The Social Security surviving spouse benefit seems easy enough to understand. But hidden in the details are small nuances that can cost you – or your loved ones – thousands of dollars in missed benefits.

If you invest the time to make sure you know the rules, you won’t end up like the 10,000 people that a 2018 Office of the Inspector General report discovered had been shortchanged by $131 million in Social Security survivor benefits.

Here, we break down what you need to know about ensuring you receive all the benefits you’re entitled to in three, easy-to-digest sections:

- Who is eligible for a Social Security surviving spouse benefit?

- How are the survivors benefits for spouses calculated?

- How can you use a specific strategy that makes a huge difference in the amount of survivor benefits you or your spouse will receive?

Understanding the Basics of Survivors Benefits

When covering the survivors benefits from Social Security, it’s really easy to get bogged down in the details. There are benefits available to surviving spouses (both ex-and current), children, and dependent parents.

The eligibility conditions and payment amounts are different for each of these types of benefits. Because of this, for this particular article, I want to narrow our focus to look at just the Social Security surviving spouse benefit.

But first, let’s do a quick recap of survivors benefits in general. The surviving spouse benefit typically works as follows:

At the death of the first spouse, the surviving spouse (or eligible ex-spouse) can receive the greater of their own benefit or their deceased spouse’s benefit, which will then be adjusted for the filing age of the survivor. (I’ll get more into detail on that adjustment later).

One big difference between survivor benefits and regular Social Security retirement benefits is that the surviving spouse can file as early as age 60. If both individuals were disabled when the spouse died or if they became disabled within 7 years of their spouse’s death, then they can file as early as 50.

Now, let’s dive in a little deeper so you’ll know when these rules may change based on filing decisions.

Who Is Eligible for a Social Security Surviving Spouse Benefit?

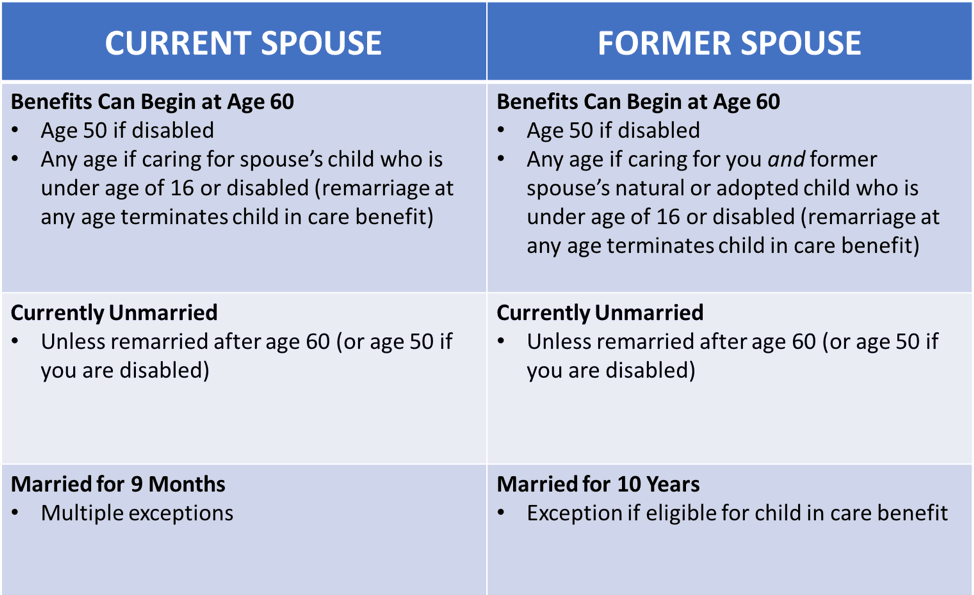

Spouses who are “current spouses” (defined as individuals who were married to the deceased when he or she died) and ex-spouses can both be eligible for the Social Security surviving spouse benefit.

While both are eligible, the rules for claiming these benefits are a little different for former spouses and current spouses.

Both current spouses and ex-spouses can begin receiving benefits as early as age 60. If the surviving spouse is disabled, they can file as early as 50. The important thing to note here is that the disability must have begun before the death of their spouse (or ex-spouse) or within 7 years of the deceased spouse’s death.

The one time where age is not a factor is if the surviving spouse has a child at home under the age of 16. This is referred to a mother’s/father’s benefit, or more commonly, a child-in-care benefit.

This is where the first difference comes in between eligibility rules for current spouses and former spouses: A current spouse can qualify for the child-in-care benefit if they are caring for the spouse’s child under the age of 16 — or of any age if the child is disabled.

For an ex-spouse, the rule is that the child must be the child of the deceased and must also be the natural or adopted child of the surviving ex-spouse. [1]

Understanding Length of Marriage Rules for Spouses and Ex-Spouses

Another — and much bigger — difference in how spouses and ex-spouses may receive survivors benefits focuses on the length of the marriage. For current spouses, your marriage must have lasted at least 9 months.

However, there are multiple exceptions to the nine-month requirement. Here are three of them:

- Your spouse died due to an accident.

- Your spouse died in the line of duty while a member of uniformed service on active duty.

- You divorce and subsequently remarried the same spouse (because only one period of marriage must last nine months).

A former spouse, on the other hand, must have been married to the deceased for 10 years. The exceptions to get around the nine-month length of marriage which covers current spouses will not work for a former spouse.

The one exception is for the child-in-care benefit. If you’re taking care of the deceased’s child who is also your natural child or you went through the process of legally adopting the deceased’s child, the 10-year requirement is waived.

Another interesting note here is that you have two years from the date of death to complete that adoption. For some, this extra income could make a big difference and may motivate a family to go through the adoption process. Before you do so, I highly recommend talking to a family law attorney about the ins and outs involved here.

Finally, it’s important to note the rules around not just your marriage with the deceased — but about getting married to someone else after your spouse died.

Within survivor benefits, there are some remarriage rules that can cause confusion. You must be unmarried to receive these benefits — but there’s one exception to the rule that applies to both current spouses and former spouses.

If you get remarried after you turn 60 (or 50 if you are disabled), you can continue to receive your survivor benefits unless those benefits are being paid to you because of a child-in-care. If that’s the case, remarriage will terminate your survivors benefit.

How Are Survivors Benefits for Spouses Calculated?

Now that you have an understanding of who can receive a surviving spouse’s benefit, let’s look at how to calculate how much the benefit will be.

The overly simplistic definition of survivors benefit is that the surviving spouse will receive the full retirement age benefit of the deceased spouse. That benefit will be adjusted according to the filing age of the survivor.

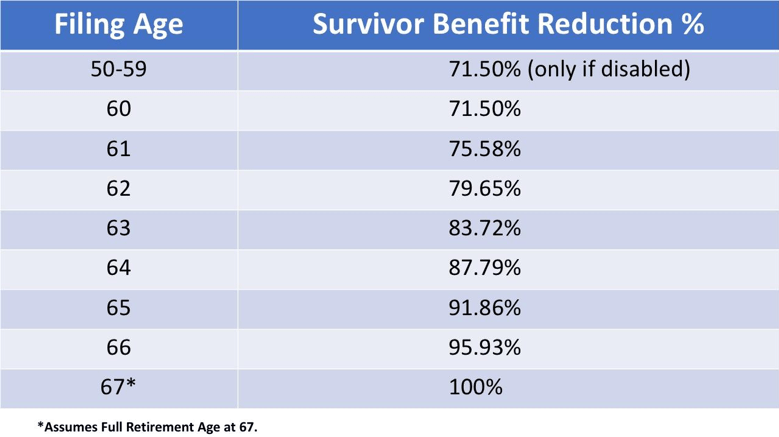

These reductions will reduce a benefit if the surviving spouse files for that benefit before full retirement age[2] e. In the case of surviving spouse’s benefits, the annual reduction is about 4% per year from full retirement age down to age 60

Technically, this reduction occurs on a monthly basis and varies slightly based on the year you attain full retirement age. For anyone born after 1962, the benefit reduction is .396% per month that you file early. If your birthday is before 1962, there is a table at the SSA website that includes a chart listing the exact reductions.

If you’re the curious type and want to know how to run this calculation of survivors benefits for yourself, follow these three steps:

- Find your full retirement age for a survivors benefit (this may not be the same as your normal full retirement age).

- Determine the number of months between turning age 60 and your full retirement age.

- Divide that by 28.5 (because survivor benefits that start at age 60 are always reduced by 28.5%, regardless of your full retirement age)

The result is the amount of monthly reduction to your survivor benefit. This reduction is taken off of the Full Retirement age benefit of the deceased including any credits to this benefit for delayed filing.

These reductions are important to understand, but there’s more to the story. A lot of this calculation hinges on what the deceased spouse did before they died. There are really three possible scenarios:

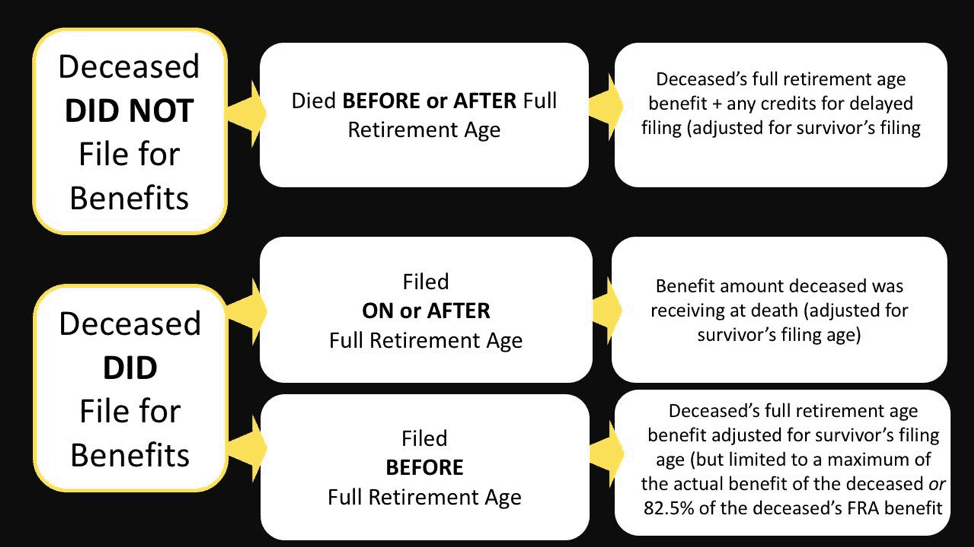

Deceased Spouse Scenario #1 – Died Before Ever Filing for Social Security Benefits

If an individual died without filing for benefits, the survivor’s benefit is simply the deceased spouse’s full retirement age benefit, plus any delayed retirement credits if they died after full retirement age. This amount would be adjusted for the filing age of the surviving spouse.

Deceased Spouse Scenario #2 – Filed On or After Full Retirement Age (FRA)

If an individual already filed for benefits before they died, the amount of benefits left to the surviving spouse is dependent on the age of the deceased spouse when they filed for Social Security.

If they filed on or after their full retirement age, the surviving spouse will be entitled to the benefit that the deceased was receiving at death. Again, this benefit will be reduced if the surviving spouse files before his or her full retirement age.

Deceased Spouse Scenario #3 – Filed Before FRA

If the deceased spouse filed for benefits before their full retirement age, things get a little a little more complicated. In this case, the surviving spouse benefit is still based on the deceased’s full retirement age benefit, adjusted for survivor’s filing age.

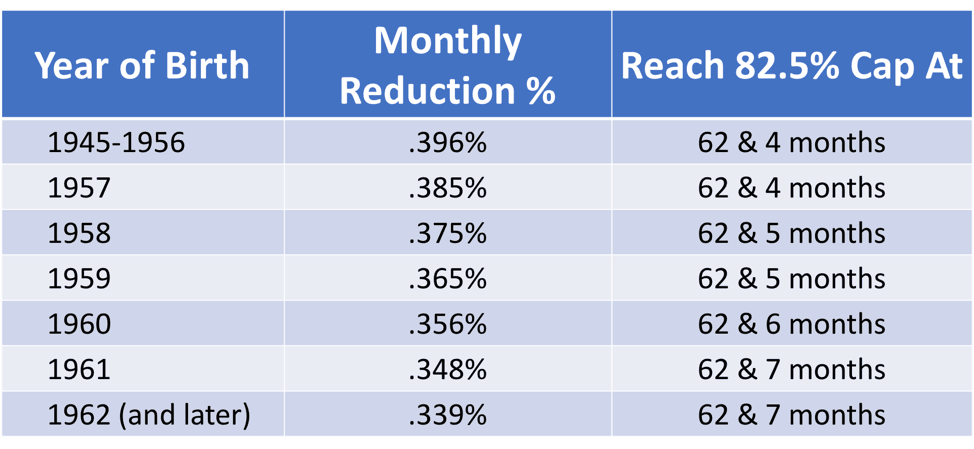

But, that benefit is also limited to a maximum of the actual benefit of the deceased, or 82.5% of the deceased’s FRA benefit. This limitation is often referred to as the widow’s limit, but it’s technical name is the RIB-LIM (for Retirement Income Benefit – Limitation).

Understanding the Widow’s Limit (or RIB-LIM)

This is a poorly-understood rule[CO3] , and the lack of clarity around this portion of the Social Security Administration’s rulebook result is often that individuals delay their filing decision for several years, not knowing that their benefit is not increasing for the delayed filing.

The Social Security surviving spouse benefit is still calculated based on the full retirement age benefit of the deceased spouse, but it will never go over the 82.5% mark — even if the surviving spouse delays to their full retirement age.

Let’s use an example of how this rule works to clear up any confusion around the widow’s limit.

Assume that Joe had a full retirement age benefit of $2,000. This means that, at 62, his benefit would have been $1,500.

If Joe filed for benefits at his earliest possible age, 62, and died a year later at 63, how much would his surviving spouse receive?

Without even knowing her age we know that she’ll never be able to collect Joe’s full retirement age benefit of $1,500. He sealed that deal when he filed early. However, she won’t have to take the $1,500 he was receiving either.

Instead, her maximum survivors benefit will be $1,650, because that’s 82.5% of his full retirement age benefit.

Here’s the tricky part. At what age would she be eligible for this maximum survivors benefit?

Many assume that she would have to wait until her full retirement age to get the max benefit of $1,650. That is not correct. Instead, she would eligible to receive this benefit when she reached 62 years and 4 months old.

This means that if she waited until her full retirement age to file for benefits, she’d find that her benefit amount would be the same as it would have been had she filed nearly five years before!

(There are some excellent examples of this scenario in a 2001 research paper.)

So how do you know when your personal benefit will reach the cap? You can run the calculation that we referenced earlier or just use the chart below.

WARNING: Be sure you have all your dates, benefit amounts and rules squared away before you do this. If you file for benefits early, thinking this cap applies to you, and later find out it does not, there will be nothing you can do to “undo” this unless you discover it within the first 12 months.

The Specific Strategy to Use to Make a Huge Difference in Your Surviving Spouse Benefit

Now that we’ve covered the calculation of the survivor’s benefit, you need to know about one of the last remaining advanced filing strategies that is still available to you.

It’s the strategy that the Office of the Inspector General was referencing when they chastised the Social Security Administration in their 2018 report — the one that would have allowed 10,000 people to get more of their benefits!

This is the “restricted application” strategy that went away for everyone except surviving spouses. Here are the basics of how this works:

If you have both a benefit from work you did, and a survivor’s benefit, it could make sense to file for one now — and switch to the other later.

For example, you could file for a survivors benefit as early as age 60. You could then switch to your own benefit as early as age 70, at which point your own benefit should have grown because you’re filing for your benefit late.

You could also file for your own benefit early, and then switch to your survivors benefit at your full retirement age. At that point you’d be eligible for the maximum survivors benefit (just beware the widow’s limit rule that we discussed).

Here’s another example to illustrate how this works:

At Paula’s full retirement age of 67, she has a benefit of

$1,500 from her own work. She also has a survivors benefit of $1,600. Using the

advanced filing strategy that we just discussed, she could file for the

survivor’s benefit at age 60. There would be a reduction due to her age, so she

would start receiving around $1,144 per month.

But at age 70, Paula could simply switch back to her own benefit, which would’ve grown to $1,860. Over her lifetime, that filing strategy could make a big difference in her total income.

Beware of the Earnings Limit When Counting on Surviving Spouse Benefits

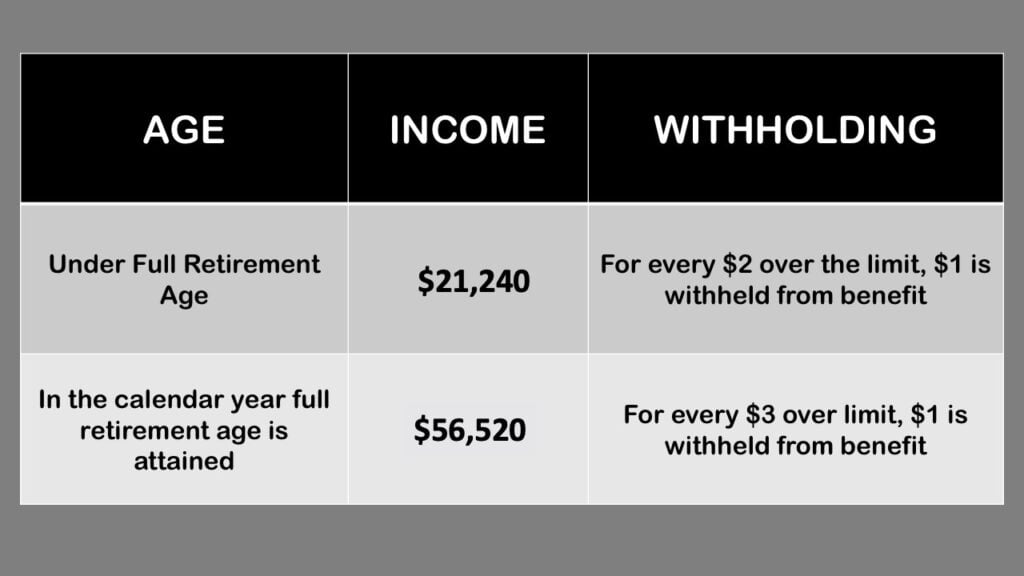

There’s one last thing that we have to talk about if you’re thinking about filing for survivors benefits — or any benefit — before full retirement age. Keep in mind that the Social Security Administration imposes a limit on the amount of income you can earn from work.

This limit changes every year, but for 2023, it’s $21,240. The one exception is the year you attain your full retirement age, and in that year you can earn up to $56,520. Once you hit FRA, you’re completely free of the earnings limit (for now, anyway; reinstating the earnings limit for everyone is one way the Administration could “fix” the Social Security system).

I know these survivor benefit rules for spouses aren’t as cut and dry as they seem at face value. You may need to bookmark this page and reread certain sections.

What may be an even greater help is to join my free Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

Check out these FAQs on the subject if you still have questions:

Frequently Asked Questions

Q. Can two spouses collect a survivor benefit from the same deceased spouse?

A. Yes. As long as the length of marriage rules were met.

Q. How do I prove disability to get the survivors benefit at 50?

A. The disability standards are the same as if you were filing strictly for Social Security Disability. The SSA must determine that you cannot do a substantial amount of work because you either meet the requirements of one of the SSA’s listed disabilities or prove that there are no jobs that you can do. You may need to find an attorney to help you with this. If you go to this link you can fill out a quick disability benefits evaluation and get connected with a pro who can help you.

Q. Is there a time window for the disability to begin after spouse’s death?

A. Yes. You have to be found disabled by the SSA within a certain period. The SSA refers to this as a “prescribed period” and it begins in the month of deceased spouse’s death or at the last month you receive a child in care benefit. The prescribed period ends 84 months (7 years) after it begins.

Q. Can Social Security Surviving Spouse benefits be retroactive?

A. Yes, but only if the surviving spouse files after full retirement age. The maximum retroactive payment is six months of benefits.

Q. What documents will I need to file for the surviving spouse benefit?

A. The SSA has a list of all the documents you’ll need along with some of the questions they’ll ask you.

Q. Can Social Security Survivor benefits be garnished?

A. They can be garnished, but in very limited circumstances. See my article on this topic for more information.

Q. Will survivor benefits increase if I delay filing beyond my full retirement age?

A. No. Survivor benefits do not earn delayed retirement credits.

A Few of the Resources I Used In This Article

Social Security Handbook Section on Survivor’s Benefits

https://www.ssa.gov/OP_Home/handbook/handbook.04/handbook-toc04.html

Exceptions to the 9 month length of marriage rule

https://www.ssa.gov/OP_Home/handbook/handbook.04/handbook-0404.html

Definition of Legally Adopted Child (2-year rule)

https://www.ssa.gov/OP_Home/handbook/handbook.03/handbook-0329.html

The same rule found in Sec. 216. [42 U.S.C. 416]

https://www.ssa.gov/OP_Home/ssact/title02/0216.htm

POMS Section on Mother’s/Father’s Benefits (Child-In-Care)

https://secure.ssa.gov/apps10/poms.nsf/lnx/0300208000

Excellent research notes on Widows Limit https://www.ssa.gov/policy/docs/ssb/v70n3/v70n3p89.html & https://www.ssa.gov/policy/docs/workingpapers/wp92.html

Monthly reductions for the survivor benefit

https://www.ssa.gov/planners/survivors/survivorchartred.html

POMS section on the computation of how deceased filing early affects benefits

https://secure.ssa.gov/apps10/poms.nsf/lnx/0300207002

POMS RS 00207.001 Widow(er)’s Benefits Definitions and Requirements

https://secure.ssa.gov/poms.nsf/lnx/0300207001

POMS DI 10110.001 Requirements for Disabled Widow(er)’s

Benefits (DWB)

https://secure.ssa.gov/poms.nsf/lnx/0410110001

Remarriage rule for divorced spouses receiving benefits as child in care

https://www.ssa.gov/OP_Home/handbook/handbook.04/handbook-0416.html

POMS Section on the Widow’s Limit (RIB-LIM)

https://secure.ssa.gov/apps10/poms.nsf/lnx/0200204045

POMS Section on the disabled widower benefit “Prescribed Period”

https://secure.ssa.gov/poms.nsf/lnx/0411005050

List of documents needed to file for Surviving Spouse benefits

https://www.ssa.gov/forms/ssa-10.html

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Cogent Advisory Group, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Cogent Advisory Group, LLC. is neither a law firm nor a certified public accounting firm and no portion of the article’s content should be construed as legal or accounting advice. A copy of the Cogent Advisory Group, LLC.’s current written disclosure statement discussing our advisory services and fees is available upon request.

[…] an ex-spouse passes away — then you could switch from a spousal benefit on one spouse to a survivors benefit on […]

In the 6th paragraph of the section “Understanding the Widows Limit,” you state she can’t take the $1500, then next sentence you say she won’t have to take the $1500. Is that a typo, or am I just confused?

I was married over 10 years. Got divorced. She remarried. I did not. I will retire this year at age 66 with full benefits. She died last year at 56 years old. Am I able to receive any of her social security benefits?

what happens when you are receiving child in care which will stop when the child is 16. But you are not yet 60 or 67.can you still file for spousal benefits at 60. you will have to do without these benefits until 60. you were married more than 10 years. my husband did collect full benefits at 66. Will I be able to apply again for benefits at 60. Please advise.