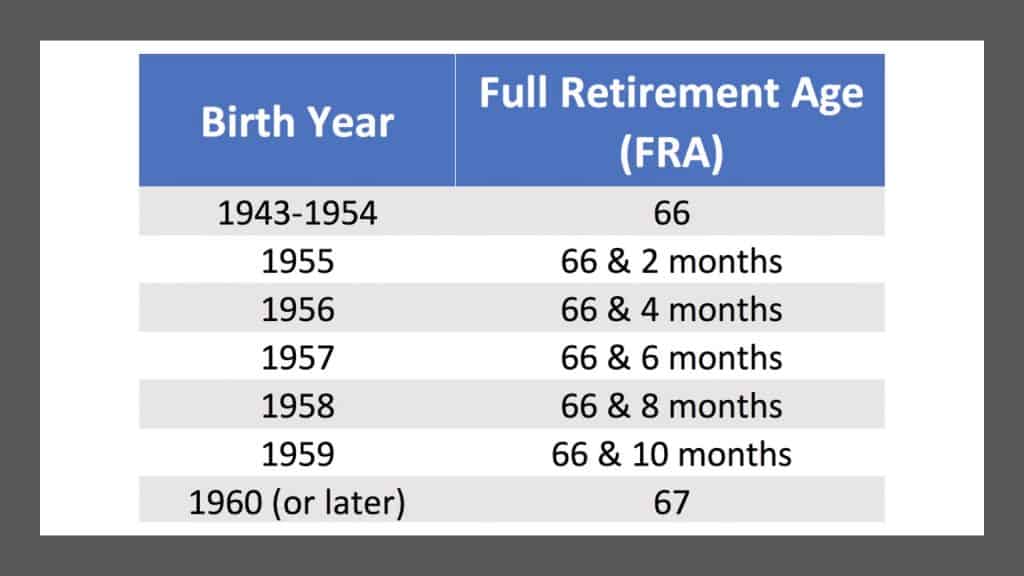

For those born between 1955 and 1959, the full retirement age will be somewhere between age 66 and 67. For everyone born in 1960 or later, the FRA will be 67 (for now).

This takes us back to the beginning where I said that you’ll never be able to get as much in benefits in 2021 or later. Here’s why.

Why You’ll Never Get As Much in Benefits After 2021

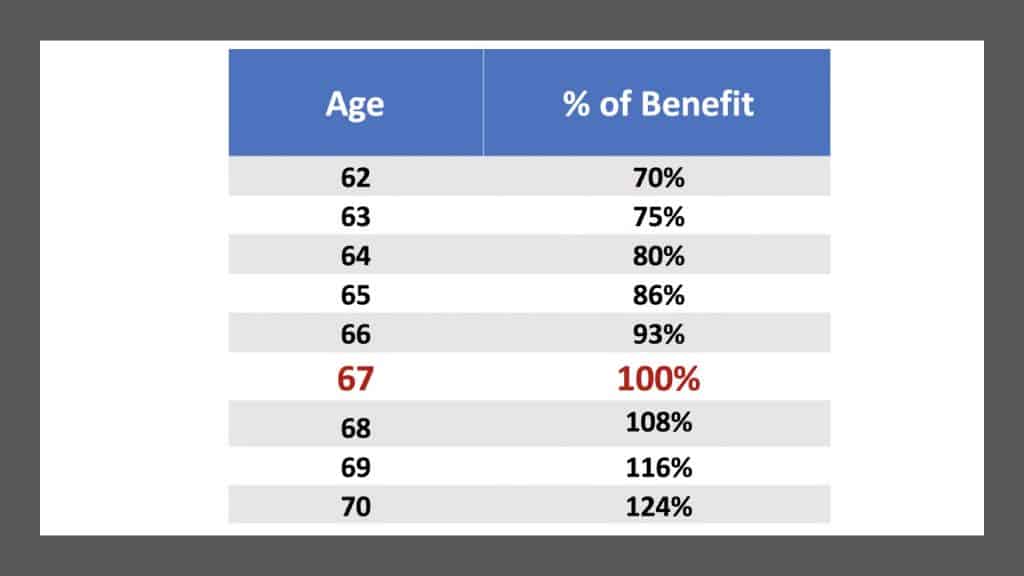

For years we’ve used nice round numbers when calculating the impact of filing for social security benefits early, or later. We’ve said if you file at 62 you’ll get 75% of your FRA benefit amount and if you wait until 70 you’ll get 132% of your benefit amount.

Well, guess what? Not anymore!

Because the increases and reductions are calculated on a monthly basis, once FRA increases, there will not be as many months for benefits to increase by.

The inverse will also be true, the reductions for filing at the earliest age will be steeper because there will be more months between age 62 and full retirement age.

This is why I stress understanding how to calculate the reductions and increases on a monthly basis. (by the way…the full retirement ages, age-based reductions, and a lot more are all covered in my easy to understand Social Security Cheat Sheet. This is where I took the most important stuff from the 100,000 page website and condensed it down to just ONE PAGE! Get your FREE copy here)

How The 2021 Changes Will Affect Social Security Benefits

Here’s how this changes the benefits and reductions if we look at filing at the earliest age and at the latest age.

Currently, the SS filing window is between 62 and 70. You can’t file before 62 and it doesn’t make sense to file after 70.

So, for those born between 1943 and 1954, the FRA is 66, you are entitled to 100% of your benefit.

You can file as early as 62, but you’ll only receive 75% of your benefit. If you file at 70 you’ll receive 132% of your benefit. Once the FRA starts moving up, it all changes.

You’ll still be able to file at 62, but you’ll only receive 70% of your FRA and if you delay…your benefit will increase to 124% instead of 132%.

Don’t Just Hope Everything Will Still Work Out — Get Proactive and Plan Now!

Many people just hope everything will work out in retirement. Sometimes it does, but sometimes a lack of planning can ruin what should be your best years. This is your retirement! Please continue to stay informed. You should start by getting your FREE copy of my Social Security Cheat Sheet. This is where I took the most important stuff from the 100,000 page website and condensed it down to just ONE PAGE! Get your FREE copy here.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the 274,000+ subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing: There is a tremendous amount of misinformation out there about the changes in 2021. Help me clear up the confusion by sharing this article on Facebook. Thanks!

I’ll be 64 in March 2021. I have a part-time job that earns 1650. a month. This is over the income limit if I draw my social security. When should I begin drawing my SS to receive max amount? Thanks

They need to give people on ssdi a cost of living more than 1.3 the price of food has gone up by the 3 week i have no money to buy food

Why do people w disability who never ever worked able to receive SSDI? WHY are they not recieving welfare instead? I contributed thru hard work of over 40yrs. And they nothing! Cutting my amount to them? I don’t get it.

I am not a financial adviser but I will tell you to start collecting at the earliest time possible. The breakeven point is on average 10 years out if you delay for one year or 7 it is still the same. However, if you want to continue working and earn an excess of $24,000 yearly wait till full retirement age. The reason is complicated to explain on this forum. The second reason to take it early is what I call the 86,400 seconds in a day rule. Not a fraction of one is guaranteed. A fraction of one can change… Read more »

I work approximately six months out of the year. If I decide to collect at 62, will my seasonal employment be averaged over the year or be reduced during the months I work?

Correct me if I’m wrong but part of the problem with social security being in trouble is the fact they give it to kids who lost a parent and they pay them social security tell 18 that’s not what this program was setup for they should be paid out of a different program social security was for retirement and the fact that baby boomers are in retirement age once they’re gone won’t it level back out and there won’t be so much draw on it!

The vast majority, if not all comments/ questions in this comment section are completely moronic, as if they didn’t even read the article. No reading comprehension amongst the senior generation, no wonder trump is president.

I was told if i am on SSD i have no choice but till wait untill full retirement i can NOT file at an earlier age like 62 i have to wait till im 66.4

Do the rules change for widows waiting for full retirement age? I was told to wait until 66 and 2 months to file

Do the rules change for windows waiting for full retirement age?

Thank you for giving everyone this and your hard work in showing everyone what’s to exsept.👍

This was really informing

I’m wondering if anyone is keeping an eye on the people who died this year with pneumonia, flu,corona virus 🦠 where is there social security check is going ? I would think that since the elderly are the ones that are dying with those three symptoms the most that should send a ton of money back to the social security bank account once those elderly folks die .

Ok, so for my generation (I had my 40 points at age 26, born in 1980), there won’t be any social security. With the expenditure from this COVID-19, it’s all going to be gone after this $3 trillion bailout. Everyone gets their $1200 and that’s it. Thanks a lot. Didn’t think about that, did you catch it? Where’s that money coming from? You guessed it! Bye-bye social security!

How will it effect my disability and social security

If the goverment would pay ss what they have robbed it if for years we could retire at 55 ss is a trust fund its notpart of thenational dBT

I am 78, born in January 1942 – because of health concerns I took SS benefits at age 62 and receive 75% of what I could have gotten if I waited. But the doctors told me early retirement would be best for me so I did it. Somehow I have survived to age 78 and with the drugs I am now taking the doctors say I could live until 90+ unless something else shows up. I noticed in the age group 1942 does not even show up as to retirement age in todays groupings. All I really care about is… Read more »

Well I’m on disability and get 1/3of my retirement I’m 59 so when I turn 65, I will receive my full ss or not because I was born in1960 so it sounds like I’m screwed guess I will be homeless I barely survive now I live below poverty line by 3000 a year it’s really hard I can’t even afford a car

My full retirement age is at 66.2 if i can continue to work and i wait to receive my benefits at age 70.if for some reason i can’t work anymore past 69 then what happens? Thank you dante Brunelli

I am currently turning 62 in April just wondering if the new changes would affect me if I wait until 63 or 64 to retire

I’m start collecting my S. Sec. benefits when I Turner 66.Still work , paying taxes,making same income in last 10 yrs.Is my S Sec $ goes up ? If yes, how much % ?

Do not be fooled or scared. Nothing is changing. I was born in 1960 and have known for years that my full retirement age would be 67. I have also known that I will gain 8% per year by waiting to claim after 67. The max you can delay is to 70 years old. If I wait until 70, I will receive 124% of my full retirement value. The author is needlessly scaring people into making mistakes in claiming. The only problem here is ignorance of the SSA rules. Please take sone time to go to SSA.gov and search the… Read more »

Why, becoming disable before 66 yrs old, is the total amount you receive, but it doesnt increase when you reach 66; retirement? Diability has nothing to do with ss retirement, does it? Are they separate?

Someone said in 2021 they are not allowing anyone to take social security early. Plus they are eliminating the greater than 100% benefits at age 70. The new law would have people only take their social security at full retirement age. IS THIS TRUE?

My mother was born in 1953. Since she was born in 53 she is currently at her full retirement age. She will turn 68 in December 202o.

Will the original chart apply to her based upon her birth date? Will she receive 132% of her benefit if she waits to retire until she is 70?

Or will the new schedule apply to her is she files after 1/1/2021?

Thanks!

Turned 68 in Dec 2019. I was holding out til 70 at 2021. Now you say I’ll be getting less than expected, (although a bit more than if I file now)?

Should I file now or in 2021?

I’m on RRR entitlement through my husband right now along with my retirement from when I worked (and paid SS )

I was wondering if the cuts are also going to be with people that are on SSDI as well as retirement

I was planning on waiting till age 70 to start collecting SS. I’m still working part time and I’m 68.5 yrs. of age. If I understand you correctly, I’d do better starting to collect SS when I turn 69 in 2020, or maybe I can wait till age 70 in 2021. I’m still adding to my income, and perhaps my top 35 yrs. while continuing to work, so not sure if I’ll ultimately benefit more by waiting till age 70 in 2021, or starting to collect in 2020, at age 69, to get the higher percentage of 132% vs. the… Read more »

I have a question for clarification. I was born in 1954 and planned on filing for SS benefits after I turn 66 in May of 2021. Are you saying that I should file now before 2021 because my benefits would be reduced, or do I remain in the current status due to the year of my birth and can go ahead and wait for my full retirement age of 66 and then file for SS benefits 2021?

Mostly correct. Between YouTube, this blog and my podcast my material is consumed by 20,000 people per day. The volume of income emails, phone calls, and comments is staggering. I wish I could help everyone, but I can’t. When time allows, I will come in and answer as many questions as possible.

Don’t see any responses to comments. Seems like the only way to contact Devin is to pay $200.

Thank you for the information.

Devin, just two simple questions: First, is this article current? There’s no date on it, so a reader doesn’t know if it was written using 2019 Social Security rules, or 1984 rules. Second, in 2020, will my benefits be affected? Here’s the deal: I was born 1955. I’m 63 now. Wife born 1960. She worked every year from 1983 until 2010. She died in 2011 at 50. I was military and she was a doctor, so when I retired from the military in 1995 after 20 years service, I became a stay-at-home dad, living off her income. (Which was quite… Read more »