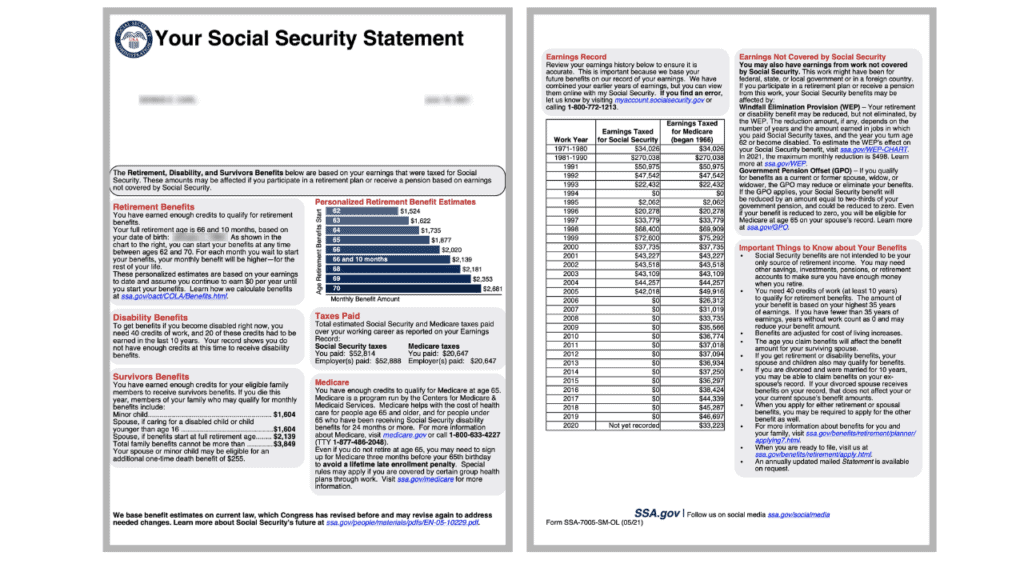

Wondering how much income you’ll get from Social Security when you retire? You might be surprised to discover that the average retiree receives one-third of their total income from Social Security, according to the Social Security Administration.

In other words, 33% of retirement income comes from Social Security, and the remaining 67% comes from other sources, like pensions and retirement savings.

While 33% is a significant amount, the statistic includes people who depend on Social Security for 100% of their retirement income and people who have so much money that they don’t notice the monthly Social Security deposits.

The often quoted 33% might be an arithmetic average, but one thing is sure — it isn’t the norm for most people.