Trying to decide the best age to file for Social Security Benefits? Using a break even calculator for Social Security can give you some important data to help you make the right decision for you.

A break even calculator for Social Security can help you understand which filing age will net you the highest total payments from Social Security over your lifetime.

At face value, using these calculations seems like a logical approach to making the filing decision. But it’s just one step in the process, as this is a complex situation with more data points to consider. Break even age is an important consideration, but that information alone cannot be the deciding factor when choosing the best filing age.

It is, however, a great starting point, so in this article we’ll aim to make sure you walk away with an understanding of the following:

- Who should use a break even calculator for Social Security

- The problem with the calculators available today that you need to bear in mind

- How to access our one-of-a-kind Social Security break even calculator (for FREE)

How Does a Break Even Calculator for Social Security Work?

The basic premise of a break even calculator is based on the way Social Security benefits are calculated, where the earlier you file the lower your benefit will be. Waiting longer can get you a higher benefit amount… but by filing at a younger age, you’ll receive more benefit checks in total.

This is why you need to understand the break even point. If you file later, your benefit will be higher. When compared to the same life expectancy as filing early, you’ll receive larger checks but for fewer months.

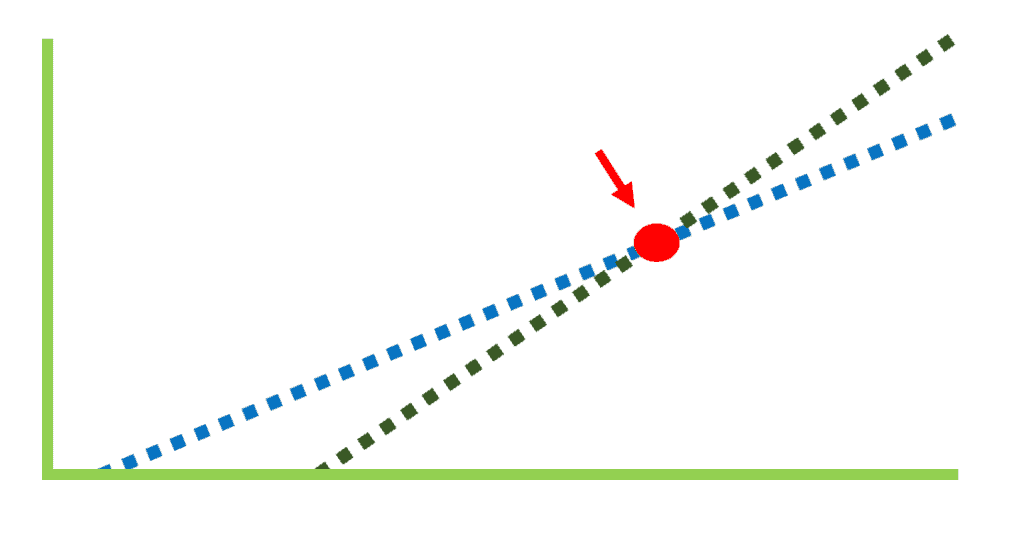

The age at which filing early versus filing later results in the same amount of cumulative payments is your break even age.

For example, lets use a very basic benefit amount that doesn’t include any cost of living adjustments. (We’ll circle back to that mistake later.) Let’s assume that your full retirement age benefit (at 67) is $2,000:

- If you file at 62 you would receive $1,400

- If you wait until age 70, you would receive $2,480

Using simple math you can see that the total benefits you would receive in each scenario would be equal, or break even, at 80 years and 4 months. For every year you live beyond this age, the choice to file later is the “winner” as you’ll have more money by waiting to claim benefits than you would have if you filed early.

But what if you don’t expect to live until (or longer than) 80 years and 4 months? You’d actually be better off by filing for benefits sooner.

The 2 BIG Problems with Break Even Calculators

Most financial planning calculations have variables that can come up and render the entire plan useless. But even knowing that, having some kind of plan increases your odds of a better outcome as compared to not having a plan.

A break even analysis is the same way: there are inherent limitations, but that doesn’t mean the exercise is useless. It just means you need to understand the potential problems and not be overly reliant on the calculator you use.

When it comes to using a break even calculator for Social Security, there are two main problems that you need to understand and acknowledge first:

Problem #1: The Impossible Question

The first big problem with using the break even method in deciding when to file is that you have to answer an impossible question: How long will you live? Obviously, no one knows that for sure. The best you can do is make a guess… but most people are extremely bad at estimating their own lifespan.

There are countless reasons for this, but one big explanation for why we can’t reliably guess at our own life expectancy is because selective retrieval of information from memory gets in the way.

Some studies, for example, show that if a close friend recently died of a heart attack, you’re probably more likely to think you’ll also die early.

So don’t just rely on what you think could happen. Look at the data to make a more educated and rational estimate to avoid underestimating your own life expectancy. According to the Social Security Administration, current 60-year-old men live until 83.1 years of age and women until 86.

Obviously, individual factors specific to each of us can lengthen or shorten those averages, such as current health, lifestyle, and family history. But keep in mind that the numbers from the SSA life expectancy calculator are the average age of death for a 60-year-old.

This means that 50% of 60 years old males will die before age 83.1, but 50% will die after that age.

Ultimately, you should be aware of your instinctive tendency towards pessimism on projecting your own life expectancy so that you don’t assume your own premature demise– and perhaps consider adopting a more positive mindset!

There’s good reason for making the assumption that you will live longer than average: individuals who are optimistic about their life expectancy have a 50 percent to 70 percent better chance of reaching 85 years of age compared to the least individuals who are not optimistic.

Problem #2) They Don’t See the Big Picture

The second big problem with using a break even calculator for Social Security is that most only consider your life expectancy and do not consider spousal, survivor, or children’s benefits.

This is where using the break even analysis as the sole method of determining your filing strategy goes horribly off course.

For example, if you are the higher-earning spouse and file for benefits early, you are forever limiting the amount of survivor benefits your spouse will receive. The ironic part of this is that I often hear the higher earning spouse saying they are going to file early because they don’t think they’ll live long.

But if they stopped and planned this out, they’d realize that an early death may decrease the amount of income to their surviving spouse and thus may be more of a reason to delay filing for benefits. But again, most break even analyses doesn’t account for that… so if you do one of your own, make sure you consider this factor!

Where Most Break Even Calculators for Social Security Break Down

For many years, the Social Security Administration had a break even calculator on their website for consumer use. They ultimately removed it over concerns that it was being used to make poor filing decisions.

Following the lead of the SSA, many of the other financial software companies also took down or stopped updating their Social Security break even calculators.

Today, it’s difficult to find a free calculator that’s useful and easy to understand. There are a few still available but when I’ve tested them, I find they have inadequacies that limit their effectiveness.

I’ve found there are two main issues plaguing these calculators:

- They don’t offer you the ability to choose specific filing ages for comparison, and

- They fail to account for inflation.

Let’s look at each of these issues so you’ll understand why they’re problematic — and how to correct it if you run your own break even analysis.

Problem #1) The Inability to Compare Filing Ages

One of the basic limitations of most calculators is that they give you no ability to choose various filing ages to compare them. Most of these calculators offer you the option to input the numbers directly from your Social Security statement: Age 62, Full Retirement Age, and age 70. That’s it.

This would be fine if individuals only filed for benefits at those ages. But obviously that’s not how a real-life scenario works. For these calculations to be useful, you need to be able to compare your benefit across all filing ages, down the specific month.

Problem #2) The Failure to Account for Inflation

The other big problem with both the calculators available online (as well as the instructions given in most articles that try to walk you through a break even calculation) is the absence of inflation. Failing to account for benefits increases due to cost of living adjustments (or COLA) skews the final numbers.

To fully understand the impact of inflation, you need to understand how the annual COLA changes your benefit amount.

When you receive your benefit estimate, it shows what the estimated benefit will be at certain ages without considering the impact of cost of living adjustments.

For example, if you are 62 and your Social Security benefits estimate says that you are eligible for a $2,000 benefit at your full retirement age, that future benefit is expressed in today’s dollars. If you filed today, you would receive a reduced benefit based on that $2,000.

If you waited until age 63 to file, it would be the $2,000 plus adjustments for inflation for that year minus reductions for filing early. The same carries all the way through to age 70.

So if you want to do this calculation on your own, be sure to inflate the full retirement age benefit for every year after 62 and then reduce or increase based on filing age.

I’ve seen some publications with experts recommending to not use the COLA when performing this calculation. I can’t figure that out, because COLA increases will happen. Maybe not every year, but over the past 45 years there have only been three years without a COLA.

As an example of the impact of COLA, consider an individual’s $2,000 benefit at a full retirement age of 67. When comparing the break even age of 62 versus 70, a 2% cost of living adjustment decreases the break even point by 19 months.

So does it change the result by a large number? No. But is it correct without inflation? Not at all. In fact, the result of not using inflation could be the tipping point to a bad decision.

Where to Access a FREE Break Even Calculator for Social Security That Solves These Problems

After several years of personal disdain for break even calculators, I’ve moderated my thoughts. As long as an individual understands the limitations of a break even analysis that we’ve discussed above, I do believe there is a benefit in using a break even calculator as a part of your overall decision.

For that reason, we’ve recently had a one-of-a-kind break even calculator for Social Security built for our community. There is no charge for you to use this calculator (for now) and simply requires you to set up a free account.

This break even calculator for Social Security addresses the limitations that most other break even calculators available today pose. With our free tool, you can compare various filing ages down to the month. We’ve also built in the COLA adjustments to make sure this calculator is as close to real life as possible.

To access this free calculator, CLICK HERE. There’s no log-in, email address, or anything else required to use it.

Hopefully, these thoughts on a break even calculator for Social Security will help you build a more informed retirement plan. If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group.

It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the nearly 400,000 subscribers on my YouTube channel! For visual learners (as many of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

[…] you’re single and have health issues, you may just want to use a simple break-even analysis. This calculation compares what you’ll receive in cumulative lifetime benefits for filing at […]

I see some other key aspects not often discussed but often encountered. Many people retire but do not take Social Security immediately upon retirement. This creates a more complicated scenario. Just some things I’ve been thinking about… (1) the SSA future payout estimates assume that you will keep working and making the same or better income than your last paycheck up until the retirement date chosen. Well, many times that isn’t the case. What happens of the company let you go at 57 but you don’t want to draw on your SS benefits until your FRA at 67? In that… Read more »

I can answer the question on “I’ve seen some publications with experts recommending to not use the COLA when performing this calculation. I can’t figure that out, because COLA increases will happen. Maybe not every year, but over the past 45 years there have only been three years without a COLA. ” It’s not about the fact that COLA increases happen every year, but more about the fact that COLA automatically negates what the cost of living will be in the future, to what is perceived today. So the benefit amount is indeed a true figure of what your money… Read more »

While C Rane may have had issues using the calculator on an iPad, I have not. Works perfectly fine.

so far it doesnt work well, using ipad doesnt show me the break even time