The amount of your monthly Social Security benefit is tied to your earnings history. Those who received higher earnings while working will receive a higher benefit. Those who had lower earnings will receive a lower benefit.

This is because the Social Security system is designed to replace a percentage of your pre-retirement earnings. However, this replacement rate is progressive in that it delivers a higher replacement for lower-income workers than it does for higher-income workers.

To understand how this works it is useful to have a basic knowledge on how Social Security benefits are calculated.

First, Social Security adjusts your earnings for to account for wage inflation over your working lifetime. The calculation takes your 35 best-paid years and produces what it calls your average indexed monthly earnings (AIME).

Second, Social Security applies your AIME to a formula to determine your primary insurance amount (PIA). (That’s the amount of benefit you would receive if you filed at your full retirement age.)

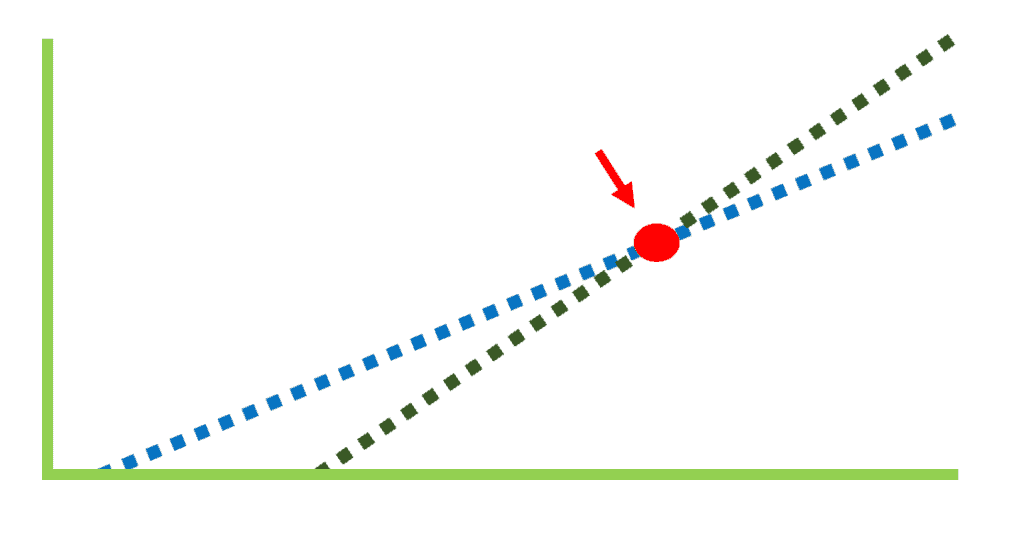

This formula breaks down your AIME into three parts. In 2020, it is:

- 90 percent of the first $960 of your AIME

- plus 32 percent of any amount over $960 up to $5,785

- plus 15 percent of any amount over $5,785

Once you calculate those three bands, you sum them up and this is your PIA.

This formula is where the progressive nature of Social Security is found. Those with lower lifetime earnings, and thus lower AIME, get a higher percentage credit to PIA than those at the upper end of the formula.

To read more about how to calculate Social Security benefits, check out my article How To Calculate Your Social Security Benefits: A Step-By-Step Guide

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.