The concept of paying taxes on Social Security benefits doesn’t sit well with many individuals. After all, the contributions you make in hopes of receiving a future Social Security benefit are after-tax dollars that were involuntarily taken out of your paycheck.

Now the benefit you receive from the system you funded for your working career could be taxed again?!?

I can see why many people feel this puts them on the hook for paying taxes twice on the same dollars. After all, isn’t there something in our complex tax code that stops double taxation? Let’s take a closer look at the issue to get clear on what’s going on.

Is There Double Taxation on Social Security Benefits?

Through the years I’ve read a lot about this issue, but I’ve never seen anything that adequately explained it. Most articles never go deeper than the surface level, which only adds to the confusion.

Most articles I’ve seen try to explain away the double taxation on Social Security benefits issue in a different number of ways. Let me know if any of these sound familiar:

- It’s not double taxation because the funds you collect don’t come directly from your taxes. Your taxes are paying for today’s beneficiaries, so the benefits you receive will be from someone else’s payroll taxes.

- You have to think about your payroll taxes as a premium into a retirement account. Just like distributions from retirement accounts, Social Security benefits are also taxable income.

- Not all of the benefits you will receive will come from the tax you paid to help fund the system. Some of the benefit comes from interest on the trust funds, some comes from taxes collected, and the rest comes from payroll taxes.

- It’s a “contribution,” not a tax. This allows the IRS to tax you on the money you put into Social Security and the money you receive out as a benefit — because on the way out, it’s technically not a tax. (I don’t care what you call it, it’s a tax! The original Federal Insurance Contributions Act (FICA), the Social Security Administration, and the IRS all explicitly refer to this as a tax.)

All the “reasons” to wave away the double taxation idea that you can easily find online sound like double speak to me. That also piqued my curiosity, so I dove into the research to figure out once and for all whether this is truly a case of double taxation.

Understanding the History of Taxes on Social Security

To understand the whole issue, we have to put some context around this. Let’s back up and look at the history of taxation, how it works and finally answer the question once and for all (although for the purposes of this article, we’ll only look at taxes on the federal level)

Social Security benefits were not taxable from January of 1937, when the first Social Security benefit was paid, until the beginning of 1984. The original thinking was that since FICA taxes are paid with after-tax dollars, the benefit from them should be tax-free.

This all changed as a result of the Greenspan Commission.

(Officially, this was known as the National Commission on Social Security Reform — but it’s commonly called the Greenspan Commission after its chairman, Alan Greenspan.)

Congress and President Reagan appointed this group in 1981 to figure out how to “fix” Social Security. Much like we hear all about today, the Social Security trust fund was also very close to running out of money in the early 1980s.

They had to do something — and fast!

The Introduction of Taxes on Benefits

The Greenspan commission saw taxing Social Security benefits as the low-hanging fruit to solve the problem, despite the fact that there were three separate Treasury rulings in the early days that explicitly excluded Social Security benefits as taxable income.

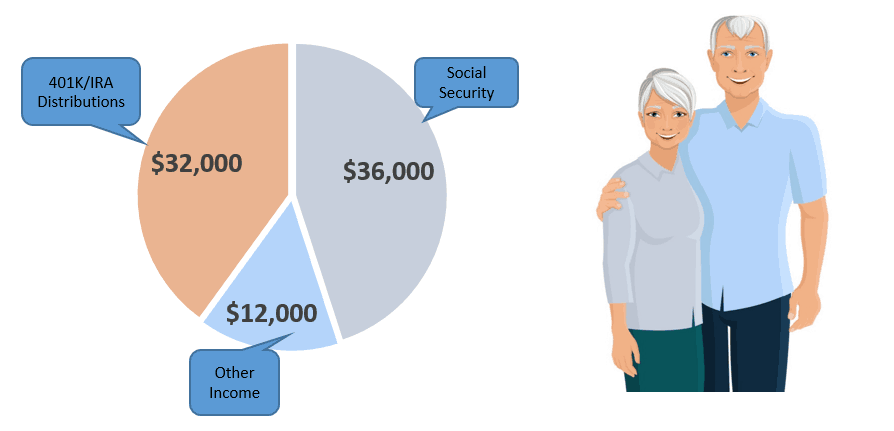

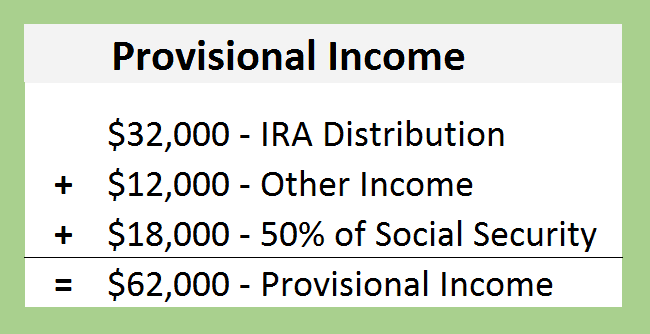

The rationalization for taxing Social Security benefits was based on how the program was funded. Employees paid in half of the payroll tax from after-tax dollars and employers paid in the other half (but could deduct that as a business expense).

This meant only 50% of payroll taxes were already taxed (the employee portion) and thus up to 50% should be taxable after it was paid.

The Greenspan commission believed this would align the Social Security rules with the ones that already existed for some pensions, annuities, and other retirement savings plans. The way this works is that if you contributed after-tax dollars to your pension or annuity, your pension payments are only partially taxable. You don’t have to pay tax on the portion of the payments that represent a return of the after-tax amount you paid.

The Greenspan commission argued that the portion of the payroll tax that the employer paid was deducted, and thus no taxes were paid on it… which created the loophole to make that portion taxable, but with the recipient of the benefit footing the bill even though the employer initially paid that portion into the system.

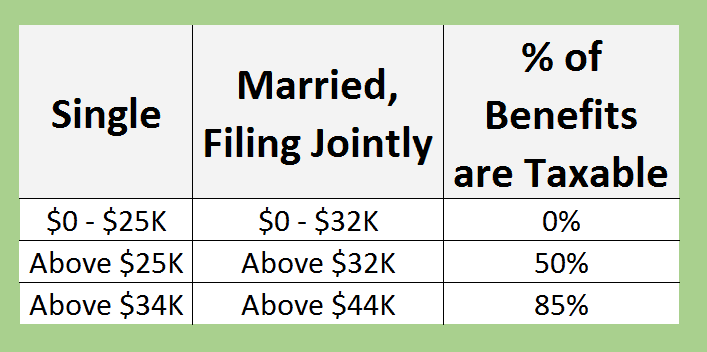

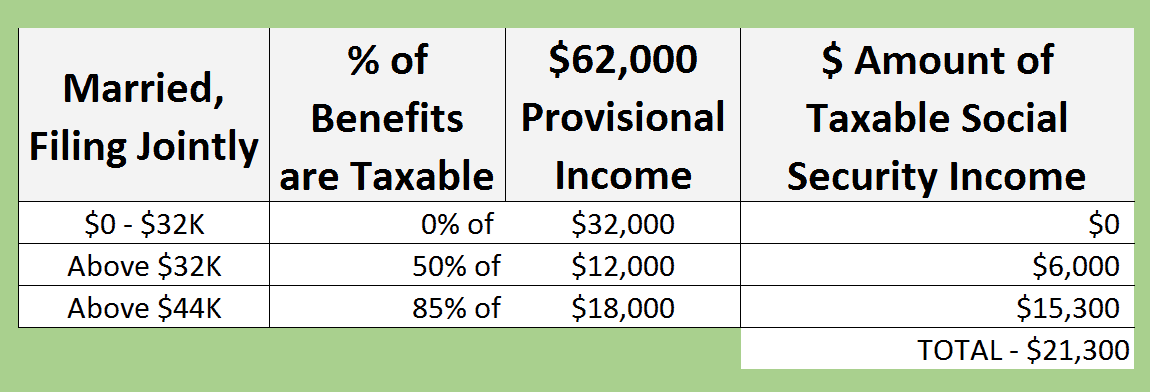

In late 1983, a law was passed which made up to 50% of an individual’s benefit count as taxable income.

Once this tax was widely accepted, it didn’t take long for the federal government to realize that they had been missing billions of dollars in potential revenue. The next step was to increase these taxes again.

Where the Increase in Taxable Benefits Came From

In 1993, a second “level” was added, making up to 85% of a Social Security benefit taxable. The rationalization they used to justify this was different than what the Greenspan commission used just 10 years earlier.

The members of the legislative committees decided that the average worker who lived to an average life expectancy will only contribute 15% of their expected total lifetime benefit in their part of the payroll taxes. Therefore, the other 85% must come from other sources and should be taxed.

For example, say someone earned an average wage and lived until an average life expectancy. They would likely receive a lifetime social security benefit of around $400,000.

But the employee only paid about $60,000 into Social Security. According to their logic, since that’s the only part that’s already been taxed, up to the remainder should be taxable.

Checking the Government’s Math: Unfortunately, They Have a Point

Although I didn’t want to admit it at first, the math here is mostly correct. A worker with average earnings who lives to an average age contributed payroll taxes that equal about 15% of their total expected lifetime benefit amount.

However, this doesn’t hold true if the worker’s income was in excess of the national average wage.

With the same life expectancy, an individual who earned 150% of the national average wage would have contributed approximately 18% of their total benefit. An individual who paid in the maximum Social Security taxes would have contributed around 23% of their lifetime Social Security benefit.

So…does the taxation of Social Security benefits constitute double taxation? Not unless you earned an income higher than the national average and have enough other income in retirement to have 85% of your benefit taxed.

But if you did…there will be some double taxation on Social Security benefits.

For example, if you worked from 1972 to 2019 and earned maximum wages, your part of the FICA tax to fund Social Security would have been around $190,000. If you file at your full retirement age and live to 85 (and get an average 2% cost of living adjustment), you’ll receive benefits totaling around $834,000.

If 85% of your benefits are taxable, you paid tax on the original FICA contributions plus $708,900 in benefit payments($834,000 x 85%). This means that in the end, you pay tax on $899,000 (85% of benefits + your part of FICA) despite having only received a total benefit of $834,000. Effectively, you get hit with double taxation on $65,000 worth of your benefits.

The Future of Social Security Taxation

If you’re breathing a sigh of relief that you won’t be impacted by double taxation on your benefits, you might not want to rest easy yet.

When Social Security benefits first became taxable, the change only affected the top 10% of retirees in terms of income earners. Now, that number is nearly 60%.

This number will likely continue to increase since the brackets that determine an individual’s income level at which point benefits become taxable has not changed since the law took effect.

In other words, the brackets are still set at 1983 and 1993 levels.

Needless to say, wages have increased between then and now. This becomes even more apparent when you look at the revenue the Social Security Administration is collecting from taxes on benefits; the tax revenue from Social Security has doubled in the last 10 years alone!

There have been a few proposals to eliminate the taxation of Social Security benefits, but with an estimated $13.2 trillion cash shortfall between 2034 and 2092, I can’t envision any proposal succeeding that would reduce revenues for the SSA. Taxes on Social Security benefits are probably here to stay.

But just because taxes may be inevitable for some, you can still plan to lessen the impact. The most obvious strategy would be to simply lower your income — but that’s not appealing or realistic for most of us.

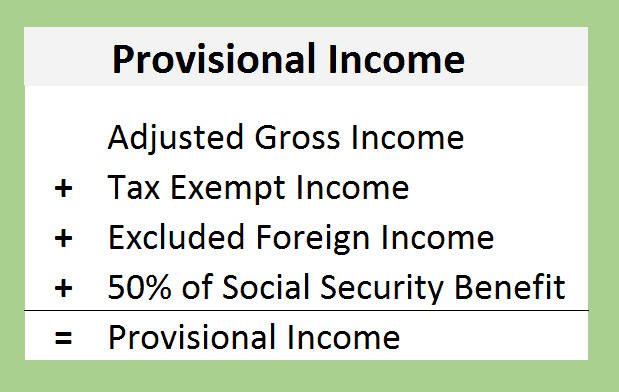

The best option may be to build a strategic plan before you retire. For example, distributions from a Roth IRA or 401(k) are not counted against you in determining whether your Social Security benefits are taxable. You could have an unlimited level of income from these sources and still not pay tax on Social Security.

If you start now, your traditional IRA and 401(k) balances may be able to be converted to Roth accounts.

Could this be an option for you? It may be depending on a number of factors that your financial planner and tax professional can help you unravel. You’ll certainly need to keep the big picture in mind when planning.

If I can help you with your financial planning or investment issues, please don’t hesitate to contact me here.

Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. Also…if you haven’t already, you should join the nearly 400,000 subscribers on my YouTube channel!

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.