If you haven’t yet reached your full retirement age but want to file early for your Social Security benefits, you need to know there’s an earnings limit.

In other words, if you earn over a certain amount of income… your benefits may be reduced.

We’ve talked about this at length on both this blog and my YouTube channel, and we field a lot of questions about this topic. One of the questions I hear all the time from married couples is this one:

“Whose earnings are they counting? If you’re married, can your spouse’s earnings affect your Social Security benefit?”

Good question! This is important to know the answer to, but I realized I’ve never directly addressed this question in any of my videos or blog posts.

That changes today!

Does the Social Security Administration Look at Single or Joint Income?

Most married couples are used to having all of their household income counted together in one big pot. For example, if you file your taxes as “married filing jointly,” earnings from both spouses are counted together to determine how much you owe in taxes.

So it makes sense to wonder what happens if a spouse earns more than the Social Security income limit — how does that affect your benefits if you want to file early?

The answer is yes…and no. It depends, but thankfully the answer isn’t that complicated to figure out. But before we dive into how spousal earnings impact the other spouse’s benefit, let me give you a quick refresher on how the earnings test works.

How the Earnings Test Usually Works

The earnings limit is also known as the income limit, the earnings limit, or the earnings test. (The official term is earnings test but income limit and earnings limit are the terms that you’ll hear most often.)

Bottom line: they all mean the same thing.

Two quick things before we jump all the way into explaining the test or limit:

- Be aware that we are talking about Social Security income limits for retirement benefits, not disability or SSI.

- The earnings limit on social security is not the same as income taxes on Social Security. Don’t get the two confused! (If you want to dive deeper into that, check out this video on the earnings test and this video on Social Security taxation.)

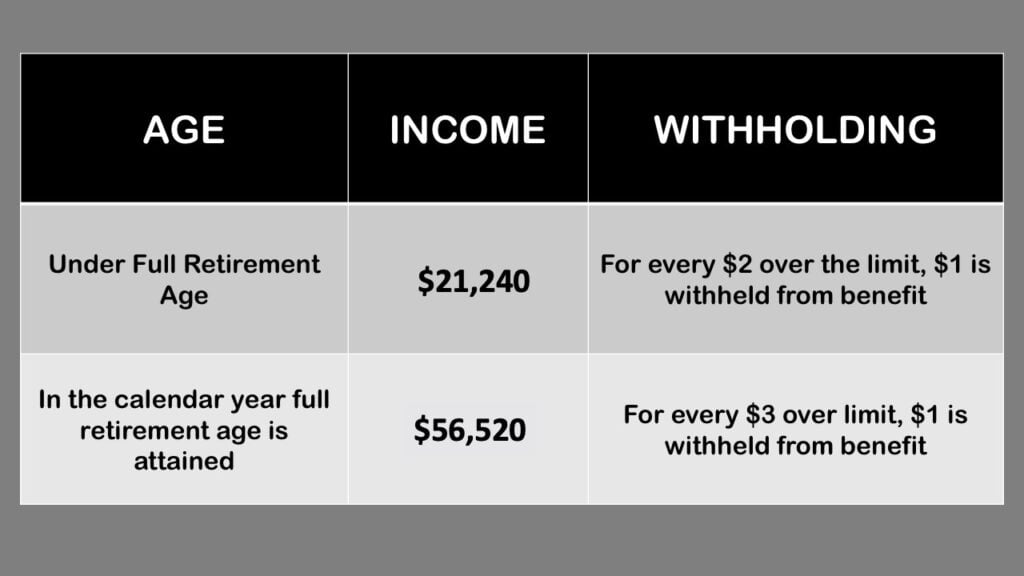

When we talk about the income limit, be aware that it only affects you if you are under full retirement age. Once you reach full retirement age, the limit does not apply. So it stands to reason that the first important step here is to know exactly when your full retirement age is.

That depends on your year of birth. It’s going to be either 66 or 67 or some age in between.

The actual amount of the earnings limit changes annually and it generally increases. For 2023, the amount is $21,240. For every $2 that you have in excess earnings, you’ll have $1 in benefits withheld.

It doesn’t matter if these are your own benefits or spousal benefits. It’s all subject to the earnings test. The only exception is the calendar year you reach your full retirement age. At this point, your income limit is increased and more excess earnings are allowed.

That’s the quick and dirty on the earnings limit, so let’s back to the question were going to work through here: Does joint income count for the earnings test?

Does Your Joint Income Count Against You?

The simple, but incomplete answer, is no…it does not count. The earnings test is an individual test. If you are a husband and wife who receive Social Security benefits from work they performed, their spouse’s excess earnings cannot affect them.

As long as the benefits you receive come from your own work history, they are insulated. For example, if your wife goes back to work it may affect her benefit payment, but it won’t affect yours.

But here’s where this can get a little tricky: Excess earnings, those earnings that are over the limit, will affect your benefits and any benefits paid from your benefits. So if anyone is collecting benefits from your work, and you have excess earnings, their benefit will also be affected.

For example, if your wife is collecting a spousal benefit and you have excess earnings, both your benefit and her spousal benefit will be suspended. The exception to this is for an ex-spouse. An ex-spouse’s excess earnings cannot affect your Social Security benefits.

Bottom Line: The Earnings Test Is Individual

The quick summary to this is to remember that the earnings test is an individual test. Normally, a spouse’s income will not impact your benefits. But excess earnings can reduce or eliminate their own benefit as well as any benefits paid to you if you receive benefits based on their work record.

Before we go…I’d like to know what you think. Do you think the earnings test should be based on single or joint income? I look forward to reading your comments below.

Also…if you have questions, join my FREE Facebook member’s group!

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

[…] The earnings limit is an individual limit. If you are still working, and your spouse is drawing Social Security, your earnings will not count towards their income limit. […]

Single income. Nearing early social security benefits age. (62) birth date 1958, wifes is 1961. Unfortunately we are relying on SS benefits. I have worked 34 years for a major aircraft corporation. We have some VIP minimal income to roll over into a IRA. I have a frozen pension fund do to divesture 19.3745 years of service at $60 per year of service. The new divetured company have 13.6 years of service in the IAM pension fund at approximately $70 per year. Think if our fearless leaders had to rely on SS benefits the program would be solvent and a… Read more »

If you’re under 50, I can’t say I blame you.

I think it will be interesting to see if any of the calculations change as to when to take social security (whether joint or individual) as we get closer to the deadline, where the government has to start pulling from reserves (I think it’s 2030). We’re relatively young empty-nesters (age 48), and we don’t factor in social security in our retirement calculations. If we get it, it’s a bonus. If not, we weren’t relying on it.