If you are planning to retire, it’s important to take into account all costs you will incur – including how much Social Security is taxable.

Taxes from Social Security are a surprise to many retirees who are unaware of the factors that determine whether your monthly benefit will be taxable.

Fortunately, it is not hard to understand how much Social Security is taxable.

Calculating How Much Social Security Is Taxable

Generally, between 0% and 85% of your Social Security benefit payments may be taxable. To determine the percentage that applies to you the IRS uses your “combined income” and applies it to a specific threshold used only for this purpose.

The first step in understanding how much Social Security is taxable is understanding how to determine your combined income. According to IRS Publication 915, you simply count ALL of your income plus ½ of your Social Security.

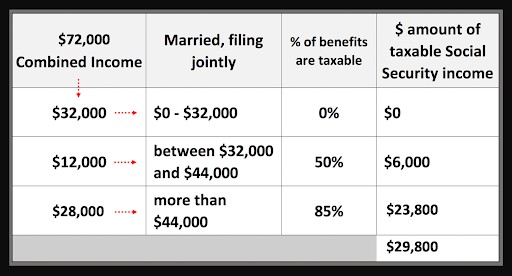

For example, assume a married couple has $30,000 in IRA distributions, $12,000 from pension payments, $10,000 in dividends, and a combined Social Security benefit of $40,000. When you sum this up, this couple would have a combined income of $72,000 (see chart below).

Once you’ve added up your combined income, you simply apply it to the threshold tables to determine the percentage of your personal Social Security which will be taxable.

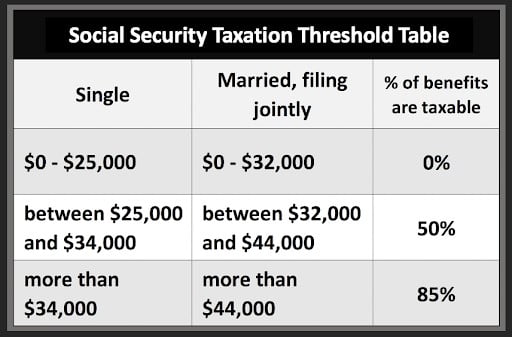

The threshold tables are as follows:

- Up to 50% of benefits will be taxed once combined income equals or exceeds $25,000 for single tax filers or $32,000 for married joint tax filers

- Up to 85% of benefits will be taxed once combined income equals or exceeds $34,000 for single tax filers or $44,000 for married joint tax filers.

In the example of the married couple with $72,000 of Combined Income, they would have a total of $29,800 (75%) of their $40,000 Social Security benefit counted as taxable income (see chart below).

That’s the broad overview of calculating how much Social Security is taxable, but there is still more you need to know. For example, there are also state income taxes that could be applied to benefit payments.

State Tax On Benefits

Since most states do not tax benefits, most Americans only need to know federal tax rules. However, 13 states do tax Social Security for at least some seniors. These include:

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- New Mexico

- North Dakota

- Rhode Island

- Utah

- Vermont

- West Virginia

Benefits are taxed differently in each of the above-named states. The links lead to the website of each state’s taxing authority so you can check the guidelines that apply where you live. In most cases, low income retirees are exempt from state tax on at least part of their Social Security income. Consequently, state taxes on retirement benefits are of primary concern to middle-class and wealthy retirees.

Social Security Benefits Haven’t Always Been Taxable

In the beginning of Social Security, benefits were not taxable. That all changed in 1983 when the Social Security Act was amended.

The new rule made up to 50% of Social Security benefits taxable for certain individuals.

In 1993, the Deficit Reduction Act expanded the taxation of Social Security benefits.Under this Act, an additional bracket was added where up to 85% of Social Security benefits could be taxable above certain thresholds.

This combination of laws resulted in the current Social Security tax structure.

Since those taxable brackets have been added, they’ve never been changed! Needless to say, wages have increased between then and now. If you look at Social Security’s revenue, it is even more evident. During the last decade alone, Social Security tax revenues have doubled!

The Future of Social Security Taxation

There have been a few proposals to eliminate the taxation of Social Security benefits, but with a looming shortfall in 2034, don’t hold your breath for any proposal succeeding that would reduce revenues for the SSA. Taxes on Social Security benefits are probably here to stay.

Instead of waiting on the unlikely elimination of these taxes, start building a plan to potentially reduce or eliminate these taxes.

A Roth IRA is a good place to start. It is probably the most valuable tool for minimizing Social Security taxes. Why? Roth distributions are not included in your combined income!

If you think you may eventually be subject to taxes on your Social Security benefit, consider building a pool of money in your Roth account. You may be able to contribute to a Roth IRA up to $6,000 ($7,000 if over the age of 50).

Check with your retirement plan at work, as well, to see if they offer a Roth option. Using a Roth in 2022 will allow you to put in up to $20,500 per year ($27,000 if over the age of 50).

Finally, you may want to consider converting traditional IRAs to Roth IRAs. There’s certainly a lot to consider when doing so, but since the tax benefits could extend beyond the tax free nature of the Roth, this could be a winning move.

For greater detail on tax-saving strategies, see my article How To Reduce Taxes on Social Security. In that article, I go into the five best strategies to reduce (or even completely eliminate) your taxes on Social Security benefits. Depending on a number of factors that your financial planner and tax professional can help you unravel, these strategies could save you thousands on taxes. One thing is for sure, you’ll certainly need to keep the big picture in mind when planning.

As a next step in your learning about this topic, you should consider joining the nearly 400,000 subscribers on my YouTube channel! This is where I break down the complex rules and help you figure out how to use them to your advantage.

And don’t leave without getting your FREE copy of my Social Security Cheat Sheet. The most important stuff from the 100,000 page website is all condensed down to just ONE PAGE! Get your FREE copy here.

[…] What we’re talking about is a means-test disguised as a tax. […]