If you had to replace your Social Security benefits with another form of income, how much would you need to save up in order to live off of in the future?

It’s probably more than you think.

The fact is, the income you receive from Social Security may deserve more respect than it currently receives. It’s easy to dismiss your benefits as “too little” or “not enough.”

And it might sound crazy to call Social Security a good investment.

Can We Call Social Security a Good Investment?

But to be honest with you, in all the years that I’ve helped folks with retirement planning, Social Security income is the only income stream that I’ve seen with the following attributes:

- It’s adjusted almost every year for inflation

- It’s not 100% taxable

- It’s backed by the US Government

- It will pay you for as long as you live

That’s a long string of benefits for one income source. So how much would you need to replace your benefit? Another way of asking that question is, what kind of value you actually get from your Social Security taxes?

Or, even better: is Social Security a good investment?

If you could stop paying into the Social Security system and just invested that money on your own instead, could you create as much income for your future self?

We can do a side-by-side comparison of the Social Security benefits you can expect to receive and the result of investing the money you have to pay in on your own instead to determine if it’s true Social Security a good investment.

What’s Better: Investing the Tax You Have to Pay on Your Own, or Paying In and Receiving Social Security Benefits?

This isn’t just a random question to ask. I receive a lot of comments about opting out of Social Security, and investing the money you’d normally have to pay in to the system on your own instead.

Since my research tends to be driven by curiosity, I decided to take a deeper look at the numbers and see which would work out better…

To get the results I made a few assumptions.

First, I assumed that your goal would be to create income in retirement as opposed to buying a vacation house or something else that would require a lump sum.

Second, I assumed that you took only your part of the Social Security tax you currently pay and invested it.

Why? Because the total FICA tax is 15.3%. If you are an employee you only pay half of that, or 7.65%.

Of that amount, 1.45% goes to Medicare and 6.2% goes to Social Security. It’s that 6.2% that I assume you invest for the purposes of these calculations.

We could chase the rabbit trails of investing the full Social Security tax, but if opting out were allowed, I hardly think an employer could be compelled to give you the other 6.2% to invest on your own.

And ultimately, I wanted to look at “what if you could invest the dollars that you currently have to put into the system?”

Next, we assume a 7% return. Obviously you may do better (or worse) than this.

This in itself raises another assumption to consider: Would you continue to get a 7% return on your investment in retirement, or would you move your money to an investment that may have less market risk when you actually needed to rely on being able to withdraw from your nest egg for income?

If you did, you’d most likely get a lower return at some point in the future. So, in the calculation, I modeled out two rates of return after retirement: 7% and 3%.)

Then, at your full retirement age, the invested balance would be used to fund an income stream that would be equal to the amount of Social Security income for which you would have been eligible.

There are multiple ways to illustrate the withdrawal, but this is the only way to keep it apples to apples.

Finally, I looked at multiple income levels while working in a job from age 19 to 66. To get a baseline, I used the national average wage index which is published by the Social Security Administration:

- The first income level was for an individual at 50% of the national average wage index.

- Then I looked at 100%, and then at 150%.

- For a maximum SS benefit, I also looked at an individual who would’ve earned the maximum taxable wages for every year he or she was working.

With these earnings figures, I used the calculator on the Social Security website to calculate what the benefit for each of these income levels would be at full retirement age.

I then increased that amount by 2% per year to keep up with the cost of living adjustment provided by the Social Security Administration, and that’s the number that I illustrated withdrawing from the portfolio accumulated from the invested Social Security taxes.

Now that you know all of the parameters and assumptions, are you ready for the results?

Here they are…

Do the Numbers Say Social Security Is a Good Investment? The Results

For an individual at 50% of the average wage index, the portfolio value of the money invested would last beyond the expected 85 year life expectancy if invested at 7%.

But if that portfolio received a 3% return instead, this person would run out of money at age 80.

This is because a lower income individual would have a larger Social Security benefit relative to the amount of taxes they’ve paid in, and the withdrawal percentage would be higher for them.

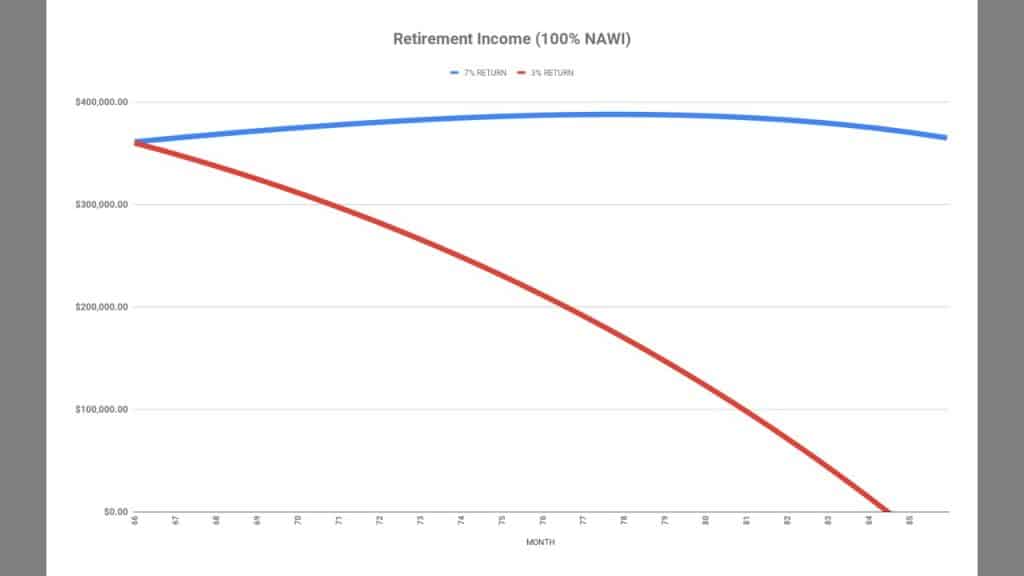

Next I looked at an individual at 100% of the national average wage index. At a 7% return, their invested money would last well beyond age 100.

But they too would run out of money if they only received a 3% return, although they’d at least get a few more years out of it. The money would run out at age 84.

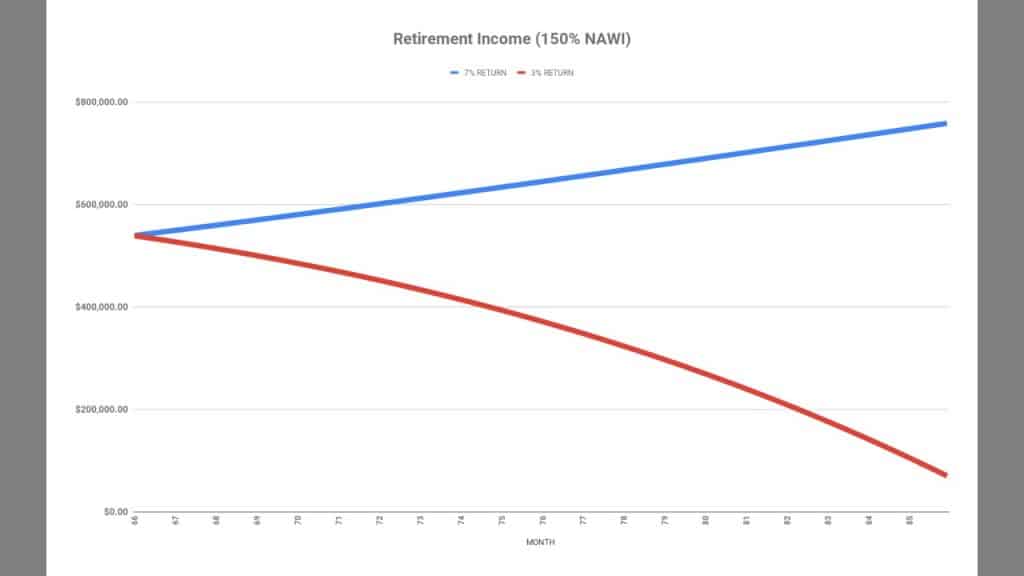

This is where things change… If an individual had earned 150% of the NAWI they would see their benefit increase and would have more in their account when they died than when they started. At 3% it would still last until around age 90.

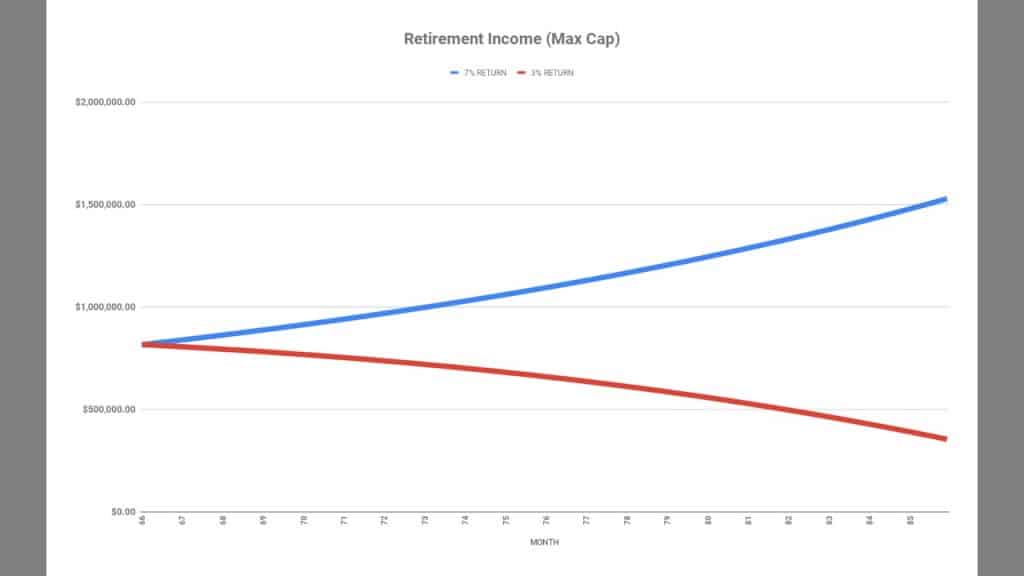

And finally, an individual who had earned the maximum wage base on an annual basis would see similar results except this time they would never run out of money in either scenario during a normal life expectancy.

To make sure my numbers were right, I spoke with Dr. Brandon Renfro. Dr. Renfro is a finance professor and a numbers guru. Things checked out!

If You’re Wondering Is Social Security a Good Investment… It Depends on Your Income

Considering we don’t actually have the option to withdraw ourselves from the system regardless of what these results tell us, it’s fair to ask: what’s the point of all of this?

Hopefully you can see that, depending on your income level, Social Security provides a better chance of having income throughout your life than investing on your own and hoping for a big enough return.

If you’re a lower income earner, then investing on your own may leave you in a worse spot than paying into the Social Security system and receiving benefits. And if you earn more income? Then you have a better shot of your own investments providing more money — but again, that depends on your investment choices and your returns. It’s certainly not guaranteed the way a Social Security benefit can be.

Take Action!

Remember: this is your retirement. Stay curious and STAY INFORMED.

You’re making the right moves by reading articles like these, but don’t use this as specific advice for your own situation. Do your research and talk to your own advisors. Most importantly, continue to educate yourself.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group.

It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the 100,000+ subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

One last thing that you don’t want to miss: Be sure to get your FREE copy of my Social Security Cheat Sheet. This handy guide takes all of the most important rules from the massive Social Security website and condenses it all down to just one page.