It’s important for you to have a clear understanding of the process used to calculate your Social Security benefits. If you understand this calculation, you may be able to spot mistakes and fix them before it’s too late.

Like anything with Social Security, the rules can seem complex at first. But once you get under the surface, they are actually pretty easy to understand. To help you, I distilled the several pages of calculation rules down into four easy-to-understand steps.

Why Do I Need To Know How To Calculate My Social Security Benefits?

So you may be thinking, “Why do I need to know how to calculate my own Social Security benefits? After all, the SSA will give me an estimate at any time.”

That’s true! You can go to your My SSA account online and see an up-to-date copy of your benefits estimate. So why would you need to know how to do this calculation on your own?

It’s important for a few reasons.

First, it never hurts to understand the mechanics behind an income stream that’ll probably be a large part of your overall retirement income.

Secondly, your benefits estimate from the Social Security Administration is probably wrong. This is because their estimation methodology has two serious flaws:

1) They assume your future earnings won’t increase

2) They use today’s social security formula

This means that these estimates are less accurate for younger workers but more reliable for workers who are close to retirement.

So, understanding how to do this calculation is especially important if you plan to retire early or later than “normal” or if you have a significant earnings change in the last few years of working.

To do this calculation, there are only four steps.

- Adjust all earnings for inflation

- Calculate your Average Indexed Monthly Earnings (AIME)

- Apply your AIME to the benefit formula to determine primary insurance amount (PIA)

- Adjust PIA for filing age

Social Security Calculation Step 1: Adjust all earnings for inflation

So let’s jump in with calculating your AIME. To do this, you’ll need to get use a notepad or a tool like Excel/Google Sheets.

You’re going to need six individual columns with plenty of room underneath for your information. Set up your columns with the following headings: Year, Age, Actual Earnings, Indexing Factor, Indexed Earnings, Highest 35 Years.

The first two headings are the year and your age. Go all the way back to the first year you had earnings that were taxed for Social Security. You can find a complete record of this by going to your online SSA account and click the link that says “view earnings record.” If you don’t have an online account, it’s very easy to set one up.

This may seem a little redundant to put the year and your age, but it’ll make another step a little easier.

Now you just need to copy down the information from the SS earnings history. You’ll want to use the part that says “your taxed Social Security earnings.” Don’t skip a year, even if there were no earnings. Just put a zero in.

Once you have all of your historical earnings recorded, it’s time to adjust them for inflation. The SSA uses an indexing factor to make sure your future benefit has kept up with inflation, but still based on your earnings.

Important note here…only your earnings through age 59 are indexed. All earnings at age 60 and beyond are used in the calculation at face value with no inflation adjustment applied.

Also…When you’re getting your indexing factors, you have to be careful to use the factors specific to your age.

The easy way to get these is to visit the SSA web page on indexing factors. At the bottom of that webpage it says, “Enter the year of eligibility for which you want indexing factors.” This should be the calendar year you turn 62. It’s really important to use this year to make sure you get the correct indexing factors.

Now that you have your indexing factors, just copy them on to the sheet. Be sure to keep your years matched up.

Once your indexing factors are written down, you simply need to multiply your actual earnings by your indexing factor. This will give you your indexed earnings.

Social Security Calculation Step 2: AIME Calculation

Now, all you have to do is extract the highest 35 years of indexed earnings.

If you’re still working and don’t have 35 years, you’ll need to estimate what your future earnings will be and apply the indexing factors just as you would for actual historical earnings. This is where you can start to play around with the numbers to see the various impacts of retiring early, or working later or maybe having variable earnings close to retirement.

Once you have your highest 35 years in the last column, you just need to sum them up and divide by 420. You divide by 420 because that’s the number of months in 35 years and we need to get your average earnings expressed as a monthly number.

Once you do this, congratulations…you have your AIME and have finished the first (and hardest) step of the calculation. It’s downhill from here.

NOTE: If you die before accumulating 35 years of earnings, there is an alternate calculation. See my article “If You Die Early: How To Calculate Social Security Survivor’s Benefits.”

Social Security Calculation Step 3: Primary Insurance Amount (PIA) Calculation

Now you’re ready to determine the heart of your benefit; your primary insurance amount (PIA). The PIA is simply the result of your benefit calculation and is generally your full retirement age benefit amount.

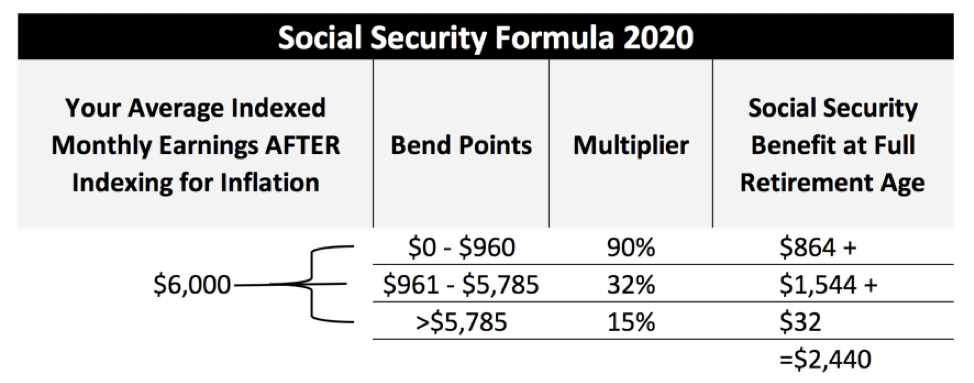

This is calculation is accomplished by using the “bend point” formula that’s in effect for the year you attain age 62. If you aren’t 62 yet, you’ll need to forecast what the bend point formula amounts will be in the year you turn 62. These change annually based on the change in annual wages and generally increase at 3-4%.

There are two numbers that make up this formula which are separated into three separate bands: The amount up to the first number, the amount between the first and second number, and the amount above the second number.

- For earnings that fall within the first band, you multiply by 90%. That is the first part of your benefit.

- For earnings that fall within the second band, you multiply by 32%. That is the second part of your benefit.

- For earnings that are greater than the maximum of the second band, you multiply by 15%. This is the third part of your benefit.

The sum of these three bands is your benefit amount at full retirement age: your PIA, or Full Retirement Age benefit amount.

In the example image below we illustrate an individual with an AIME of $6,000 being applied to the bend point formula.

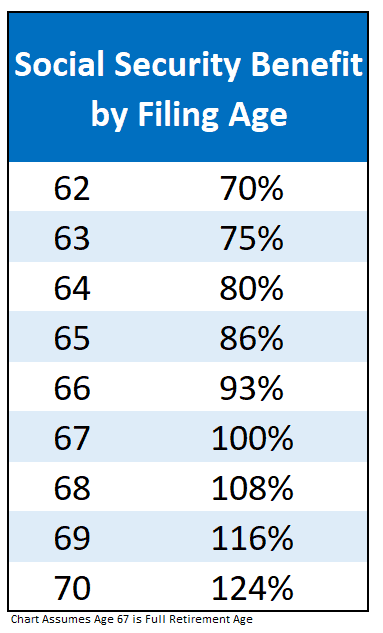

Now that you’ve calculated your average index monthly earnings and applied them to the PIA formula, you simply need to figure out how your filing age will impact your benefit amount.

Social Security Calculation Step 4: Adjust for Filing Age

The easy way to look at it is to think about it in annual numbers.

Your benefit will be lower if you file at 62 and higher if you file at 70.

If you file after your full retirement age, your benefit will increase by 8% per year. If you file in the 3 year window immediately prior to your full retirement age your benefit will decrease by 6.66% per year of early filing. For anything more than 3 years before your full retirement age, your benefit will decrease by an additional 5%.

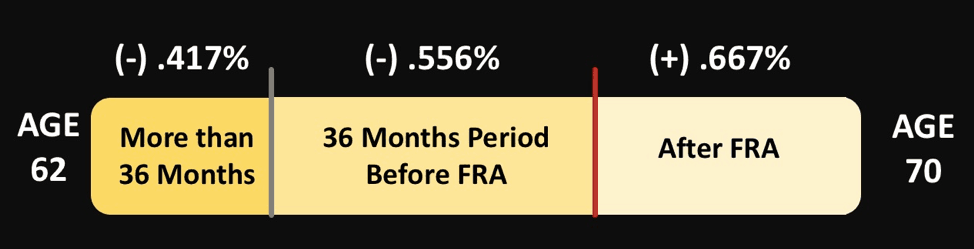

A lot of people don’t want to retire on their birthday so it’s important to break this down by a monthly amount.

Monthly Increase/Decrease Percentages

After your FRA, your benefit will be increased by .667% per month you delay.

For the 36 month period before full retirement age your benefit is reduced by .556% and for more than 36 months it is reduced by .417% per month.

And that is it! Once you’ve gotten through this step you’ve successfully calculated your Social Security benefit.

It’s your retirement!

Before you leave I’d recommend staying connected with my content so you won’t miss anything. In many cases, I’ll publish my newest stuff on YouTube (with more than 400,000 subscribers!) and then have a discussion in my Facebook group.

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

[…] early as age 62 and can be deferred as late as age 70. Collecting early reduces annual benefits (by roughly 5 to 7 percent per year) and collecting late increases benefits (by roughly 8 percent per […]

You write: “The red line is your full retirement age. This is where you receive the amount of the benefit you calculated plus any cost of living adjustments that happen between now and then.” This is my question. When is “now” and “then”? Is “then” always your full retirement age? Is “now” assumed to be some year after “then”? I am calculating a PIA based on bend points for hitting age 62 in 2039. Full retirement age is 67 in year 2044. So, does the calculated PIA refer to 2044 dollars? Of course this makes a huge difference for how… Read more »

This is the best explanation I’ve found on how to calculate SS benefits, especially helpful are the handy links to get the age-approrpiate indexing and bend-point figures. Nice work.

[…] when Social Security benefits are calculated, historical earnings subject to Social Security taxes are indexed to the “average wage level two […]

It’s important to know how to compute your social security benefits before you retire so that you would know how much to receive when the time comes that you would have to actively retire from service. The reason for this is that you would want to maximize how much you would be receiving in your retirement years as ‘payment’ for all the work you’ve done in your prime. If I had to look for a calculation service I would want to use it to help my father calculate his retirement benefit fund.