Social Security credits are the building blocks that the Social Security Administration relies on to determine whether or not you qualify for one of its programs. In 2021, you receive one credit for each $1,470 of earnings, up to the maximum of four credits per year. The amount of earnings needed to earn a credit increases annually as average wage levels increase.

One stipulation is that your earnings must be subject to Social Security tax to count for a credit. In exchange for this tax, you are eligible for the following important benefits:

- Social Security Retirement Benefits

- Social Security Disability Benefits

- Social Security Survivor Benefits

- Medicare

Each of these programs have different requirements for the number of credits to gain eligibility. Here’s a quick look at the eligibility for each.

Social Security Credits Required for Retirement Benefits

The Social Security credits required for retirement benefits is the easiest to understand. If you were born after 1929, you must be fully insured (40 credits) for eligibility. In most cases, all 40 credits can be satisfied by 10 years of work.

If you do not have enough Social Security credits based on your work history, you may qualify for a benefit on a spouse’s work record.

Social Security Credits Required for Disability Benefits

Generally, the number of Social Security credits required for disability benefits is 40. You must also have recent work history. In fact, 20 of your credits must have earned in the last 10 years ending with the year you become disabled (unless you are blind). Since disabilities can also happen to younger workers, there are some exceptions to the 40 credit rule.

The rules are as follows:

- Prior to age 24–You may qualify if you have 6 Social Security credits earned in the 3-year period ending when your disability starts.

- Age 24 to 31–You could qualify if you have credit for working half the time between age 21 and the time you become disabled.

- Age 31 or older–Generally, you need to have the number of Social Security credits shown in the chart below.

Social Security Credits Required

for Survivor Benefits

Much the same as disability benefits, Social Security survivor benefits do not always require you to be fully insured (40 credits). An individual who does not have 40 credits may still be eligible for survivor benefits if they are “currently insured.” The Social Security Administration defines “currently insured” as having at least six Social Security credits during the full 13-quarter period ending with the calendar quarter in which the worker dies.

For more indepth reading on what benefit eligibility if someone dies young, see my article: If You Die Young: How to Calculate Social Security Survivor Benefits.

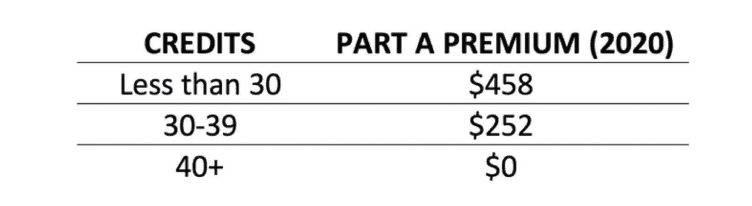

Social Security Credits Required for Medicare

Technically, there are no credits required for Medicare. The credits for Medicare purposes simply reduce, or eliminate, your Part A premium. The chart below lists the part A premium amounts for the corresponding Social Security credits.

For part B, everyone pays a premium. For most, it is $148.50 per month (in 2021). However, it’s important to note that the premiums are higher for individuals over certain income amounts.

There are a few other exceptions to receiving free part A Medicare. See the Medicare website for more information.

As with retirement benefits, you may qualify for free part A Medicare on a spouse’s work record.

The Takeaway

It’s important to stay informed on your Social Security credits. I’ve seen more than one case where someone was just a few credits short of having a benefit on their own record. You need to check it out today! Thankfully, this is easy to accomplish. I’ve published a step-by-step guide to checking your earnings history on my website. You can jump online and make sure that all of your earnings have been correctly reported and ensure you have met your requirements to qualify for your own benefit.

Before you leave…if you haven’t already, you should join the 330,000+ subscribers on my YouTube channel! I release a new video every week and work hard to break down the complicated rules so you can get every nickel in benefits you deserve.

I participated in a depression study a few years ago and ssi counted all of it and I just read in the information above that sometimes the 1st $2000 isn’t supposed to be counted so that means I only owe $3000 not 5 correct?

Could you clarify the requirement for disability benefits. You mention that 20 of the needed credits must be earned in the last ten years. Would earning 4 credits a year for the next five years meet the standard? Thank you.