NOTE: The Social Security Fairness Act was signed into law on January 5, 2025. As a result, the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) have been repealed. This article reflects information prior to the repeal and may no longer be applicable.

If you have a pension coming from a government job where you did not pay Social Security tax, you need to know about the Government Pension Offset. Why? If you are affected, it could drastically reduce, or even completely eliminate, your Social Security benefits.

I’ve had more than one client who was shocked to find out they would not receive a spousal or survivor’s benefit due to the Government Pension Offset. It can seem incredibly unfair and can be a nasty surprise. Especially if you’ve been planning your retirement income with this stream of payments calculated in.

History of The Government Pension Offset

The Government Pension Offset (GPO) was enacted as part of the 1977 Social Security Amendments. It was meant to keep public sector employees from receiving both a Social Security benefit and a pension from work where they did not pay into the Social Security system. This intent was to stop an indivual from “double dipping.” The result has been that it sometimes works as intended. But in many cases, it’s overly punishing to those who can’t afford the offset.

This rule is often confused with the Windfall Elimination Provision, so it’s important to understand the differences.

The Windfall Elimination Provision: Only applies to individuals who are entitled to a Social Security benefit based on their own work history AND have a pension from work where they did not pay Social Security tax. See my article with an easy explanation HERE.

The Government Pension Offset: Only applies to individuals who are entitled to a Social Security benefit as a survivor or spouse AND have a pension from a federal, state or local government employer where they did not pay Social Security tax.

How The GPO Works

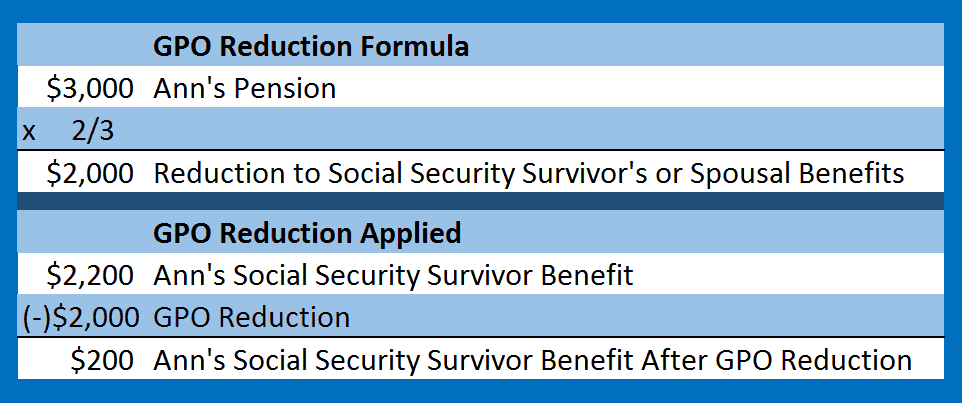

The mechanics of the Government Pension Offset (GPO) are really simple. If you have a pension from non-covered governmental employment (no Social Security tax paid),your survivor’s or spousal benefit from Social Security will be reduced by an amount equal to two-thirds of your gross pension.

For example, let’s consider the case of Ann. She worked as a schoolteacher for 30 years and her husband was an accountant. Her years teaching were spent in Texas, one of the 15 states where teachers are not covered by Social Security. When she retired, she began receiving her Texas teachers retirement pension of $3,000 per month. Her husband also retired and filed for his Social Security benefits of $2,200 per month. Sadly, her husband passed away a short two years later.

She was devastated by his passing and it didn’t help to find out that she would not continue to receive his full Social Security benefit. Instead, the Government Pension Offset kicked in and reduced the survivor’s benefit down to a measly $200 per month.

Some would say that’s not necessarily fair. I think they have a valid point. Why? The GPO only applies because of Ann’s chosen profession! This is effectively a penalty for public service. If she would have worked as an accountant instead, she would have been eligible to receive the full $2,200 per month.

Your Filing Age and the Government Pension Offset

The Government Pension Offset reduces your benefit by the same amount whether you file early – or at full retirement age. For example, if your reduction amount is $2,000, it will be that amount whether you file at 62 or some other age. When the Social Security Administration calculates your benefit they look at it as follows:

Full Retirement Age Benefit

(-)Reduction for filing early

(-)Reduction for GPO

Benefit Amount

How to Get Around the GPO

There are two ways to exempt yourself from the Government Pension Offset. Depending on your situation, neither of them may make sense for you.

Last 60 Month Rule

The first way to get around the GPO is called the Last 60 Month Rule. Here’s how it works.

You will not be subject to the GPO if you meet the following criteria:

- Work at a job where you contribute to Social Security for the last 60 months of employment

AND - That job is covered by the same retirement plan

Here’s an example of how this works.

Dave worked for Lancaster ISD for 30 years. Since Lancaster only participates in Texas TRS, and not Social Security, Dave would be subject to the Government Pension Offset when he retires. However, he resigns from Lancaster and spends the last 60 months working for Austin ISD, a school district that participates in BOTH Social Security and Texas TRS. By doing so, he exempts himself from the provisions of the GPO.

How far-fetched is this? Depending on your state, there may be a decent list of community colleges or school districts that participate in both Social Security and your state teacher’s retirement pension.

Would it be worth the hassle of a late-career change to exempt yourself from the GPO? Here are some numbers to help you decide for yourself.

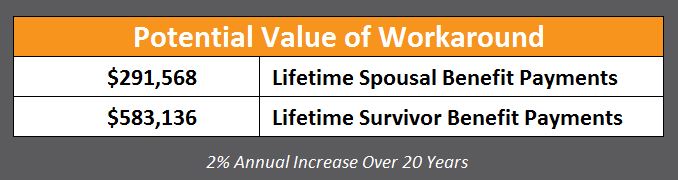

Let’s assume that your spouse has a Social Security benefit of $2,000 per month at his/her full retirement age. If you can sidestep the GPO, you would be eligible for a spousal benefit of $1,000 per month at your full retirement age. Assuming that Social Security has an average cost of living adjustment of 2% per year, and that your retirement lasts for 20 years, the spousal benefit would pay you $291,568 in lifetime benefit payments. If your spouse dies, you’d be eligible for a survivor benefit. Using the same cost of living and life expectancy number, that would be worth $583,136 in lifetime benefit payments.

There is a really important stipulation to this workaround. If you are trying to get around the GPO by using the last 60 month rule, you have to be very careful not mix employment! The SSA states the following: If, at any time during the last 60 months of government service, the individual worked in noncovered employment under the retirement system that provides the pension, the individual’s spousal benefit will be subject to GPO. GPO will apply, with regard to that pension, even if the individual concurrently worked in another position with the same or a different employer covered by Social Security. In other words, during the period you are fulfilling your last 60 months, you cannot work even one day under employment that does not pay Social Security tax and participates in the same retirement plan. If your old employer asks you to work a couple of weeks during the summer…just say no! It’ll ruin everything.

Withdrawal from Pension

The second option is to completely withdraw from your pension plan. You’d withdraw your contributions and interest, and forfeit your future rights to the pension. This option may not make any sense at all. In fact, it could place you at a tremendous disadvantage. However, it could be an good avenue for certain individuals in certain pension plans. Again…it all depends on your individual circumstances.

Here’s what the Social Security Administration says about this on their page titled Determining Pension Applicability and Pension Amount:

- Withdrawals from a defined benefit plan, before or after eligibility for the pension, of only employee contributions plus any interest (i.e., none of the employer contributions are included in the withdrawal), and whereby the employee forfeits all rights to a pension, are not pensions for GPO purposes. This rule applies even if the employer paid the employee contributions for the employee (i.e., some employers may pay for the employee’s contribution).

- Any other separation payment, withdrawal, or refund that consists of both employer and employee contributions from a defined benefit or defined contribution plan is a pension subject to GPO.

The takeaway from this option is that you’d better make sure you are receiving ONLY the amount you put in plus interest. If the employer contribution is included in the withdrawal, you’ll still be subject to the GPO.

If Your Pension Has COLA

If your pension has cost of living adjustments, you need to report these increases to the Social Security Administration. Since the GPO is calculated as a percentage of your pension, the corresponding amount of reduction will need to change as your pension increases. Don’t assume the SSA won’t notice! It may take them a few years, but they’ll probably catch it and send you one of their nasty overpayment notices. You don’t want that!

You may also find this video that I made useful. Don’t let the title fool you, the information is good for anyone who is subject to the WEP and the GPO.

Questions?

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. Also…if you haven’t already, you should join the 328,000+ subscribers on my YouTube channel!

My wife is a retired teacher with a $2200 per month TRS pension. and she did not pay into Social Security and does not qualify for any SS benefits on her own. I am a retired Engineer with a Social Securty benefit of $3300 per month, I am at Full retirement age And have just filed for my first SS payment. We plan to file for her benefits when she reaches her FRA. We live in Texas, How does the annual Cost of Living Adjustment affect my wifes GPO in the future. Lets say My SS increases by 5% every… Read more »

I was a teacher in a state that was not covered by social security and now I receive a pension from that state. After I retired I moved to a state that was covered by social security and after working for 178 months, I retired and am now receiving a pension from the second state. Both pensions are administered by the state’s government. Can I be exempt from the GPO based on my employment in the second state?

My wife is a california retired teacher- she has 35 SS credits from previous work- she worked for 2 years in private sector after retirement and paid SS. She is 65- I receive $2,000 in SS- what are her options? Her teacher pension if the 2/3 reduction was made she would receive cero from her spousal benefit.

The GPO will only impact Social Security benefits for an individual who earned the non-covered pension. The SSA’s piece on the GPO says, “If you receive a retirement or disability pension from a federal, state, or local government based on your own work for which you didn’t pay Social Security taxes, we may reduce your Social Security spouses or widows or widowers benefits.” [emphasis mine] You can see that sheet here. https://www.ssa.gov/pubs/EN-05-10045.pdf

How does GPO affect benefits drawn by an ex spouse? Current significant other (not married) appoints me as their state govt pension beneficiary, we’re in one of the red states. I was also previously married over 10 years to someone else and should qualify to draw spousal SS benefits from them, their employment is not government related. I also paid into SS myself but the earnings are much smaller. Will the ex-spouse’s benefits to me be reduced as a result of the state gov’t pension?

Mr. Carroll could you please confirm that the Government Pension Offset does not apply to foreign pensions?Andr

I’m told that even though my state pension was based on salary in which I paid into social security that my social security benefit would still be decreased by 2/3. Why is this if I paid into social security when I was employed with the state?

Hello – I have a GPO question. I am currently a teacher in Texas and expect to retire at 66 with 13 years of service. Prior to teaching, I worked in industry and have paid into Social Security since 1981. When I retire, I anticipate receiving my TRS pension and Social Security (WEP does not apply to me since I have 30+ years paid in to SS.). Let’s just say I receive $1400 from TRS and $2000 from Social Security. OK, so my husband also retires along with me and draws $3000 in Social Security. If he passes away, how… Read more »

I think what bothers me most about the windfall offset is that the money that Social Security is denying me is money I paid into the system. No employer contributes to Social Security it is all employee paid. Give me my money regardless of where I worked or other retirement plan. This is so unfair

If you file for SSDI, your spouse is eligible for spousal benefits.The earliest age of eligibility is 62. At her full retirement age she would be entitled to 1/2 of your benefit amount. If she files earlier, it would be reduced.

if the husband is retired on a social securty disabilty pension and his 4 kids are over 18 and the wife is in the proses of appealing her disabilty ssdi because she has had 2 knee replacments can’twork 56 yrs old ocuppation food server for 35 yrs does the wife recieve 50% of her husbands ssdi payments