Yes. If your other income exceeds certain limits you will have to pay tax on up to 85% of your Social Security benefits.

To determine how much of your benefit amount will be taxable, you need to calculate your “combined income” as defined by the SSA.

Combined income can be roughly calculated as your total income from taxable sources, plus any tax-exempt interest (such as interest from tax-free bonds), plus any excluded foreign income, plus one half (50%) of your Social Security benefit.

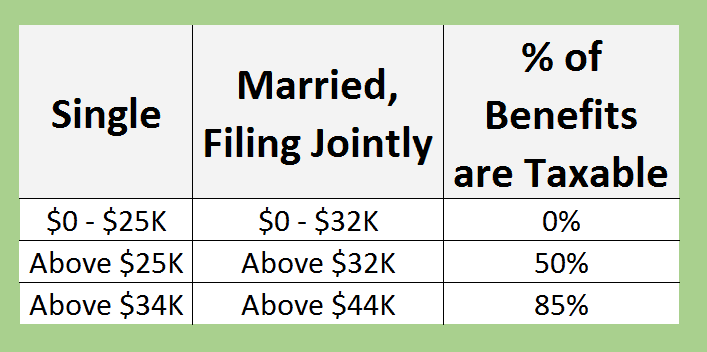

If your total combined income is less than $32,000 ($25,000 for singles), none of your Social Security benefits will be taxable.

If you are married and your total combined income exceeds $32,000 ($25,000 for singles), then 50% of the excess is the amount of Social Security benefits that must be included in taxable income.

If your provisional income exceeds $44,000 (or $34,000 for singles), then 85% of the excess amount is included in taxable income.

To see an example of this calculation, check out my article “Taxes on Social Security” or video https://youtu.be/juj4YsXOdkc.