If you file for Social Security retirement benefits before your full retirement age, there is a limit on the amount of income you can earn. This limit is almost always based on your annual earnings, but in certain circumstances, it could be your monthly earnings that are counted.

The monthly income limit was created because the Social Security Administration recognized that some people who retire mid-year have already earned more than their yearly earnings limit. The SSA recognized that it wasn’t fair to make those individuals wait until the next year to file for benefits if they are truly retired, so there are some cases in which it’s your monthly earnings that are counted.

For example, say you earned $100,000 from January until July, and then retired in the summer. If you then filed for benefits, the monthly income limit would make you eligible to receive those benefits even though you are clearly in excess of the annual test.

Your Full Retirement Age and the Income Limit

For context and background I’d like to cover the basics of the income limit. This will help add clarity to the discussion on the monthly limit and help it make more sense. Here and throughout this article, I may refer to the monthly income limit as the income limit, the earnings limit or the earnings test. These terms are all used synonymously.

The first thing to know is that the earnings limit only applies if you are under full retirement age.

Currently, full retirement age benefits are in a period of transition for individuals who are close to retirement. It’s more important than ever before that you to know exactly when you will reach full retirement age.

If you were born:

- 1943 – 1954: Your full retirement age is 66

- 1955: Your full retirement age is 66 + 2 months

- 1956: Your full retirement age is 66 + 4 months

- 1957: Your full retirement age is 66 + 6 months

- 1958: Your full retirement age is 66 + 8 months

- 1959: Your full retirement age is 66 + 10 months

- 1960 or later: Your full retirement age is 67

Once you reach your full retirement age, you can earn an unlimited amount of money and the earnings limit will not affect you. But before that point, you need to understand everything there is to know about the monthly income limit.

The Basics of the Annual Income Limit

If you decide to file for your benefits before your full retirement age, you need to keep up with the year-to-year changes on the amount of income you are allowed to earn. (If you want to make it easy, just subscribe to my YouTube channel because I do an update for these numbers as soon as they are published.)

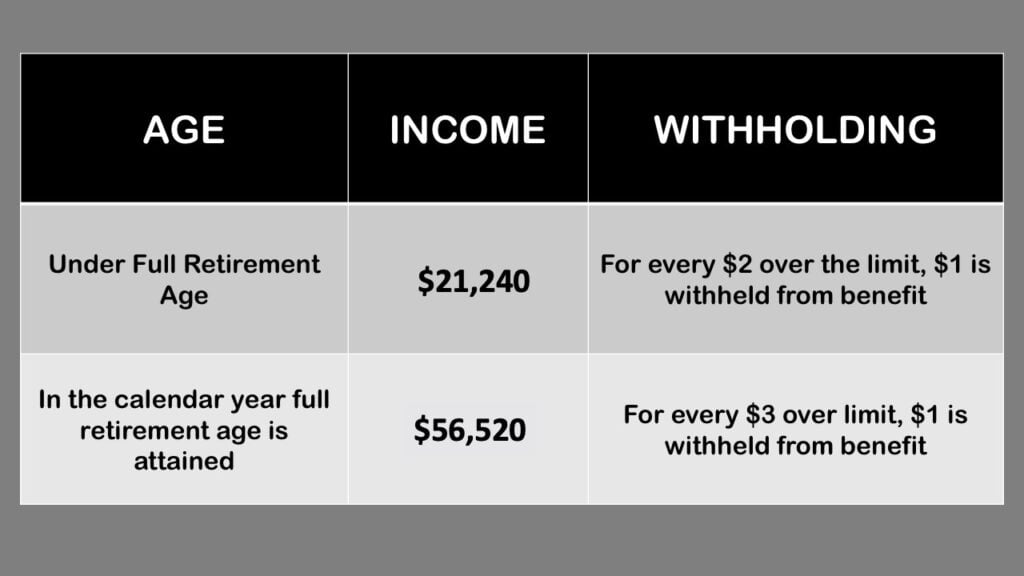

If you make more than $21,240 in 2023, the Social Security Administration will withhold $1 in benefits for every $2 over that amount that you earn. The one exception is during the calendar year you attain full retirement age.

2023 Social Security Income Limit

During that period, the earnings limit that will apply to you nearly triples to $56,520. The withholding amount on dollars earned over that limit is not as steep, either. For every $3 over the limit, the Social Security Administration withholds $1 in benefits.

Again, this is the number for 2023. Keep in mind that the limits and the dollar amounts associated with them generally increase on an annual basis.

What Counts as Income?

The big question that most people have about the income limit is, “what actually counts as income in the eyes of the Social Security Administration?”

While much of the ins and outs of Social Security benefits seem designed to be confusing, in this case, the SAA makes it easy to understand for most types of income normally received.

Then most common types of income that will not count toward the income limit include:

- Pension payments

- Most annuity payments

- Money from IRAs and other retirement account distributions

- Dividends

- Interest income

- Capital gains

The income that does count against you when considering the earnings limit includes:

- Gross wages from employment income

- Net earnings from self-employment (plus, there are additional rules on the time you spend in the business if you’re self-employed)

These lists should address about 95% of all the types of income that exist, but there are numerous other types of income that can cause confusion. For a more complete view on types of income, check out my article The Social Security Income Limit, What Counts as Income?

The Monthly Income Limit Versus the Annual Limit

Now that we’ve covered the basics of the income limit, let’s dive into how the monthly limit is a little different.

To make this as easy as possible to understand, we can address the differences by asking and then providing answers to three important questions. These are the most frequently asked questions that I receive on the monthly income limit

- How do I know when the SSA will use the monthly limit versus using the annual limit to determine my benefits?

- How much is the monthly limit?

- What happens if my monthly earnings are more than the monthly income limit, but I haven’t yet exceeded the total annual limit? Which limit wins?

Let’s walk through each of these separate questions one by one.

Are You Covered by the Monthly Income Limit, or the Annual Limit?

The Social Security Administration says that the “Monthly Earnings Test (MET) applies when an entitled beneficiary has one or more non-service months (NSM) in a grace year.”

Here’s what that means: In the first calendar year you receive Social Security benefits and have a month of earnings that is less than the monthly earnings limit amount, the income limit turns into a monthly income limit test.

It will run for the remainder of that calendar year. After that, it’s back to the annual test.

How Much is the Monthly Income Limit?

Your monthly income limit amount is simply the annual limit divided by 12. If you are subject to the monthly limit in 2023, then you would take $21,240 and divide it by 12.

That gives you your maximum monthly earnings allowed. For this year, that’s $1,770.

The exception is if you attain full retirement age this year. In that case, your monthly income limit would be $4,710.

Remember, the limit that applies to you will change to a higher amount in the year you reach your full retirement age.

Your Earnings Are More Than the Monthly Income Limit and Less than the Annual: Which Limit Wins?

Let’s assume you retire and file for Social Security at the first of January. This would trigger the monthly earnings test since you have a month of earnings less than the monthly amount and you are entitled to benefits.

But then in March, you got a call to do some consulting work which paid you $10,000. Here’s the problem: your earnings have not exceeded the annual limit, but they have exceeded the monthly limit.

So which limit wins? Which will be applied to determine your Social Security benefits?

The way the rules are written you cannot exceed the income test unless you first exceed the annual amount. So in this case, you would not have exceeded the earnings limit.

The basis to this can be found in their POMS manual which says:

“a. For beneficiaries under FRA, use the entire year’s income to calculate the amount of excess earnings.

- Regardless of the excess earnings amount, pay full benefits for any month the beneficiary neither earns wages higher than the monthly exempt amount nor performs substantial services in self-employment.”

Part (A) in that section indicates that you use the entire year to determine if there are excess earnings. Part (B) then says that the Social Security Administration pays full benefits for any month that the beneficiary neither earns more than the monthly amount nor performs substantial self-employment services.

With (A), you have the limitation that a single month can’t trigger the withheld benefits unless it’s greater than the annual test. Any month that the monthly test is not surpassed will be paid in full.

Just to make sure that I was reading this correctly, I reached out to a Technical Expert connection at the Social Security Administration to find out what their procedure is in these cases. She said, “We are always going to go with what will benefit the claimant in the grace year when they have earnings.”

A big thanks to that helpful SAA employee, and also Jim Blankenship for his help in unraveling this rule!

Have More Questions? Use My Free Resources

When you see someone who has a great retirement, it’s usually no accident. In most cases, it’s the result of a carefully thought-out plan and strategic execution.

Since you’re reading articles like these, it’s obvious that you really care about your own plan… and that you already know an innocent mistake or simple error is all that it takes to undo the good work you did to work hard and save a lot over the past decades of your working life.

To help you in your journey, whether you are in the planning stage or the execution phase, I’ve created three separate high-value resources for you that are completely free.

First, you should start by getting your FREE copy of my Social Security Cheat Sheet. This is where I took the most important rules and things to know from the 100,000 page Social Security website and condensed it down to just ONE PAGE! Get your FREE copy here.

Second, you should consider joining the 400,000+ subscribers on my YouTube channel. This is where I break down the complex rules and help you figure out how to use them to your advantage, and it’s a great resource for visual learners.

One last thing: There is a tremendous amount of misinformation out there about the income limit. People are commonly misinformed about how and when the monthly income limit and the annual income limit are each applied. Help me clear up the confusion by sharing this article with your friends on Facebook. Thanks!

Here are a few of the resources used in this article:

SSA POMS reference on Applying the Monthly Earnings Test (MET).This reference includes information on the Grace Year and Non-Service Months.

https://secure.ssa.gov/poms.nsf/lnx/0302501030

SSA POMS (monthly test if not in excess of annual test)

[…] Image Source […]

I was wondering if you could answer a question for me. My husband is retiring as of 9/1/22. He is not at FRA. He has made over the yearly limit of income. My worry is that I have read about so many people still being penalized for the annual even though their monthly is now 0. How can I make sure that he doesn’t have to worry about that or can I?