If you’re building a retirement income plan (and I hope you are!), Social Security will likely play a role. As such, you need to know what to expect in Social Security benefits when constructing your plan to ensure it works.

Unfortunately, your Social Security benefits estimate from the statements you can pull from the Social Security Administration is not the best source of information on what to expect in the future.

The issue lies with the omissions that the Administration makes with their estimate methodology. To understand why this is a problem, we need to start with a basic overview of the calculation used to create your Social Security benefit estimate.

How the SSA Calculates Your Estimated Social Security Benefits

To calculate your Social Security benefit, the SSA will take your historical earnings and adjust them for inflation. This inflation adjustment goes through age 59; once you hit 60, your benefit amount is at face value at that point and into the future.

Then, the Administration takes your highest-earning 35 years of work and income history and calculates an average annual earnings amount. They they apply a formula that is specific to individuals who are 62 in that calendar year.

The result is your full retirement age benefit, also known as your primary insurance amount or PIA. (If you want to get a deep dive into how your benefit is calculated, check out this in-depth article on the topic here, or watch the video on my YouTube channel.)

Where the Problems Start with Your Benefits Estimate

This seems straightforward enough — but when the Social Security Administration actually runs this calculation, they tend to work with inaccurate data that leads to a bad result for your estimate.

The biggest problem? They assume that today’s numbers will not change! Two key components of the Social Security calculation for your estimated benefit amount have no adjustments built in for future growth.

This means that these problems are worse for people who are younger because they have more years of future earnings, and the calculation’s assumptions of o% growth, ahead of them. When you compound that initial error over time, you end up with an estimated result that is extremely far from the potential reality.

The good news is that as you get closer to retirement, your benefit is based on actual numbers and is more reliable. To further understand this, we can look at it as two separate problems:

PROBLEM #1 They Don’t Inflate Your Future Earnings

Your calculation likely works just fine if you are at least age 62. By that time, you have enough years of real earnings to run through the calculation, and thus don’t need the Social Security Administration to (erroneously) estimate your future earnings.

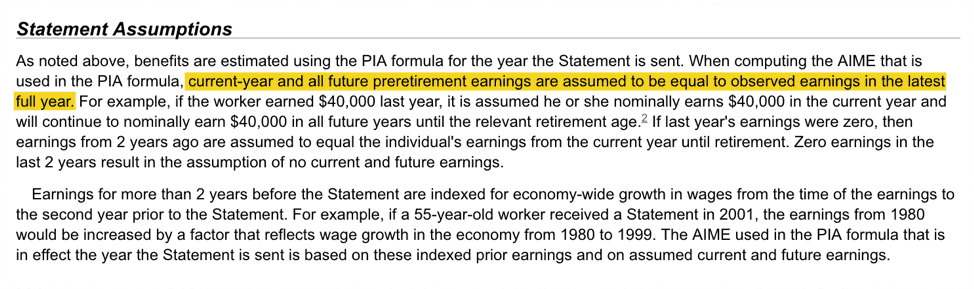

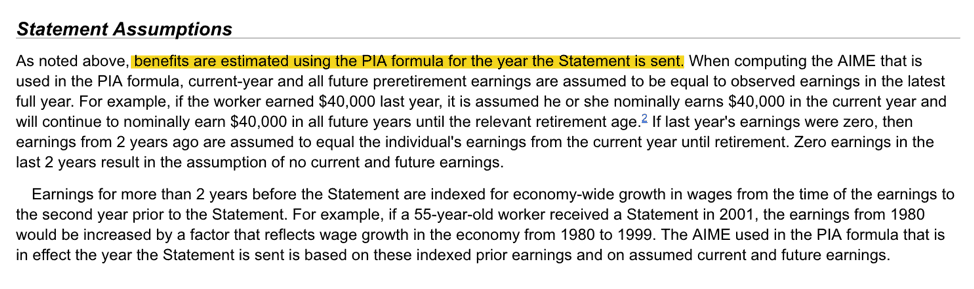

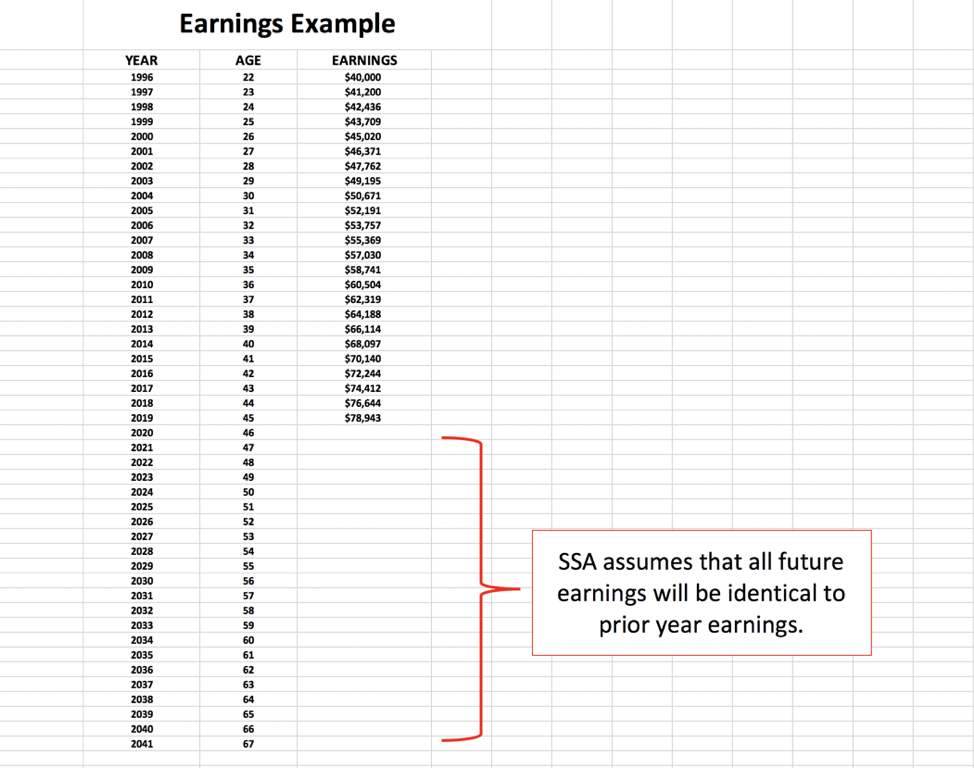

The SSA does inflate past earnings two years prior to the statement year. So, if the statement year is 2020, your earnings through 2018 have been indexed for inflation. But the problem is that when they estimate your future earnings, they assume that what you earned in the last year is what you’ll earn in the future.

If there were no earnings in the last year, they’ll look at two years prior and make the same assumption. If you don’t have earnings recorded for the past two years they’ll assume that the future earnings will be $0.

The interesting thing about these earnings is that when the Social Security Administration estimates your future earnings, it uses the exact dollar amount of earnings from the prior year. No inflation is used.

For example, if you are 45 years old and earning $75,000 per year, the SSA will assume that exact same $75,000 level of earnings will continue until the various estimate benefit amounts at 62, 67, and 70.

That tends to lowball the actual income you’ll most likely earn. For that same 45-year-old that earns $75,000 and experiences a modest 2% annual increase to their salary, their average salary between 45 and full retirement age will be slightly over $94,000.

Since the system is progressive and rewards a higher benefit for a higher earnings history, not paying attention to these additional earnings is a serious oversight.

PROBLEM #2 They Use Today’s Formula

The double whammy of the underestimation issue is that not only does the Social Security Administration assume your earnings will not increase over time, but they also assume the Social Security formula will stay the same.

Frankly, it won’t. It generally increases every year in response to the average wage index. In fact, the formula has increased every year since 1979, with the exception of just one year between then and now.

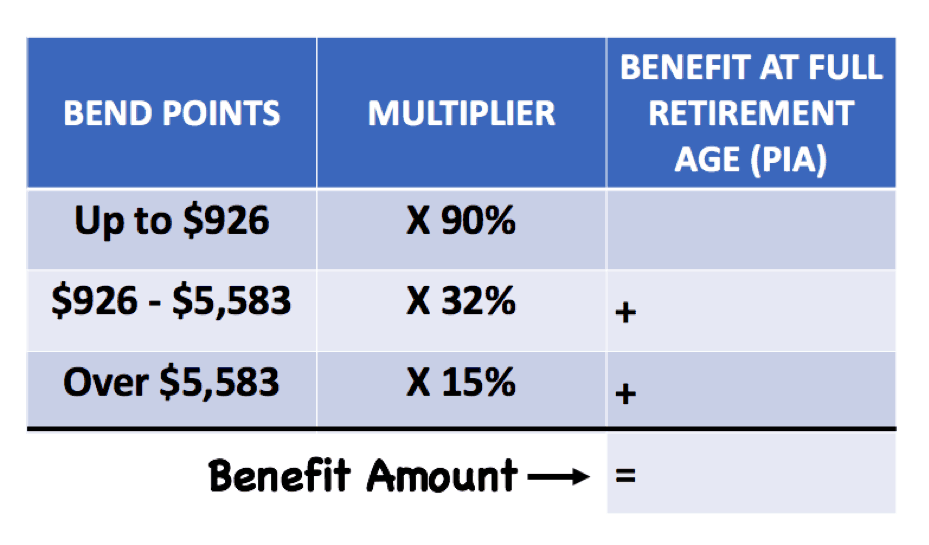

Once the Administration calculates your average inflation-adjusted earnings (also called AIME), they apply this amount to a formula. This formula is commonly known as the “bend point” formula and is responsible for breaking down your average monthly earnings into your specific benefit amount.

For individuals turning 62 in 2019, the formula for your full retirement age benefit (PIA) is as follows:

- For every dollar of average indexed monthly earnings up to $926, you’ll get 90 cents per month in benefits.

- For every dollar of average indexed monthly earnings between $927 and $5,583 you’ll get $.32 cents per month in benefits.

- For every dollar of average indexed monthly earnings beyond $5,583 you’ll get $.15 cents per month in benefits.

An important note about this formula is that your final benefit is calculated using the formula in the year you turn 62. But the SSA does not estimate what this formula will be when you turn 62. Instead, they use the bend point formula during the year your statement is generated.

If you received a benefit estimate in 2019, the 2019 formula was used. This means that if you are 45, the formula that your estimate is based on is most likely much lower than what it’ll be when your final benefit calculation is completed.

The combination of not assuming your wages will increase or the use of the bend point formula means that you could be planning your retirement income strategy with faulty numbers.

Not including these number on the benefits estimates raises a few questions. The first is why not? Honestly, I can’t think of a good reason — especially when you consider that when the Administration projects out the longevity of the Social Security trust fund they do assume that wages will increase (and account for the corresponding increase to AIME and the bend point formula).

So it doesn’t seem like a huge step for them to begin including these same projections in the benefits estimates. But for some reason they don’t — so you’ll need to factor that in to your own estimates to get the most accurate results.

How to Work Around an Inaccurate Social Security Benefits Estimate for Planning Purposes

Let’s look at an example case to see how badly your Social Security benefits estimate can skew your planning if you work with inaccurate numbers — and the simple adjustment you can make to get a more accurate projection.

Jeremy got his first job in 1996 at the age of 22. His starting pay was $40,000 per year and every year since, he earned a 3% raise. This gives him a 2019 salary of $78,943. When the SSA estimates his future benefits, they assume that the prior year’s salary will continue until his retirement at either age 62, 67 or 70.

So how does this affect the estimate?

To figure this out we can use the Social Security Online Calculator (I love this calculator, by the way). If we plug in Jeremy’s earnings and use the “today’s dollars” option, it gives him a benefit at age 67 of $2,452 per month. If you simply change that to “future (inflated) dollars” it changes the benefit at age 67 to $5,464 per month — that’s a $3,012 per month jump in benefits!

Which is why I offer this quick word of warning: don’t use the inflation method option here to estimate your future benefit. It’s too high. The assumptions they use are 4% or higher for future wages which will be applied to both your earnings and the benefits formula.

Instead, you need to get under the hood and figure out for yourself how to calculate your benefit. I promise: it’s not that hard. For a step-by-step video, check out my guide on How To Calculate Social Security Benefits [3 Easy Steps]

Now that you know the truth about the Social Security benefits estimate and how to get a more accurate projection yourself, you’ll be in a better position to plan for your future retirement income.

Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

Hi. I just turned 60 this year and expect to take Social Security in 2024 at age 62. My online estimate with Social Security is $1,876. If my yearly income remains the same for 2022-2024 Will my estimate increase. I have 35 years of earnings. Thank You. Thomas J Marino

If my estimate for social security is $1300 a month, is that after or before they take out for part b?

Ok….turned 63 in June of 2021. Began to collect a pension. I realize I will be subject to WEP when I decide to claim my SS benefits. On the SSA website, I don’t believe I’ve seen my estimates increase for a long time. I am not working and adding anything to SS but….shouldn’t the yearly cola be reflected in my SS benefits?

Thanks…John D.

I received my disability. But I think my lawyer and this as herein Batesville Ar..has took me for some of my back pay who can I get to look at this.