Social Security benefits for children are a big deal. In October of 2022, there were more than 3.8 million children receiving Social Security benefits because one or both of their parents are disabled, retired, or deceased. These benefit payments to children total more than $2.6 billion every month.

Sadly, many children don’t get the benefits for which they are eligible. Most people don’t know about the qualifications and rules for this special benefit, so they don’t know to apply for the children in their lives.

Who Is Eligible for Social Security Benefits for Children?

A child who is your biological child, adopted child, or dependent stepchild is eligible for children’s benefits if:

- you become disabled

- you retire

- you die

AND the child is:

- unmarried, and

- under age 18, or

- 18 or 19 if a full-time student in secondary school through grade 12 (see note below), or

- 18 or older and disabled with a disability that started before age 22.

Note: A 2022 report by the Office of the Inspector General found that the Social Security Administration erroneously terminated the benefits of students who turned 18. In their sample, they found that 87 out of 100 students were incorrectly terminated. They went on to further estimate that based on their sample results, they estimate SSA underpaid 14,470 beneficiaries approximately $59.5 million. Depending on the school schedule, benefits can be paid to a student through 19 years and 2 months of age. See the Social Security website section on this for more information.

What about Grandkids?

As long as the rules are followed, dependent grandchildren could be eligible for a benefit. I’ve covered this in-depth in my article Social Security for Grandchildren.

How Much Is The Benefit?

If you become disabled or retire, your qualified child is eligible for up to 50% of your full retirement age benefit.

If you die, your qualified child is eligible for up to 75% of your full retirement age benefit.

Family Benefit Maximum Limits

Although each qualified child may receive a monthly benefit payment based on your full retirement benefit amount, there is a limit to the amount the Social Security Administration will pay. They refer to this limit as the Family Benefit Maximum. This maximum benefit is not a set number but is about 150 to 180 percent of your full retirement benefit. Where your percentage falls depends on your full retirement age benefit.

There is one notable exception to maximum calculation. If you have a divorced spouse who is receiving benefits from your work record, it will not count in the family benefit maximum and it will not affect the amount of benefits you or your family may receive.

Children’s Benefits and the Earnings Limit

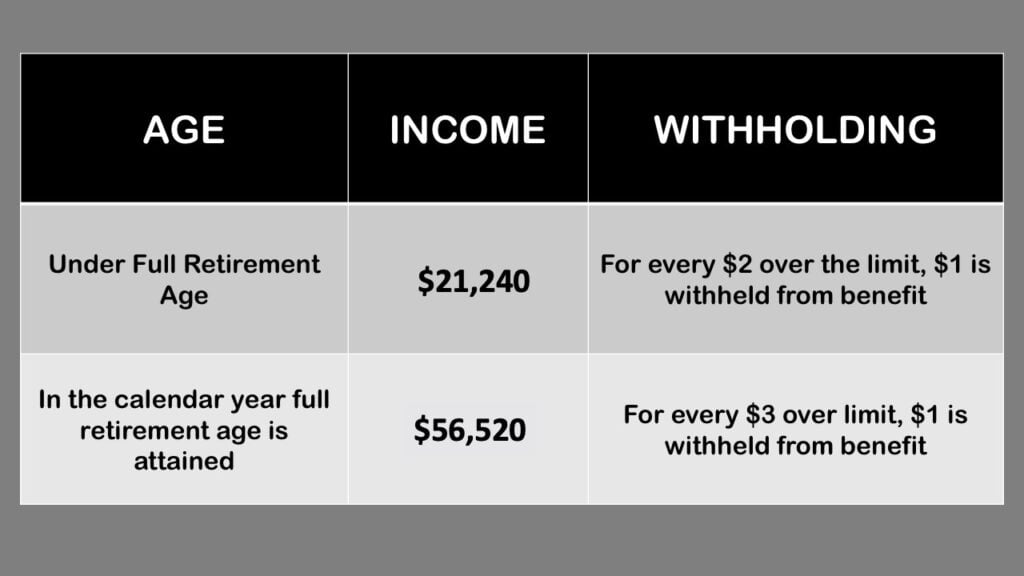

If a child is receiving benefits from Social Security, they are subject to a limit on the amount of earnings they can receive from wages or net earnings from self-employment. These income limits change on an annual basis and listed below is the limit amount for 2023.

It should be noted that your child’s earnings affect only their own benefits and not yours or those of any other beneficiaries on your record. For an in-depth view of the Social Security earnings limit, see my article on this subject.

Strategy: Why Filing Early for Retirement Benefits Could Be Best

Unfortunately, you don’t get much of a say so as to when you file for survivors benefits or disability benefits. But you DO get to decide when to apply for your retirement benefits. For a household with children, the decision when to begin receiving Social Security retirement benefits is just more complicated. The penalty for not understanding the rules and the resulting difference in lifetime benefits can be enormous.

In many cases, there are many reasons to delay filing for Social Security benefits. But not all cases are the same! If you have kids at home, and are thinking about filing for Social Security, filing early could make more sense. Why? Your children cannot collect a Social Security benefit until you file.

Consider the difference in lifetime benefit amounts for a couple with the following circumstances.

Roger is 62 and his wife is 46. They have two kids at home, ages 8 & 10. Roger is financially well off enough to stop working and can be flexible on what age he begins to collect Social Security.

If Roger waits until his full retirement age, he’ll get $2,000 per month. If he files now, he’ll only get $1,500 per month. He ran the numbers and figured out that if he lived to 90, he’d receive an additional $70,000 in benefits for delaying filing until 66 instead of filing at 62.

For most people, this math shows that it makes sense to delay receiving benefits. However, this does not account for the benefits paid to the children. While the children are eligible for benefits based upon Roger’s retirement, the kids cannot get benefits until he files. Roger’s family would be able to collect thousands of dollars more in lifetime benefits if Roger files early and turns on the benefits for his children.

Here’s how…

If you run Roger’s full retirement age benefit through the family benefit calculator, you’ll arrive at a maximum benefit of approximately $3,500 . If Roger files at 62 he’ll receive $1,500 and each of his children would be eligible for $1,000 in children’s benefits. That additional $2,000 per month ($1,000 for each of the children) is only available if Roger files for Social Security.

Reporting Requirements

Whenever a minor child receives a benefit, the Social Security Administration pays the benefit to a representative payee. This individual is often a parent and is responsible for managing the benefits on behalf of the child.

Before a recent law change, all representative payees were required to file an annual report. However, due to a recent change in the law, the SSA no longer requires most parents or guardians to complete an annual Representative Payee Report.

Even though the SSA doesn’t require an annual reporting, they do have the following cautioning language. “All payees are responsible for keeping records of how the payments are spent or saved, and making all records available for review if requested by SSA.”

If you haven’t spent all the money, the SSA will require you to send it back to them when your child turns 18. This is because your child is considered an adult in their eyes and they will begin to deal directly with them.

This surprises many who were trying to do the prudent thing and save the checks for the child’s car, college tuition or some other important expense. You can see the Social Security Administration’s page titled “Transfer of Conserved Funds” on this topic for more information.

Are Children’s Benefits Taxable?

How To Apply For Child Benefits

You can apply for benefits at your local Social Security office or via phone.

Ready to start your application for benefits for your child? Review the Information You Need To Apply For Child’s Benefits page on the Social Security website to ensure you have all the necessary documentation.

Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. Also…if you haven’t already, you should join the nearly 400,000 subscribers on my YouTube channel!

My husband is 65 and we have a 7 year old. He gets about $1,000 a month for her in addition to his SS. I am asking for full physical and legal custody. What happens to that money if the custody is awarded to me? I cannot find anything on the SS website that answers this.

If a child moves out of his parents home and he collects his dad’s social security disabled benefits and he gets his own check he is 18 and still in school and his mother moves out from his dad also and she wants to receive her portion of the husband social security disabled check will this affect the son’s check if the mother request to the ss office To receive her check in her bank account instead of it going to husband’s account

Hi there and I hope someone can help me. In 2016, my husband passed and I had one minor child at the time. I thought it would be a good idea to apply for benefits for her. It took a few months but then they did give her back pay and a regular check began and around March or April of 2017. The reason for the back pay was because at the time she didn’t have a social security number or birth certificate. I opened an account for the money and didn’t use it until approximately 2018 whenever she started… Read more »

My 2 oldest children no longer receive SSI from their deceased father. But my younger one does. Can I find out why he doesn’t get the full amount per family allowed?? For example, when my oldest stop receiving at 18, his amount was split between the other 2. My daughter just turned 18 and no longer receives it. My younger sons amount didn’t change. Why did we loose the full amount allowed? I thought the amount stayed the same regardless? Shouldn’t my younger child receive those payments??

My son just found out that my grandson is eligible for Social Security Survivor Benefits but he was told that he would only receive six months of payments out of the 16 months since his mother’s passing. Is there any way to file for the full amount since he did not know he could file for Survivor Benefits after his mother passed away.

My daughter was pregnant when her spouse passed away. She is 4 years old and my daughter did not apply for death benefits for her. Can she file for them now?

My Daughter receives Social Security Benefits because her Father passed away. Is there a limit as to how much she can save or keep in her saving? I’ve kept as much possible in her savings for her future.

If you are receiving SS retirement benefits before FRA and have minor dependents whom receive a benefit, if you work and make more than the allowed amount and lose some of your benefit, do the children still receive theirs or do they lose some of their benefit?

I have an older husband who retired at 62. His full retirement amount was just over 2000. We have 3 kids all are 13 and under. Our family maximum is 3,600. My kids are getting 334 each. So that 50% is not for each kid but 50% is for all minors to divide up. After reading everything we read only saying up to 50% each we were disappointed to learn that’s not the case.

My fiance passed about a year ago, and we shared a son. I started the application process for Child Survivor Benefits. Due to the father’s name not being on the birth certificate & my trauma from the manner of my fiances death, the application was denied. I also had no clue where to start with adding his name to the birth certificate & still am not sure. How would I go about adding my son’s father to it, and can he still receive the benefits.

Hi. I don’t know how to go about this. My daughter father pass away so what do I need to do? she was telling me that i need to go to the office for some benefits for her.

Our minor children are receiving SS on my husband’s record since the time he retired. If he were to pass away, would they continue to receive the SS on his work record until the age of 18 PLUS get survivor benefits? Or would the survivor benefits take over and be the sole support?

Divorced, 2 children ages 13 and 16, ex retiring, we have joint legal, I have physical custody. Can the children receive retirement benefits?

My son’s wife passed away at the age of 30, on 30 December 2019. She had a daughter from a prior relationship, but never married the father to her daughter. The birth father and my daughter in law shared custody, but my daughter in law had full-time guardianship. The daughter is now 12. My son has temporary guardianship for her. My daughter in law worked outside the home occasionally, but never full time. Would my “granddaughter” qualify for a SS benefit from her mother?

Hello. I’m a divorced wife, with minor children. I plan on filing at 62, and understand my benefit will be based off of my ex’s (who will not have filed yet).

I don’t have much of a work record. (FRA

400). I can not figure out if my children will get benefits since their father has not yet filed. Will they be eligible under my record, and if so, will it be off the amount I get from my ex’s record or my actual record?

Thank you.

i am about to divorce i am to the shelter right now with the kids for domestic violence and my husband got open case with CPS, but i should get money from the kids because i claimed two of them. So, what to do?

My child bio father getting ssi how do I file for benefits for my 2 boys they are disabled there self’s and under 18 years old I dont know fathers ssi or date of birth.can someone please help me thank you

Check out my article on this topic where I provide lots of examples (including one that sounds a lot like yours). https://www.socialsecurityintelligence.com/social-security-family-maximum-benefits-the-complete-guide/

If a child’s parent goes to prison for life can they receive ss payments as if there parent died

What happens if you still have custody but your child lives with a relative and not in your home? Will they still qualify for benefits?

I was looking for an appropriate clarification for severe and permanent disability benefits. Much appreciated, administrator for sharing such awesome substance on this theme. Presently I have all I require about it. Here’s another enlightening substance for Permanent Disability Benefit . You will get well-informed data about it here.

I receive survivors Benifits for 2 children, 17yrs and 10yrs. When the oldest turns 18 will the funds she receives be added to the funds that the 10yr old is now getting or will there be a decrease in the total amount?

Shared custody or ‘shared physical custody is related to how much time the child gets to spend with each of his/her parents. In other words, both the parents have shared physical custody of their child. They also get the same amount of time despite living separately. Mostly, in this case, the judge considers one parent as the primary custodian, and the other parent gets visitation rights based on a pre-planned schedule. Legal parental rights may or may not be subjected here. But generally, if one parent has primary custody, the other parent provides the child support in important matters like… Read more »

My son is 17 and our family receives survivor benefits from their Dads passing. My son has been living at a friends house because he does not want to follow house rules etc. although he is welcome here. I have been giving the friends Mom $300/month to help with food etc, plus I put spending money in his account every month. Does he have to live here physically for me to receive his benefit? How does it work? It’s only been a few months and I’ve asked him to come home. He wants to live at his friends and have… Read more »

Hi, my husband and take card of his disabled nephew, Shaun. Shauns mom and dad both passed away with his dad passing many years ago. He worked in the coal mines in West Virginia. Shaun was diagnosed with disabilities in his teens before his dads passing. He is now 40 and does collect 778 SSI. Can he collect SS from his dad?

I am retired and receiving benefits. My child will turn 18 on May 31 and if a full time student. Her graduation date is in June, should she receive a payment for June since she will still be a student until her graduation?

My children’s father passed away 10 years before i finally was able to get some help. The family wouldn’t help me. Every time i went to ss office they turned me away for not having his death record and the birth certificates saying that there was no father due to his imprisonment. I feel I am entitled to that 10 years of back pay. I couldn’t get the Death certificate , I didn’t have his social, they turned me away every time. there job was to let me file the paper work get denied and then at least I had… Read more »

if the mother is bipolar and incapable of keeping a job so she is on ssi, will she be able to get a check for her and her husband?

Yes my husband on Social Security disability because he got his leg agitated how can I add my he wants to know how he can add his daughter so she can start receiving also Social Security how can I do that

Can anyone else besides the surviving legal guardian file for benefits for their minor child?

If my child who is not disabled turns 18 in middle of high school, will he obtain SSI until he turns 19?

I applied for survivor benefits for both of my children. Their father passed away 5 months ago and applied 4 months ago i haven’t received anything and when i call they tell me it’s in process. Does it take that long ? By the way my husband was the main provider our children are 1 year old and 3 year old

My ex and I were married 15 years . Although the last two years we lived apart . Before the divorce we gave birth to our youngest and to push the divorce through my ex is not on the birth certificate but we were technically still married at the time . My older three children collect SS . can I file for support or can I not file since no father is listed on birth certificate. But we were married at the time of the birth

I am 65 and my minor child is 8. I will reach my full retirement age on 9/20/2021. I understand my child can receive 50% of my FRA amount regardless of when I claim SS retirement benefits. My Questions: 1. His Mom and I file our taxes separately and she claims him as a dependent for tax purposes. Does this matter for the purposes of claiming additional minor SS benefits? 2. Can my child stiil get these benefits if I file for SS now or before my FRA and continue to work? (In other words, what if I earn over… Read more »

If a parent retires at 62 but continues to work earning more than the cap allows before social security benefits are reduced, and has a dependent child, is the dependent child eligible to receive social security benefits?

Is a child entitled to ss death benefits if the deceased parent hadn’t worked much

I’m 17 and draw survivor benefits from my mother. If I move in with someone else will that disrupt/hurt my benefits?

How to collect social security back payments for my son on his father’s s s??

My husband passed away in 2017 and I I have been receiving benefits for my son ever since. Today I received a letter from Social Security stating that they are not paying in May. They are saying that they didn’t receive the beneficiaries reconnect form. How hard is it to get this fixed? I have returned every form they have ever sent me. Help!

I am divourced & retiring at 66 with a 13 yr old living with ex wife who has full custody as I did nothing in the divource. I am paying excess Child Support & Alimony compared to income to help them. Question is, is SHE required to receive child benefits as having full custody or can I be the receiver and manager of monthly money as I do not trust her to benefit kid with it.

I tried to apply for benefits for my grandchildren (5) when the mother passed and was told they were not entitled to any benefits due to the that no credit for the mother. There was nothing I could do but take care of the children out of pocket and have since the day of death of mother.

If I filed for social security for my daughter and then my aunt got legal custody of my kids and I’m the one that filed for it and I won the claim so now who is entitled to the back pay since there going back to June 2017 my aunt just got legal custody on Sept20 2020

My grandson recieves survivors benefits from his deceased father. The state recently took custody of my grandson away from my daughter. I have him in my care as a kinship / foster care. I am not a certified foster care giver so the state keeps his survivors check every month. What happens to my grandsons survivors benefit checks? Do they put it away for him until he either goes back to his mother or is adopted by me?

I took early retirement . MY DAUGHTER IS 12 and gets a benefit . Her mom , is the disbursing parent ,25% of the time I have her with me , her mom still gets her benefit , why would I get 25%

I have partial disability from the VA. Does one need to be fully disabled for the child to draw children’s benefits?

My children lost their father in Feb he was only 37 I cannot get any survivor benefits for them because their father didn’t have enough credits is there anything else I can do

My sister receives death/survivor benefits. 75-80% of that is saved . Will the savings eventually affect the amount of benefits she receives monthly?

I recieve disability and adopted a child one year ago. The state she is from made a mistake on the birth certificate, her social worker sent it back to the state and we just recieved it back. I know I need to take the birth certificate to the social security office, but I am wondering will I receive any back money for her?

I am a retired firefighter/paramedic who retired in 1993. Social Security took 56% of my benefits .I have a Fire department retirement from a so called ” Qualified ” pension. Qualified means I didn’t have to pay Social Security taxes on my earnings. Now this week ( 10/27/2019 ) I received a letter telling me I will no longer receive any benefit at all. What a marvelous government that makes people pay into Social Security ( on part time work ) and then they take it away from you. My question is are any congressmen or senators affected by this… Read more »

When a child ages out does the younger sibling receive their part