Now that the votes have been counted and we know that Joe Biden will be “President” Biden in January 2021, it’s time to dive into his plans to change Social Security.

Biden campaigned on a number of agenda items that came up fairly often during his election bid. We can reasonably expect at least some of his proposals will go through the legislative process to become laws during his term in office.

One of the proposals involves plans to change Social Security.

The New Administration’s Plans to Change Social Security

Biden has talked about preserving Social Security as a program for all people, and not just for low-income individuals. One thing in particular was especially encouraging to hear, and I hope he sticks to it.

He said that “proposals to make the program ‘means-tested,’ so that only low-income retirees workers receive benefits, jeopardizes the program’s universal nature and key role as the bedrock of American retirement.”

Now as we look at the six ways in which the President-Elect proposes to change Social Security, you’ll likely notice some of the suggestions make the system more advantageous for low-income households. While it’s possible to make the argument that some of these changes look like a form of means-testing, keep in mind none of the proposed adjustments draw a hard line where, on one side, you get benefits and on the other side you get nothing.

I’m glad to see that Biden doesn’t plan to use means-tested rules right away. So with that said, here are the six aspects of the system and rules that President-Elect Biden does suggest changing:

- Extending the longevity of the trust fund by increasing payroll taxes

- Changing the calculations that determine survivors’ benefits (we’ve covered this specific point before, which you can learn more about here)

- Increasing the special minimum benefit

- Eliminating the Windfall Elimination Provision and the Government Pension Offset

- Updating the calculation that determines Social Security’s annual cost of living adjustment

- Giving a raise to all individuals who have received benefits for a certain period of time

Let’s dive into each of these potential changes to better understand the details involved. As always, we’ll keep you updated and informed as things crystalize and rules are actually updated and changed.

The best way to stay in the know? Subscribe to my YouTube channel here.

Fixing Social Security’s Financial Shortcomings

The first thing the Biden plan for Social Security calls for is a fix for the financial issues facing Social Security.

His website says, “The Biden Plan will put the program on a path to long-term solvency by asking Americans with especially high wages to pay the same taxes on those earnings that middle-class families pay.”

Currently, workers only pay the Social Security taxes on the first $142,800 of earnings. (That specific number is for 2021 and it generally increases on an annual basis in response to the annual changes to the average wage index.)

If you make $200,000 per year, for example, then you only pay the 6.2% portion of the payroll tax that goes to Social Security on the first $142,800 of that income. (If you’re self-employed, you owe 12.4% instead of 6.2%.) That means you do not pay the 6.2% Social Security tax on 57,200 worth of your earnings under the current system.

Biden’s proposal would have the Social Security portion of taxes withheld from your paycheck kick back in once you earn $400,000 or more. That would create a gap between the current maximum taxable wage base (again, that’s $142,800 for 2021) and $400,000.

This gap would eventually get smaller and smaller because the first amount, the current maximum taxable wage base, would still be set to increase with wage inflation while the $400,000 mark, where wages again become taxable, would remain static. Some reports say that within 30 years, all wages would be subject to Social Security taxes under this change.

But… the folks who are subject to the additional taxation here would not receive additional Social Security benefits. This is where Biden’s ideal of “preserving the nature of Social Security” may be seen to fall short, as it breaks the connection of receiving increased benefits for increased contributions.

How effective would this change be? The Urban Institute, a think tank that generally leans left, said Biden’s plan “would extend the life of the program’s trust funds by five years, to 2040.”

While that sounds good, keep in mind that this doesn’t solve the problem; it only extends the deadline for when a longer-term solution must be implemented to avoid bankrupting Social Security and requiring a cut to benefits.

Understanding Proposed Changes to Survivors’ Benefits

The Biden Plan also outlines changes to how survivors’ benefits are calculated as well as a proposed increase to the minimum benefit individuals receive.

Again, I’ve already covered changes in the calculation to determine survivors’ benefits in another video complete with detailed examples. I highly recommend watching that video, but in the meantime, we can quickly recap the basics of the potential change here.

Should this go into effect, a new calculation method determines the combined benefit of the deceased and the benefit of the surviving spouse by adding together 75 percent of the surviving spouse’s own benefit from their work and 75 percent of the benefit the deceased spouse would have received if still alive.

Then a survivor could receive the higher of the benefit from that calculation or the benefit from the old calculation.

Let’s look at a hypothetical couple under the current rules and then the same couple under the new proposed rules. Assume the husband has a benefit of $1,500 and the wife has a benefit of $1,000. This gives them a current household benefit of $2,500.

If the husband dies, the wife would start receiving his benefit and her benefit would drop off. This means that her income from Social Security would decline by $1,000 per month – a 40% cut in benefits.

Under the new rules the survivors’ benefit would be calculated by taking 75% of the deceased husband’s benefit ($1,125), and then adding 75% of the still-living spouse’s benefit ($750).

The new calculation adds these two reduced benefit amounts together to determine the new survivors’ benefit, which, in our example, would be $1,875.

That’s actually a 25% increase from what the surviving spouse could receive (although the new calculation does come with a maximum limit, so it benefits low-income individuals more than higher-income earners).

How the Special Minimum Benefit Could Change

Next, let’s look at the proposed increase to the minimum Social Security benefit. This is an alternative benefits formula for those who worked for at least 10 years with earnings over a certain threshold.

Once benefits are calculated, an individual that meets the requirements will receive the higher of the normal calculation or the special minimum benefit.

The thought behind revising this is that the special minimum benefit is increased on an annual basis by price growth, instead of wage growth. Because of this, some argue the benefit amount has fallen behind.

President Biden’s plan is to increase the minimum benefit to an amount equal to 125% of the federal poverty level. In 2020 this would be $15,950 for an individual with at least 30 years of earnings that were above the minimum threshold.

This is a 50% increase to the current special minimum and changes in future years would be tied to changes in wage growth (not price growth) to help it keep pace with the normal benefit calculation.

This change only impacts those who start collecting benefits in 2020, or die after 2020 – not those who are currently on benefits. If you think this may apply to you, and you haven’t filed for benefits yet, you may want to wait and see what develops here before you file.

Eliminating Social Security’s WEP and GPO

The Biden Plan also calls for eliminating the Windfall Elimination Provision and the Government Pension Offset. This doesn’t impact a huge number of people, but for those who are subject to these provisions, this is a BIG DEAL.

Biden’s website claims that this change will “eliminate penalties for teachers and other public sector workers.” At face value, it sounds as though the WEP and GPO would be eliminated entirely.

But when the plan gets more specific, it clarifies that the change intends to:

, “…eliminate these penalties by ensuring that teachers not eligible for Social Security will begin receiving benefits sooner – rather than the current ten-year period for many teachers. The Biden Plan will also get rid of the benefit cuts for workers and surviving beneficiaries who happen to be covered by both Social Security and another pension.”

This is really confusing for me. I’m not really sure what this ten-year period is that’s referenced here.

This also doesn’t make it clear whether or not Biden plans to simply abolish these provisions, or replace them with another formula.

A few years ago there was a piece of similar legislation that had a better chance than any in recent history at abolishing the Windfall Elimination Provision. A lot of people got really excited about it – but when you dove into the actual legislation, it turned out that it eliminated the WEP and it replaced it with another formula that would have cast a wider net and ended up reducing the benefit of even more people!

It’s not clear if Biden’s plan would do the same, or truly eliminate the WEP and GPO provisions without replacing them with rules that would negatively impact more people.

How Annual Cost of Living Adjustments Could Change

The Biden Plan also intends to change how the annual cost of living adjustment is calculated.

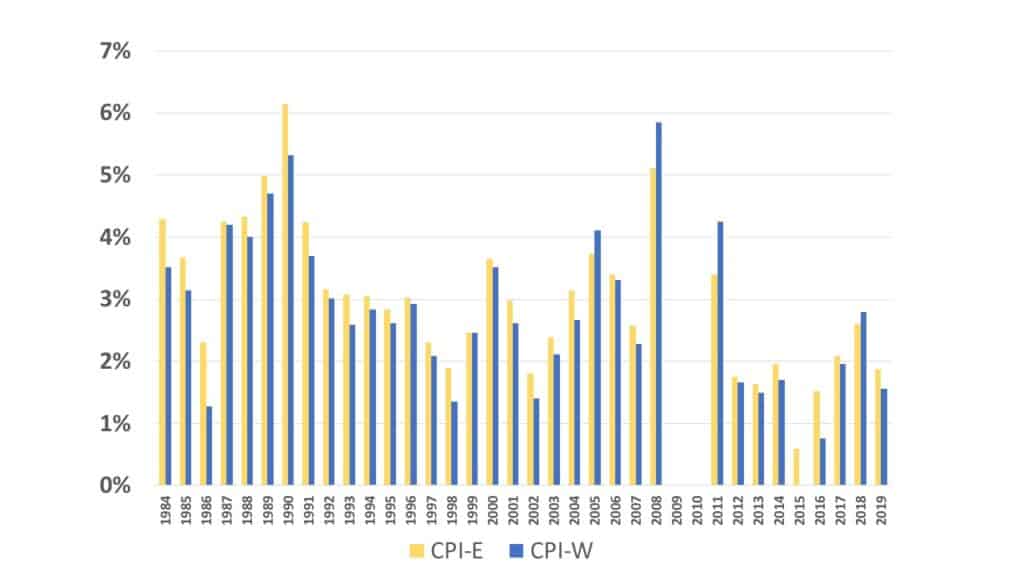

This is also something that I covered in another video; if you want to see all the details, you can watch it here. To get the 10,000 foot view of the topic, you just need to know that the Social Security Administration could start using the CPI-E as the method to measure inflation instead the current index, the CPI-W.

The big question most retirees want answered around this issue is whether or not using a different measurement of inflation would result in a larger benefit increase for seniors.

Well, we have CPI-E data available from December 1982, so we can go back to 1984 and do a year-by-year comparison with the CPI-W, the version that’s currently being used. When viewed side-by-side you can see that there are some years where the CPI-W was ahead (those are the blue bars below), but in most years the CPI-E (yellow bars) was slightly higher:

If you average the difference between the two measurements since 1984, the CPI-E has been about .27% higher per year. With the effect of compounding, that certainly adds up over time… but it’s not a big difference that will equate to meaningful change in benefits numbers for most people.

Across-The-Board Increase for Older Americans

The last segment of Biden’s plans to change Social Security is his proposal to provide a 5 percent benefit increase for individuals who have been receiving benefits for 20 years or more.

From what I’ve seen so far, this adjustment would be phased in starting with a 1% increase to your Social Security income in your 16th year 16 of receiving benefits. Your benefits would continue to increase by 1% per year to year 20, to get you up to a total increase of 5%.

This increase would be based on the full retirement age benefit of an average wage earner. If you made more than average wages, your increase would not be the full 5%. But spouses and anyone else who received benefits from your benefit, like a spousal benefit, would also see a benefit increase.

Have More Questions? Use My Free Resources

When you see someone who has a great retirement, it’s usually no accident. In most cases, it’s the result of a carefully thought-out plan and strategic execution.

Since you’re reading articles like these, it’s obvious that you really care about your own plan… and that you already know an innocent mistake or simple error are all that it takes to undo the good work you did to work hard and save a lot over the past decades of your working life.

To help you in your journey, whether you are in the planning stage or the execution phase, I’ve created three separate high-value resources for you that are completely free.

First, you should start by getting your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

Second, you should consider joining the 295,000+ subscribers on my YouTube channel. This is where I break down the complex rules and help you figure out how to use them to your advantage, and it’s a great resource for visual learners.

Lastly, if you still have questions, you could leave a comment below. But what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who would love to answer all the questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

Help survivors widows GPO WINDFALL ELIMINATION PROVISION IS DROWNING US. STOP THE STEALING.2021

Help survivors widows GPO WINDFALL ELIMINATION PROVISION.2021 EARN SSA FROM HUSBAND

WEP and GPO are just wrong. What they do to widows is just embarrassing. We worry about the benefits of everyone else but widows have had husbands who have aid into the system. Why should they now be able to draw off of their records. Who knows what they gave up for their husbands during their marriages. They could have given up their jobs many times so hubby could move for a promotion etc. It is just too bad widows have to live on half oa any income could be due them if GPO was gone.

Social security is an insurance policy. You get out of it what you put in to it. It should not be means tested at all. It is not fair to all the people who have paid into the system for years.

I certainly believe that it should be reformed. I covered the reasons why in a recent article. https://www.socialsecurityintelligence.com/why-the-windfall-elimination-provision-wep-should-be-reformed/

The WEP is a big deal. According to a recent informational email (April 2021) to its retirees, the Los Angeles County Employees Retirement Association (LACERA) indicated that WEP negatively affects at least 2 million retired government pension recipients, reducing (penalizing) their monthly Social Security benefits by a very significant $ amount. WEP is very much a big deal…… The Windfall Elimination Provision must be repealed. This WEP penalty is totally inappropriate and totally unfair.

Would be nice if they eliminate the Windfall Elimination Provision since this is not a fair regulation.