We’re taking a look at the math behind a social security strategy that’s been around for a while. Here it is: File early, invest the monthly benefit, and you’ll be able to generate more income than someone who waited until later to file.

Effectively…you can do better on your own. But does it make sense to file early and invest the money?

A Decade of Positive Returns Creates Optimism in Investing

There’s nothing like a decade of positive returns in the market to create optimism for investing. We’re starting to see this optimism affect how individuals file for social security.

A few years ago, there weren’t many people saying they were big believers in the market. We were still recovering from the worst market since the Great Depression, and news was still (mostly) negative.

A few years later, individuals started seeing a few years of positive returns. Some of those have been double digit returns, and optimism began rising.

And so I’ve started to hear more people say things like “Devin, I think I could file early for Social Security, invest it, and create more income down the road than what I would’ve had with Social Security.”

So, You Think You Can Do Better?

Now, I’ve heard things like that for a while, but I’ve never gotten into the numbers to see what was really possible. So…I decided it was time for a closer look.

Let’s consider someone with a $2,000 benefit at their full retirement age. For this example, we’ll assume full retirement age is 67.

You can file as early as 62 and get $1,400 or as late as 70 and get $2,480.

Let’s look at two scenarios: First one is where you need to start your income at 67; and the other is where you need to start your income at 70.

In both cases, I’ll assume that you file for benefits at 62. That benefit has a 2% cost of living adjustment (COLA) applied and that you invest the monthly benefits check.

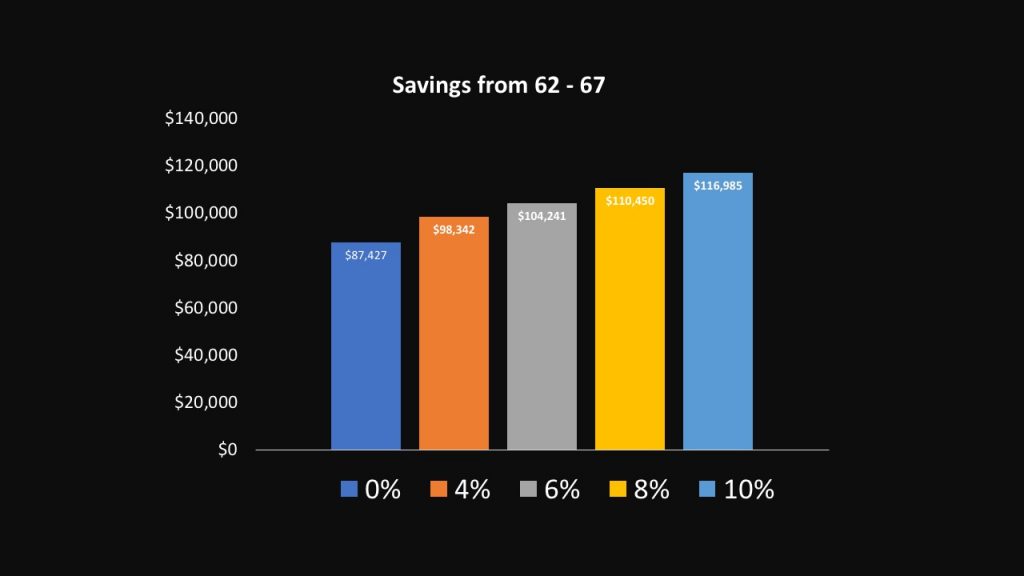

Here’s how that investment would accumulate at various rates of return from the beginning if age 62 to the beginning at age 67:

First, let’s assume you didn’t make anything. That $1,400 would be worth $87,427. At 4, 6 and 8 percent it would gradually increase and the highest rate of return I assumed was 10 percent where your balance would be $116,985. These amounts would be the available balance to use in supplementing your income.

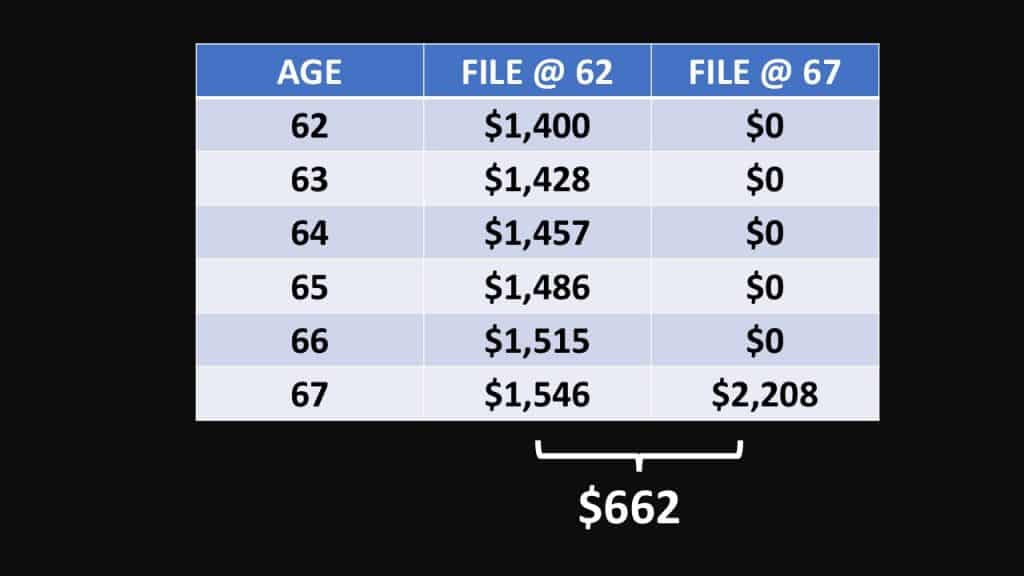

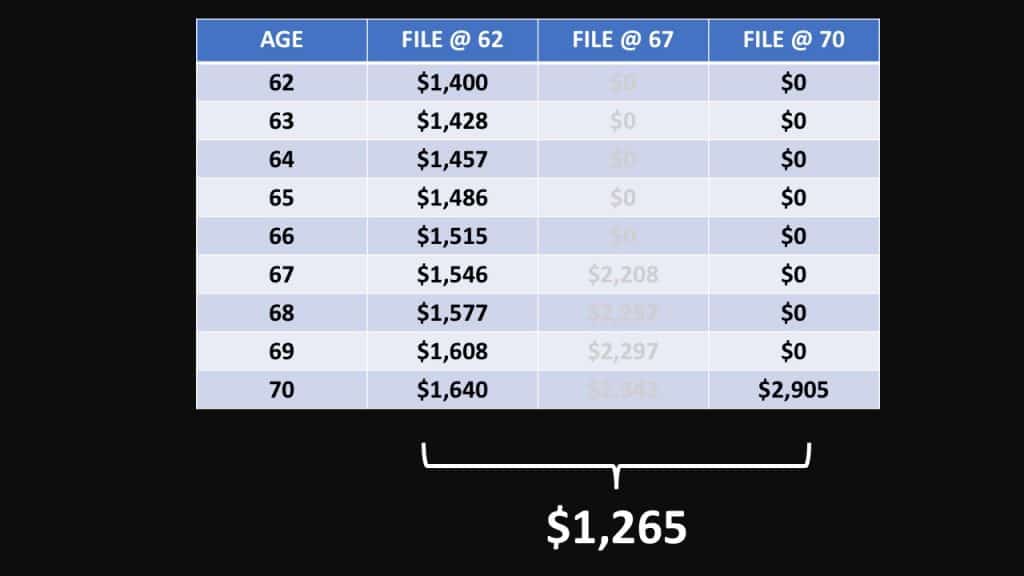

So now let’s look and see what the income gap would be after we adjust for the annual cost of living adjustments. Your benefit would start at $1,400, but by age 67, it would be approximately $1,546 if there was a 2% annual COLA.

The age 67 benefit was $2,000, but when you add the COLA to it, that amount would now be $2,208. So there would be an income gap of $662 that you would need to create from the invested Social Security benefits.

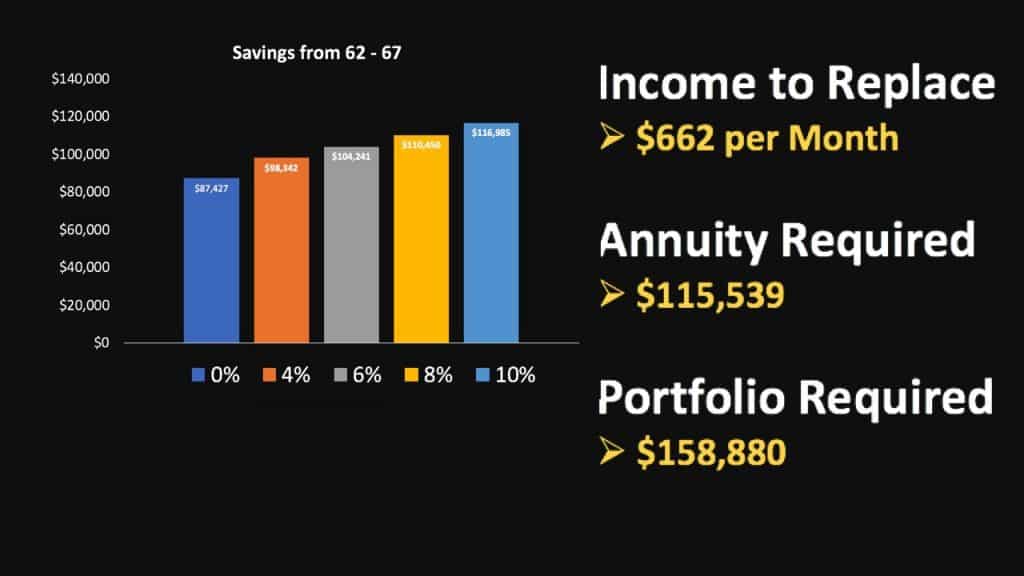

I’m assuming there are two ways to generate this income. First, is an immediate lifetime annuity. This is the closest thing to your Social Security benefit in that it offers a fixed payment that’s guaranteed for your lifetime. The way these work is that you give a lump sum of money to an insurance company and they send you the payments. The other option I assumed was leaving your money invested and taking a 5% annual withdrawal to supplement the income.

And The Results Are In

Here were the results: If you need to generate an income stream of $662 per month, it would require an annuity of $115,539 and an investment portfolio of nearly $160,000.

For the annuity, this would mean that you’d have to achieve an annual return of 10% and for the portfolio option you’d need to get a return of 21%.

Keep in mind…these are the returns needed to break even. You’d have to exceed that to do better that what you’d get with almost no risk from the Social Security administration. I’m not sure how you feel about your capabilities to get consistent investment returns like these, but if you can…maybe you should start a hedge fund. I can tell you that there’s no way I would take that chance with a client’s money.

What If You Invest It For A Longer Period of Time… Does That Work Out?

But what if you have a longer time period?

Let’s say that you don’t need the income to start until you’re 70. In this scenario, you’d have from the beginning of age 62 to the beginning of age 70 to receive benefits and invest them. How would the time/value of money change the outcome?

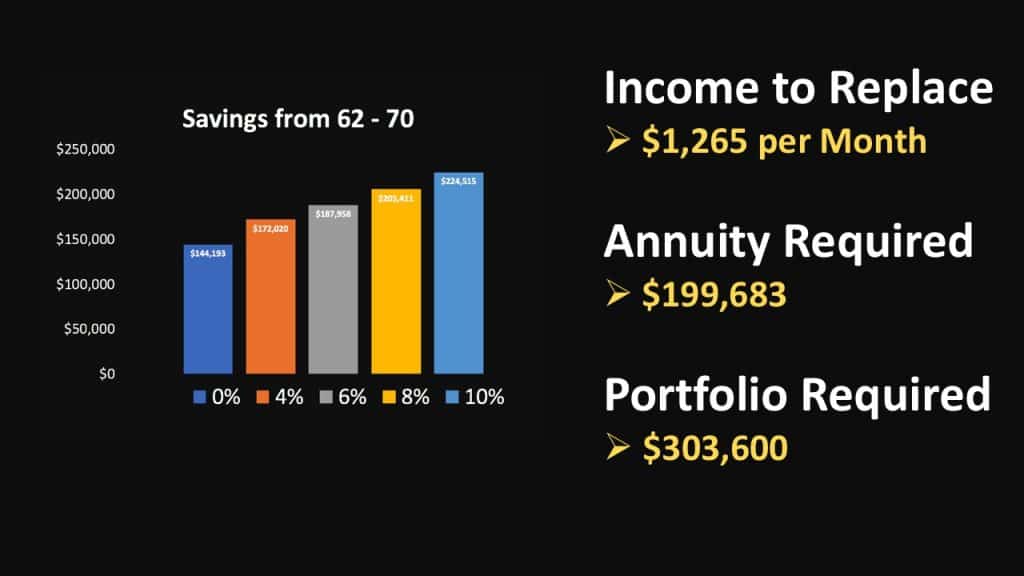

By the time you take your age 70 benefit, it would have grown to $2,905 with an annual 2% cost of living adjustment. That’s an income gap of $1,265 you’d need to cover. Since you’d have a few additional years to invest, the balance of the investment portfolio would be higher than in the prior scenario ranging from 144,000 to 224,000 at 10% annual return.

Now we know you may have saved, but how much would it take to replace $1,265?

You need an annuity of $200,000, and an investment portfolio of around $300,000. This means that for the annuity to work you’d need to get about a 7% return and for the portfolio to work you’d need about a 17% return.

Again…those numbers are just to give you the dollar amount of income that you’d get from Social Security without taking hardly any risk. And, the risk is not the only difference here.

For example, the annuity options do not have survivor benefits, the taxation of an annuity vs. investment portfolio vs. social security is all different so the net amount would not be the same. The annuity options were calculated with today’s interest rates and there’s just no way to know what the interest rates would be in the future and how these annuities would be affected. The investment returns I illustrate are compounded annually and would be slightly different if compounded on a monthly basis. The amount of your social security benefit would also affect the required rate of return on the other options.

This article is based on what we know today with a set benefit amount, but your mileage may vary with your own circumstances.

It’s Your Retirement!

Ultimately, remember…I’m not your financial, legal or tax advisor. This article is meant to help educate you, but not as specific advice for your specific situation. I’d highly recommend that you keep learning and stay curious!

Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. Also…if you haven’t already, you should join the 100,000+ subscribers on my YouTube channel!

One last thing, be sure to get your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

What happens to the formula when social security does not recive a cola or falls short of the 2% in your projections because certain benchmarks were not realized.

Also what if you fall under a WEP and are only looking at 250.00 @ month. I would think you take the money early. Curious in California

That is an interesting way to look at it and is quite apples and apples. Most of the comparisons I’ve looked at did not assume that you’d buy an annuity but that you’d pull income from the portfolio. They solved for how long you needed to live before you ran out of the portfolio funds. In other words if you died at 71 then you made out like a bandit for drawing at 62, of course you would be a dead bandit.