If you are attaining full retirement age in 2023, your maximum Social Security benefit is between $3,500 and $3,800.

That’s no small sum! If you wanted to get that same amount of income from a portfolio of retirement savings you’d need A LOT of money at the beginning of your retirement.

And it could get even better for you if you waited to file for Social Security. In 2023, the maximum Social Security benefit for an individual who delayed filing for benefits until age 70 is $4,555 per month. That’s more than $54,000 per year in benefits!

With dollars like these at stake, it makes good sense to pay attention to the best filing strategies for you — and how to potentially claim the maximum Social Security benefit.

What Does It Take to Get the Maximum Social Security Benefit?

How does someone get the maximum Social Security benefit? The simple answer is from 35 years of real earnings at or above the maximum taxable earnings for Social Security.

Once you hit $160,200 in income (in 2023), you pay Social Security taxes on that amount — but not on any income above that. The Social Security Administration only considered wages up to that $160,200 mark for their maximum because you quit paying into the system on any dollars above that point that you earn.

You can expect the maximum taxable earnings number to increase, usually annually. The Social Security Administration makes these changes to stay in step with the national average wage index.

For example, in 1984, the maximum wage considered for Social Security taxation was only $37,800. Inflation and wage growth drives that number higher most years.

What If You’re Close to the Maximum Social Security Benefit – But Not Quite There?

If you check your earnings history and find that you fell short of the limit for a few years, don’t despair. It may not even affect your benefit very much.

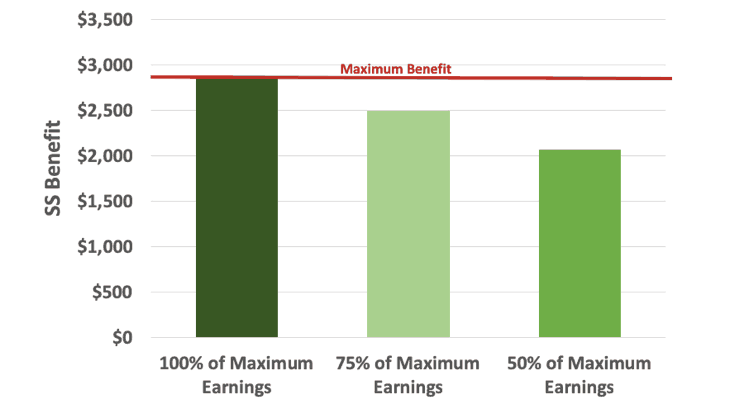

Since the Social Security formula is progressive, meaning more credit is given for lower earnings and less credit given for earnings which are approaching the maximum taxable earning limit, you can earn less than the maximum limit and still receive a benefit that very pretty close to the maximum.

Let’s say your average earnings for 35 years amounted to 75% of the maximum limit. In this case, your benefit would equal 87% of the maximum.

If your earnings had been at 50% of the maximum taxable earnings amount, your benefit would still be 72% of the maximum benefit.

How the Age at Which You File Impacts Your Maximum Benefit

It’s important to note that this “maximum” benefit is for individuals who file at their full retirement age (FRA). If you file at another age, your benefit could be less than — or more than — the maximum.

Here’s how this breaks down for 2023:

- If you file for benefits at 62, the maximum benefit is $2,572.

- If you file for benefits at 66, the maximum benefit is $3,506.

- If you file for benefits at 67 the maximum Social Security benefit is $3,808

- If you file for benefits at age 70, the maximum benefit is $4,555.

These numbers will also change on an annual basis, as they are directly tied to the full retirement age benefit. The benefit amount available at your full retirement age is also known as your PIA (or your primary insurance amount).

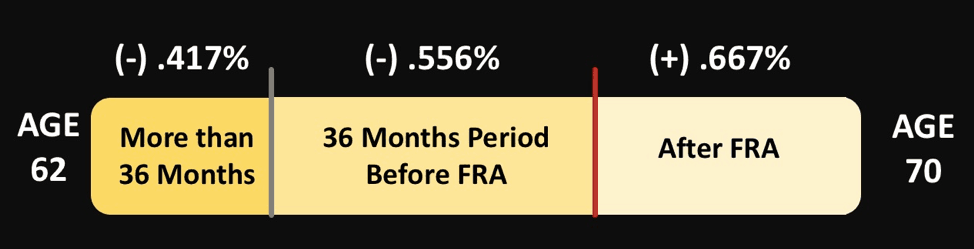

The Social Security Administration calculates your PIA from your historical earnings. That result is then adjusted, either increased or decreased, depending on when you file. The amount of increase for delaying beyond your full retirement age is .667% per month up to age 70.

The decrease amount is broken up into two separate bands depending on where you are in relation to your full retirement age. For the 36-month period immediately prior to your full retirement age, your benefit is reduced by .556% per month. For the months in excess of 36, your benefit is reduced by .417%.

Does Receiving the Maximum Social Security Benefit Change How Much You Pay in Taxes?

If Social Security is your only income, you are not required to pay taxes on it. That holds true even if you’re receiving the maximum Social Security benefit… with one small difference.

If you and your spouse both receive the maximum benefit allowed, your total benefits as a couple will be more than the first threshold amount where Social Security income does become taxable.

This doesn’t mean you’ll actually owe taxes once you fill out and submit your tax return — but this presents one of the rare cases where Social Security benefits alone could cause you to exceed the taxation thresholds.

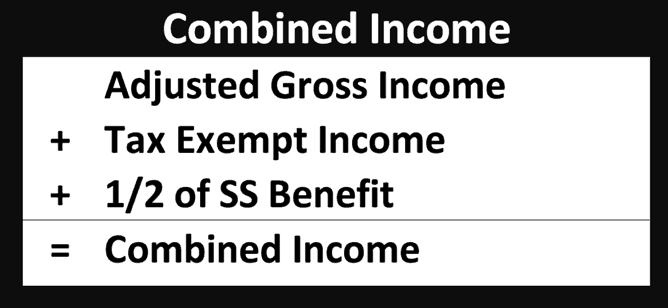

Here’s a quick review on how the taxation of Social Security benefits works. All of your income plus half of your Social Security benefits are totaled to calculate your combined income:

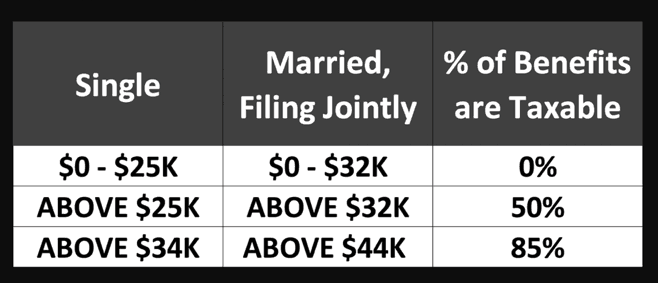

As long as your combined income is below certain limits ($25,000 for single individuals or $32,000 if you’re married filing jointly), you won’t have to pay any taxes on your Social Security benefits.

Once your combined income exceeds those thresholds, the part that is in excess is added to your taxable income:

(For a more in depth view on how taxation on Social Security benefits works, see Taxes on Social Security: A Simplified View.)

In the case of a married couple who both turned 66 in 2021 and received the maximum benefit but no other income, they would have a total benefit of $74,712 (2021 monthly max benefit of $3,113 x 12 months x 2 individuals).

Since the combined income formula only accounts for half of this amount, their total combined income would be $37,356 — which exceeds the first threshold amount of $32,000. This may be a rare situation, but it does happen and it’s important to be aware of how this might impact you if you’re in a similar position with your spouse.

Again, this does not mean that this couple would owe money in taxes. With the standard deduction alone, they’d still have a tax bill of $0.

What I find noteworthy here is that these tax thresholds were established back in 1983 and 1993 — and they’ve never been changed. Meanwhile, the amount of Social Security benefits you can receive has increased. The consequence is that, as time passes, a bigger percentage of benefits will become taxable.

Will the maximum Social Security benefit ever be so high that it alone triggers an income tax bill? Barring significant changes to tax provisions, it will take 30 to 40 years for the maximum benefit alone to be high enough to trigger a tax bill.

“Significant changes” could come about sooner, considering that the majority of provisions from the Tax Cuts and Jobs Act, including the much higher standard deduction, are scheduled to expire in 2025.

If allowed to expire, it wouldn’t take as long for couples who both have high enough earnings to hit the maximum Social Security benefit amount to be exposed to taxation solely because of their Social Security benefit.

Find Out If You’re on Track to Get Maximum (or Near Maximum) Benefits

If you want to find out how close your historical earnings are to the maximum amounts, you’ll first need to get access to your earnings history. You can easily do that on the first page of your mySSA account.

If you haven’t already set one up, you should! There are lots of reasons, but checking your earnings history is one of the biggest. Aside from looking to see if you can get the maximum benefit, you want to make sure those earnings were correctly recorded in the first place.

Mistakes happen and, unfortunately, they’re more common than you might think. See my step-by-step guide to setting up your account so you can check your earnings history.

Once you have your earnings history, sharpen up your pencil and learn how to calculate your own Social Security benefit. There’s only three main steps to the calculation, and I break it down for you here in this video.

Learning how to do this will let you experiment with various earnings levels to see how it would affect your future benefit amount.

There’s no question that getting the maximum Social Security benefit, or close to it, can make your retirement a lot easier. If you have further questions, or want to learn more, join me and 400,000 others on my YouTube channel and Facebook group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security.

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

I got some information on Social Security when my Mother applied for benefits in 1985 (she is now age 89) and have not seen this discussed since then. Its a bit of a half truth to say “the more you earn and put into the social security system” the more you will get out. Yes that is true but if I recall the numbers from 1985-it went like this. 1st 85% of your 1st 20K in annual income for a year is used to figure your benefit. 2nd 50% of your next 20K per year in income is used to… Read more »