Not many of us want to spend too much time thinking or reading about taxes, but if you want to understand how Social Security is funded then we need to discuss the FICA tax. This payroll tax makes a big bite out of your paycheck and take-home pay but is responsible for funding the monthly Social Security benefits of millions of current retirees.

FICA stands for Federal Insurance Contributions Act, and the taxes this act imposed are used to fund federal benefit systems. Workers pay in through the tax now in order to receive their own benefits in the future.

In other words, FICA taxes are like your admission ticket to your eventual Social Security and Medicare benefits.

How the Taxes Withheld from Your Pay Break Down

Have you ever looked at the federal income tax brackets and wondered why the taxes taken out of your paycheck seem so much higher than the rates published by the IRS?

Seems awfully unfair, right? But the mismatch is due to the fact that the federal income tax rate — which is what we usually hear about when discussing taxes on a broad scale — is a relatively small part of the overall taxes most people pay.

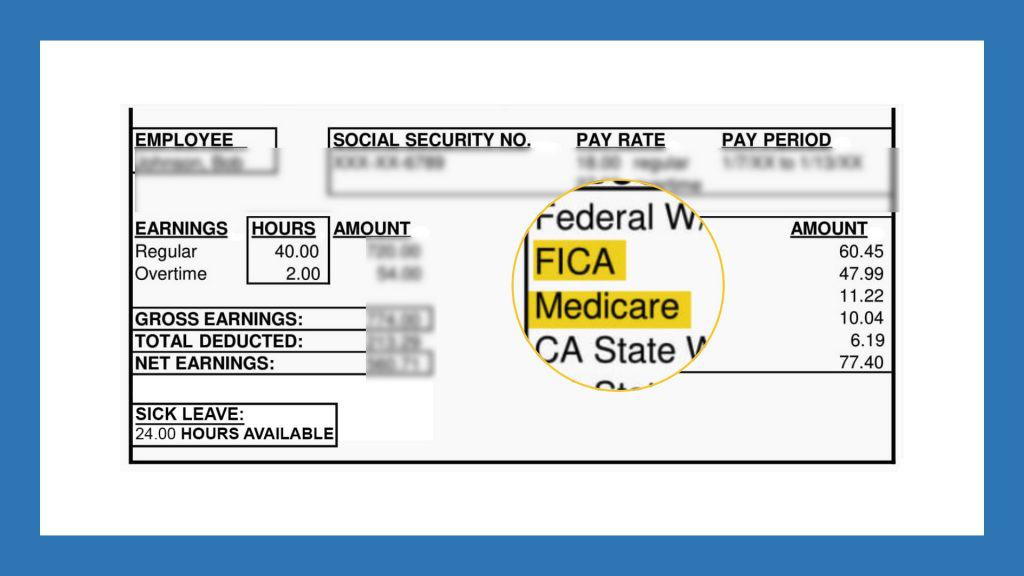

Take a close look at your paystub when you receive it next. You’ll see the deduction from gross pay due to federal withholding, and depending on your state, you may also see state withholding:

If you keep moving down your stub, you’re going to see a line for FICA taxes. Let’s take a closer look.

Understanding the FICA Tax

Again, the FICA tax is what you contribute to the federal government to pay current recipients of Social Security and Medicare benefits. Participation is required for most workers; the FICA tax is a mandatory payroll tax.

The tax collected for both programs could show up on your paystub as two separate line items, one for Social Security and another for Medicare.

Or the Social Security portion could be labeled “OASDI” for the Old Age Survivors Disability Income fund.

There are a few occupations groups that do not pay FICA, but 96% of all workers do pay it — so chances are good that includes you!

How Social Security Is Funded

I want you to understand more about what this tax is (since you’re obligated to pay it!) and how your money goes to fund Social Security and Medicare.

We know there are two components for the two programs. Here’s how the tax breaks down between the two:

The Social Security portion: This is also the largest part of Social Security. The total is 12.4%.

However, the tax rate is only applied to your first $132,900 in wages (for 2019; the limits do change yearly). In other words, you do not pay the 12.4% on your wages once you cross this limit.

Also, you actually only pay for half of the 12.4% you owe. Your employer is responsible for paying the other half.

The exception, of course, is if you’re self-employed. In that case, you’re on the hook for paying the full amount of FICA tax.

The Medicare portion: This is a total of 2.9% in taxes. It’s also split 50/50 between you as the employee and your employer (but again, self-employed folks are responsible for paying the entire amount themselves).

This means that in total, 15.3% of your wages are paid in to the Social Security and Medicare programs in order to fund the benefits going out to current recipients.

I hope that next time you look at your paycheck you’ll have a better understanding of how Social Security is funded.

Need More Info? Here’s Where to Go

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group.

It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the 330,000+ subscribers on my YouTube channel! For us visual learners, this is where I break down the complex rules and help you figure out how to use them to your advantage.

And one last thing that you don’t want to miss: Be sure to get your FREE copy of my Social Security Cheat Sheet. This handy guide takes all of the most important rules from the massive Social Security website and condenses it all down to just one page.