If you are a firefighter and are planning for retirement, you need to know the rules on receiving firefighter pensions and Social Security. Specifically, you need to understand how much the Windfall Elimination Provision (WEP) will reduce your Social Security payments.

This rule can reduce the Social Security benefit rules of anyone who:

1. Worked at a job where they did not pay Social Security taxes and qualified for a pension from that job

AND

2. Worked at another job where they did pay Social Security taxes, which qualified them for Social Security benefits

While these WEP rules affect anyone who has a pension from a job where they didn’t pay Social Security, there is a special nuance in these rules that could help ease the pain for many firefighters. Before we jump into that, let’s cover a few of the basics.

The WEP Penalty: Already shown on your Social Security benefits estimate?

If you have earned a Social Security benefit from work where you did pay into Social Security, you probably have seen a statement of estimated benefits. One of the most important things to know upfront is that the penalty amount from the WEP is not reflected in your estimated benefits. This is because the Social Security Administration does not know whether an individual is eligible for a pension from non-covered work and will thus use the normal benefit formula to calculate future payment estimates.

The Social Security Administration only learns about non-covered employment once the individual applies for benefits and will then recalculate the benefit with the alternate WEP formula.

The Social Security benefits estimate statement says this:

In the future, if you receive a pension from employment in which you do not pay Social Security taxes, such as some federal, state or local government work, some nonprofit organizations or foreign employment, and you also qualify for your own Social Security retirement or disability benefit, your Social Security benefit may be reduced, but not eliminated, by WEP. The amount of the reduction, if any, depends on your earnings and number of years in jobs in which you paid Social Security taxes, and the year you are age 62 or become disabled.

TIP: You can use my free WEP calculator to find out what your real benefit will be

How much is the WEP penalty?

In 2021, the maximum WEP penalty is $491. There are a few factors that can reduce this penalty amount, but to fully understand how these factors may affect your personal situation requires understanding the basic benefit calculation.

When Social Security benefits are calculated, the SSA inflates your historical earnings (that were subject to Social Security taxes), takes your highest 35 years of earnings, and divides by 420 (the number of months in 35 years). This gives them the inflation-adjusted average indexed monthly earnings. The SSA website will frequently refer to this by its acronym AIME.

Next, the calculation applies your monthly average to what is commonly called the “bend point” formula.

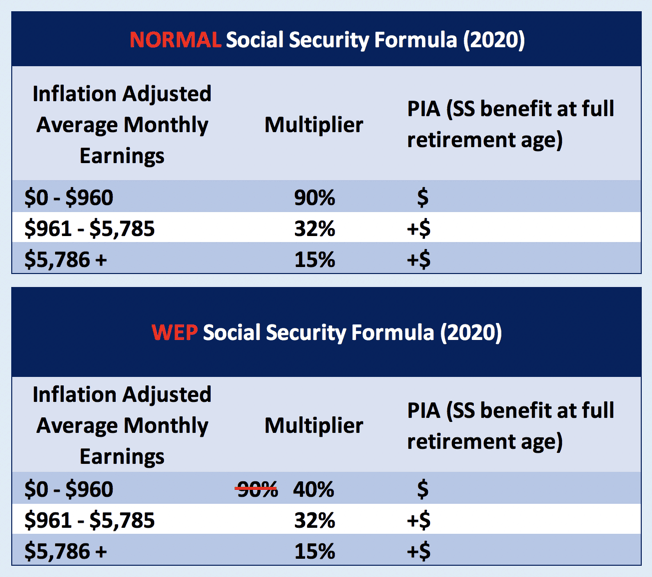

Two numbers make up the bend-point formula, which creates three bands your average income falls into to determine your benefit amount:

- For earnings that fall under the first bend point, you multiply by 90%. That is the first part of your benefit.

- For earnings that fall between the first and second bend point, you multiply by 32%. That is the second part of your benefit.

- For earnings that are greater than second bend point, you multiply by 15%. This is the third part of your benefit.

The result of this formula is your primary insurance amount (PIA) which is also known as your full retirement age benefit.

Here’s where the WEP enters the calculation. If you have a pension from work where no SS taxes were paid, your benefits are calculated on a slightly alternate formula and the result of this alternate formula is a lower benefit amount.

At first glance this alternate formula looks nearly identical to the ‘normal’ formula. However, upon closer inspection, you’ll notice that the difference between the two formulas is found within the first “bend point.” Instead of the 90% found in the normal formula, your earnings are credited to your final Social Security benefit at 40%. See the chart below for an illustration of the 2020 formula.

The difference is the 90% of the first bend point and 40% of the first bend point is the penalty amount. In the example in the chart above, this works out as follows:

(-)$960 x 90% = $864

(-)$960 x 40% = $384

2020 Penalty —-$480

The bend points generally increase every year in response to the Average Wage Index. When the first bend point increases, so does the penalty amount.

How Firefighters Often Reduce (or eliminate) the WEP Penalty

One of the aspects which is unique to many firefighters is they often work more than one job. The non-firefighting job is often covered by Social Security. If there are enough years of earnings at the second job, and those earnings were in excess of a certain annual amount, the WEP penalty will begin to decline.

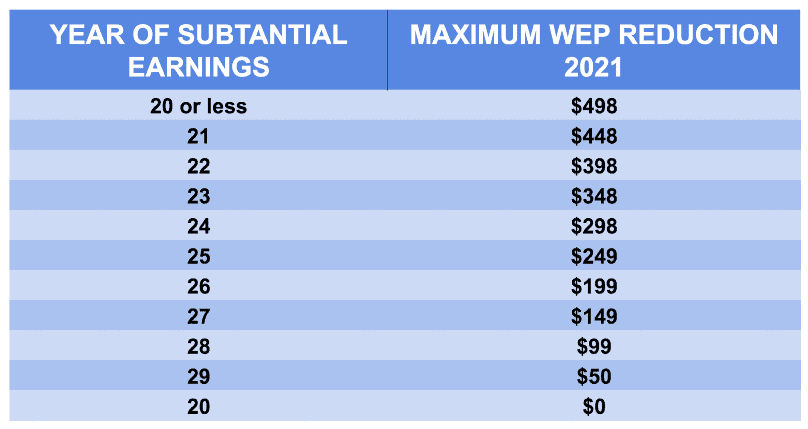

This decline in the WEP penalty starts with 21 years of substantial covered earnings (where you paid Social Security tax). At 30 years of substantial covered earnings, the WEP does not apply.

This is where understanding the benefits calculation that we just covered comes in handy. If you have less than 21 years of substantial earnings, the first bend point multiplier is 40%. For each year of substantial earnings beyond 20, you simply add 5% to the multiplier. For example, if you have 21 years of substantial earnings, the first multiplier would be 45%. At 22 years it would be 50%. At 23 years it would be 55% and at 30 years it would have worked itself back up to the full 90% that is used for individuals without a non-covered pension.

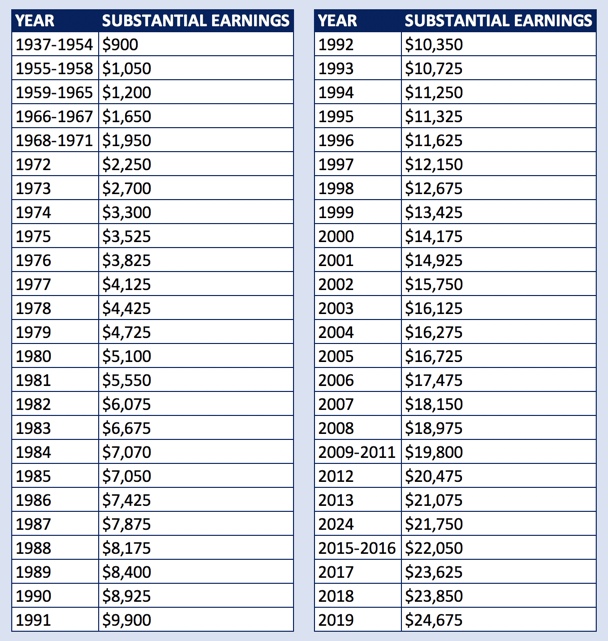

This phase-out of the WEP reduction offers an incredible planning opportunity if you are working at another job where you are paying Social Security tax. What’s especially important to know for firefighters whose second job is through self-employment is that the definition of “substantial earnings” is a hard line. If you are one dollar short of the threshold it will not be counted towards the 30 years necessary to wipe out the WEP penalty.

Below is a chart of the substantial earnings by year which would be required to sidestep the WEP.

If you consider how much more in benefits you could receive over your retirement lifetime, eliminating the WEP penalty could be worth $100,000 or more in extra income over a 20-year retirement! Obviously, not everyone has the option of accumulating enough years to wipe out the big monthly WEP reduction. But for those who do, or can get close, it’s worth taking a closer look.

What to Do If You Still Have Questions

Don’t leave without getting your FREE copy of my latest guide: Top 10 Questions and Answers on the Windfall Elimination Provision. In this guide, I go over more detail on the WEP and answer questions like:

- Can I avoid the WEP by taking a lump sum from my pension?

- What about 457 accounts?

- Does my pension affect my spouse’s Social Security?

You CAN simplify the WEP rules and get every dime in benefits you deserve! Simply click here http://www.devincarroll.me/top10WEPSSI.

In addition, I’d highly encourage you to check out some of the additional resources I’ve created that will deepen your knowledge on the WEP.

- The Best Explanation of the Windfall Elimination Provision

- Subject to the WEP? Your Social Security Statement is Wrong!

- How To Calculate The WEP & GPO With Mixed Earnings Under The Same Retirement Plan

- Social Security and Lump Sum Pensions: What Public Servants Should Know

- How the Government Pension Offset and Windfall Elimination Provision Affects Dually Entitled Spouses

You should also consider joining the 326,000+ subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

And don’t leave without getting your FREE copy of my Social Security Cheat Sheet. This is where I took the most important stuff from the 100,000 page website and condensed it down to just ONE PAGE! Get your FREE copy here.