“Can I get teacher’s retirement and Social Security?”

That’s one of the most commonly asked questions that I see in my Facebook group Social Security WEP & GPO Discussion.

There’s no doubt this can be a complex topic and most of the teachers that I’ve talked to have seen lots of conflicting information — so let’s clear up the confusion and take a closer look at the rules on teacher’s retirement and Social Security.

The Social Security Rules Teachers Need to Know

In the 1970s and 1980s, laws were passed that amended the Social Security rules to keep individuals from “double dipping,” or receiving both a Social Security benefit and a pension from a job where they did not pay into the Social Security system.

The results of these amendments are two rules that could impact your ability to claim your full Social Security benefit as a teacher: The Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

These provisions reduce (or eliminate) benefits for those who worked in a job in which they:

- Qualified for a pension and

- Did not pay Social Security taxes.

This is not limited to teachers. Other professions that often fall into this group include public sector workers like firefighters, police officers and numerous other state, county and local employees.

If You Were Employed But Weren’t Covered by Social Security

In the beginning, Social Security didn’t cover any public sector employees. But as many states dropped their own pension plans and adopted coverage agreements with the Social Security Administration, things have changed.

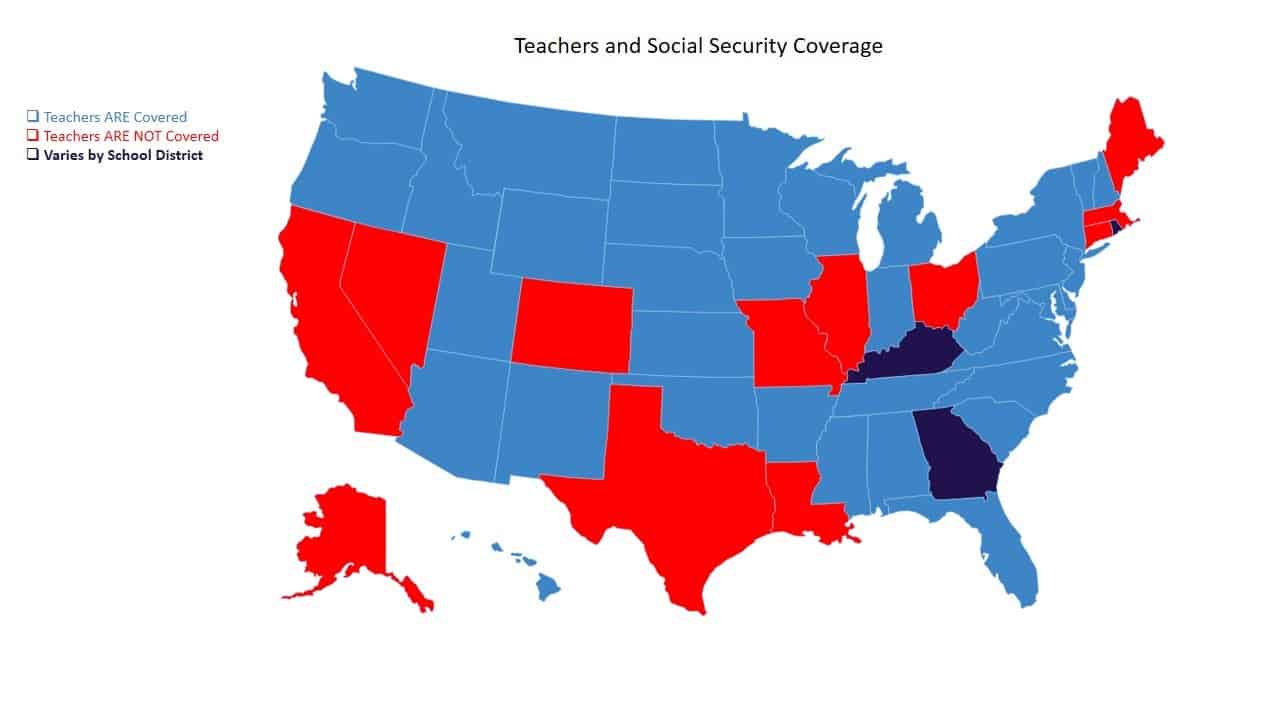

Today there are still 15 states that participate solely in their own pension plans instead of Social Security:

Those states are:

- Alaska

- California

- Colorado

- Connecticut

- Georgia (some school districts)

- Illinois

- Kentucky (some school districts)

- Louisiana

- Maine

- Massachusetts

- Missouri

- Nevada

- Ohio

- Rhode Island (some school districts)

- Texas

If you are a teacher in one of those states, the rules for collecting a Teacher’s Retirement System (TRS) pension and Social Security can be confusing and maddening to try and figure out.

That’s especially true if you’ve paid into the Social Security system for enough quarters to qualify for a benefit, which is fairly common among teachers.

Many teachers find themselves in this situation for a variety of reasons. For some, teaching is a second career, after they’ve spent years working in a job or a state where Social Security taxes were withheld.

Others may have taught in a state where teachers do participate in Social Security. For example, teachers in my town, which is divided between the states of Arkansas and Texas, could qualify for both.

If they worked in Arkansas (where teachers do participate in Social Security) for at least 10 years and then taught in Texas (where teachers don’t participate in Social Security), they would qualify for both Social Security and the Teacher Retirement System of Texas.

UPDATE: Don’t leave without getting your FREE copy of my latest guide: Top 10 Questions and Answers on the Windfall Elimination Provision. You CAN simplify these rules and get every dime in benefits you deserve! Simply click here.

How to Understand Your Social Security Benefit If You Worked in Both

This may surprise you but your Social Security statement does not reflect any reduction in benefits due to your teacher’s pension. They’ll wait until you file to tell you what the reduction is if you qualify for both a teacher’s retirement and Social Security benefits.

Understanding if a reduction in benefits will apply to you, and how much that will be, does not have to wait until you file for Social Security. You can get a good idea today by understanding the key differences between the two rules which may reduce your benefit amount:

From a very high level, you should understand that the WEP rule only applies to individuals who are eligible for a Social Security benefit based on their own work history and have a pension from work where they did not pay Social Security tax.

Meanwhile, the GPO rule only applies to individuals who are entitled to a Social Security benefit as a survivor or spouse and have a pension from a Federal, state, or local government job, in which they did not pay Social Security tax.

Here’s a look at how each rule would impact your benefit.

Understanding the Windfall Elimination Provision

The Windfall Elimination Provision (WEP) is simply a recalculation of your Social Security benefit if you also have a pension from “non-covered” work where no Social Security taxes were paid. The normal Social Security calculation formula is substituted with a new calculation that results in a lower benefit amount.

It would be easy to write a multipage essay on the WEP, but the necessary components can be distilled to a few simple points:

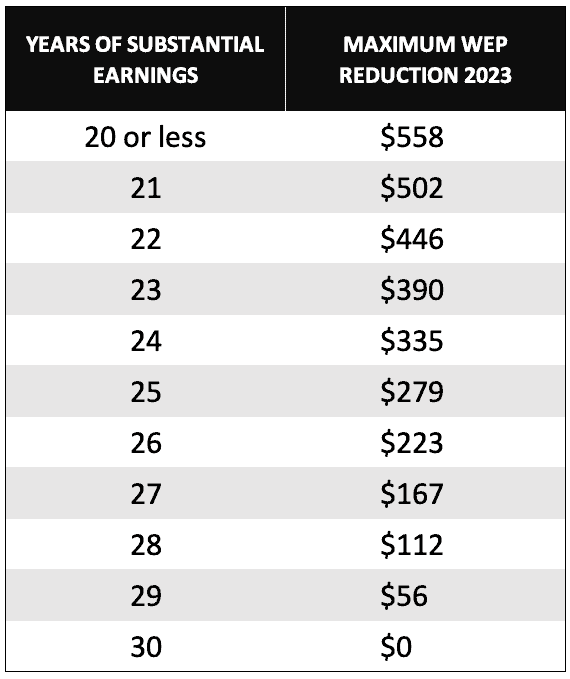

- The maximum Social Security reduction will never be greater than one-half of your pension amount. This is capped at a monthly reduction of $558 maximum WEP reduction (for 2023).

- If you have more than 20 years of substantial covered earnings (where you paid Social Security tax), the impact of the WEP begins to diminish. At 30 years of substantial covered earnings, the WEP does not apply.

Image Source: Devin Carroll, Data: Social Security Administration

This phase-out of the WEP reduction offers a great planning opportunity if you have worked at a job where you paid Social Security tax. For example, if you worked as an engineer for 20 years before you began teaching, you may be able to do enough part time work between now and when you retire to completely eliminate the monthly WEP reduction.

Would it be worth it? If you consider how much more in benefits you could receive over your retirement lifetime, it could be worth $100,000 in extra income over a 20-year retirement.

Obviously, not everyone has the option of accumulating enough years to wipe out the big monthly WEP reduction. But for those who do, or can get close, it’s worth taking a closer look.

Calculating How the WEP Will Affect YOU

I know this is a lot to follow, so if you want to take a shortcut in figuring out how the impact of the WEP, you may want to use my free calculator.

This calculator will tell you:

- The amount of monthly Social Security benefit you can expect after the WEP reduction (for comparison we also illustrate your benefit without considering the WEP).

- The number of “substantial earnings” years you already have

- How additional years of substantial earnings will affect the WEP penalty

To use this calculator you’ll need to get a copy of your earnings history from the SSA. You should only put in your years of earnings that were covered by Social Security.

For more information on the Windfall Elimination Provision, see these helpful resources:

- The Social Security Administration’s WEP Benefit Calculator.

- My article on The Best Explanation of the Windfall Elimination Provision

- My article on the potential repeal of the WEP

What About the Government Pension Offset?

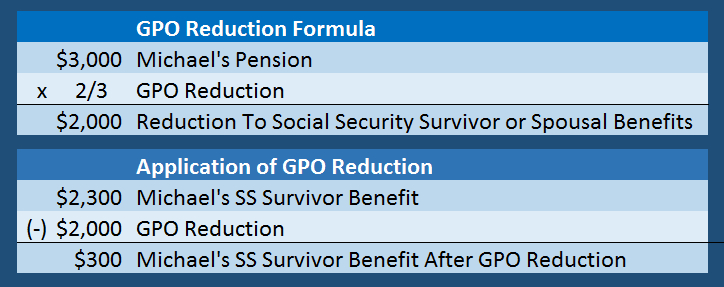

The nitty-gritty of the Government Pension Offset (GPO) is simple. If you meet both of the requirements for the GPO – you are entitled to a Social Security benefit as a survivor or spouse and have a pension from a government job where you did not pay Social Security tax – your Social Security survivor or spousal benefit will be reduced by an amount equal to two-thirds (2/3) of your pension.

As an example, let’s say Michael worked for 30 years as a teacher in California (one of the 15 states where schoolteachers are not covered by Social Security) and his wife was an accountant.

Upon retirement, he began receiving his California teacher’s retirement pension of $3,000 per month. His wife retired at the same time and filed for her Social Security benefits of $2,300 per month. Sadly, she passed away a short three years later.

Upon her death, Michael learned that because of his CalSTRS pension he would not be eligible to receive a normal Social Security survivor’s benefit. Thanks to the GPO his survivor’s benefit was reduced to a measly $300 per month. Here’s the math:

Source: Devin Carroll

Some would say that’s not fair and I think they have a compelling point. Why? In a case like this the GPO only applies because of Michael’s chosen profession. This is effectively a penalty for teaching (what some call the hero’s penalty).

If he had been a pharmacist instead of working in education, he would have been eligible to receive the full $2,200 per month.

If you’d like to dig into the Government Pension Offset a little deeper, see my article on What You Should Know About the Government Pension Offset.

If You Only Qualify for a Teacher’s Retirement System Pension

If you have never paid Social Security tax and only qualify for your teacher’s retirement, it’s likely you’ll never receive a Social Security benefit.

Although this makes perfect sense to some, others think it’s still pretty unfair that this isn’t true for everyone. For example, if you had chosen to stay at home as the household manager, you would not have paid into the Social Security system. However, you would be eligible for spousal and survivor benefits.

These intricate Social Security regulations and how differently they may affect a worker’s retirement income make it critical that you plan ahead and prepare. Before you make your elections on your teacher’s pension, you must consider how your monthly cash flow would change with a spouse’s death.

As a teacher, you have plenty to keep up with and these complex rules on Social Security don’t make it any easier. That’s why it’s important to have a quick and easy source of information at your disposal so can make the best decisions for you and your family.

What to Do If You Still Have Questions

Don’t leave without getting your FREE copy of my latest guide: Top 10 Questions and Answers on the Windfall Elimination Provision. You CAN simplify these rules and get every dime in benefits you deserve! Simply click here http://www.devincarroll.me/top10WEPSSI.

If you have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too.

You should also consider joining the nearly 400,000 subscribers on my YouTube channel! For visual learners (as most of us are), this is where I break down the complex rules and help you figure out how to use them to your advantage.

And don’t leave without getting your FREE copy of my Social Security Cheat Sheet. This is where I took the most important stuff from the 100,000 page website and condensed it down to just ONE PAGE! Get your FREE copy here.

I am a widow and my husbands died at 46 and I am now 61. My widows benefit is more then I would draw from TRS because I withdrew my pension after he died and left teaching for a few years. Now I have 9 years in TRS. I have not retired from TRS. But, when I do, will the withdrawn pension over 12 years ago be calculated into my GPO?

I have 33 credits toward the 4o I need for Social Security.I retired from a teachers job and am turning 65 in December. I applied for Medicare and have moved to NJ (my entire teaching career was in Massachusetts). What do I need to do? I will not be covered for Medicare. My husband passed away in 1995 at 37 and worked for US Postal Service, do I get benefits from him?Help

I have been teaching for 16 years and plan on retiring when first eligible in 12 years…I also have had a full-time job in the service industry for 26 years and by that time 38 years paying into SS the entire time…Will i get my TRS AND SS benefits?

Hello,

I teach in Texas, am 67 and plan to retire next year. If my husband dies, I know my surviving spouse ss benefit will be reduced by 2/3 of my pension, which in my case will leave me with about $1800 from spouses social security. My question is: will I still recieve my full pension from TRS, along with my surviving spouse social security.

Thanks in advance!

How does ss benefits work for a teacher? If I retire in June, I still have pay owed me since it is spread our for the year. Will my benefits be reduced because I will be paid for July and August for work I have already completed?

What if I have a teacher’s pension, and I have paid the full 10 years into SS? Would I get the full state TRS pension and full SS benefits?

Thank you.

If he worked for 10 years with the minimum annual earnings, yes. A quick call to the SSA and you can be certain.

My teacher husband worked summers at other jobs. He died Would he have been eligible for any Social Security benefits?

Here is the rub guys. Apparently the last two years the school that I worked at post retirement no longer contributed to Social Security because they changed accounting companies.

What they changed is that they began reporting to Cal Strs. That means that because they as a school report to CalSTRS, they do not contribute or take money out of your paycheck to contribute to social Security. Therefore I had no contributions to my Social Security for the two years since they changed how they do their accounting with CalSTRS. Something Important to know about!

I’m a retired CT educator. I worked in two jobs. One as a private school educator where I did pay into SS for 12 years and the majority of my teaching in the local school district for 25 years. I will collect 3 pensions. The first is my CTRB Pension. The 2nd, and smallest, is my private school pension, and the 3rd, will be the SS benefit ( minus the WEP reduction of about $490 dollars and Medicare payment of course). I’m surprised by the number of teachers who, as intelligent people, rely on others to do their research. Folks,… Read more »

I’m a retired teacher of 35 years in LA where we must deal with WEP. I have earned my quarters and should be entitled to $345 now. I am paying $170 towards Medicare but cannot get the benefits. Just seems unfair. Am I thinking correctly?

I’m retired several years and have been receiving CALSTRS monthly income. The question is that obviously I don’t any longer contribute to CALSTRS and I should be paying into Social Security – correct?

I have a practical question. My mom is a retired schoolteacher in Illinois; my late father was a university professor. Social Security has been drawing payments from my mom’s bank account (previously the joint account she held with my father) every month for years now. This makes no sense to me because schoolteachers are covered by TRS in Illinois, but it must have something to do with my parents’ combined income. At any rate, my mom is currently reorganizing her finances, and wants to close down the bank account from which the automatic payments are being drawn. To get the… Read more »

My wife passed away right at her retirement time at 20 yrs service.I recieve Social Security from my job and receive her pension. How do those taxes work?

My wife doesn’t have enough SS credits right now and just went back to work as a teacher (where she does not pay into SS) and should be eligible for a small pension when she finishes in a few years. Will her spousal benefit from me and this teacher pension be subject to WEP? This line made me think she would not be, but reading elsewhere it sounds like she would be:

“only applies to individuals who are eligible for a Social Security benefit based on their own work history”

Can you clarify for me?

Thanks,

Ed

I am 66, retired from teaching in June 2014. I have not yet applied for social security because I can’t find the answers to my particular situation.

I worked 16 years in Texas school districts that did not pay into social security, and last 10 years with a district that did. My TRS pension is based on all 26 years of service.

How will WEP affect my social security retirement benefits?

I have only 17 years of substantial earnings.

This is so unfair. I worked hard as an accountant for 10 years before teaching. If I paid all of that money into Social Security for a decade, why would they be allowed to not give me my full amount? Why do they want us to struggle after a lifetime of working? Why do they want us to have to get another job at 67 to make up the difference after a lifetime of working? TRS is not enough to live on.

I am retiring in 2021 from teaching in Connecticut. I put in 21 years. I worked in private business in Massachusetts and have more than 40 quarters of social security. I worked from early 70’s to early 80’s in private business to earn these quarters. Can I collect anything from Social Security?

I work as a teacher in Ohio but before I taught I worked for the private sector and paid into social security. I would have to work for another 10 years to get a semi decent retirement from STRS. I am thinking of quitting teaching and finding a job that pays into social security because I only need 8 years before the GPO doesn’t effect my retirement. My question is, can I collect from my STRS while I am working in the private sector? I am now 65. If I could collect from my teacher retirement I could afford to… Read more »

What if I paid into SS and have enough to receive benefits but then began teaching in CA. I will only work as a teacher for 15 years and will not get a FULL pension from CA. Is the windfall still 50%?

So I taught in Illinois for 13 years. We moved to AZ. I dont teach in Arizona. I got a job as a medical technician and I pay into social security. will I be able to collect both and how will this impact survivor benefits

I’m a Michigan public school basic teacher with 34 years. Will I get social security and pension?

Great info but confusing

My wife retired with Cal STERS in October 2020, She taught for 30 years. She has enough quarters paid into social security in the past. SS says on her annual statement that she is eligible for about 350.00 a month. Should she go ahead and apply for that SS benefit, or is it a waste of time. Or will she get a reduced amount. Thanks Ron Landers

Looking for clarification. I worked in Illinois as an educator for 3 years eligible for a very small pension. and worked For state government (Illinois) for 30 where I have paid into Social security and also paid into social security when I worked for those 3 years in the summertime. My husband recently passed. Would my entitlement to his pension amount be reduced?

No. You should be able to receive a benefit. It will be reduced by the WEP

Looking for clarification: I’m a CA retired teacher with a pension (currently 64 years old and preparing for Medicare next year), I have accumulated 40 SS quarters mainly from various jobs prior to, I believe that I cannot receive ANY SS benefits at all. Am I correct?

Without knowing all the personal numbers its really hard to know what the impact will be. I would assume that with your length of employment as a teacher your pension will be high enough to completely wipe out any survivor benefits. This leaves your benefits which will be subject to the WEP. In 2020, the maximum penalty is $480 per month. If you want to see how it will affect you, go to the SSA’s WEP calculator at https://www.ssa.gov/planners/retire/anyPiaWepjs04.html

It’s an uphill battle for sure!

Generally speaking, if his SS benefit is greater than 1/2 of your benefit you may be eligible for an additional benefit. The SSA office will be able to give you the numbers you are looking for.

No. The GPO does not affect an individual’s SS benefits from the work they performed. It only impacts spousal or survivor benefits.

You’ll have to keep trying by phone. One this is for sure, you don’t want to wait for them to catch your non-covered pension and send you an overpayment letter. Those are nearly indecipherable.

If you met the “last day” exemption from the GPO, you should be eligible to receive a spousal benefit. Fair warning…there aren’t many SSA techs that know about this rule. Have them refer to https://secure.ssa.gov/apps10/poms.nsf/lnx/0202608102.

In 2004, when I retired from teaching(29 years), I worked 1 day in a TX district that did pay social security. This work day was suppose to fill a “loop hole” in the Texas and SS law at the time to allow me to collect SS benefits. My husband is 66 and I am 68. He has applied for social security. Am I entitled to half of his benefits? I need a quarter to qualify on my own but was hoping to qualify as half of his benefit. I paid a lawyer to do paperwork for me in 2004. I… Read more »

SSA offices are closed. Impossible to connect with them by phone. I am retiring from teacher in mid June. Presently receive SS benefits and Medicare A, BUT must inform them of my retirement fro teaching for sake of WEP and for me to start receiving the mandatory part B (with fee deducted from remnants of SS benefits). How can I notify them of the upcomingchanges?

Does the GPO change if the surviving spouse (teacher) also earned 40 social security quarters in another job aside from the teacher job?

Somebody asked what to do about this. There have been Bill’s in congress for over 10 years concerning this. SB521 and HR141. If HR141 get about 40 more sponsors (I don’t remember exact number) the house must have a vote. Call your congressman (or woman) and tell them to sponsor the Bill’s.

I am 66 years old and still working as a teacher before teaching I was a graphic designer and paid into social security. Will I be entitled to my benefits if I apply for social security benefits?

My deceased husband passed away 3 years ago and I want to remarry to this amazing man . However I get from the Teacher’s retirement system every month will getting remarried affect that?

I worked 28 years in social security covered positions, then began teaching, 19 years in CalStrs. My husband passed away 9 years ago, my children received social security benefits as they were minors at the time. My youngest is receiving benefits now due to a disability based on her dad’s account. I turn 66 in September and was told I could start receiving my survivor benefits, but it would be decreased because of my daughter to $600/month. If I retire and start receiving my Calstrs pension can I still receive the survivor benefits? Would I also benefit by waiting until… Read more »

If I was married to a rx teacher for 38 yrs but divorced do to his being a sex offender. Are there any spousal benefits for me? He draws a lot more than I do in social security.

Thank the Ronald Reagan years for these absurd laws penalizing teachers,etc. My brother ,who worked for SS, always said there is a zero chance they will ever be repealed(has been tried but goes nowhere) because the government just makes so much money off of it they would not give it up.

I worked 1985-1995 in business and paid into SS for 40 quarters. I have been teaching from 1996-present and paying into Mass Teachers Retirement System. My late husband (died in October 2011) worked in business from 1985-2011 and paid into SS. I am 59 years old and plan to retire at 65 yo.

How will the WEP and GOP impact me? What is my best strategy to maximize my benefits at retirement?

I hope that a website with ‘intelligence’ in its name will correct the information concerning Texas. There are several school districts that participate in Social Security as well as TRS, including my own, Austin.

I worked at jobs where I paid social security and earned my quarters. I then went to work teaching and hope to retire after 20 years paying into TRS. I just became eligible for Social Security widow benefits. Will this be penalized with the windfall provision. I heard if I wait until I’m 70 to retire on TRS that my Social Security would not be penalized. Is this true?

Teaching is second career. I worked in finance and paid into SS for 20+ years. My question is…my husband passes away and I’m over 60 and I continue to teach. Can I receive his benefits and still teach?

I will not be able to recieve one dime of my late husbands social security because l got my own job teaching. So $2,200 a month goes … where? Not to me. Not fair that two independant pensions , cancel each other out. Time to petition our elected officials.

My mom has been a paraprofessional in Texas for 28 years. My dad elected for early SS benefits at 62. What is the best scenario for her to receive her TRS & spousal support?

Who can we speak with to get these rules changed?

After a lifetime paying SS from a variety of positions to include the military, I worked a relatively low paying admin job in higher ed for 18 years accumulating 60G in TRS pension. I retired last year at 62 and will accrue 72G from my small TRS pension over the next 8 years before applying for SS. After that the pension will net only $250 a month above my SS. The trick in my case was to retire, early collect the TRS pension for as long as possible before applying for SS.