It’s common to hear that Social Security will run out of money within a few years or otherwise be bankrupt by the time future generations are ready to start claiming benefits. While there may be problems for the program in the future if changes aren’t made, it’s essential to understand how Social Security is funded and how the program works in general so that you can better understand where problems might arise. Putting the many rumors about Social Security’s impending demise into context can help you better plan for your retirement and claim your benefits with less fear that the program may not be there when you’re ready.

Let’s look at how Social Security is funded, its expenses, and some of the problems it inherently faces.

What is the Social Security trust fund?

Social Security is funded through two separate trust funds managed by the federal government. The first is the Old-Age and Survivors Insurance (OASI) trust fund which provides monthly benefits to retired workers, their spouses and children, and survivors of deceased insured workers. The second fund offers monthly benefits to disabled-worker beneficiaries and their spouses and children and is called the Disability Insurance (DI) trust fund.

Although the two trust funds are legally distinct, they are often referred to collectively as “the Social Security trust fund.” You may also see ‘OASDI’ used to reference the whole of Social Security and referring to both the old-age and survivors trust and the disability trust as a single entity. For this article, we’ll look at these trust funds as the whole of Social Security and refer to both as the trust funds.

How is Social Security funded?

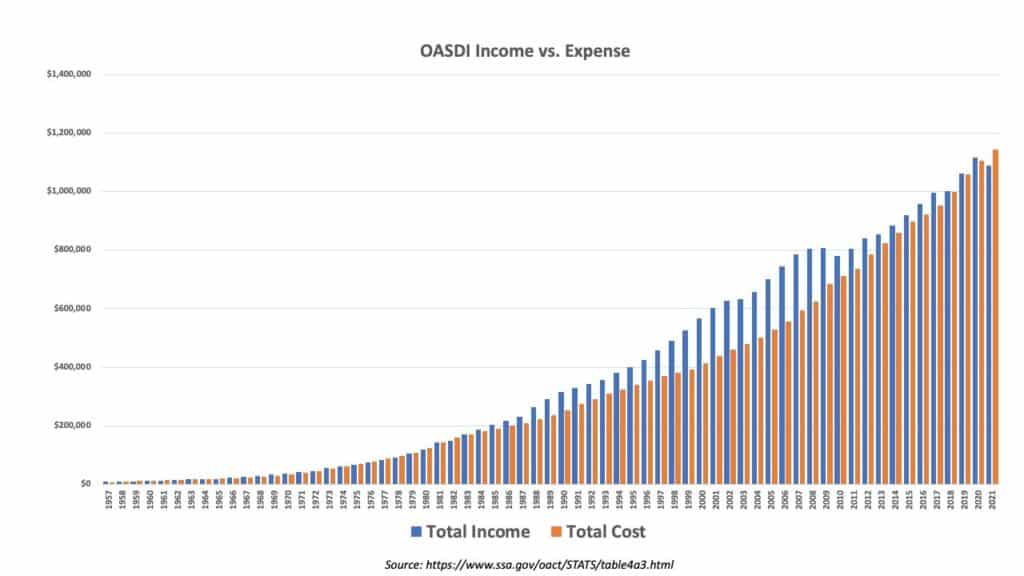

It’s easiest to think of these trust funds working like your bank account. Income comes into the fund through payroll taxes and other revenue streams, and expenses (or benefits) are paid out to Social Security beneficiaries. Since 1957 there have been multiple years where more income has come in than has been spent on benefits, resulting in a nearly $3 trillion cushion waiting in the trust funds for future use. As you can see in the graph below, the blue bars are the income of the trust funds, and the orange lines are the cost associated with Social Security.

It can be easy to think that there are piles of money sitting in a vault, waiting to be paid out to beneficiaries. Instead, when money is collected, the treasury department makes a digital accounting entry in the trust fund, just like is made for all other aspects of government spending — no physical money is moved around.

The Social Security trust funds buy special-issue certificates and bonds only used for these two trust funds. These investments pay interest just like those in your brokerage or retirement accounts. When money needs to come out of the trust fund to pay benefits or other expenses, these special issue investments are sold to meet the program’s costs.

Social Security brings in income in various ways: payroll taxes, investment interest, and benefits taxation. Let’s dig a little deeper.

Income from payroll taxes

In 2021, the trust funds had just over $1 trillion in income. The most significant source of income is the payroll tax, also called the Federal Insurance Contributions Act (FICA). If you look at your W2, you’ll see your yearly contributions to the Social Security system through this payroll tax. There are also additional taxes taken out under FICA for the Medicare program.

The total tax for Social Security is 12.4%, but if you are an employee, half of that amount (6.2%) is paid by your employer. This means that most people pay the standard 6.2% to the Social Security trust funds up to the taxable earnings cap for the year, but you’re responsible for the total 12.4% tax on your income if you’re self-employed.

The federal government limits how much of your yearly income is subject to the Social Security tax. In 2022 the taxable cap is $147,000 in gross salary. In 2023, the limit will be $160,200. Any earnings over that cap are not subject to the Social Security portion of payroll taxes. Of the 6.2% total, 5.3% is paid into the OASI trust fund, and .9% is paid to the DI trust fund. In 2021 the trust funds received just under $1.1 trillion in total income, and payroll taxes alone accounted for $980 billion.

Interest on trust fund investments

The second largest piece of Social Security funding comes from investment interest payments. The chart above shows long periods where Social Security brought in more income than it paid out in expenses. The surplus income was invested, and those investments paid interest. In 2021, the trust fund investments earned slightly over $70 billion in interest.

As a side note, investing surplus Social Security income is an area of contention. Some say that it would have been beneficial to invest the surplus differently for a higher rate of return than the special issue treasury notes provide, as Bill Clinton initially advised. For example, instead of the special certificates and bonds that surplus income is currently invested in, which return about 2.3%, better use of the funds would have been investing in the Railroad Retirement Board, which has averaged more than 8% per year in returns.

Benefit taxation and General Fund reimbursement

It can be shocking to learn that Social Security benefits are taxable, but those taxes offer an additional income stream for the Social Security trust funds. In 2021 the taxes collected on benefit payments came to nearly $38 billion. Although that’s a relatively small percentage of the overall Social Security income, it is certainly a large sum of money that helps contribute to the program’s overall revenue.

The smallest amount of income that Social Security receives comes from general fund reimbursements. This income is a combination of smaller things, like any temporary payroll tax credits that have happened throughout the years. In 2021, General Fund reimbursements added about $1 million to the trust funds, a small sum that doesn’t even appear on the chart.

The income of nearly $1.1 trillion in Social Security trust fund comes from these various sources. To help you get a better understanding of the magnitude of each revenue stream, below is a listing of each of the items we’ve discussed in numerical form:

- Total income $1,088,326,000,000

- Net payroll taxes $980,602,000,000

- Income from taxation of benefits $37,610,000,000

- General fund reimbursements $1,000,000

- Interest $70,113

How much Social Security costs

Now, let’s break down the costs of the program. The first, and by far the largest, is the cost of benefit payments to eligible beneficiaries. These payments make up 99% of the outflow from the trust fund. In June 2022 alone, Social Security paid 47.9 million retired workers $80 billion in benefits or an average monthly payment of $1,669. Additionally, a further $10.6 billion was paid to 7.8 million disabled workers, for an average monthly payment of $1,362. In total, 66 million people will receive benefits from the two trust funds.

The remaining expenses are about $6.5 billion in administrative costs, which pay salaries of those who work for the Social Security Administration and fund the Social Security offices you can visit to apply for benefits in person. Additionally, $4.9 billion is transferred back to the Railroad Retirement Program from a 1951 amendment.

Below is a numerical breakdown of 2021 Social Security expenses to help you further understand the program’s scope.

- $1,144,582,000,000 total cost

- $1,133,191,000,000 benefit payments

- $6,492,000,000 administrative expense

- $4,900,000,000 transfers to railroad retirement

The potential problem with Social Security

While Social Security isn’t likely to run out of money entirely, there are issues with the way Social Security is currently funded that may cause problems for future workers if Congress doesn’t take action. Due to changing conditions, Social Security costs are expected to be higher than the income collected over the next few decades. The nearly $3 trillion in current surplus will be spent, and the projected income won’t be enough to cover full worker benefits as they are currently structured.

Once the excess is empty, estimated to be around 2034, the only funding source for Social Security will be the current payroll taxes being collected. Current estimates say that incoming taxes will be enough to meet about 75% of the expected expenses if the Social Security overage is depleted. There is still time to fix the problem, but Congress will need to pass legislation to amend the program.

Make Social Security work for you

Understanding how Social Security is funded and its expenses can help you put the program into context. While there are currently multiple income streams for Social Security, the projected costs may deplete any surplus in the coming decades. Instead of relying solely on Social Security for your retirement funds, make sure you work with a retirement planner to help you develop a plan for your retirement.

Additional information about how Social Security is funded

- Trust fund data: https://www.ssa.gov/oact/STATS/table4a3.html#income

- How the tax transfers happen: https://www.ssa.gov/oact/progdata/taxflow.html

- Tax rates to each trust fund: https://www.ssa.gov/oact/progdata/oasdiRates.html

- How the trust funds are invested, interest rates, etc.: https://www.ssa.gov/oact/progdata/fundFAQ.html

- Interest rate formula for the special tax obligations: https://www.ssa.gov/oact/progdata/intrateformula.html

- Transfers to Railroad Retirement: https://www.ssa.gov/policy/docs/ssb/v68n2/v68n2p41.html