You may already know that if you’re under full retirement age and file for Social Security benefits, there’s a limit to the amount of income you can make before your benefit is reduced — or shut off completely.

But there’s one big question that keeps coming up when I talk to people about this topic: What income counts towards the Social Security earnings limit?

Today, let’s find the answer. I’ll cover what the Social Security Administration counts as income as well as what doesn’t count as income on your earnings test.

Before we get there, let’s go over a quick overview of how the earnings limit works.

What You Need to Know About the Social Security Earnings Test and Income Limit

The first thing to know is that, right now, the earnings limit only applies before your full retirement age. Once you reach your full retirement age, you can earn a bazillion dollars and continue to receive your full Social Security benefit.

(Changing this is one way that we could fix a breaking Social Security system.)[1]

Because full retirement age differs based on your year of birth, we need to take a quick look at the table so you’ll know exactly when your full retirement age is.

- If you were born between 1943 and 1954, your full retirement age is 66.

- For 1955, the age is 66 and 2 months.

- For 1956, it’s 66 and 4 months.

- For 1957 the age is 66 and 6 months.

- For 1958, full retirement age is 66 and 8 months.

- For 1959, it’s 66 and 10 months.

- For those born in 1960 or later, the full retirement age is set at age 67.

Obviously, the current full retirement age if you were born after 1960 is subject to change with the proposals floating around to fix Social Security — but this is where we are right now.

How the Earnings or Income Limit Relates to Your Full Retirement Age

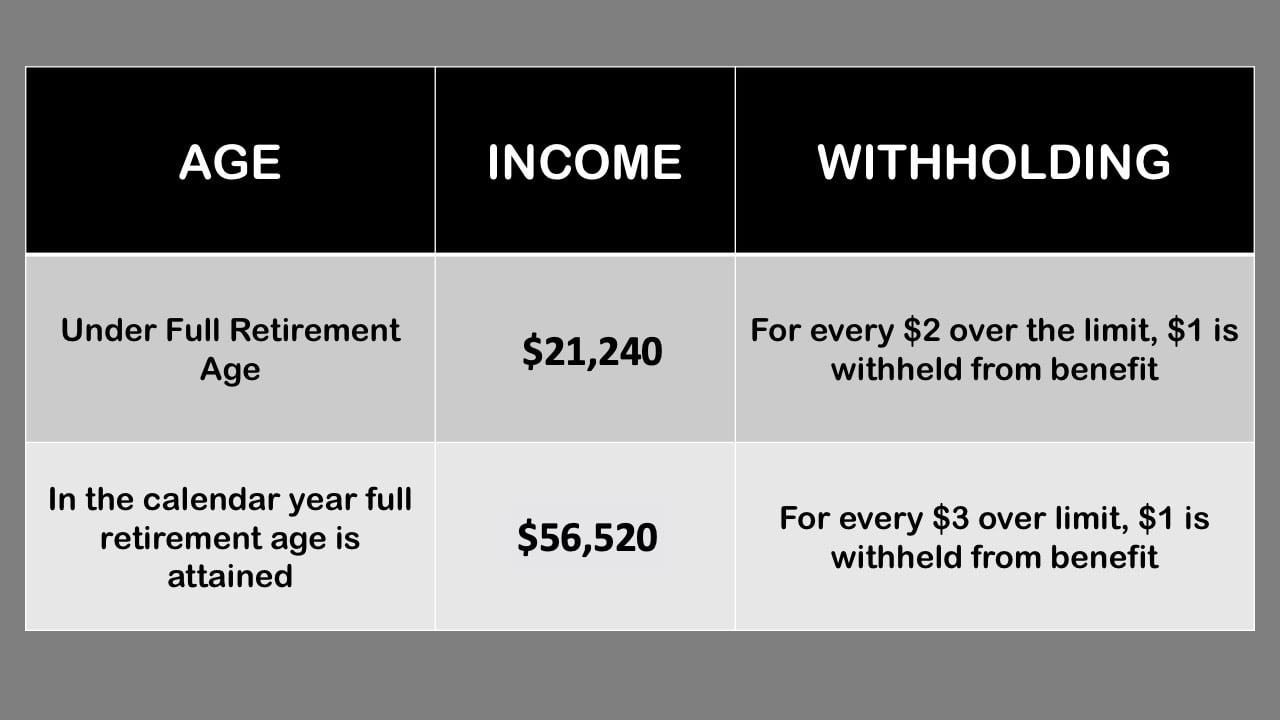

If you make more than $21,240, the Social Security Administration will withhold $1 in benefits for every $2 in income that exceeds that amount.

The one exception is during the calendar year you attain full retirement age. During that period, the earnings limit nearly triples and the withholding amount is not as steep.

For every $3 you earn over the income limit, Social Security will withhold $1 in benefits. At your full retirement age, there is no income limit.

The $21,240 amount is the number for 2023, but the dollar amount of the income limit will increase on an annual basis going forward. You need to keep up with the year-to-year changes to stay informed.

(Want to make this very easy to do? Just subscribe to my YouTube channel, because we do an update for these numbers as soon as we see them!)

What Counts As Income to the Social Security Administration

Now that you have a basic understanding of the income limit, we need to look at what actually counts as income toward that limit.

Thankfully, the Social Security Administration makes it easy to understand for most types of income that you might normally receive. First, let’s look at the income that does not count.

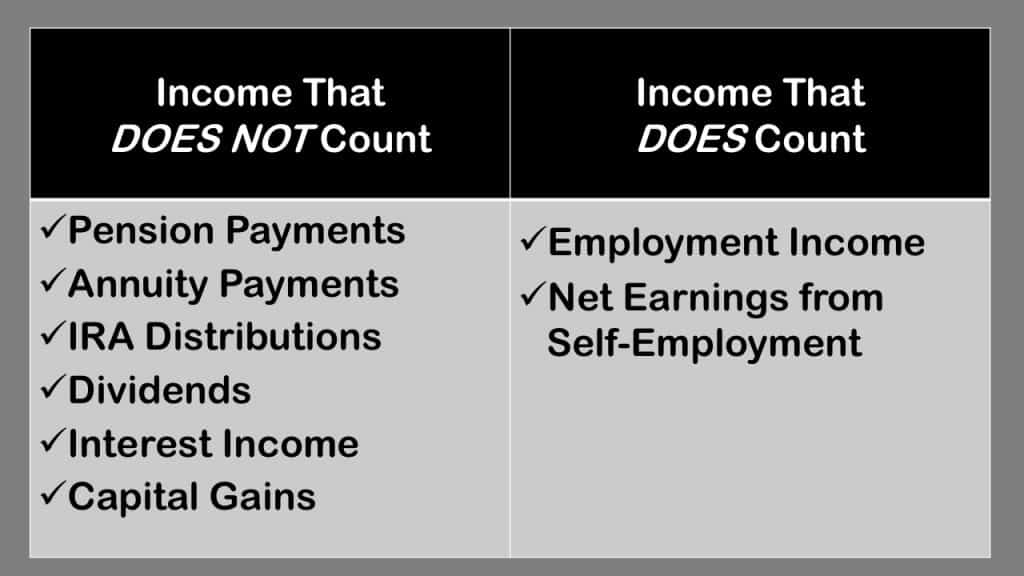

Income that does not count toward the earnings limit includes:

- Pension payments

- Most annuity payments

- IRA and retirement account distributions

- Dividends

- Interest income

- Capital gains

As the law is currently written, you can receive an unlimited amount of income from the sources above and receive your full Social Security benefit.

The income that does count in the earnings limit is employment income. That means gross employment wages if you’re an employee and/or your net earnings from self-employment.

Some Income Sources Are Harder to Classify Than Others

This nice, concise list will take care of 95% of all the types of income that exist. But there are numerous other types of income that can cause confusion.

You might have back pay, bonuses, vacation pay, deferred comp, fiduciary fees, renewal commissions — the list goes on. Unfortunately, we can’t go through each of these in detail here because even the Social security administration’s page lists 88 different types of income!

To confuse it even further, there are some types of income that are not counted for employees, but it is counted for those who are self-employed.

You can take a look at that page to learn more about how these different types of income are treated. Some of this income is counted, and some of this income is not counted — but before you get too stressed about this, remember that 95% of income sources are easily classified with our simple list above.

What to Do If You Get an Overpayment Notice from the Social Security Administration

If you are under full retirement age and receive income from a source that is not one of the common ones we discussed above, you’ll likely receive a letter from the SSA alleging an overpayment.

If you do, DON’T IMMEDIATELY ASSUME YOU HAVE TO PAY THE AMOUNT BACK.

You do need to communicate with the Social Security Administration about this notice, or they’ll turn you benefit off — but just because you receive a letter saying that the earnings test should’ve applied doesn’t mean they are right.

I’ve seen multiple cases in which all a client had to do was write a letter of explanation because the mistake was on the SSA’s end.

Just be aware that when it comes to the earnings test, the Social Security Administration seems to use the same playbook as the IRS does when they have a question. Instead of sending you a letter to get clarification, they simply assume they are right and tell send you a letter saying how much you owe in additional taxes.

For example, if a client sells a stock and doesn’t include the cost basis, the IRS just assumes the entire amount of the proceeds should be a capital gain. You have to go back to them and tell them how much of the proceeds were the cost basis and how much represented an actual gain.

The Social Security Administration will often do something similar when it comes to the earnings test and payments or income you received. They’ll send you an overpayment letter that says something along the lines of,

“Because you received this payment you should not have received your benefit. Starting on X date, we are going to stop paying your monthly benefit until the overpayment is recovered.”

Then the burden is on you to explain why the payment doesn’t count as income for the earnings test.

(As a side note to this…I recommend watching my video on How To Fix Social Security Overpayment Notices. I explain the process to file appeals and how to explain your position using their rules. If you get one of these letters, do some research to protect yourself!)

It’s Not Just Income That Matters – It’s Timing, Too

Additionally, the Social Security Administration will often want clarification on the timing of your earnings. In some cases, you may have earned money while you were still working, but didn’t receive it until after you stopped working and filed for Social Security.

Does that income still count? The answer is, it depends. The rules are slightly different for employees and for self-employed workers.

For previous employees, the Administration’s article, How Work Affects Your Benefits, says if you work for wages, income counts when it’s earned, not when it’s paid.

Then it goes on to say if you’re self-employed, income counts when you receive it, not when you earn it. But there’s a time qualifier at the end of that sentence; it goes on to say that this is true “unless [the earings are] paid in a year after you become entitled to Social Security and earned before you became entitled.”

Effectively, this means that if the payment occurs in the taxable year after you file for benefits, it will not count against the earnings limit as long as the work was performed before you filed for benefits.

But even within these rules there are some types of payments that fall in the cracks and don’t line up perfectly with these rules. Again, I want to strongly emphasize that if you receive a notice from the SSA alleging that you earned more than the allowable amount, dive into the rules to make sure they are right.

I promise you…they are not always right.

Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

If you’re wanting to get into the nitty-gritty of the research, here are a few resources that may help.

My video: How To Fix

Social Security Overpayment Notices

https://www.youtube.com/watch?v=MkYXVwMmx0w

Social Security Handbook Chapter on Wages – https://www.ssa.gov/OP_Home/handbook/handbook.13/handbook-toc13.html

SSA publication “How Work Affects Your Benefits”

https://www.ssa.gov/pubs/EN-05-10069.pdf

SSA POMS RS 02505.240 Summary

of How Major Types of Remuneration Are Treated

https://secure.ssa.gov/apps10/poms.nsf/lnx/0302505240

SSA POMS RS 02505.005 How to Count Wages Under the Earnings Test (ET)https://secure.ssa.gov/apps10/poms.nsf/lnx/0302505005

SSA POMS RS 01402.000

Wage Exclusions

https://secure.ssa.gov/apps10/poms.nsf/lnx/0301402000

SSA Publication “Special Payments After

Retirement”

https://www.ssa.gov/pubs/EN-05-10063.pdf

SSA POMS RS

02510.016 Treatment of Special Payments (SP)

https://secure.ssa.gov/apps10/poms.nsf/lnx/0302510016

[…] If you want to see a more in-depth conversation about what counts as income for the earnings limit, see my article on the Social Security Income Limit: What Counts as Income? […]

[…] Source: https://www.socialsecurityintelligence.com/social-security-income-limit-what-counts-as-income/ […]

[…] Social Security Income Limit: What Counts as Income … […]

[…] These lists should address about 95% of all the types of income that exist, but there are numerous other types of income that can cause confusion. For a more complete view on types of income, check out my article The Social Security Income Limit, What Counts as Income? […]

Your book Social Security Basics in chapter 10 provides an example of the what counts as provisional income towards the income test for those under FRA. Your example uses IRA/401K Distributions to count, but your Social Security Cheat Sheets says it doesn’t count. Please explain which one it is. Also since we are on the topic the Social Security Cheat sheet list the earning limit for an individual at 62 years of age until the year of reaching FRA at $19,560. However, still on the Cheat Sheet second page its shows the combined income threshold for a single return as… Read more »

I am drawing social security benefits and I have been asked to come back and work for a few months. I know I need to submit my pay stubs monthly but I am trying to find out if milage reimbursement is considered earned income.

Your web sight saved me a trip to social security office. I was confused about the taxation on SSA benefits. I am now 66 retiring this month . Thank You