Most of us spend a lot of time figuring out how to maximize the benefits we can receive from Social Security. After all, when we’re talking about retirement, every extra income stream and every dollar makes a difference.

So it might sound strange at first to talk about how to stop your Social Security benefits from coming in. But in some situations, there are a number of reasons why stopping your Social Security benefit is the right thing to do.

There’s a right way to do this, and a wrong way — and you need to know the difference so you can understand when it makes sense to turn off Social Security benefits, and how to do it correctly so that action doesn’t come back to bite you down the road.

Why Stop Social Security Benefits?

Sometimes, people file for their Social Security benefits and then realize they need to stop receiving this income — at least for a little while. It might be because they went back to work and earn their income that way, or feel like they made a mistake to file when they did (and feel it would have been beneficial to file later).

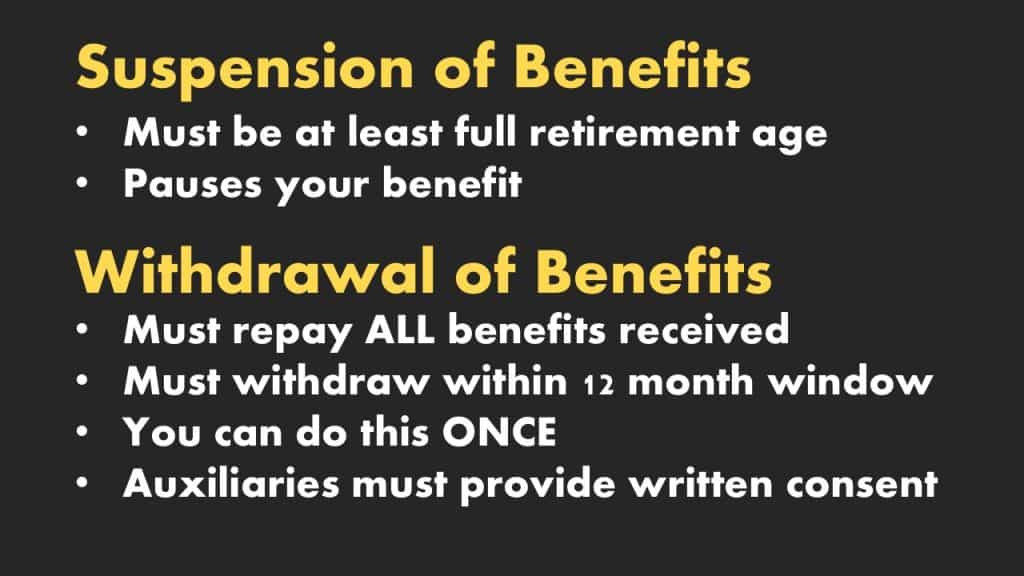

Whatever the reason you might face, know that you can change your mind and stop your benefits. However, there are two distinct methods you can use to stop Social Security benefits, and each of them have different rules and outcomes.

Understanding the differences between these two methods is really important.

Method 1: Suspending Social Security Benefits

Suspending Social Security benefits is the first way you can go about this. A suspension of benefits can only happen after you reach full retirement age.

This is the simplest way to stop your benefits (assuming you’re of the right age), because there’s no paperwork to fill out or lengthy process to follow. You simply call and tell the technician you want to suspend your benefit. That’s it.

This method is like hitting the pause button — and the upside of doing this is that every month you suspend your benefits, the total amount you receive increases by ⅔ of 1%. Not a lot, obviously, but again, sometimes every little bit helps when it comes to retirement income.

Method 2: Withdrawing Social Security Benefits

The second option available to you to stop Social Security benefits is choosing to withdraw those benefits. If suspending your benefits was like hitting the “Pause” button, the withdrawal option effectively hits the “Undo” button on your benefit election.

Going this route makes it like filing and receiving your benefits never happened. But the rules for this option are different than Method 1.

You can withdraw Social Security benefits anytime between ages 62 and 70 — but you must choose to do so within the first 12 months of receiving benefits. Once that 12 month window closes, you can no longer use this option.

Withdrawing benefits also means you have to repay all your benefits. This includes the benefits that you already received and any benefits that your spouse or children received. (The one exception is for a divorced spouse.) You must also pay back any Medicare premiums that were withheld and any voluntary tax withholding that came out of your benefit check.

You can only use this withdrawal method once, and keep in mind that anyone else’s benefit that would also be stopped from your withdrawal will have to provide written consent before your request is approved.

For example, a spouse who is receiving spousal benefits right now would no longer get those benefits should you withdraw your benefits. Since this would create a loss of income for them, they’ll have to agree to the withdrawal of benefits.

Should You Stop Social Security Benefits Using Either Method?

You need to be fully armed with all the information before you decide to make either of these moves. Continue to do your own research and talk to your own advisors before you make a big move like this. There are a lot of BIG things to think about here. For example, what happens if you paid tax on those Social Security benefits that you’re now paying back?

Do you get those tax dollars back?

Joe and His Tax Bill

Usually, I can answer most of my client’s Social Security questions. But when they start to ask for specific tax advice, I have to turn to my resources.

That happened recently when “Joe” attended one of my workshops. He filed for benefits when he was 66 and attended my workshop 8 months later. For his personal situation, it became apparent that his choice of filing strategy could have been better. He quickly made the decision to “undo” filing for Social Security. He filed the Form 521 and paid back all the benefits that he had already received.

I don’t get many questions on Social Security that take me off guard. However, his next question did. He asked, “What happens to the taxes I paid on those benefits?”

Time for A Tax Pro

For that answer, I had to reach out to my friend Chris Evans. He is an Enrolled Agent and owner of Tax Solutions.

Here’s what he had to say.

“This can actually get pretty complex.”

He went on to explain.

“As with most tax questions, this one brings up more questions before I can get to an answer. Are you drawing any current benefits? Is your spouse drawing benefits? If we add the net benefits for each of you (Box 5 SSA-1099) is it negative? If it is negative what is that amount?

If you or your spouse are drawing current benefits, the repayments will offset those benefits and reduce your current tax liability. If one spouse’s net benefits (Box 5 SSA-1099) is negative, and the other spouse still has current benefits then you will subtract from the spouse’s current benefits to calculate the taxable benefits for the current year. While neither of these effect the previous tax that was paid in, it at least reduces the current amount of taxable benefits.

If the total of all SSA-1099 forms are negative then you can take an itemized deduction, however this deduction is handled in two different manners depending on the amount of your deduction.

If the amount of the deduction is less than $3000.00, then it is considered an itemized deduction subject to the 2% adjusted gross income (AGI) limit. If you are unable to itemize your deductions, unfortunately you would not recoup any of the taxes paid.

The most complex scenario is if your deduction is more than $3000.00. If this is the case you will have to calculate your tax in two different methods to determine which gives you the lowest tax liability.

You would first calculate your tax with the deduction as a Schedule A itemized deduction. A big distinction here is that when your deduction is over the $3000.00 it is a line 28 deduction which is not subject to the 2% AGI limitation.

With the second calculation you recalculate taxable benefits for previous years by reducing repayments and determining the new tax liability for the previous year. The schedule A deduction is removed from your current year return to calculate your tax liability. The difference in the previous tax year(s) liabilities are subtracted from the current year liability.

Once your tax is determined both ways, you would use the calculation that gives you the lowest tax liability. If the first method is best, use schedule A line 28 for your deduction. If the second method is best, the tax credit is reported on line 73 of form 1040.”

Whew!

My advice? Get professional tax help if you’re thinking about this.

Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

Also…if you haven’t already, subscribe to our YouTube channel for more educational content like this to help you find the answers you need for all things Social Security. And for more information on this topic, you can start with these links from the Social Security Administration:

- If You Change Your Mind: Information on withdrawing Social Security benefits

- SSA’s Manual on Withdrawals

- Suspending Retirement Benefit Payments

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

12 months after receiving benefits – is never explained adequately in any of these articles! I was eligible in December of 2018, I applied, Social Security said my benefits would start January of 2019….I thought that meant a check! It did not! First check was February of 2019. Now am I past 12 months, because my benefits started in January (even though I did not get a check)? Or is it within 12 payments??? Because I have only received 11 checks? It would be helpful if the experts provided a more clear definition of the 12 month period…..an example would… Read more »