NOTE: The Social Security Fairness Act was signed into law on January 5, 2025. As a result, the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) have been repealed. This article reflects information prior to the repeal and may no longer be applicable.

If you will be subject to the Windfall Elimination Provision (WEP), it may be possible to reduce that impact with enough years of substantial earnings. If you are planning for your retirement, you need to understand what’s on your earnings record and know how many years meet the definition of “substantial” as defined by the Social Security Administration.

To fully comprehend how these substantial earnings interact with your benefit and WEP reduction, it’s helpful to understand the basics of the WEP first.

A Quick Rundown of Social Security’s Windfall Elimination Provision

The Windfall Elimination Provision (WEP) is a Social Security rule that can impact the amount of benefits you receive. It often affects public service workers who have “mixed” earnings, or working careers in which some of their jobs paid Social Security taxes while other positions might not have.

If you earned income from a job that paid into Social Security, those earnings are “covered” by the system. Income earned from positions that did not pay into the system are not covered.

The WEP rule can reduce the amount of Social Security benefits received by anyone who:

1. Worked at a job where they qualified for a pension, but did not pay Social Security taxes AND

2. At some point, worked in a different job (or were self-employed) that did Social Security taxes (which qualified them for Social Security benefits)

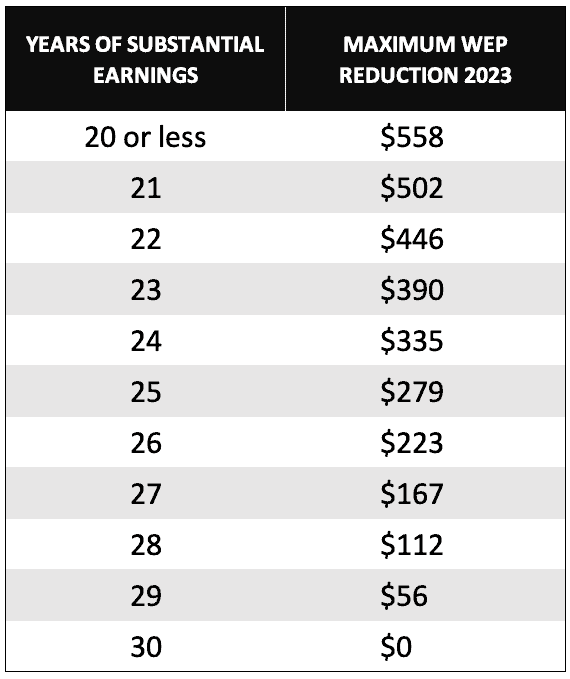

While originally intended to avoid “double-dipping,” the WEP in practice often unfairly penalizes those with mixed earnings. In 2023, the maximum WEP penalty is $558; the penalty is lower if you have a certain number of earnings years that meet the definition of substantial.

To fully understand how these factors may affect your personal situation also requires understanding the basic Social Security benefits calculation.

Understand How Social Security Benefits Are Normally Calculated

The SSA inflates your historical covered earnings (earnings that were subject to Social Security taxes), takes the highest 35 years of your income history, and divides by 420 (the number of months in 35 years) to calculate your Social Security benefits.

What this calculation provides is your inflation-adjusted average indexed monthly earnings. The SSA website will frequently refer to this by its acronym AIME.

Next, the calculation applies that monthly average to what is commonly called the “bend-point” formula.

Two numbers make up the bend-point formula, which creates three bands your average income will fall into to determine your benefit amount:

- For earnings that fall under the first bend point, you multiply by 90%. That is the first part of your benefit.

- For earnings that fall between the first and second bend point, you multiply by 32%. That is the second part of your benefit.

- For earnings that are greater than second bend point, you multiply by 15%. This is the third part of your benefit.

The result of this formula is your primary insurance amount (PIA), or your full retirement age benefit.

How the WEP Impacts Your Normal Benefits Calculation

Here’s where the WEP enters the calculation. If you have a pension from work where no Social Security taxes were paid, your benefits are calculated on a slightly alternate formula.

The result of this alternate formula is a lower benefit amount.

At first glance, this alternate formula looks nearly identical to the one outlined above for figuring your normal Social Security benefits. However, upon closer inspection, you’ll notice there’s a difference in the first “bend point.”

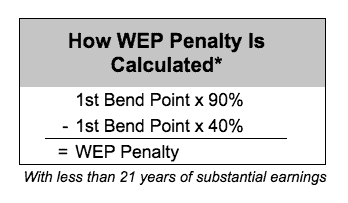

Instead of multiplying the first amount of AIME by 90%, you multiply by 40% under the WEP. The difference in the 90% of the first bend point and 40% of the first bend point is the penalty amount.

Where Substantial Earnings Come In

Substantial earnings come in when there are enough earnings years at a job that is covered by Social Security. As long as those covered earnings were in excess of a certain annual amount, the WEP penalty starts to decline.

You’ll see the decline happen with 21 years of substantial covered earnings (which, again, is income from jobs where you paid Social Security tax). At 30 years of substantial covered earnings, the WEP does not apply.

This is where understanding the benefits calculation that we just covered comes in handy.

If you have less than 21 years of substantial earnings, the first bend point multiplier is 40%. For each year of substantial earnings beyond 20, you simply add 5% to the multiplier.

For example, if you have 21 years of substantial earnings, the first multiplier would be 45%. At 22 years it would be 50%. At 23 years it would be 55% and at 30 years it would have worked itself back up to the full 90% that is used for individuals without a non-covered pension.

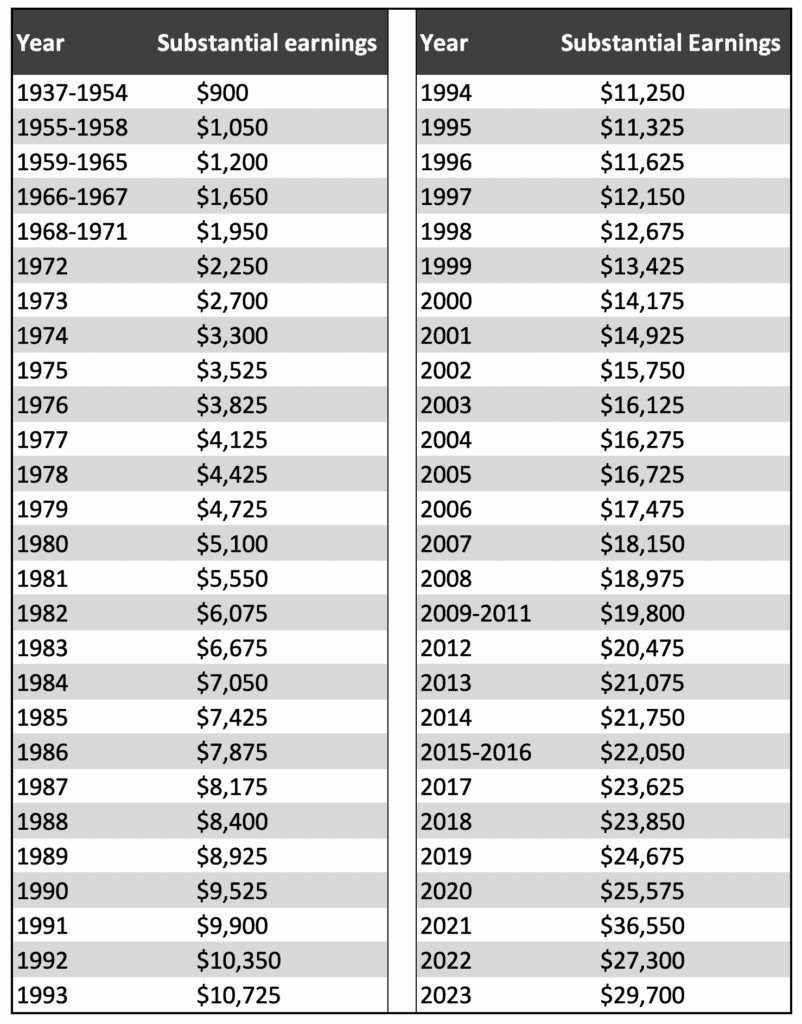

What’s especially important to know is that the definition of “substantial earnings” is a hard line. If you are one dollar short of the threshold it will not be counted towards the 30 years necessary to wipe out the WEP penalty.

Below is a chart of the substantial earnings by year which would be required to sidestep the WEP:

How the Annual Amount of Substantial Earnings is Determined

If you are planning to work a non-covered job and want to make sure the earnings will be sufficient to be defined as substantial, how do you know where the future thresholds will be?

The easy way would be to take the current number and increase it by around 3% per year. This will provide you with a reasonable estimate.

If you want to understand the actual mechanics of how this annual number is determined, it’s based on the average wage index and the Old-Law Contribution and Benefit Base.

The Old-Law Contribution and Benefit Base is the maximum taxable earnings base that would have been effective without the enactment of the 1977 amendments to the Social Security Act.

Although this is a fairly obscure part of the Social Security system, one of the things this old law base is used for is in determining the amount of earnings deemed as “substantial” for purposes of the Windfall Elimination Provision.

To calculate the Old-Law Contribution And Benefit Base, use the following formula:

(AWI from two years ago / 1992 AWI) x $45,000 (1994 old-law base)

A year of substantial earnings is equal to 25% of the current old law base.

Still Have Questions?

One thing is for sure, if you want to understand these rules, don’t leave without getting your FREE copy of my latest guide: Top 10 Questions and Answers on the Windfall Elimination Provision. In this guide, I go over more detail on the WEP and answer questions like:

- Can I avoid the WEP by taking a lump sum from my pension?

- What about 457 accounts?

- Does my pension affect my spouse’s Social Security?

You CAN simplify the WEP rules and get every dime in benefits you deserve! Simply click HERE.

In addition, I’d highly encourage you to check out some of the additional resources I’ve created that will deepen your knowledge on the WEP.

- The Best Explanation of the Windfall Elimination Provision

- Subject to the WEP? Your Social Security Statement is Wrong!

- How To Calculate The WEP & GPO With Mixed Earnings Under The Same Retirement Plan

- Social Security and Lump Sum Pensions: What Public Servants Should Know

- How the Government Pension Offset and Windfall Elimination Provision Affects Dually Entitled Spouses

- Why the Windfall Elimination Provision (WEP) Should be Reformed

You should also consider joining the nearly 400,000 subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

And don’t leave without getting your FREE copy of my Social Security Cheat Sheet. This is where I took the most important stuff from the 100,000 page website and condensed it down to just ONE PAGE! Get your FREE copy here.

Is there a typographical error in the substantial earnings table for the 2021 year?

[…] Substantial Earnings for Social Security’s Windfall Elimination Provision […]