What do you know about Social Security delayed retirement credits — and how confident are you in that knowledge?

If you don’t fully understand how delayed retirement credits work and how they get added to your benefit amount, you might be disappointed when you receive your first Social Security check after you file.

You should know that when you delay filing for your Social Security benefits after your full retirement age, your delayed retirement credits aren’t added right away.

Here’s why, what else you need to understand, and when you should file instead to minimize the delay.

Why You May Be Missing Credits

Does the Social Security Administration have a little trick up their sleeves when it comes to delaying your benefits?

It can look that way! They do not add your credits immediately if you file after full retirement age.

To be honest with you, this is a little puzzling to me and I’m not sure why they do this. It’s not as if they don’t have the systems in place to do the calculations. After all, if you file early, the reductions are applied immediately!

So why don’t you get the same treatment when you delay filing?

I’m going to show you how this works — but let me give you a little context around this first.

Know How to Calculate Monthly Changes to Your Benefits

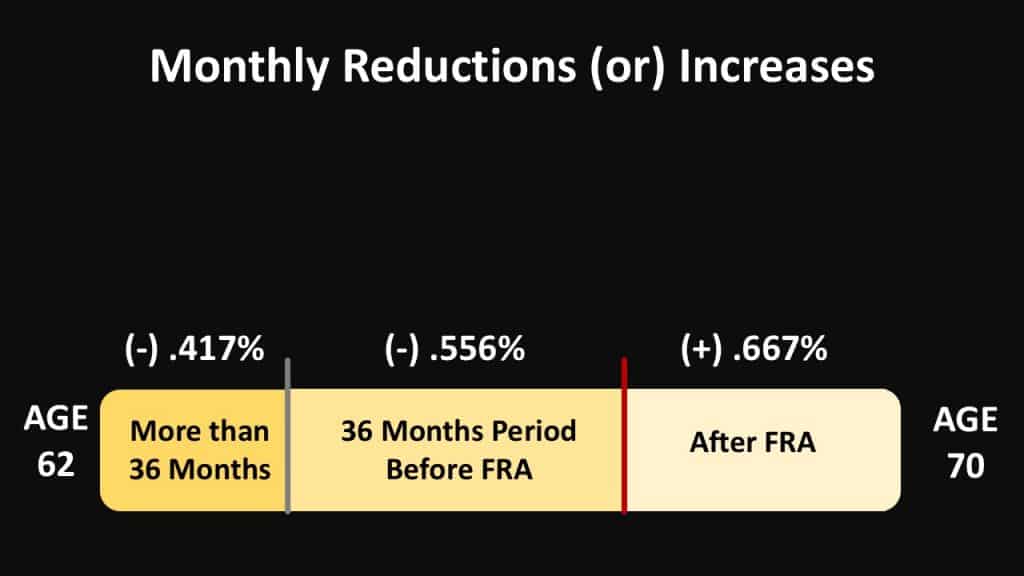

I often discuss the monthly reductions for filing early or increases for filing early, and understanding that is a fundamental part of today’s discussion. Let’s take a look at this chart to start:

You can file for your retirement benefits between the ages of 62 and 70. The red line in the chart above represents your full retirement age.

Knowing this, you can calculate how much your Social Security income benefits should increase if you delay filing — as well as how much those benefits might decrease if you file before full retirement age.

If you file early, decreases are broken up into two separate bands. First, you have the 36 month period immediately prior to full retirement age where benefits are reduced by .555% per month, and then anything more than 36 months, benefits are reduced by .417%.

But if you file after your full retirement age, your benefit will be increased by .667% for every month. These increases are referred to as delayed retirement credits.

What Happens If I File After My Full Retirement Age?

It’s important to understand that there is a difference in how the increases and reductions are applied.

If you file at any time before your full retirement age, your benefit will be calculated by these reduction amounts and immediately reduced beginning with your first check.

That is not the case for the increases.

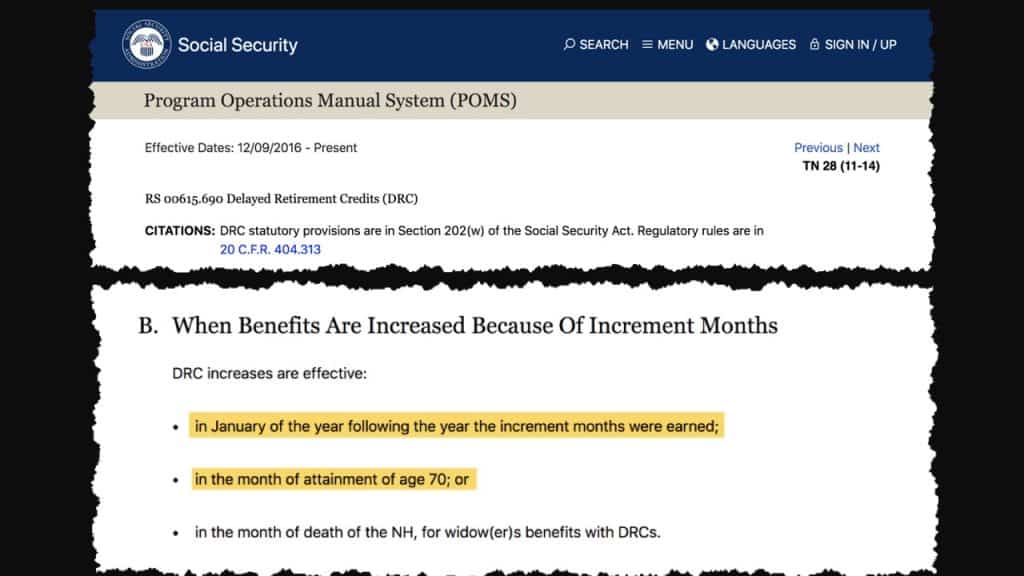

In the Social Security Administration’s operations manual, you can see there are two times retirement benefits are increased for delayed retirement credits:

- The month you attain age 70

- In January of the year following the year you earned the delayed retirement credits.

Let’s look a specific example to better understand this.

Make Sure You Understand the Full Impact of When You Choose to File

Let’s assume your birthday is in February, and this is the year you hit your full retirement age.

Six months later, you decide to file for benefits and you receive your first check in September of that same year.

You’ve probably already calculated in your head that you should receive 6 months of delayed retirement credits; that works out to 4% increase to your full retirement age benefit.

When you get your first check deposited in September, therefore, you might be surprised to find that check is for the same amount as it would have been had you filed for Social Security benefits back in February.

The delayed retirement credits would be added — eventually. The fact that they don’t kick in immediately throws many people off!

You’d probably see the delayed retirement credits come through starting in January of the following year, which means you wouldn’t see it on your actual checks until that February.

And no, you don’t receive any sort of payment to make up for those months that you missed.

Can You Get Your Delayed Retirement Credits Faster?

One way to lessen the lag is to file later in the year.

If you want to avoid this lag altogether, you could wait until your 70th birthday. Then, no matter what month it falls on, the delayed retirement credits are added immediately.

Maybe in the future the Social Security Administration can figure out how to do this for any filing age after full retirement like they do before. It can’t be that hard, right?

One would think!

But for now, this is how the system is set up. It’s important to know this so you can get proactive and plan accordingly — and not get hit with a nasty surprise after you’ve already delayed filing so you can get a bigger benefit.

Take Control, Because It’s Your Retirement and Your Benefits

You’re making a smart move by learning all you can and reading sites like these, but don’t use this as specific advice for your own situation. I encourage you to do your research and talk to your own advisors. Most importantly, continue to educate yourself and stay curious!

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the 400,000+ subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

Filed to receive SS benefits at 68 years 9 months starting in Nov 2021. Received no bump up in benefits(other than cola) in Jan 2022. Was told in Dec, SSA needed my income amount from my last employer and as soon this was done I’d see the added amount. Nothing yet. called SSA and filed a request, told to call back beginning of May if not contacted.

I’m 62 going to retire at 67. When can I file without reductions? And how long does it take to get your 1st check? Thank you for your videos