How confident are you that your Social Security earnings record is accurate?

Unless you’ve checked it recently, you shouldn’t be too sure.

Mistakes in an individual’s Social Security earnings record are actually much more common than most people think. In tax year 2012 alone, the Social Security Administration reported $71 billion in wages that could not be matched to an individuals earnings record! The good news is that the Social Security Administration has a system for sorting out some of these mistakes and assigning the earnings to the correct record. But nearly half of the mismatches are never corrected. That means that in 2012 there were approximately $35 billion in wages that was never credited to an individual’s Social Security history.

Why A Social Security Earnings Record Mistake Matters

A mistake in your earnings history can make a big difference in how your Social Security benefits are calculated. How? It all goes back to the benefit’s formula. The Social Security Administration uses your highest 35 years of earnings as a cornerstone of the benefit calculation. If any of these 35 years are incorrect or missing altogether, the average is skewed. One year of missing earnings can make a difference of $100 per month (or more!) in your benefit amount. Over your lifetime, that could be nearly $30,000 in missed benefits from one year of missing earnings.

You need to check your Social Security earnings record today. Thankfully, it’s pretty easy to do.

Here’s how to accomplish this in five easy steps.

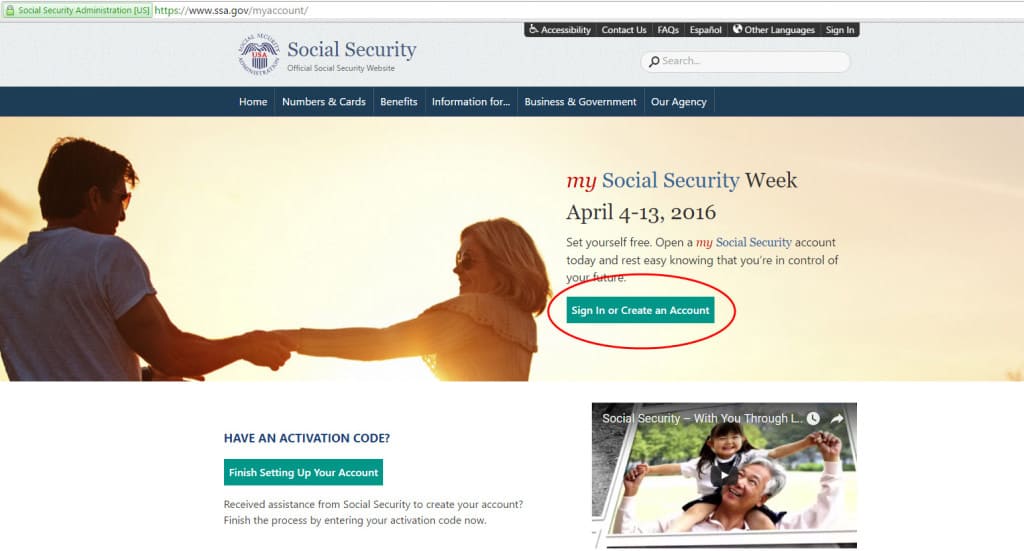

Step 1

Visit www.ssa.gov/myaccount to get started. If you click the link, it will open Social Security’s website in a separate page so you can keep using this guide.

Once the page loads, simple click on the button labeled “Sign In or Create an Account.”

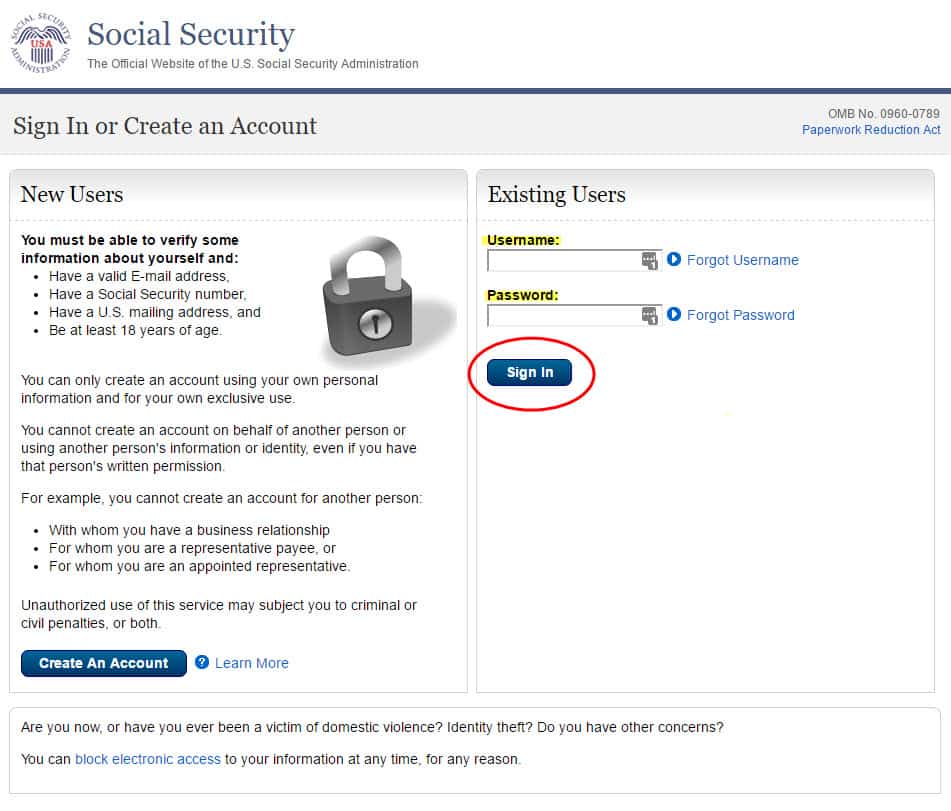

Step #2

Type your username and password and click the button labeled “Sign In.”

Step #3

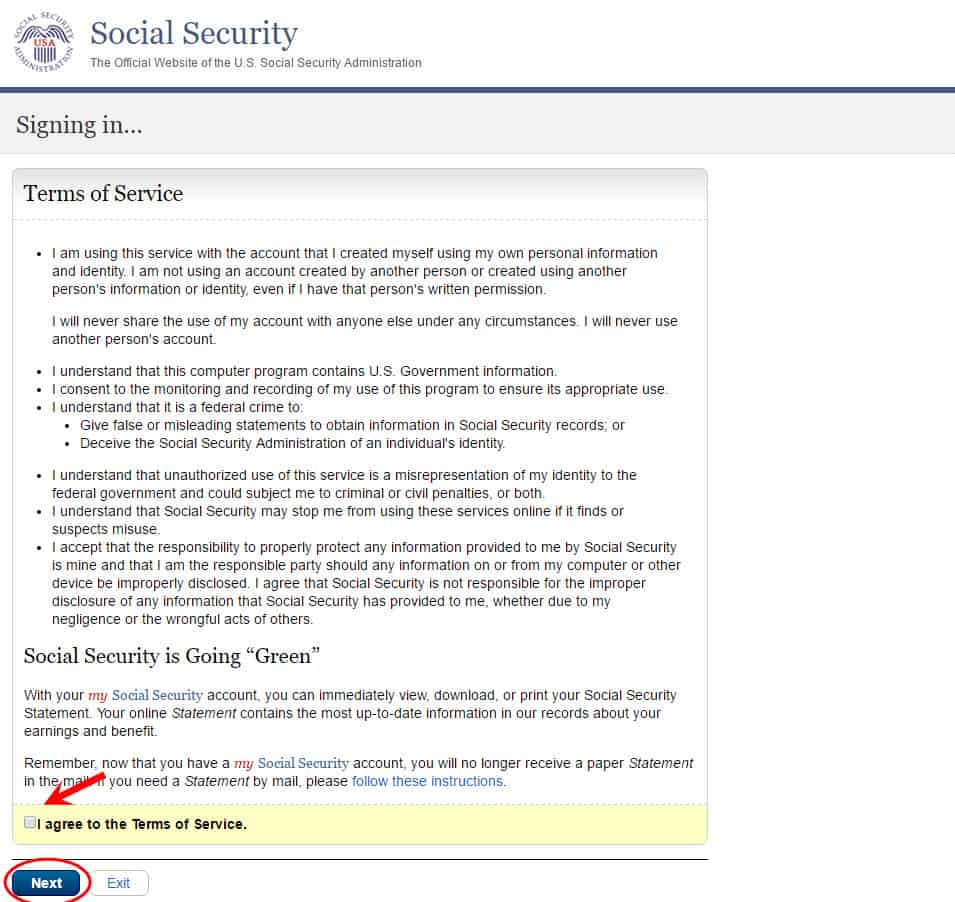

In the third step, you need to read and agree to the my Social Security Terms of Service. Be sure to carefully read this page before clicking in the “I agree” box and then clicking “Next.”

Although you need to understand this information for yourself, here’s a summary of what you are agreeing to.

-You will never share your information with anyone or use anyone’s account

-Once you open an account, you will no longer receive a paper statement in the mail. Instead, you’ll receive an annual email reminding you to log in and check your information.

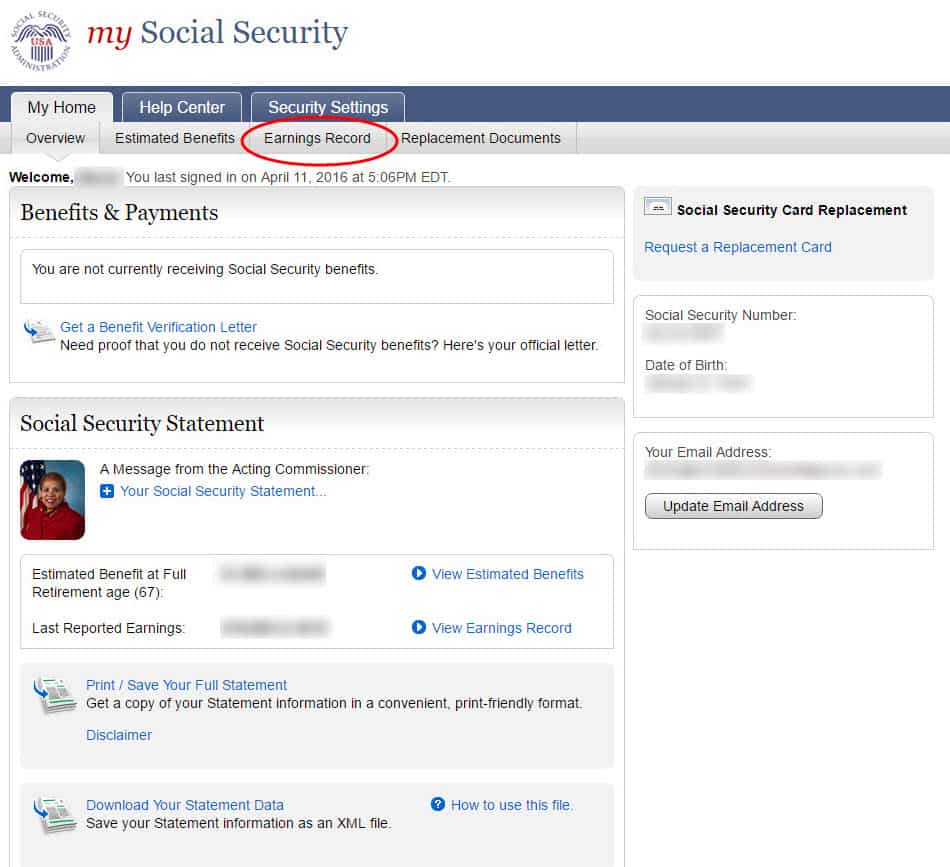

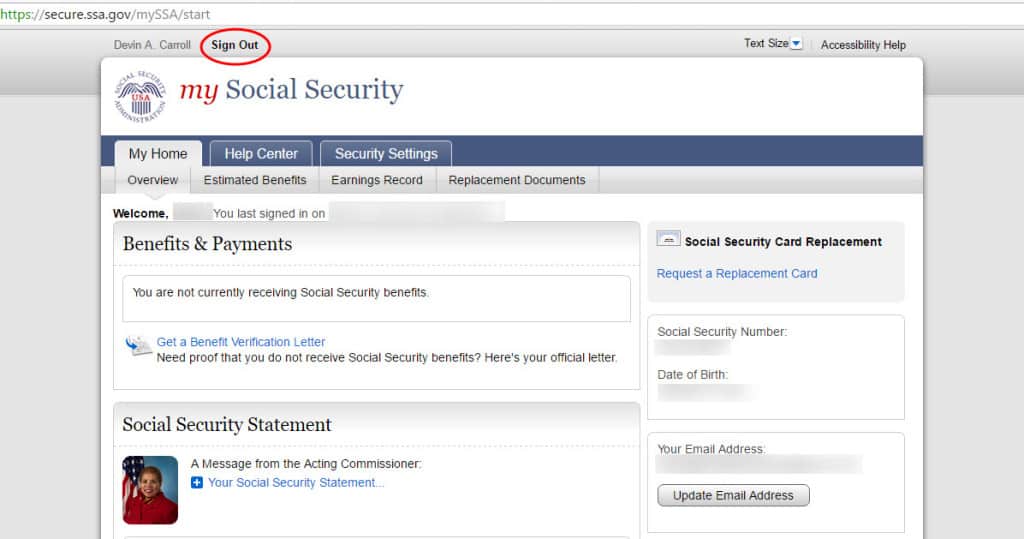

Step #4

Now that you are on the home page, you just need to click on “Earnings Record” tab at the top.

Step #5

On your screen you should see your earnings record. Check it carefully. If there is a mistake, the burden is yours to prove it. You’ll need to locate documents that prove the error such as tax forms, W-2 forms or pay stubs. If you can’t find these, Social Security says to write down the name and address of your employer, the dates you worked there, how much you earned and the name and Social Security number you were using while you were employed, and the agency will use this information to investigate the problem.

For more information from the Social Security Administration on the procedure, you can visit the section of their POMS manual that discusses this.

Step #5 1/2

Dont forget to sign out! This system has too much valuable information to leave it open.

If you have questions about any of this, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

How do i find my earnings on 1040 that is reported to social security so i can check if it is correct?

Can I pay someone to recheck my social security calculations at 66 years❓

Who does this❓

does SS use gross earnings for the year or taxable earnings on the “your earnings record”?

Have any of these questions been answered? I too an interested in why many years’ earnings do not match my W-2 or any number on my tax returns. Is some sort of cap applied if you earn over a certain threshold so that the earnings record ceases to be a record of actual earnings?

I am missing several years earnings- 4 of which I have the tax returns, schedule C, and Schedule Se. On two went through admin hearing with IRS which found filed before deadline and I eas owed 8500. First SS rep said 3 year 25 day rule for 2008 expires March 15 2011- counting both year and month as 1 starting begenning istead of after tax year ends. Now they claim I have to have receipt- not just proof of filing. IRS does not issue receipts when they owe a refund due to earned income credits- or previous year refund being… Read more »

No janel you can’t stop being a scammer for money

I can’t find an answer to the following anywhere–not even on SSA: How each year’s salary shown on the earnings record determined? Is it my gross salary? Is it my salary minus deductions? I don’t make over the 132,000 taxable threshold so should each year show my government salary? I can’t get this answer via telephone or chat with the SSA.

My Earnings Record still does not show my earnings for 2018. Can you tell me when this will be posted?

Can you check your deceased husband’s record for past earnings?