For a majority of recipeints, Social Security benefits are shrinking.

This isn’t due to a new rule that has made it under the radar, this is actually a nearly 40 year old law that is finally starting to have the effect the creators knew it would. And it’s only going to get worse.

If you are planning for your retirement, I want you to stop what you’re doing for the next few minutes and pay CLOSE attention because I don’t want this to sneak up on you as a big surprise once you retire.

Let’s begin with a hypothetical scenario.

Let’s say I enter into an arrangement with someone to pay them $1,000 per month for the rest of their life. But when I send them this money, I ask for $100 back. How much did I actually pay them? I think you’d agree that I paid them $900. The money they actually got to keep was how much I paid them. The amount I sent them was really irrelevant.

This is what’s starting to happen with Social Security payments. You have an arrangement with the Social Security Administration to pay you a certain amount, but then they want some of that money back. When they first started asking for some of this money to be returned, it only affected a very small number of the people receiving benefits. But now, it’s over half of everyone who receives benefits and the numbers are projected to continue growing. And not only is the affected group size growing, but the percentage of benefit payments they have to return is also increasing.

What we’re talking about is a means-test disguised as a tax.

President Regan signed the Social Security Amendments of 1983 on April 20 of 1983. Under this new law, up to 50% of Social Security benefits became taxable for only a small number of high-income people who were receiving benefits. 10 years later, the Deficit Reduction Act of 1993 expanded the taxation of Social Security benefits. Under this act, an additional bracket was added where up to 85% of benefits could be taxable.

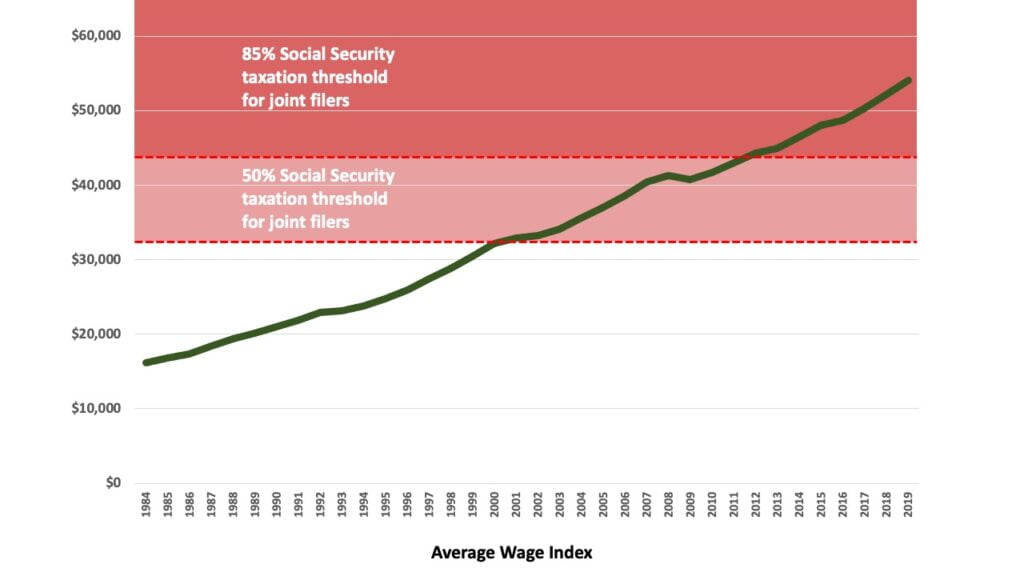

When Social Security benefits first became taxable, back in 1984, only about 8% of all recipients had to pay tax on their benefits. Now that number is more than 50% of all recipients. This is because the income thresholds that trigger taxation have never been changed. They are still frozen at the levels they were when signed into law and they are likely to remain there. This means that with a set of static tax thresholds, more and more people will be caught in this tax net and have to give back some of their benefit payment.

To see how this has worked out so far, consider that in 1984, when benefits first became taxable, the average wage index was just over $16,000. That has grown to just over $54,000 dollars in 2020.

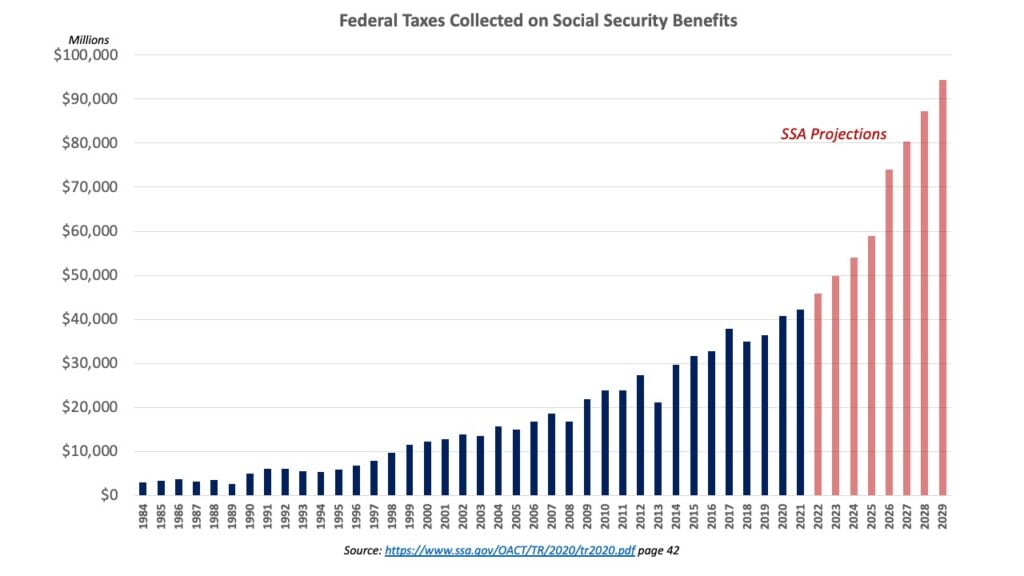

If you really want to see a staggering number, look at the dollars collected through this tax. In the first year of benefit taxation there was a total of just over $3 billion that came in. Just eight years later, that number had doubled to just over $6 billion and it kept growing from there. By 2020, there was more than $40 billion dollars in taxes collected on benefits and by 2029, this is projected to be $94 billion.

So what started out impacting a very small number of people, now casts a much wider net. (The one silver lining in this is that the money collected through taxes on benefits is returned as revenue to the Social Security trust fund so it’s helping to keep the system alive for a little longer.)

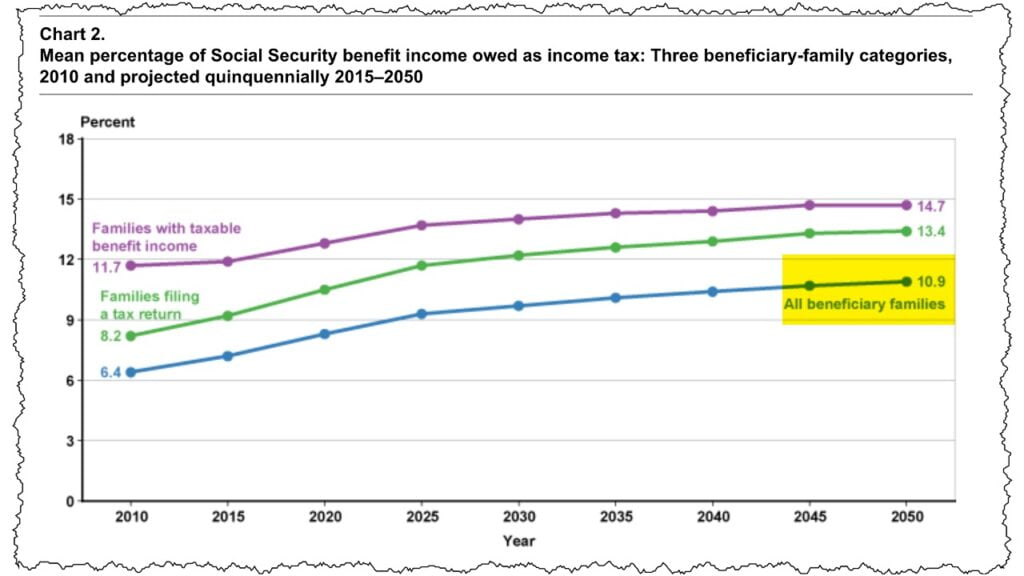

While benefit were initially tax free, according to the Social Security Administration, by 2050, 10.9% of ALL Social Security payments will have to be paid back through taxes.

This means that for every $100 in benefit payments that go out, nearly $11 will be returned to the Social Security Administration through a tax on that benefit. For individuals who have other sources of income, that percentage will be even higher.

But the big question is, what can you do about it? Well, unfortunately you probably can’t change the law. Giving back some of your future benefits is probably inevitable. But, this doesn’t mean you can’t build a plan to lessen the impact.

For example, distributions from a Roth IRA or Roth 401(k) are not counted against you in determining whether your Social Security benefits are taxable. You could have an unlimited level of income from these sources and still not pay tax on Social Security. So if you don’t have either of those types of accounts you may ought to investigate starting to save in one or even do a Roth conversion.

It may be that you need to take income from your retirement savings first, while delaying your Social Security. That way, you’ll eventually be able to get a greater share of your retirement income from Social Security which would lower your overall taxable income.

Another strategy would be to use the qualified charitable distributions from your IRAs once you are aged 70 1/2. This strategy works pretty well for those who are in the habit of giving money to their church or some other non profit.

For greater detail on tax-saving strategies, see my article How To Reduce Taxes on Social Security. In that article, I go into the five best strategies to reduce (or even completely eliminate) your taxes on Social Security benefits. Depending on a number of factors that your financial and tax advisors can help you unravel, these strategies could save you thousands on taxes.

You may also find my article on the double taxation of Social Security interesting. I can see why a tax on Social Security benefits is perceived as paying taxes twice on the same dollars. After all, isn’t there something in our complex tax code that stops double taxation? In this article I take a closer look at the issue to get clear on what’s going on.

As a next step in your learning about this topic, you should consider joining the nearly 400,000 subscribers on my YouTube channel! This is where I break down the complex rules and help you figure out how to use them to your advantage.

And don’t leave without getting your FREE copy of my Social Security Cheat Sheet. The most important stuff from the 100,000 page website is all condensed down to just ONE PAGE! Get your FREE copy here.