Thanks for checking out my Social Security calculators!

There are a few things you should know:

- These calculators have been released to you for testing. They were created for function, and not beauty. The intent of this early version is to gather feedback from users which will help us shape the direction of future software.

- While these calculators work on all devices, your best experience will be on a desktop.

- I value your constructive feedback in my Facebook group.

- User assumes all risk. 🙂

Go directly to your calculator

- Future Benefit Calculator

- Benefit % At Specific Filing Age

- Benefit $ At Specific Filing Age

- Full Retirement Age Calculator

- Windfall Elimination Provision Calculator

- Taxable Social Security Benefits Calculator

- Break Even Calculator

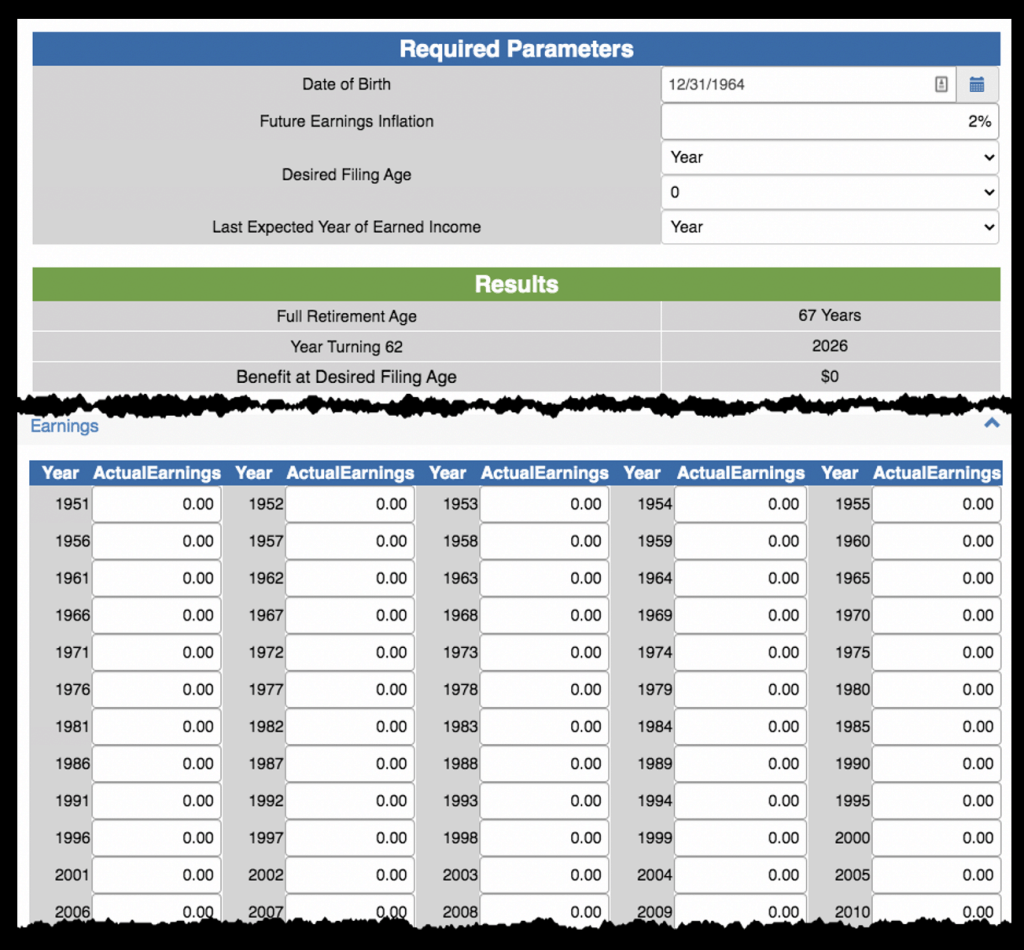

Future Benefit Calculator

This calculator is made for individuals who:

- want to know how their Social Security benefit will be affected by variable earnings scenarios in the future

- understands how the SSA calculates their benefit and wants to examine alternative calculations

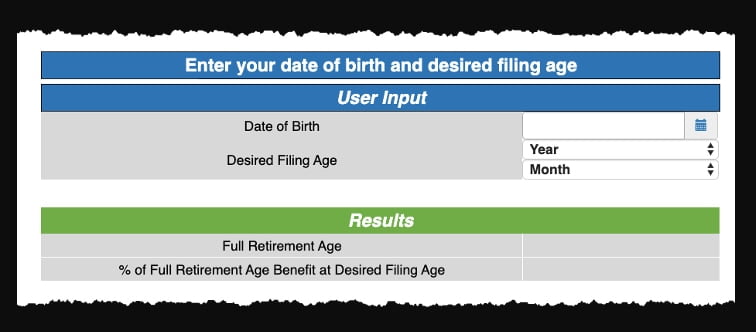

Benefit % at Specific Filing Age

When planning when to file for Social Security, it’s helpful to know how much your benefit will be increased, or decreased, based on the month you file.

This calculator will tell you the percent of your benefit you can expect to receive based on your chosen filing age.

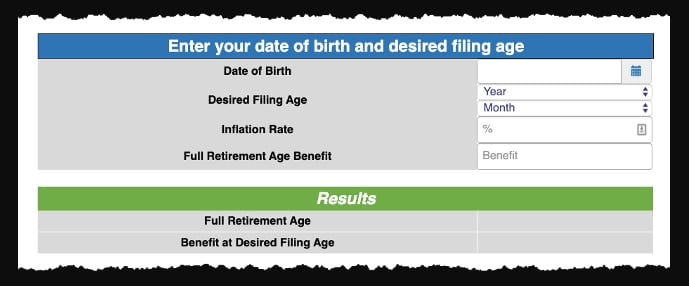

Benefit $ at Specific Filing Age

This calculator is very similar to the Benefit % at Full Retirement Age calculator. The key difference is that it is designed to tell you the dollar amount of benefit you can expect to receive in benefits at a specified age. Additionally, this calculator allows you to use inflation if desired.

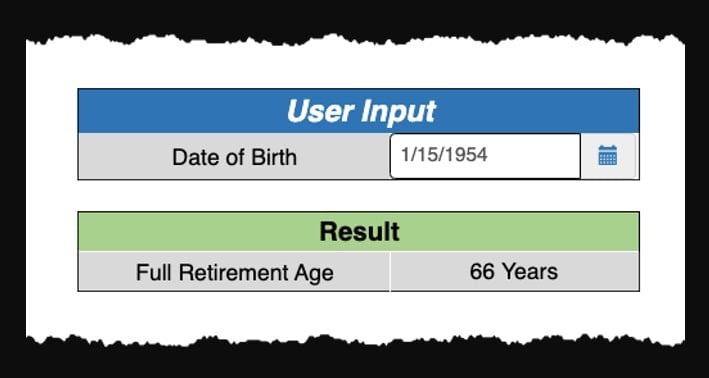

Full Retirement Age Calculator

This calculator answers one simple question: What is your full retirement age?

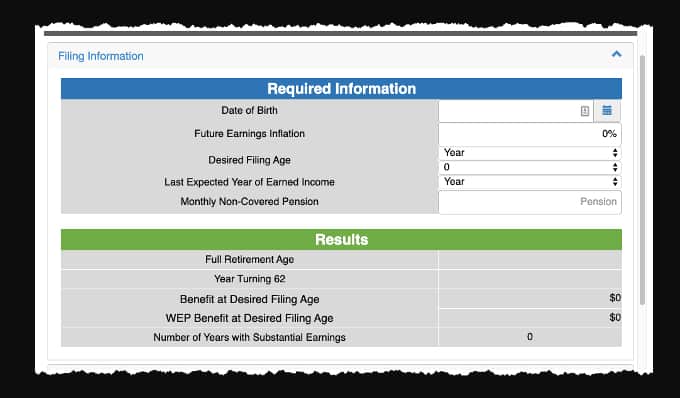

Windfall Elimination Provision Calculator

The Windfall Elimination Provision (WEP) is poorly understood and catches a lot of people by surprise.

This calculator will tell you:

- The amount of Social Security benefit you can expect after the WEP reduction

- The number of “substantial earnings” years you already have

- How additional years of substantial earnings will affect the WEP penalty

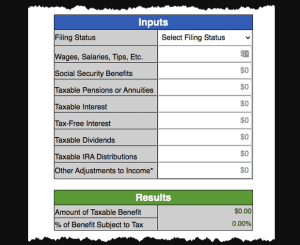

Taxable Social Security Benefits Calculator

This taxable Social Security benefits calculator will give you an estimate of how much you’ll have to pay in taxes on your monthly benefits.

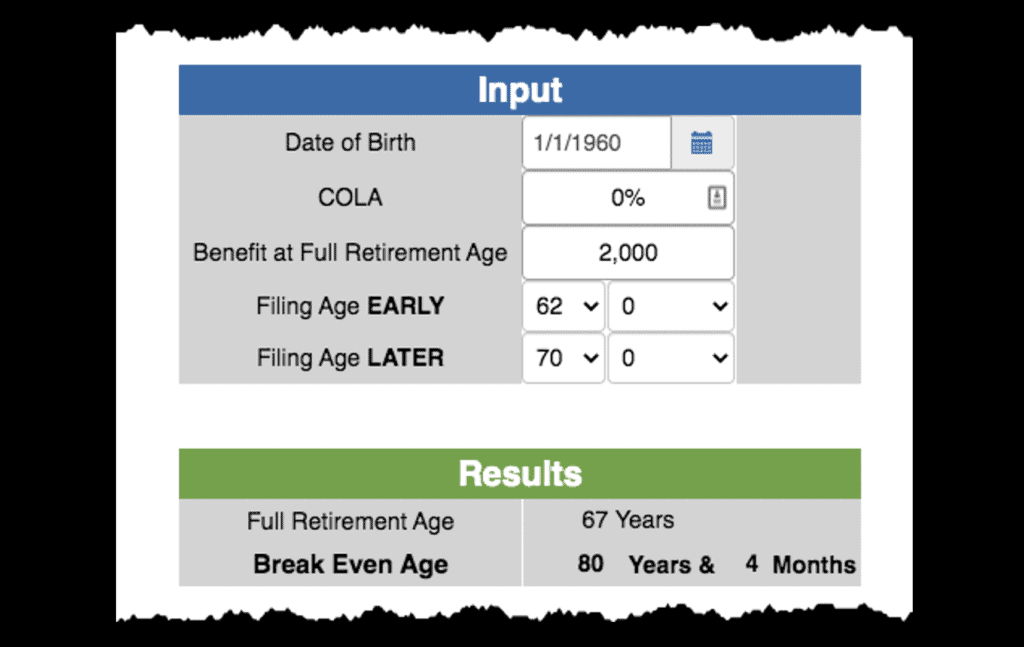

Break Even Calculator

This calculator helps answer the question; over your lifetime, which filing age will net you the highest total payments from Social Security?

Thank you for the YouTube videos. I will continue to work as long after age 66 as I am able.

Your insight and the advice help to inform the decisions I have to make.

Take care,

Doyle Cole