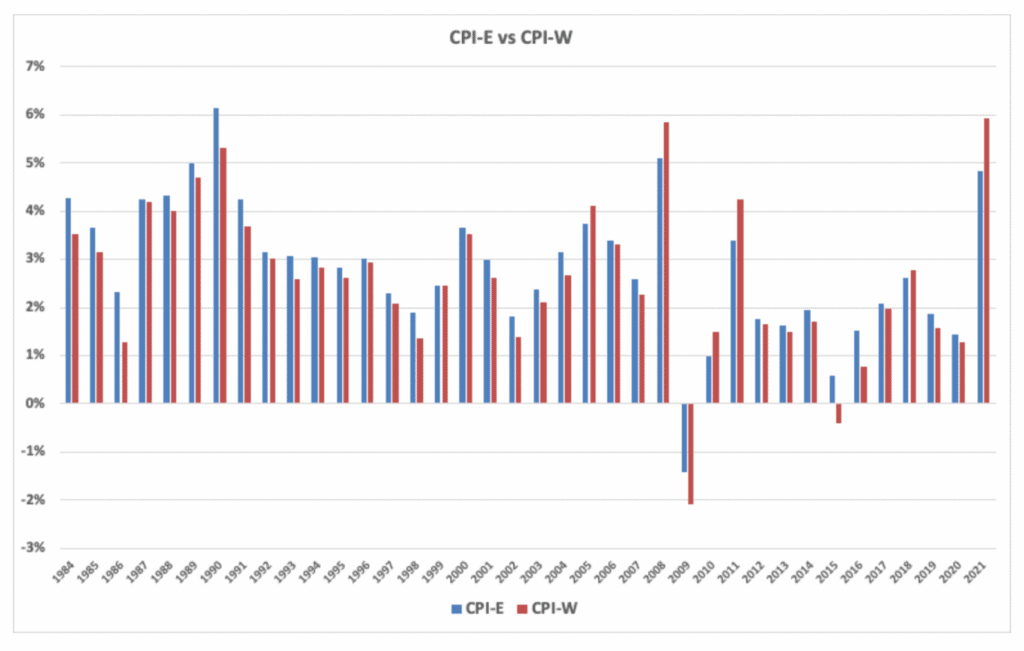

If the annual cost of living adjustments to benefits would have been based on the CPI-E, instead of the current CPI-W, the benefit increase in 2022 would be 1.1% lower!

Recently, the Social Security Administration announced yet another Social Security cost of living adjustment. And once again, the amount of the adjustment left some wondering why it wasn’t higher.

The announcement ignited the same conversation and questions as it does every time. In the comments of my videos, my Facebook group, and on my website, many people say things like, “My expenses have increased a lot more than this cost of living adjustment,” or, even more commonly, “There has to be a better way to measure the increases to living expenses than the way it’s being done now!”

Given that it’s such a common response to the usual Social Security cost of living increases, I want to cover the proposal that may change how these adjustments are calculated.

How Social Security Benefits Cost of Living Adjustments Are Made Today

Right now, Social Security benefits are automatically adjusted every year. The Social Security Administration uses a certain measurement of inflation to determine if benefits should be increased or not.

The measurement they currently use is the CPI-W, which stands for the Consumer Price Index for Urban Wage Earners and Clerical Workers. This inflation gauge is compiled and published by the Bureau of Labor Statistics.

Although they release this on a monthly basis, the Social Security Administration (SSA) only uses the data for the third quarter when making the adjustment to Social Security benefits. That means they look at the data for July, August, and September each year.

To determine a potential increase in Social Security benefits to match an increased cost of living, the SSA adds the sum of the index for the prior year’s third quarter and compares it to the sum of the third quarter index for the current year. If the difference between the two numbers is positive, Social Security benefits increase. If there is no increase in the CPI-W, then there is no cost of living adjustment for the year.

It’s really pretty simple… but some folks believe it’s not very effective.

There’s an argument against this way of determining cost of living adjustments for Social Security benefits.

Some say the CPI-W measurement method may not be the best because retirees spend their money very differently than individuals who are not retired. Retirees tend to spend more on healthcare and housing, and less on gasoline, education, and consumer electronics.

As a fix for this, it has been widely suggested that the Social Security Administration should discontinue basing the annual cost of living adjustments on the CPI-W and instead start using a measurement known as the CPI-E.

Considering Costs Specific to Retirees: The CPI-E Proposal

This version of the CPI is meant to track the expenses specifically for Americans who are 62 years of age or older. While both of these indexes measure the same categories of goods and services, they have different weightings to the categories.

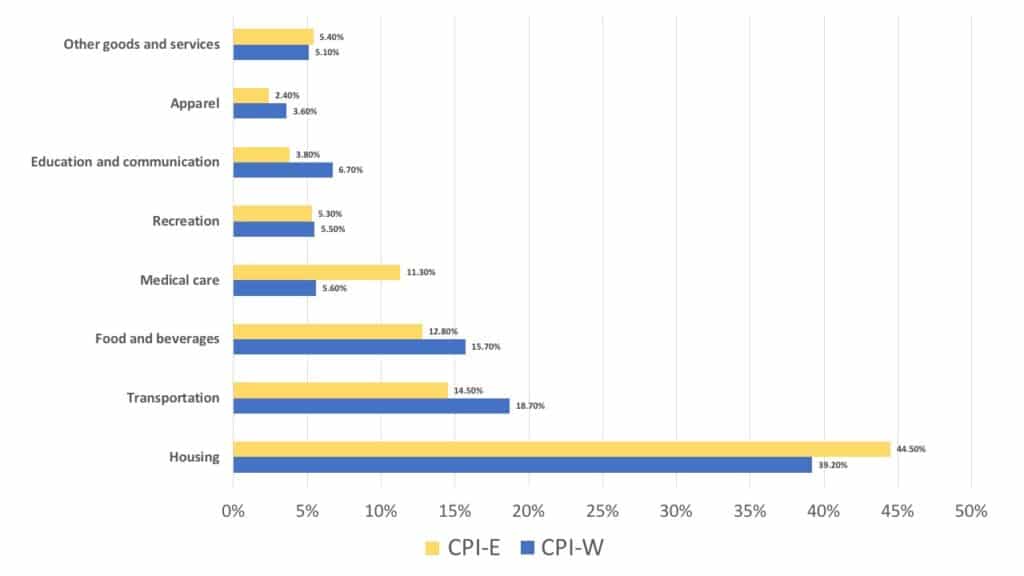

So for example, the CPI-E factors in around 11% of its index to healthcare cost. The CPI-W, however, only counts 5.6% of the overall index as healthcare expenses. Since statistically, seniors spend more of their money on healthcare, an index that assigns a higher weighting should be more accurate to the way they spend money and experience inflation.

There are some other differences in weightings between the CPI-W and the CPI-E that may be significant for determining cost of living adjustments for Social Security benefits. In total, each index measures 8 main categories:

- Housing

- Transportation

- Food and beverages

- Medical care

- Recreation

- Education and communication

- Apparel

- Other goods and services (for the stuff that doesn’t fit anywhere else)

As you can see from this chart the two big differences are the weightings assigned to housing expense and medical care:

The big question here is, how does this affect the actual cost of living adjustment for benefits? Would it result in a larger benefit increase for seniors?

Using the CPI-E data available from December 1982, we can go back and do a year-by-year comparison with the CPI-W, the version that’s currently being used.

When viewed side by side, you can see that there are some years where the CPI-W was ahead, those are the red bars, but in most years the CPI-E was slightly higher.

If you average the difference between the two measurements since 1984, the CPI-E has been about 0.2% higher per year. So yes, in most years the CPI-E would yield a higher cost of living adjustment than the CPI-W, but there are some years (like the COLA announced for 2022) where the CPI-W was higher than the CPI-E.

The CPI-E Is Not A Magic Formula

This highlights the reluctuance of legislators to make this switch. On paper, it sounds good. An index that more accurately represent the expense of retirees should work better. But no politician wants to be responsible for making this switch in a year where the new method results in worse results.

Additionally, there are a few problems with the measurement method. First, the Bureau of Labor Statistics is very blunt about this being an “experimental” index. The Government Accountability Office also released a report this year that identified several issues with the potential accuracy of the CPI, and specifically mentioned the small sample size of the CPI-E as a factor.

The CPI-E sounds great to many folks who receive Social Security benefits and feel like their costs go up more than their Social Security income does. But ultimately, there is no magic formula that works well enough to keep everyone happy.

I know that with the current fiscal challenges that the Social Security system is facing, I wouldn’t expect a more generous formula for increasing benefits. But as this conversation continues to develop, I’ll keep you informed right here.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

Also…if you haven’t already, you should join the 356,000+ subscribers on my YouTube channel!

Here are some of the resources I used in creating this article:

BLS CPI-E VS CPI-W

https://www.bls.gov/opub/ted/2012/ted_20120302.htm

Data on weightings in CPI-W vs CPI-E

https://www.bls.gov/opub/ted/2012/ted_20120302_data.htm

CPI-W table

Monthly CPI Data (xls download in Data section) https://www.bls.gov/cpi/research-series/r-cpi-e-home.htm

[…] were spending to fuel their cars this year) but usually, CPI-E outpaces CPI-W, according to an analysis from Social Security Intelligence, a blog run by Devin Carroll, a financial adviser and founder of […]

[…] were spending to fuel their cars this year) but usually, CPI-E outpaces CPI-W, according to an analysis from Social Security Intelligence, a blog run by Devin Carroll, a financial adviser and founder of […]

Would you please use data from the last 10 and 15 year periods (or compare moving 5 year averages)?