In 2012 there were 2.7 million grandparents who had primary responsibility for a grandchild under the age of 18, according to a recent US Census Bureau report. Many of these grandparents don’t know that Social Security retirement benefits for dependent grandchildren is a real possibility.

Retirement doesn’t always go as expected. It hasn’t for the Causey’s. Instead of the frequent traveling they had always planned for their retirement, they are raising their young grandchildren. There’s no sense of burden though, they strongly believe it’s a privilege to have the mental, financial, and physical health that affords them the chance to offer security to their grandchildren. I admire their attitude! I hope that I would feel the same if I were placed in their situation.

Although the Causey’s had a well thought out retirement income plan, they’ve quickly discovered that the extra expense of raising kids will require them to increase their monthly cash flow.

They were surprised when I advised them to file for Social Security benefits immediately. They had always planned to wait until full retirement age to file for benefits, but that all changed when they found out that by filing for their own benefits, they would turn on Social Security benefits to their dependent grandchildren as well.

It’s not one of the more well-known benefits, but under the right conditions grandchildren (or step-grandchildren) can receive a benefit based on the work history of a grandparent. The Social Security Handbook spells out the requirements in their typical murky fashion.

A dependent grandchild or step-grandchild of the worker or spouse may qualify for benefits as a “child” if:

-

-

The grandchild’s natural or adoptive parents are deceased or disabled:

-

-

At the time the worker became entitled to retirement or disability insurance benefits or died; or

-

-

At the beginning of the worker’s period of disability which continued until the worker became entitled to disability or retirement insurance benefits or died; or

-

-

-

The grandchild was legally adopted by the worker’s surviving spouse in an adoption decreed by a court of competent jurisdiction within the U.S. The grandchild’s natural or adopting parent or stepparent must not have been living in the same household and making regular contributions to the child’s support at the time the insured worker died.

Besides meeting the requirement in (A) or (B), the grandchild or step-grandchild must be dependent on the insured as described in § 336.

Although that sounds technical, these rules are fairly easy to understand. There are two main rules.

Social Security for Grandchildren Rule #1

The grandchild (or step-grandchild) must be a dependent.

It’s important to note that Social Security’s definition of dependent is as follows:

To be dependent on the worker, a grandchild (or step-grandchild) must have:

-

-

Begun living with the worker before the grandchild became 18 years old; and

-

-

Lived with the worker in the U.S. and received at least one-half support from the worker:

-

-

For the year before the month the worker became entitled to retirement or disability insurance benefits or died; or

-

-

If the worker had a period of disability that lasted until he or she became entitled to benefits or died, for the year immediately before the month in which the period of disability began.

-

If the grandchild was born during the one-year period, the worker must have lived with and provided at least one-half of the grandchild’s support for substantially all of the period from the date of the grandchild’s birth to the month indicated in (B) above.

Essentially, the Social Security Administration has taken the normal definition of dependent and added the additional requirement of living with the grandparent for at least one year prior to filing for benefits.

Social Security for Grandchildren Rule #2

So far, it sounds pretty easy. Unfortunately, this next rule is what disqualifies many grandparent/grandchild households from grandchildren’s benefits.

To qualify for Social Security benefits, one of the following must be correct.

A) Both parents are disabled or deceased or

B) You are the legally adoptive parent of the grandchild.

How Much Is The Benefit?

Children (or grandchildren in this case) are generally eligible to receive an amount equal to 50% of your full retirement age benefit, up to a “family maximum” benefit. The family maximum varies, but is equal to 150 to 180 percent of your full retirement age benefit. Here’s how they figure the Formula For Family Maximum Benefit.

For example, if your full retirement age benefit is $2,000, the maximum benefits that can be paid on your work record is $3,498. For those raising kids, that extra $1,498 will be welcomed.

Why Is This Important?

For a household with grandchildren, extra care and expertise should be applied when applying for Social Security. The penalty for not understanding the rules and the resulting difference in lifetime benefits can be enormous.

Consider the difference in lifetime benefit amounts for a couple with the following circumstances.

-Full Retirement Age Benefits: $2,000 for one spouse & $1,000 for the other spouse.

-Two grandchildren ages 8 & 10.

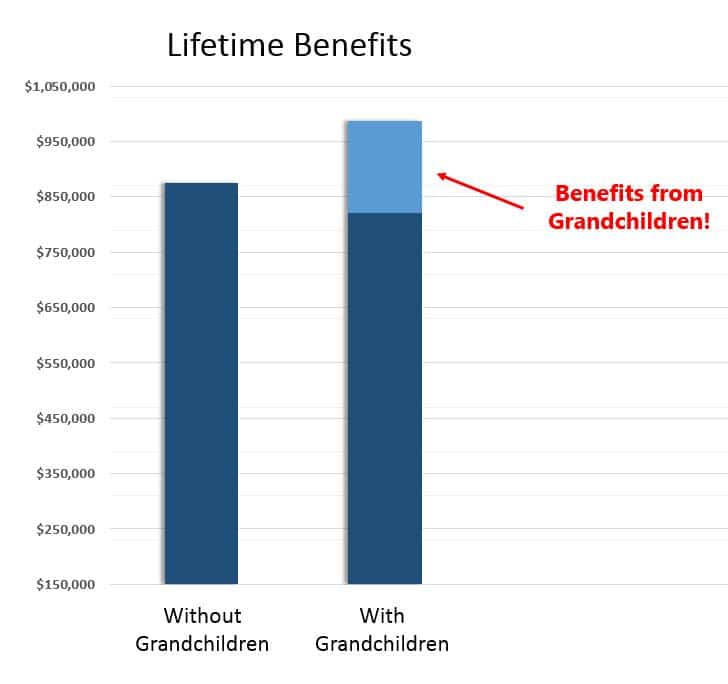

In the first example, they simply waited to file at full retirement age. Over the course of their lifetime (through age 85) they received $874,705 in Social Security benefits. These were benefits paid on their own work record only.

In the next example, they filed for benefits at age 62! Why? It’s because the benefits to the grandchildren are not available without the grandparent filing first.

In many cases, delaying your filing age is a smart move for multiple reasons. But not all cases are the same! In this case they were able to collect an additional $111,920 in lifetime benefits by filing early and turning on the benefits to their grandchildren.

I hate one size fits all Social Security advice. A situation like this illustrates that filing strategies are dependent on individual circumstances. Before you make a filing decision, make sure you understand your options.

Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. Also…if you haven’t already, you should join the 400,000+ subscribers on my YouTube channel!

My main concern is my grandkids age 7 and grandson just turned 12 it’s just super hard on my husband and I . I’ve been disabled for several years and draw disability monthly it’s just this time of the year I get very depressed because we can’t afford Christmas for the kids my husband is still working but we’re both getting old and we had no clue that we’d be raising our grandkids at this age ., or even at all but there parents were addicts and the grandkids were in danger and October 2022 we were granted permant guardianship… Read more »

I’ve just received permanent guardianship custody of my grandkids until they reach 18 years old there 7 and 12 years old I’ve been disabled drawing ss disability for several years I’m just wondering if my grandkids are eligible for benefits as well

I am an employed widow . I collected my husbands ssi early…i am now raising my two grandchildren who ive had for six years now. They receive benefits from my deceased son . Mom disappeared shortly after his death. They each receive 247 a month. is there anything i can do to get ssi benefit increased

Me and my wife are raising our Grandson, we’ve had him since he was 3mo old , The mother brought him to us at 3 am in the morning and told her mother she couldn’t do the mother stuff, left the baby and doesn’t call or come see him, not apart of his life what so Ever, he is now 12 years old, and he has feeling that he is a mistake, that he should of never been born, we have given him assurance how much we love him,but he wants so bad to have parents like other kids in… Read more »

My grown daughter is disabled. She’s on ssdi. She’s now pregnant. My wife and I are 71 and I have been retired for nearly ten years. Since my daughter is disabled and the father is not in the picture, will my grandchild qualify to get benefits under my social security if I am the primary provider?

I have physical legal custody of my granddaughter I have applied for social security in Dec..I turned 66 in Jan of 2022…she is my dependent age 11..

I am raising four grandchildren didn’t adopt them but have leagle custody until their eighteen do they qualify if Im on disability

If my husband deceased and I adopted my grandson can he draw off my husband social security

Question my wife retired with full Social Security benefits age 66. We have adopted grandchild and she receives survivor benefits based on my wife social security. I am a retired on a teacher retirement plan also I have social security but reduced because of Windfall Profit tax. If I die before my wife she will receive survivors benefits from my state retirement. My question is does our adopted daughter continue to receive her survivors benefits that were originally granted too her. ???

I recive social security and has been raising my great granddaughter for ten years just temporarily custody of her but was reciveing child support but not now can I put her on my social security?

Its horrible that a leagal guardian of a grandchild can’t get benefits they need to adopted which is unaffordable

Sadly money our parents busted their balls to make was taxed poverty sad man 4 in am am 7 years old tryinghold flash light one hand a umbrellas in other cause its poured so hard and this man installing a motor why cause white people wasnt given white privileges Black lives matter claims we collect ????? Broke my back in crash nit my fault as i being hustle out of welfare told i get 25 from aflac i get nothing no cash no food stamps nothing the racist person that was hustle me out grabs this man of color am… Read more »

Nope.ur daughter needs step up and dig in them pockets

Both parents are dead he drug over dose unfortunately same sister my parents has raised him from birth sad momom died last week poisoned from covid vaccine we was told we can not collect my moms benefits because hers benefit are 200 bucks less then pops now my parents raised 5 kids no help at all they paid all their lives and now my father must up route this poor child that gas seen 3 of his parent.drop dead am amazed he not crazy yet here thing pop worked his ass off 71 years and being told he cant collect… Read more »

If a child’s mother dies and her grandmother keeps child has custody and collects the social security survivor benefits for said child can the grandparent then sue the surviving parent for child support even though they are ALREADY collecting survivor benefits from the child’s deceased parent. Is that not like collecting double support. The living parent supplies health insurance for the minor child living with grandparent

If the grandmother raised her two grand daughters from birth by her self but did not adopted them because the parent wouldn’t let can those kids still qualify for benefits from their grand mothers benefits who just recently passed away these children need some kind of help they have no one else now.

What if mother is disabled, father incarcerated and I only have guardianship not adopted.

Iam on Social Security disability my daughter died I have custody of my grandson . But we have a very hard time making it on 900.00 a month his father has been in prison and has never paid child support. Our there and extra help programs to help me with expend for my 12 year old grandson .

I am 65….i will get approx $2400 soc sec if i work til 66 and 2 months. I am raising a grandson since birth…age 10. Both parents disabled. I am in the process of adopting to have full legal control…i can draw on my exhusbands SS and get $1235 month. Is it a financially wise move to retire now to turn on benefits for my grandson? And use my exhusbands benefit? Or should i wait til 66 and 2 mos?

Please I need help my grandfather raised me since I was 6 months old my father and mother were both disabled father died I lived with my grandfather who worked for the city of Chicago in a government job and was retired United States Army served 21 years prior I lived with him all of my life for 30 years till he died in 2013 and he had claimed me almost his entire life although was told that he was not allowed to for the past possibly 2 years not sure if he still did so. I was on disability… Read more »

We have legal conservatorship of our 4 year old grandson. I get SS and my husband get SS. Can we get benefits for our grandson? The mother abandoned him and father in prison.

MY husband and i adopted our grandson WE are not disable ,WE are not retired, would our son still qualify for any benefits ?

I’ve had temp custody of my granddaughter since she was 4 moth old & is now 5yrs old. I’ve been on disability for 8yrs. Can I receive a check for her or do I have to have full custody?

I didn’t know that we could get our dependent grandchildren covered under Social Security benefits because my husband and I are both retired. I wonder if our case would be stronger if we were able to prove our inability to move around easily to a judge. We’ll have to start looking into attorneys who are experienced in Social Security matters.

Hello, I receive social security and I have custody of my grandson my daughter just passed away in April my question is can I receive benefits for him

My brother died 2 months before his son was born, the mother left the baby with my father 10 days later and never came back ever again, my nephew is now 15 my mother and father both died in the past 2 years, they got full custody of him 15 years ago and raised him solely, I the the 15 year olds aunt now have custody. My dad had a great job and retired from there from 46 years. Can my nephew receive survivor benefits from my father?

My husband is 64 he took his ss at 62, our adopted granddaughter(now 14 years old), and I the spouse are collecting off of husbands ss. I will be turning 62 next month. I talked to ss and asked if I the spouse can continue to collect off of husband ss until our granddaughter turns 18, they said yes that I could continue on husbands social security. Just want to make sure this is true. Thanks for any device!

I just retired at 65 and since I am in excellent health and enough savings I planned to wait until 70 to receive social security and get my max benefit. My wife is 58 and still work and plans to retire at 62 but also wait until 70 file for s.s.. But something new has happened we will adopt out 6 years old grandchild. I know she can get 1/2 of my s.s benefits. But now I don’t know if it better to still wait until I am 70 or do it now.

I am only 48 and have had grandaughter for 3 years with no physical or financial assistance from biological parents

I draw ssi disability for 8 years I have soul custody of my grandaughter can I draw or receive any benefits ..I dont qualify for assistance due to my family household income from ssi

If you receive xtra on the child due to adoption and drawing at 62 would this count as your total income for tax purposes or would the social security for said child be in child name instead if the person adopting?

We have had our granddaughter since she was born addicted to a slew of drugs my husband is on ssd he is 64,the day we brought her home I had to quit work to care for her she’s 6 months now 2 months after our granddaughter was born her mother of and passed away,our son also a addict lives in his truck we are waiting on our court day to finalize the adoption our son has signed away all rights.We’re told she and her sister that lives with the other grandparents were supposed to draw money from their mother because… Read more »

My husband and I recently was awarded permanent guardianship of our grandkids..can they drAw a heck off his SSA?

If I have had legal guardian and the mother which was my daughter was killed but the father is alive but in prison for the crime until well after my grandson turns 18 do I still have to adopt him in order to get him a check off of me because I am disabled and also draw off my husband who recently passed away it is exspensive to adopt is the reason I am having difficulty adopting him

My grandchildren have lived with my husband and me for over ten years and I have temp. custody and have since day one. I am disabled, my husband recently retired and money has grown so tight. Although the children aren’t my husbands blood relatives he has helped support and raise them for over ten years and filed them on our taxes too. I can no longer get my SSI due to his retiring and drawing SS. Why were we turned down help from his SS for our grandchildren? We live in Tennessee.

We have filed on our 4 grandchildren we adopted and social security won’t complete this. We have given them the adoption paperwork 3 times. What can we do?

I have had my grandson for a year and the adoption is in progress, what i need to know is everything is being done in my name only I am a 70 year old woman I get a monthly social securtiy check. what i want to know is if my husband is not on the adoption papers can I file for S.S for my grandson on my husbands SS or do i have to do it on mine. also my husband and i are seperated we do not live together but are still legally married so where does that leave… Read more »

Our daughter and two granddaughters have been living with us for 3 years. Due to physical and mental health issues, our daughter has not been able to work for 2 1/2 years. There is an order of protection against the father who was not married to our daughter. We are the sole support for the three of them except for federal food stamps and federal and state health care. Our daughter has not been able to quality yet for disability. Could we file for social security for our 5 and 8 year old granddaughters?

My husband and I are being awarded a durable, legal guardianship for our 2 1/2 granddaughter. We were her foster parents for well over 2 years. My husband currently draws social security. Does a legal guardianship count? We were offered the choices of adoption or legal guardianship. The legal process will be complete on 9/6/19. It would relieve a huge amount of stress and anxiety if we could find a clear answer, if legal guardianship will enable our granddaughter to receive social security. We live in a 55+ community and are having to sell our home in order to raise… Read more »

My husband and I have permanent guardianship of our grandchildren. Their father has died and they receive social security survivor benefits. We want to adopt our grands but will they lose the social security?

I don’t think so. However, check with a family law attorney to see if the next logical step may be an adoption.

Would a curt ordered full custody of a grandchild work as well as an adoption?

The mother of our grandchildren died suddenly and the children are 15 and 12. Their parents were divorced 11 years ago and due to addiction issues my wife and I have legal conservator ship of the children but for the last two years the mother carried then as dependents since she was able to obtain insurance for them through work. The children alternated weeks living in our house and her house for the last 11 years. The father has not ever carried the children as dependents and we did so until the last two years. My wife and I are… Read more »

Two of my grandchildren have lived with me off and on since their birth. I currently am responsible for the care of them, ages 11 and 14. I am 69 and already drawing Social Security. They have been under DSS supervision for over a year, after their mother gave birth to another child and was reported to DSS by the hospital. I need Social Security benefits for them. What do I need to do?

We are USA citizens living overseas , we have been bringing up a grandchild since birth (usa citizen ) and we have full custody, would we qualify for benefits if we adopt the grandchild ?

My husband died in 2003, My sun turns 16 in Sep,2019 and my survivors benefits will end, I have been fighting for disability for 7 years and it is in appeal council cancel being worked right now. If I am denied by appeal counsel before September can I reapply before my survivors benefit end and get disability under my husband or do I have to apply for SSI benefits because I do not have enough points to file SSA under my own, I have not worked enough since 2003. I am unhappy if I loose the back pay I feel… Read more »

If I am already getting widow social security can I adopt a family member will it mess up my social security benefits?

If I get widows benefit would it mess up my social security benefits if I adopt my grandchild

my father was receiving his benefits before my daughter was born. But he, as well as my mother before she passed recently, have taken care of her her whole life. can someone please HELP,!! thanks

I have permanent custody of two grandchildren ages 3 and 5. I just filed for SSI on the 5 year old since he has disabilites. According to the social security office, he can draw based on his disability, and since he is not adopted our income does not determine his eligibility. (I know a really well off lady who is drawing a check on each of 3 disabled grandchildren with permanent custody, also. She is the one who told me I could file.) So, if the child has a disability, and is not adopted, then SSI is a good possibility.… Read more »