Note: The Social Security earnings limit changes each year. The most current version of this article uses numbers for 2023.

At one of my first speaking engagements, I heard a great story from one of the attendees. Her experience provides us with one of the best examples I’ve ever heard of how much the Social Security income limit can catch you by surprise.

A few years earlier, she’d been at her bridge club when the topic turned to Social Security. As she and the other card players chatted about the best way to leverage Social Security Benefits, the consensus around the table seemed to be that filing at 62 was the smartest thing to do.

This lady, trusting the advice of some of her closest friends, did just that: She filed for benefits as soon as she turned 62.

She then told me she’d always wanted to buy a brand-new Toyota Camry. She figured that, once she started receiving Social Security income, it would be the perfect time to buy the car. She was still working, which meant her Social Security check would be extra income.

As she told the story to me, she bought the car and took out a car loan to do it. She planned to repay the loan using some of the income she expected to receive from her Social Security benefits since she filed for them.

Imagine her surprise, then, when a nasty letter from Social Security Administration showed up in her mailbox. The letter claimed she had been paid benefits that she was not eligible for!

The Social Security Administration not only asked her to pay the benefits back, but also informed her that future benefits would be suspended due to her income.

Now she had a new car and a car loan, without the Social Security benefits she planned to use to handle that monthly payment. What happened here?

Something that surprises more than just the poor Camry owner who approached me that day: the Social Security income limit.

What Is the Social Security Income Limit?

The earnings limit is also known as the income limit, or the earnings test. The official term is “earnings test,” but income limit and earnings limit are the terms that you’ll hear most often.

For our purposes, know that all these terms mean the same thing — and there are four quick facts about the Social Security income limit that you should know before we jump all the way into explaining the test or limit:

- Be aware that we are talking about Social Security income limits for retirement benefits, not disability or SSI.

- The earnings limit on Social Security is not the same as income taxes on Social Security. Don’t get the two confused!

- The earnings limit does not apply if you file for benefits at your full retirement age or beyond. These limits only apply to those who begin taking Social Security benefits before reaching full retirement age.

- The earnings limit is an individual limit. If you are still working, and your spouse is drawing Social Security, your earnings will not count towards their income limit.

Why We Have An Earnings Limit

Not long ago, a viewer on my YouTube channel asked me to give her a good reason why we have the Social Security earnings limit. The comments that followed showed how many viewers shared the belief that the earnings limit is unfair and should be eliminated.

In my response, I explained that the rationale behind the entire program of Social Security was to create a safety net. The original intent of the Social security program was not to supplement retirement income, but to keep the elderly (most of whom lost any potential long-term wealth in the Great Depression) out of poverty.

I also added that today’s earnings limit is relatively generous compared to where the Social Security earnings limit began. The original Economic Security Bill (which is what the Social Security Act was originally called) President Roosevelt sent to Congress featured a very restrictive earnings limit.

That bill stated, “No person shall receive such old-age annuity unless . . . He is not employed by another in a gainful occupation.”

Whoa! This means that if you had even a single dollar in wages from a job, you could not collect a Social Security benefit at all.

(If you’re curious, you can read more about the history of the Social Security earnings limit here.)

Thankfully, the system we have in place today allows for individuals to have some earnings from work while they are receiving a Social Security benefit.

However, it’s very important to stay informed on the dollar amount of this limit because it changes every year.

For 2023, the Social Security earnings limit is $21,240. For every $2 you exceed that limit, $1 will be withheld in benefits.

The exception to this dollar limit is in the calendar year that you will reach full retirement age. For the period between January 1 and the month you attain full retirement age, the income limit increases to $56,520 (for 2023) without a reduction in benefits. For every $3 you exceed that limit, $1 will be withheld in benefits.

This means that if you have a birthday in July, you’ll have a 6 month period with an increased income limit before it’s dropped completely at your full retirement age. This increased limit and decreased withholding amount allow many individuals to retire at the beginning of the calendar year in which they attain full retirement age, rather than waiting until their actual birthdays.

Again, once you reach full retirement age, there is no reduction in benefits regardless of your income level.

A Real-Life Example of the Social Security Income Limit in Action

To put these numbers into context, let’s look at an example of how this might work in a real-life scenario:

Rosie is 64 years old. She started taking Social Security benefits as soon as she turned 62. Based on her birth year, her full retirement age is 66.

Right now, Rosie is eligible for $20,000 in Social Security benefits per year. She also worked during the year and made $31,240 in wages.

The question we want to understand is, how much was Rosie’s benefit reduced by working while on Social Security? To answer that, we first need to calculate how much Rosie was over the Social Security earnings limit for her age.

In 2022, Rosie filed for Social Security; she received her first check in January of 2023. Throughout the year she received $1,667 in benefits every month. Without knowing the rules, she also worked and earned $31,240 in wages.

With a Social Security earnings limit of $21,240, she was over by $10,000:

$31,240 Total Wages – the Social Security Income Limit of $21,240 = $10,000 Income in excess Of limit

Because this is a full calendar year during which Rosie is receiving benefits but is not yet full retirement age, the benefits reduction amount is $1 reduction for every $2 in excess wages. Since she was over the limit by $10,000, her benefits will be reduced by $5,000.

The benefit reduction calculation would appear as follows:

$10,000 Income in Excess of Limit x 50% ($1 reduction for every $2 over limit) equals a $5,000 Benefit Reduction

With a $5,000 benefits reduction for exceeding the income limits, Rosie’s $20,000 yearly Social Security benefit will be reduced to a $15,000 benefit for the year. In the following year, she would attain her full retirement age and after her birthday, the limit would no longer apply.

How Does The Income Limit Affect Spousal, Survivor, or Children’s Benefits?

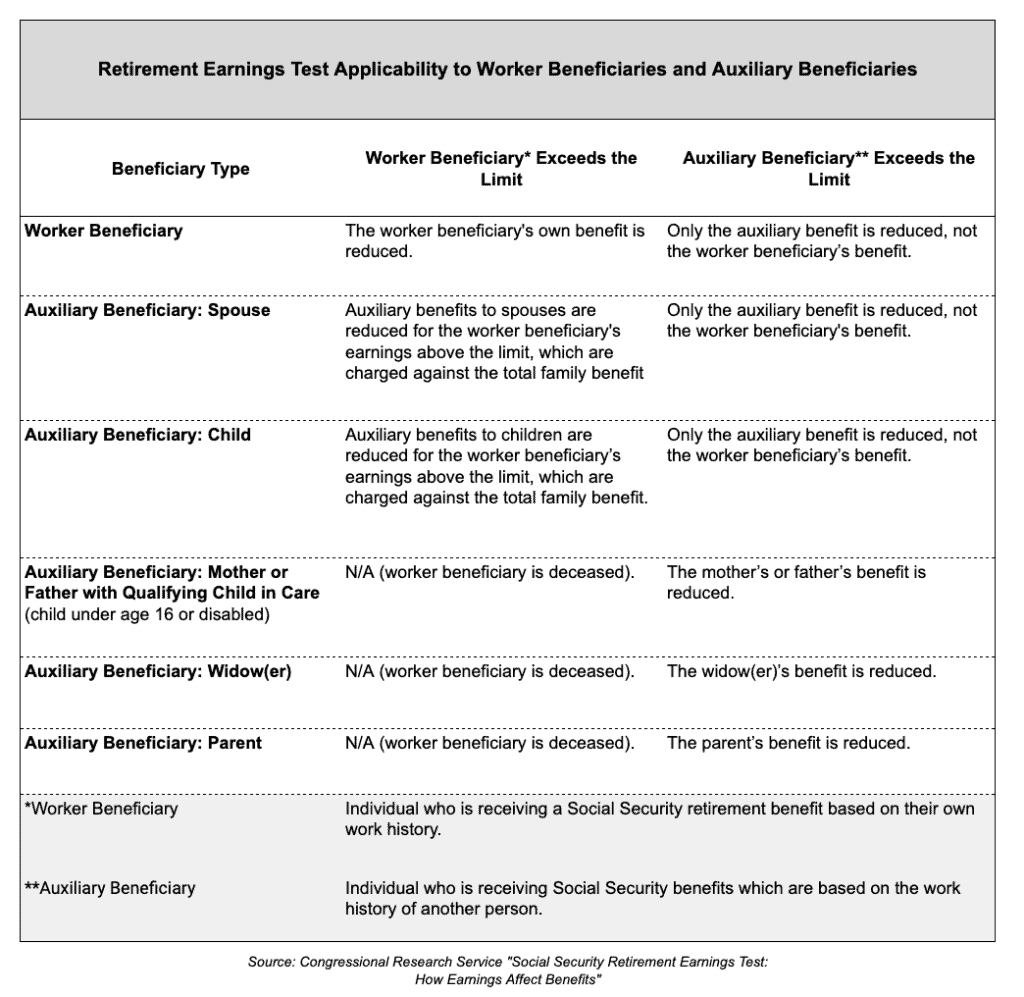

There are millions of individuals who receive benefits as an “auxiliary” of a retired or disabled worker. These auxiliary beneficiaries are also subject to the same earnings test.

See the chart below for more detail on how the limits are applied to each type of benefit.

Special Monthly Income Limit Rule for the First Year (or, Your Grace Year)

Many people who retire mid-year have already earned more income than the limit allows. This is why there is a special rule where the earnings limit switches from an annual limit to a monthly limit. (These monthly limits are 1/12 of the annual limit.)

This rule allows you to receive a check for any month you are considered “retired” by the SSA even if you have already exceeded the annual earnings limit.

That sounds straightforward enough — but the interpretation of “retired” as defined by the SSA can cause some confusion. Here’s what they mean by this term:

You are retired if your monthly earnings are 1/12 of the annual limit ($1,770 for 2023) or less and you did not perform substantial services in self-employment.

Essentially, you are considered retired unless you make more than the income limit. The rule for the year you reach full retirement age also applies when working with the monthly limit. In this calendar year for 2023, the limit is $4,710 (1/12 of $56,520).

It’s very important to remember that in the year following this first year, the monthly limit is no longer used and the earnings limit is based solely on your annual earnings limit.

How the Earnings Limit Is Applied

The most confusing part of the benefit reduction due to income is how it’s reflected in your monthly benefits deposits. Instead of taking out a little bit every month, the SSA will withhold several months of benefits at a time.

If you predict in advance that you will have excess earnings and report this to the Social Security Administration, they may take a few months of benefits before you actually earn the anticipated excess earnings.

For example, if your Social Security payment is $1,667 per month, and you expect to receive $31,240 in wages from your job, the Administration would calculate that you’ll be over your earnings limit by $10,000 and thus $5,000 in benefits should be withheld. So, they would withhold your benefit payment from January to March. In April, your checks would resume.

If you don’t report excess income before you earn it, then you have to report this information after the fact. You can do this when you file your income tax return, but the preferred method is to be proactive and call your local Social Security Administration office.

If you wait for the Social Security Administration to learn of your excess earnings via your tax return, there could be a significant gap between the time you earn the excess income and the time that they withhold your benefits. In most cases, it’s better to report the excess earnings quickly so the benefits reduction occurs closer to the time you actually earn that extra income.

Regardless of whether your benefits are withheld in advance or in arrears, benefits withholding can make budgeting and planning difficult, especially if you don’t understand the system. You may need to create a separate savings account to set some of those earnings aside to compensate for benefits withholding that will occur in the future.

What Kind of Income Counts as Earnings?

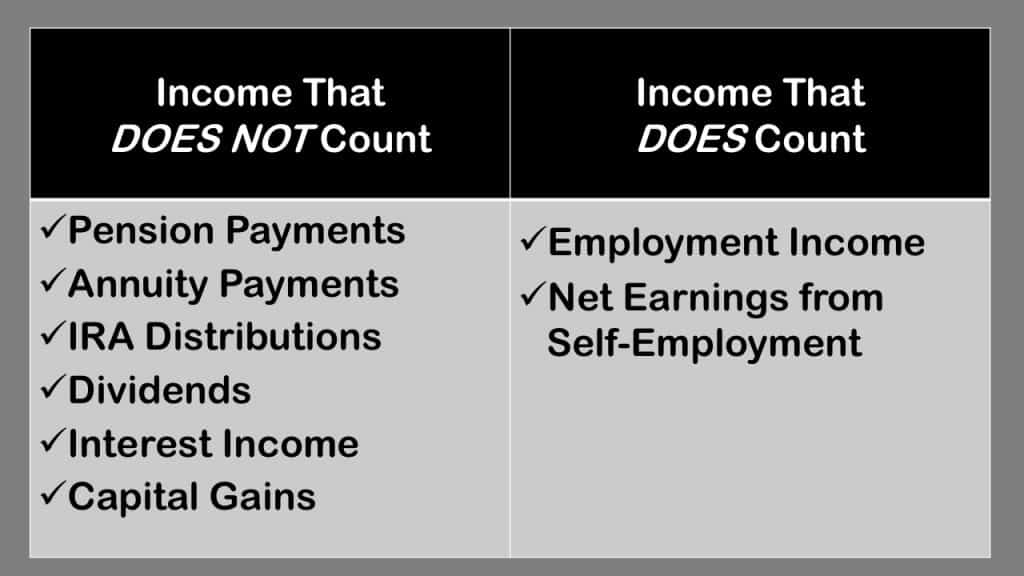

The Social Security income limit applies only to gross wages and net earnings from self-employment. All other income is exempt, including pensions, interest, annuities, IRA distributions, and capital gains.

The term “wages” refers to your gross wages. This is the money that you earn before any deductions, including taxes, retirement contributions, or other deductions.

If you want to see a more in-depth conversation about what counts as income for the earnings limit, see my article on the Social Security Income Limit: What Counts as Income?

What to Do If Your Benefits Are Already Being Withheld

If you’re subject to the Social Security earnings limit, don’t wait for the SSA to start reducing the benefit you receive. Instead, I’d recommend voluntarily suspending benefits.

If you wait for the Social Security Administration to discover that you’ve earned too much working while receiving benefits, your risk of an overpayment notice is higher.

Either way, you aren’t missing payments that you’ll never get back. Your benefit amount will be recalculated at your full retirement age (or when you stop working) to reflect the months that benefits were withheld.

The best way to avoid the earnings limitation is to wait until full retirement age to file for benefits. If you can’t wait, make sure you have a clear understanding of how working impacts your Social Security benefits.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the nearly 400,000 subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing that you don’t want to miss: Be sure to get your FREE copy of my Social Security Cheat Sheet. This handy guide takes all of the most important rules from the massive Social Security website and condenses it all down to just one page.

I retired in May, 2022 at age 63, earning the annual allowed of $19,XXX in Jan-May. I had only SocSec retirement and pension from Jun-Dec, 2022. I earned the annual allowed, but was over the monthly allowed from Jan-May. Will I be penalized for that, or am I safe because of the total annual earned? Thank you.

Hello. I’ve read the article, which is fantastic, and I’ve watched your YouTube info. I’ve read sections of the SSA manual. I still don’t know if my state sponsored disability payments should be considered wages. The official statement in the SSA manual says such payments “may be considered Social Security earnings”. I’d appreciate any information. Thank you for all of your with Social Security.

I am 64 and collecting my social security benefits,of 1372.00 per month. I need part time work. How much can I earn?

what is the full retirement age for a person born in September of 1055?

So I reach fra next month. Does that mean that I don’t have an income limit for 2022?

I see no explanation of possible reductions in SS benefits if I started receiving at age 62 but did not work until after I reached age 73

I am 60 and have been receiving SSDI for the past 7 years, I work a part-time job and make well under the income cap each year. When I reach 62 am I still at risk of losing my benefits if I make more than the limit?

My two children receive survivor’s benefits as a result of their dad’s death. My son wants to get a job to save money for a car. Does the $18,960 limit apply to those survivor benefits also or is the limit different?

It sounds as if the kids are receiving their benefits from your work record. If that’s the case, your wife’s income would not impact their benefit (but would impact her benefit).

The earnings limit only applies to individuals who are under full retirement age.

I am sixty-six and still working. My earnings are well below the 2021 requirements. I took SS at sixty-two. I just applied for a position that is part time, but the yearly salary is 26,884. Would my benefits be reduced?? Thanks.

Is the Social Security earnings limit based on gross taxable income (ie minus 401K deductions) or plain gross income?

Devin, thanks for the great info. I am retired with SS benefits, and as a result, my younger spouse and two U-18 kids each receive SS benefits. If my spouse starts work and makes over the $18k limit, would it reduce only her benefits, or it would impact the kids SS benefits as well?

Answer to Lon Reynolds: If you were to enter the following question into Google “Full retirement age for person born in 1955” (or what ever your birth year is), then you will have the answer in two seconds.

my birthday is in January

I Plan on collecting SS when i turn 65 I am still working and make 30k at my job and SS I will make 22k and my wife makes 8K per on SS. My full retirement is 66 yrs 6 months ,will i have to pay much in tax and how much will i owe back to SS the following year.

Sorry, I didn’t read all the way through the article. I believe my question was answered.

I was 62 in January 2020. If I work 9 months in 2020 before deciding to file for SS benefits, does the income I already earned count toward the $18240, or does that get pro-rated for the remaining 3 months?

What would I do if I miss a dose of medication?

The income limit is an individual limit. I wrote an article that covers this with all the SSA rules to support. Here’s the link https://www.socialsecurityintelligence.com/single-or-joint-income-what-counts-for-the-social-security-earnings-test/

What is the combined income limit for a couple-married, filing jointly who are 62 and collecting early SS? In 2020, is it $18,240 per person? I cannot find this clearly stated anywhere.

thanks

Lon Reynolds said: QUOTE

“Full retirement age” is mentioned a million times in this article. Funny, though: NO MENTION OF WHAT THAT AGE IS! Is it me? Simple godam question! UNQUOTE

This statement would cause one to wonder if Lon is a certified idiot. But he is correct. It is a simple question that anyone with a brain and online access could answer in seconds!

ok thanks

I would like to know if you can email me. I know you stated SSI/SSA disability are two different things from retirement benefits. Social Security has messed up my benefits for years. I am disabled and was on SSI/SSA, starting in 2000. I was declared totally and permanently disabled, from PTSD, from being assaulted at work from employment by a supervisor, which I got fired from my job, and I did get a restraining order, but because of what happened to me and being stalked as well and harassed, I had a nervous break down and wasn’t able to work… Read more »

Does a Presidential Disaster Declaration exempt the earning cap so retirees can respond to declared emergencies?

Does a Presidential Disaster Declaration exempt the earnings cap for employment? I want to go help with the COVID-19 response, but I don’t want to lose SS either.

We sold our farm now Social security is with holding our benefits

It took 2 years to sell land and equipment and my husband and I are both 73 years old

Have been to SS office to no avail..can you help?

Trying to find out it the limit rule applies if I want to start collecting in Jan would like to make my 1760 then stop working for the year

I’ll be 70 next month. My FRA was 66 (four years ago). I just received a notice from the SSA telling me that I am not eligible to receive SSI because my wages are too high. Per your chart above it says if a person is past their FRA there is no limit on wages. I am still working and had believed that being past my FRA that there was no income limit. I had chosen to keep working and hold off claiming SSI until I maxed it out at 70 years of age. What’s going on here?

“Full retirement age” is mentioned a million times in this article. Funny, though: NO MENTION OF WHAT THAT AGE IS! Is it me? Simple godam question!

Thank you

Lon

I’m self-employed and my net is much lower than my gross. If I understand this correctly, only my net income is considered when determining the income limit? Please clarify this for me. Thank you.

Why can’t we move the income limit higher? It should be well above $20,000. How can you expect anyone to live for less these days?

Do pre-tax deductions from an employer count towards the income limit? i.e. do health insurance premiums or HSA contributions reduce the income number to get below the max?

how much income can I earn if I am 68 receiving social security

Thanks for bringing that typo to my attention. It should have read, “For example, if you receive sick pay in the first 6 months after retiring, it will be considered as “wages” under the earnings test. If you receive the sick pay after 6 months have elapsed since retiring, it doesn’t count.” This comes from the POMS section on this and can be found at https://secure.ssa.gov/apps10/poms.nsf/lnx/0302505240

Devin – I have read the following (from the article) at least 10 times, and it still makes no sense to me! Please review this: “For example, if you receive sick pay in the first 6 months after retiring, it will be considered as “wages” under the earnings test. If you receive the sick pay in the 6 months after retiring, it doesn’t count.”

I have a daughter under 18 receiving social security death benefits from her late dad, is there a limit to how much she can make? She just got her first job today.

Regarding self employment rules it’s my understanding that the 15 hour and 45 hour rules you mention in reference to a reduction in ss benefits only applies to a “grace year” i.e., the first year you apply for benefits prior to full retirement age and not years following the grace year where annual net income would apply.

“In a grace year, it is significant whether a person renders SS in SE in order to determine benefits payable under the monthly earnings test (RS 02501.030).”

Please comment…thank you.

Nothing in the article addresses my work earning limits at age 77 that would reduce my SS payments.

I am 77. Nothing in the article addresses what my Income should be not to trigger a SS payments reduction.

I have a September birthday. My plan was to file at FRA in September 2020. I will still be working at that time, but plan to retire shortly thereafter. If I earn more than $46,920 prior to reaching FRA, will that affect my SS benefits? If I work until the end of that year, will the $46,920 limit affect me? Thank you.

Is there any difference in income limit if I am taking my late husband’s social security at this time and won’t take mine until I reach age 70 in 6 years?

I will turn FRA May 2020 can I get survivor benefits starting January 2020 if I don’t go over 46,920 and still work all of 2020?

Is the limit calculated on the filers income or household income?

I’m in SSDI. I will receive a settlement money from an accident I had last year.

Do I have to report this money?

What if your ex is requesting child support end and child collects social security from his social security? He has also stated that at 17 1/2 child will receive payment intead of parent raising child. How does this really work?

If I had a business and drew only a wage in accordance to SS, legal?

Is drawing early SS due to disability the same as retiring early?

Hello!

Are you in any kind of financial loan problem? Do you need a quick loan to clear up your debts and get back to business At very low interest rate? If yes kindly contact us now via Email below:(michaelnordmannloanfirm@gmail.com)

Our Services Include the Following:

* Loans for blacklisted customers:

* Debt consolidation loans:

* Car Loans:

* Business Loan:

* Personal loan:

* International Loans:

* Education Loans:

* Mortgage:

* Refinancing Loans:

* Home Loans:

Contact us via Email: (michaelnordmannloanfirm@gmail.com) God bless you all.