Within the next few months, you’re going to start hearing a lot about the impact of the coronavirus pandemic on the Social Security system.

Even though we have been dealing with this pandemic for many, many months now, we still don’t yet know the full measure of economic damage caused by the shutdowns of schools and businesses. We can reasonably assume this devastation will have long-term effects we’ll feel for years into the future.

The economy moves like a train; when someone yanks the brakes without warning, it tends to at least partially derail.

That economic derailing we suffered in 2020 will, unfortunately, most likely have a negative impact on Social Security.

How the Coronavirus Will Accelerate Mandatory Benefit Cuts to Social Security

There’s no good time to see an economic collapse, but the negative impact the coronavirus pandemic will have on Social Security came at a particularly bad time.

Before the pandemic was even declared in the spring of 2020, experts expected that Social Security benefits would have to be cut by 25% across the board by 2034. The revenue coming in would not be enough to meet the benefits that needed to be paid.

Now, we have to factor in the financial impact of the pandemic — which includes reduced revenue from payroll taxes due to massive job losses. This will likely accelerate that mandatory benefit cut timeline.

The reality we’re facing is that, lacking any drastic action, we’ll probably see a benefit cut even sooner than 2034..

That’s bad enough, but the real story about the impact of COVID-19 on Social Security is how the pandemic is going to impact those who are nearing the eligibility age for Social Security.

Why COVID Will Upend the Formulas Used to Determine Benefits

Social Security benefits are determined using the formula that’s in place the year you turn 62. You can keep working, and the extra earnings years will be considered in your annual recalculation, but they’ll still use the formula from the year when you were 62.

This formula is determined by year-over-year changes to the average wages of Americans, as measured by the average wage index. Needless to say, wages took a big hit in 2020.

This is going to work its way into the formula and for some, without government intervention, this could be a big deal.

Fair warning: we’re going to need to get into the weeds a little bit, but I want you to stick with me. An understanding of the background is critical if you want to fully understand what’s going to happen.

The core issue is tied to wages as measured by the average wage index. The Social Security Administration uses the Average Wage Index (AWI) as the foundation in creating the formula used to calculate a person’s Social Security benefit payments.

Using this wage data helps ensure that benefit payments reflect the general rise in the standard of living that occurred during an individual’s working lifetime. But the system hasn’t always been linked to changes in wages.

Prior to the 1972 Social Security Amendments, changes to the various components of the benefit program were determined by Congressional action. The 1972 amendments introduced the concept of automatic adjustments based on the changes to the cost of living. Under these rules, if price inflation went up, so would benefits. But within just one year, the Social Security Board of Trustees began to project financial problems for the system coming down the road.

At the time, price inflation was soaring out of control but wages were stagnant. That caused projections of workers’ future Social Security benefits to increase beyond what those individuals made while working, because payments were tied to inflation.

The 1977 amendments were enacted to solve this problem. Payments after 1977 were determined by a formula tied to the average wage index instead of the consumer price index.

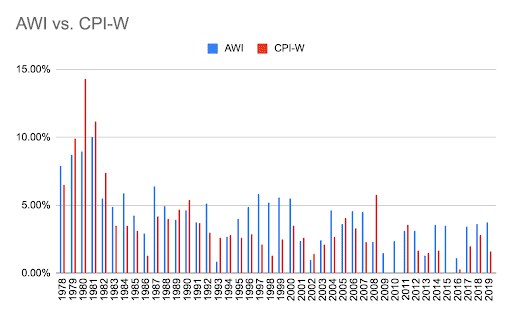

For the most part, this system has worked out fine. The average wage index helped smooth out the impact of inflation and actually gave larger increases to the benefits formula than would have been received if the system still used CPI to determine how to calculate benefits.

There have been Unlike when the Social Security Administration used the CPI in their formulas, there has only been one year where the average wage index did not increase. That was in 2009, where it dropped 1.5% from the 2008 level.

One key difference is that the CPI will never lead to a benefit decrease, as it can’t go below zero. But the AWI can – which brings us to today.

So what’s the big deal? One word: Unemployment.

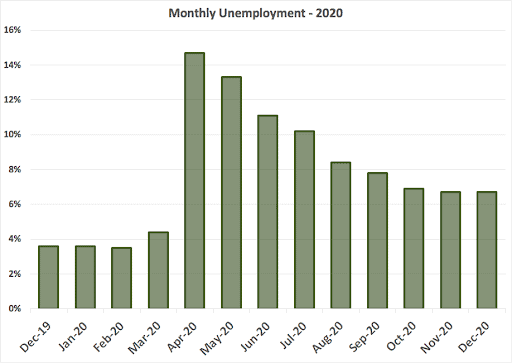

SOURCE: BLS DATA

The shock to the economy from the coronavirus pandemic was so great in 2020 that, in April 2020, unemployment increased by 10.3% to 14.7%.

This set two records: It was the highest rate ever recorded, and it was the largest month-over-month increase.

At the beginning of April there were 7.2 million unemployed Americans. By the end of the month, that number had more than tripled to 23.1 million. In one month, 15.9 people lost their jobs.

Massive Unemployment Throws a Wrench into How Social Security Benefits Are Calculated

There’s a somewhat obvious connection between unemployment and wages. You know that if unemployment goes up, fewer people are working and fewer wages are being paid.

But things start getting complicated when you consider how the average wage index is calculated.

The government arrives at the annual index number by simply taking the total of all annual reported employment income and dividing that amount by the total number of workers who received W-2s for work performed at some point during the year. The result is the raw wages.

The percentage difference in year-over-year raw wages gets applied to last year’s Average Wage Index. That results in this year’s Average Wage Index.

To put it simply, this is a division problem. You have the number of W-2s, which is the denominator, and the total employment income paid to workers, which is the numerator.

Unemployment wasn’t high at the beginning of 2020; it didn’t spike until April. We will likely see a normal number of W-2s for 2020, but employment income will drop. When we go to do the math for the wage index, the numerator will be lower but the denominator is the same.

In a typical recession, you don’t get these sudden gyrations in unemployment. It’s more gradual, which means that if wages have fallen, so has the total number of workers who will receive a W-2. Both the denominator and the numerator will drop, but that’s not the case for 2020!

Because of this, some economists expect a 10% decrease in the 2020 average wage index. Stephen Goss, the Chief Actuary of the Social Security Administration, believes the total decline will be closer to 5.9%.

Assuming Goss’ analysis, we can expect a $118 monthly drop in Social Security income for an average income earner in 2022.

That’s not the way it’s supposed to happen. Benefits are supposed to increase over time.

Meanwhile, the CBO predicts the AWI may only drop by .5%. While is better news, it could be such a small decrease that it doesn’t catch enough attention to start the wheels of policy changes. This isn’t exactly ideal either.

What to Expect from a Potential Benefits Decrease

Let’s look at the average wage index in action so we can see the nuts and bolts of how and why this is going to happen.

To understand this completely, we need to break down two key pieces of the Social Security benefit benefits calculation:

- The indexation of historical earnings to determine the average indexed monthly earnings, or AIME.

- The application of AIME to a bend point formula to determine the primary insurance amount, or PIA.

These two pieces on their own make up the bulk of the calculation and both pieces rely heavily on data from the average wage index, so let’s look at each individually.

To calculate your indexing factors, you take the average wage index (AWI) in the year you attain age 60 and divide by the AWI in each of the other years you had earnings (but only up to the maximum earnings taxable for Social Security).

This will result in a ratio that’s commonly called the indexing factor. You simply multiply this indexing factor by each year’s actual earnings to result in that year’s indexed earnings.

For example, let’s assume you turned 60 in 2019. In that year, the average wage index was $54,099.99. You’d divide that by the wage index in 2018, which was $52,145.80. This would give you an indexing factor of 1.0374755.

Next, you’d divide the 2019 AWI by the AWI in all the other years you had earnings. That indexing factor is what you use to multiply your actual earnings. This is what indexes them for wage inflation over your career.

Once your earnings are indexed to reflect wage inflation, you drop all earnings years except for the top 35. Then you take these 35 years, sum them, and divide the total by 420. The result of this calculation is known as your Average Indexed Monthly Earnings (AIME).

This is the step where the first big problem comes in. If the average wage index when you are 60 drops, you’ll get a lower result when you divide it by all the prior year’s average wage index numbers.

This means that your indexing factors for every year are going to be smaller — which, ultimately, drives down your average indexed monthly earnings.

This problem gets compounded when you move to the next step to determine your primary insurance amount (PIA). The PIA is simply the result of your benefit calculation and is generally your full retirement age benefit amount.

This calculation uses the “bend point” formula. For retirement benefits, you only use the formula in place the year you turn age 62.

You can keep working, and the extra earnings years will be considered in your annual recalculation, but they’ll still use the formula from the year when you were 62. This is frozen.

These bend points are the actual numbers in the formula and, like the indexing factors, they are changed annually based on the changes in the average wage index .

There are two numbers that make up this formula, which are separated into three separate bands:

- For earnings that fall under the first bend point, you multiply by 90%. That is the first part of your benefit.

- For earnings that fall between the first and second bend point, you multiply by 32%. That is the second part of your benefit.

- For earnings that are greater than second bend point, you multiply by 15%. This is the third part of your benefit.

The sum of these three bands is your PIA, or benefit amount at full retirement age.

Bend points increase or decrease based on changes to the average wage index. Because there is often a lag in updating the average wage index, the bend point calculation always uses the AWI data from two years prior to the year you attain age 62.

For example, if you turn 62 in 2022, the average wage index data from 2020 will be used to determine the bend points used in your calculation. With a lower average wage index, the dollar amounts of the bend points will decline.

In Summary: Why the Coronavirus Pandemic Could Cause Social Security Benefits to Drop

Because the average wage index is expected to drop by as much as 10% in 2020, individuals who are turning 62 in 2022 will have lower indexed earnings running through lower bend points which will ultimately lead to a permanently smaller benefit.

The last time the formula caused a drop in benefits in 2009, Congress did not intervene. But things could be different this time around, as this is a significantly larger decline.

There is a currently pending piece of legislation called the Protecting Benefits for Retirees Act. It was sponsored by Senator Tim Kaine of Virginia. This bill specifies that the national average wage index used in calculations related to Social Security benefit programs must be at least as high as the wage index used in the previous year. Specifically, for any year in which the average wage index declines, the calculations must use the index that applied during the previous year.

This wouldn’t be the only piece of the system that has this safeguard in place. In addition to the key pieces of the Social Security formula, the average wage index also controls the earnings limit, the maximum taxable wage base, the amount needed to earn one credit, and the amount of substantial gainful activity for disabled individuals

None of the items can be decreased due to the decline of the average wage index. This same rule needs to be applied to the indexing factors and the bend point formula.

As this proposed legislation works itself through the system, as well as the other related news about the decline of the average wage index, I’ll be keeping my eye on it and helping you navigate the latest developments. So if you haven’t already, be sure to subscribe to my YouTube channel so you can receive the latest updates as they happen and stay fully informed.

RESOURCES:

My Article: HOW SOCIAL SECURITY BENEFIT PAYMENTS ARE CONTROLLED BY THE AVERAGE WAGE INDEX (AWI)

https://www.socialsecurityintelligence.com/the-average-wage-index-awi/

My Video: Social Security: The Average Wage Index (AWI)

SSA Webpage on the AWI

https://www.ssa.gov/OACT/COLA/AWI.html

CRS Report: How Benefits Are Calculated

https://fas.org/sgp/crs/misc/R43542.pdf

Elizabeth Bauer’s article in Forbes

Andrew Bigg’s Paper

Link to all AWI based calculations

https://www.ssa.gov/OACT/COLA/AWI.html

Stephen Goss Testimony https://waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/Steve%20Goss%20Testimony.pdf

January 2021 CBO Report

https://www.cbo.gov/system/files/2021-01/56973-AWI.pdf