Medicare will play an important part in your retirement plan, but it can seem confusing at first. But it’s critical that you learn enough about Medicare to have a basic understanding of the different parts and how they work together.

What Is Medicare?

Medicare is the government-run health program for older or disabled individuals. There are several parts to Medicare, and each part covers different things. The four main parts are:

Part A: Hospital coverage

Part B: Doctor’s visits, lab work, x-rays, etc.

Part C: Medicare Advantage (combines both A & B in one plan)

Part D: Prescription drug coverage

Then there are many more types that are specific to certain situations. Most of these are Medicare Advantage plans, which we’ll discuss below.

Understanding the different parts of Medicare is critical to making the right choices and taking the right steps at the right time.

Who Is Eligible for Medicare?

Most people become eligible for Medicare when they turn 65, based upon their work record or the work record of their spouse.

There are other ways to qualify, such as through Social Security disability income.

How Much Does Medicare Cost?

Medicare costs vary based on the individual, which parts you have, and which choices you make.

Medicare Part A

A worker, or spouse, who has worked 40 quarters, will pay no premium for Medicare Part A. If you don’t have 40 quarters of credit, and you’re not married to someone who has worked 40 quarters, you can pay for Medicare.

Medicare Part A has a pretty large deductible for the first 60 days of hospital coverage, and co-insurance costs for each day thereafter.

Medicare Part B

Medicare Part B has a monthly fee, which changes every year. The standard monthly premium for Medicare Part B enrollees will be $164.90 for 2023. However, the amount of the Part B premium that you pay may be different. There are two different adjustments that can apply to the amount you’ll pay for Medicare Part B. They are the Hold Harmless provision and the Income Related Monthly Adjustment Amount.

Part B does not cover everything. There is a yearly deductible ($226 for 2023.) After that deductible is met, you will pay 20% of the Medicare-approved amount for services, therapies, and durable medical equipment.

The Hold Harmless Provision

The Hold Harmless Provision ensures that even though Medicare Premiums go up each year, a Social Security beneficiary won’t ever get a smaller net benefit from Social Security. If you are having your Medicare premium deducted from your Social Security check, and the Medicare Premium goes up more than the Social Security Cost of Living Adjustment (COLA), then the increase on your Medicare Part B Premium is limited to the amount of your Social Security COLA.

Folks who are using Medicare, but haven’t yet filed for Social Security benefits, and therefore are not having their Medicare premium deducted from their Social Security benefit, are not protected by the Hold Harmless provision.

The Income Related Monthly Adjustment Amount

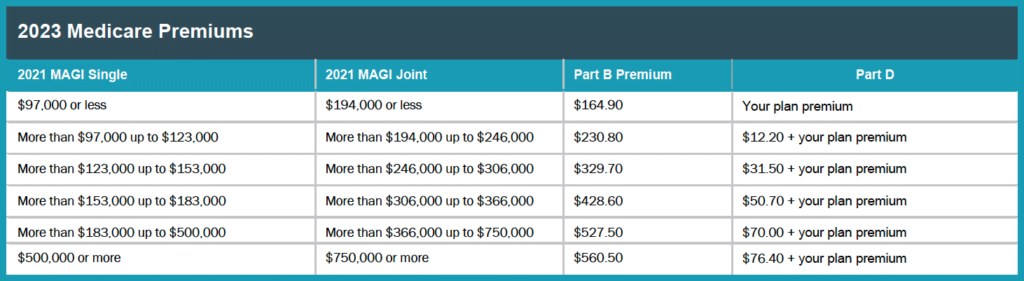

The Income Related Monthly Adjustment Amount (IRMAA) applies to those individuals with higher income. For an individual, the 2023 Medicare Part B premium increases if your 2021 income was more than $97,000. For a married couple, the 2023 Medicare Part B premium increases if your 2021 income was more than $194,000.

See the table below for the additional premium increases based on your income.

Medicare Part C

Medicare Part C has a monthly premium. The amount will vary depending on the plan you choose. Your specific Medicare Part C plan may have a deductible and/or cost-shares or co-pays.

Medicare Part D

The cost of Medicare Part D varies depending on the policy that you choose and may be increased based upon your income. There is a penalty if you had a period of time when you were eligible for Part D but did not have Part D coverage.

How Do You Enroll in Medicare?

If you are already receiving Social Security benefits when you turn 65, you will be automatically enrolled in Medicare Part A and Part B.

If you’re not receiving Social Security benefits when you turn 65, you need to sign up for Medicare Part A and Part B either online or at the Social Security office.

If you are eligible for Medicare, you should be receiving many offer from Part C and Part D providers.

How Do You Pay For Medicare?

If you are already receiving Social Security benefits when turn 65, your Part B premium will automatically deducted from your Social Security benefit payment. If you’re not receiving Social Security benefits, you’ll need to pay those Medicare Part B premiums until you start drawing Social Security benefits.

Details About Part B

Pretty much everyone should sign up for Medicare Part B. If you don’t sign up for Part B when you’re first able, you may pay a penalty when you do sign up for Part B.

There is a situations where you’re not required to sign up for Part B immediately. If you are still working, and your company who offers medical coverage and has more than 20 employees, you may not be required to begin Part B immediately. However, even some companies who meet those qualification may require that the employee take Part B. If you think you may not be required to start with Medicare Part B, you need to double check all the details. If you do meet this exception, when you do stop working, you must sign up for Part B within 8 months of working.

Details About Part C-Medicare Advantage Plans

There are special plans that encompass all the parts of Medicare wrapped into one plan. They are called Medicare Advantage plans.

These plans are low cost and often offer a range of services that aren’t covered under traditional Medicare plans. On the other hand, they often have significantly lower benefits than the standard Medicare plans. You’ll get a lot more care with traditional Medicare and a supplement than you’ll get with a Medicare Advantage plan.

If you are a young, health retiree, a Medicare Advantage plan may be an economical choice for you.

Medicare Supplement

Some people receive retiree Medicare supplement through their former employer. Everyone else who wants supplemental coverage has to purchase it.

These are private insurance programs with different costs, coverages, and exclusions. There may be deductibles and/or co-insurance or co-pays.

When considering Medicare supplements, you should check to ensure that coverage is available in your area and whether your preferred doctor participates.

Details About Part D

Part D is the prescription drug coverage. It’s a relatively recent program, started in 2006. You get to select your own Medicare Part D provider, or you can use a Medicare Advantage plan that rolls the prescription coverage into your Medicare Advantage plan. It’s important to understand how Medicare Part D work – it can be a little tricky.

Medicare Part D policies are private policies with different costs. You should check to be sure that any drugs you take are covered by the policy you want to purchase.

Medicare Part D policies also have a yearly open enrollment period, but benefits can change from year to year.

Getting Authorization

When your doctor recommends medical care, you will need to get approval from Medicare. Sometimes you get approval before the procedure, and sometimes you get approval after the procedure.

Appealing A Denial

If Medicare denies your request for approval or your claim for service, you’ll have to do a little extra work. Your denial will come the directions to appeal. Eighty percent of Medicare appeals are paid on the first appeal.

Obviously, this isn’t every single thing that you will ever want to know about Medicare, but it is a pretty comprehensive overview. I also have two podcast episodes on this topic at my Big Picture Retirement podcast:

What Medicare Covers, and What It Is Going To Cost

Digging Deeper Into Medicare, and Donut Holes

Health care costs are an important part of your retirement finances, and Medicare is a key part of how much your health care will cost. Understanding how Medicare will help you make smart choices.