The Social Security monthly benefits statement that most people are familiar with has been around since 1999. That means we’ve been looking at the same Social Security statements for the last 22 years… and it’s high time the Social Security Administration gave their paperwork a modern makeover.

They did just that recently, and I want to walk you through what to expect when you see this new format come to you in the near future. While some people began receiving the new Social Security statements in May, the rollout is still in progress – so don’t be surprised if your statement still looks the same as it always has.

Once you do get your hands on the newest version, you may notice there are a few elements that you’re probably used to seeing that will no longer be included. Meanwhile, other aspects of the statements are brand-new and you want to make sure you fully understand those.

The current version of the Social Security statement has been around since 1999. It has great information on it, but it’s been the same for so long that most people don’t even pay attention to most of what’s in the statement. It’s just how the brain works. If something becomes really familiar, we stop paying attention to it. Just this morning my wife asked me when I was going to paint some spots on an wall upstairs. I’d puttied in some holes several weeks ago and then never got around to painting them. I don’t go up there all that often, but often enough that as the weeks went by, I eventually stopped noticing those spots that needed painting. The Social Security statement has become like those spots on my wall. Everythings been the same for so long that most people don’t even notice the verbiage the Administration includes, they just see the estimated benefits amount and maybe the earnings record. So an update is well past due because there’s some important information you need to see.

The biggest change you’ll likely notice is that you won’t get this statement in your mailbox. My sources tell me the Social Security Administration will never mail these statements, and they’ll only be available online.

Moving forward, the only people who still receive the paper version of the Social Security statement are those who are age 60 and older – but only if they don’t already have a mySSA account.

If you do have a mySSA account, don’t be surprised if you haven’t noticed any changes there yet, either. Only about 20% of individuals with online accounts get the new Social Security statements right now.

My personal statement still reflects the old style, but later on this year the SSA will complete their rollout of the new version and everyone should see the latest version in their online accounts.

What Does the New Social Security Statement Look Like?

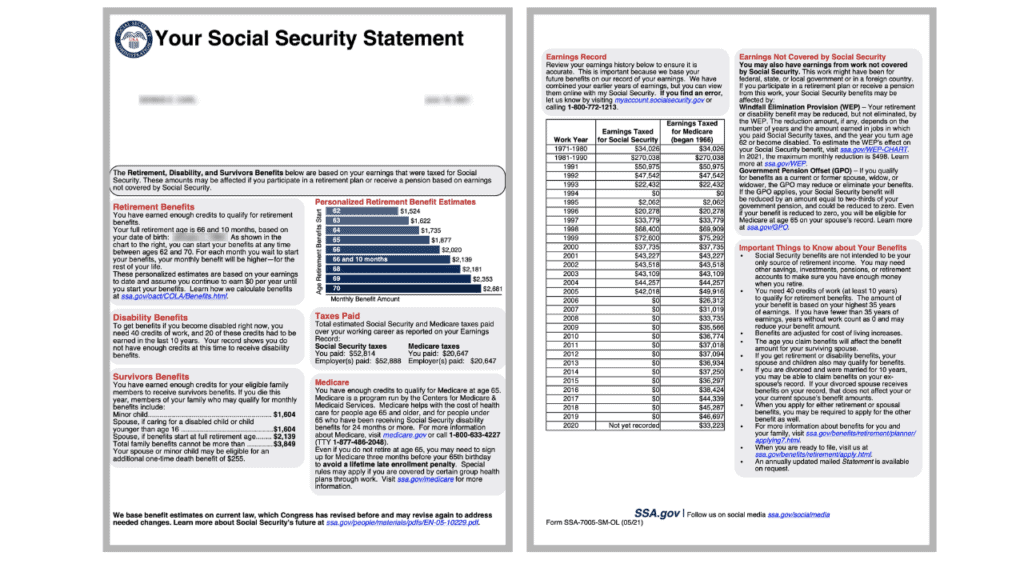

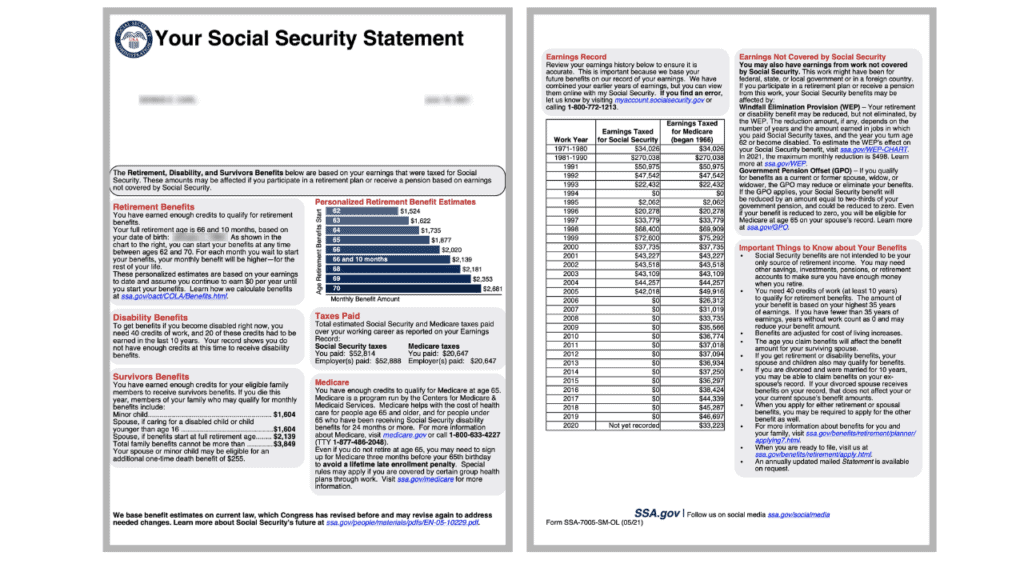

Here’s what the new statement looks like. Instead of the old four-page, green-and-white statement, the new version is only two pages with text in shaded boxes:

Where the old statement used the first page to cover some generic information, the new version jumps right into information that is specific to you.

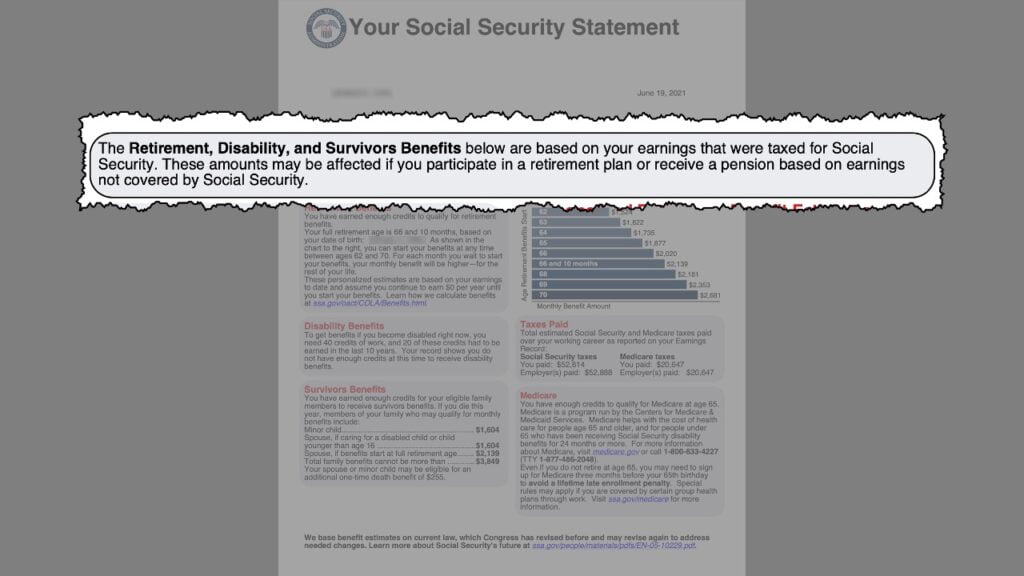

One of the first things I noticed is how they’ve moved an important warning to the very top of the statement that says “The Retirement, Disability, and Survivors Benefits below are based on your earnings that were taxed for Social Security. These amounts may be affected if you participate in a retirement plan or receive a pension based on earnings not covered by Social Security.”

This highlighted warning may sound like an obvious statement, but it’s a critical reminder for those who worked at a job where they did not pay Social Security taxes (like teachers in several states, firefighters, police officers and several other types of public service jobs).

Those individuals need to know that the quoted benefit amounts may not be accurate. I’ve seen lots of cases where someone was devastated to find out that their actual benefit would be much lower than what was shown on their statement.

While this only affects those who worked at a job where they did not pay Social Security taxes, and earned a pension from that work, I’m still glad to see the SSA put this callout front and center.

Sections of the New Social Security Statement That Break Down Your Benefits

In the sections directly below the notification about how benefits are based on qualified earnings, the statement clearly articulates benefit amounts you can expect.

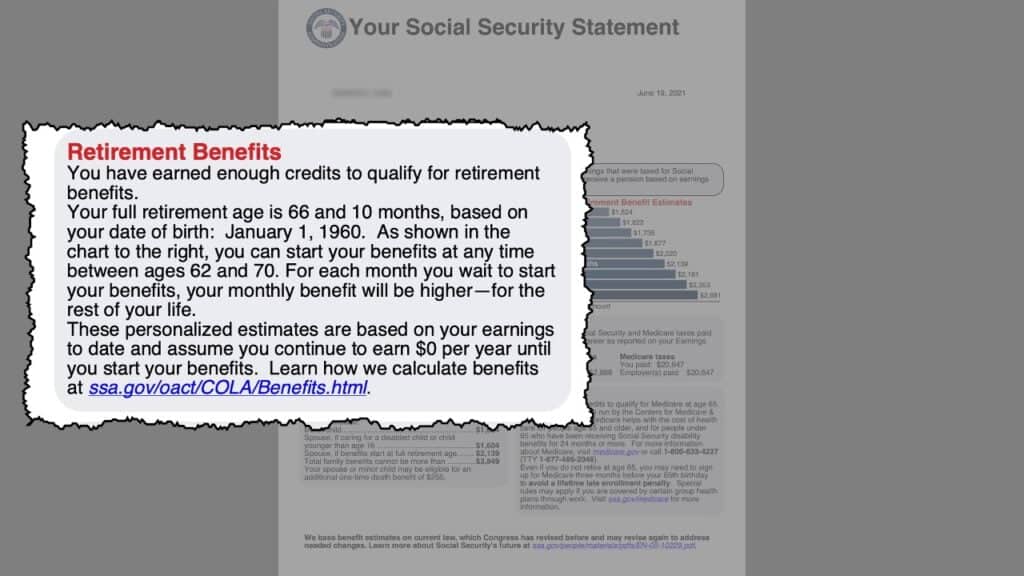

The first explains retirement benefits for Social Security. This box tells you if you have earned enough credits for your own benefit, what your specific full retirement age is, and then tell you that your benefit amount will increase for every month you delay your filing for benefits between age 62 and 70:

To my knowledge, the monthly increase was never mentioned in the old statement which led many people to believe that their benefit would only increase on an annual basis. So I’m glad they included this sentence.

The statement also explains that your estimate is based on your historical earnings and assumes that you will make the same earnings as you did in the year prior. For this individual’s statement that we are using here as an example, you can see that he did not have any earnings in the prior year. That means his estimate is based on earning $0 until he starts his benefit.

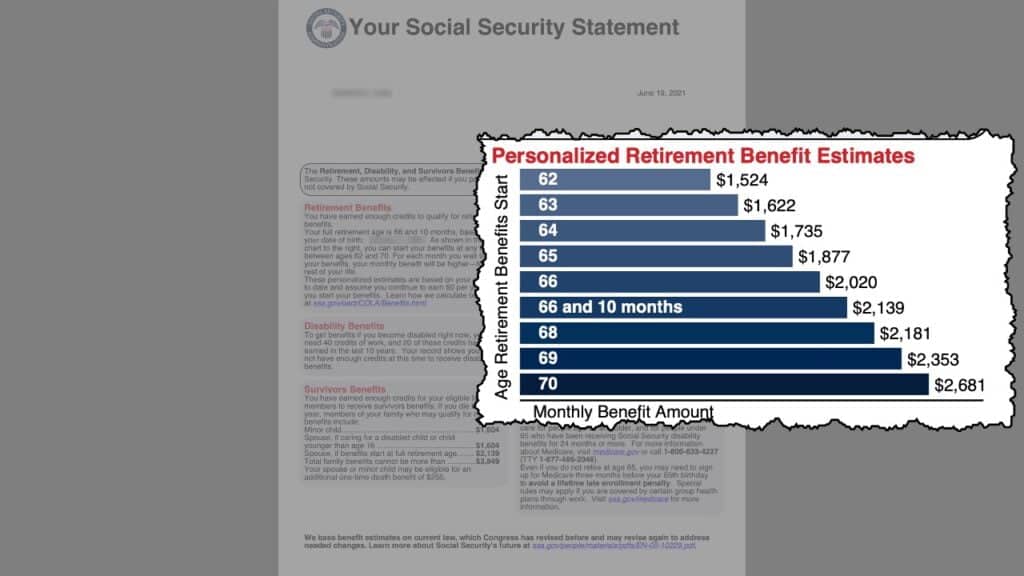

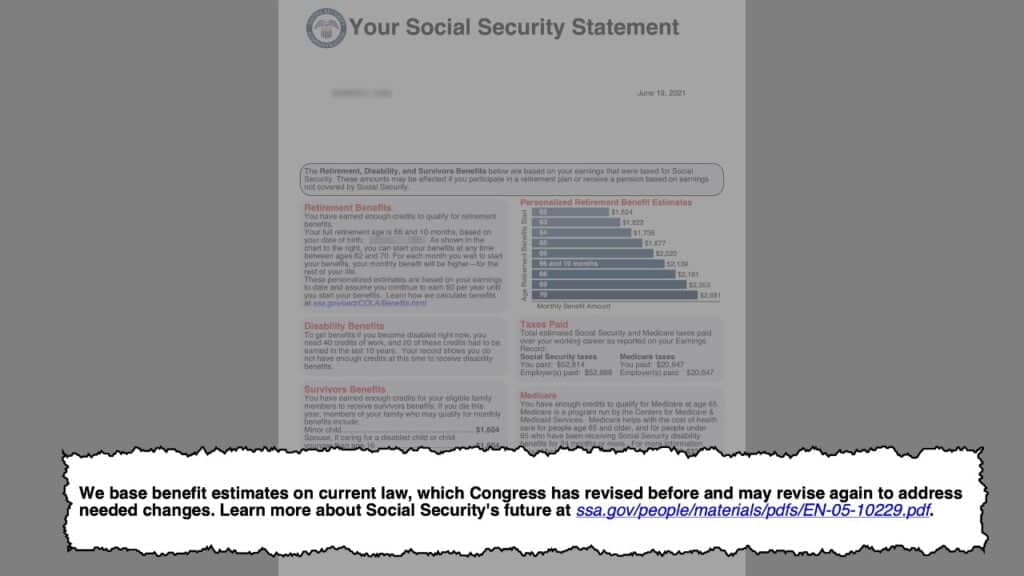

In the chart directly next to that section, there’s a simple-to-read graphic that shows the actual benefit estimates for you specifically. What I like about this is that they show the benefits amount for each year between age 62 and 70.

The older version only has the estimate at 62, full retirement age, and age 70. If you are already 62 and haven’t filed for benefits yet, the old version will show current age, full retirement age, and age 70. This lays it out by year, which I think will lead to better choices.

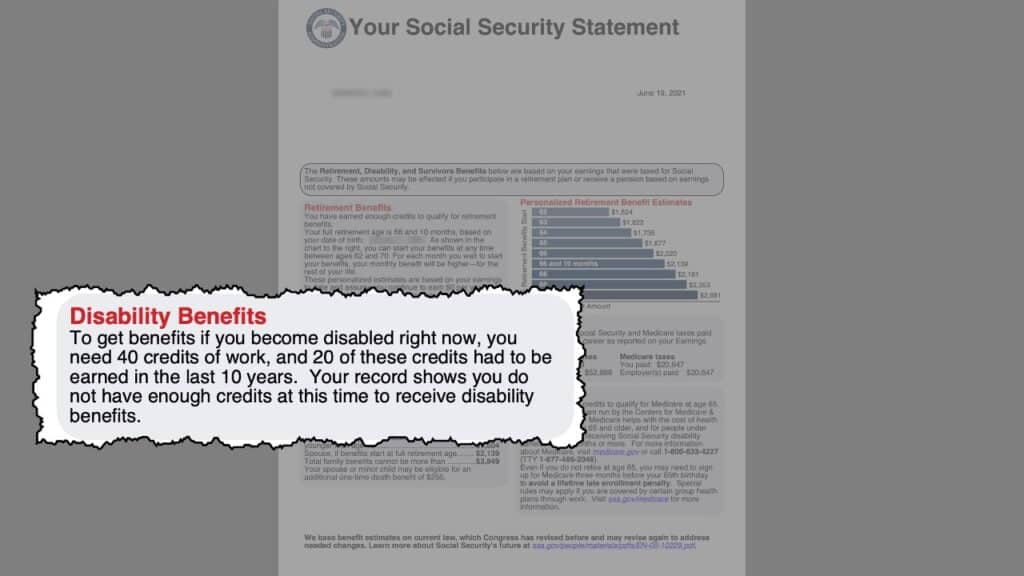

The next shaded box explains your disability benefits if you qualify to receive them. In the example statement we’re using here, we can see that this worker hasn’t met the recent work requirements for disability benefits. If they had, there would be an estimate in this box of what someone could expect to receive in benefits:

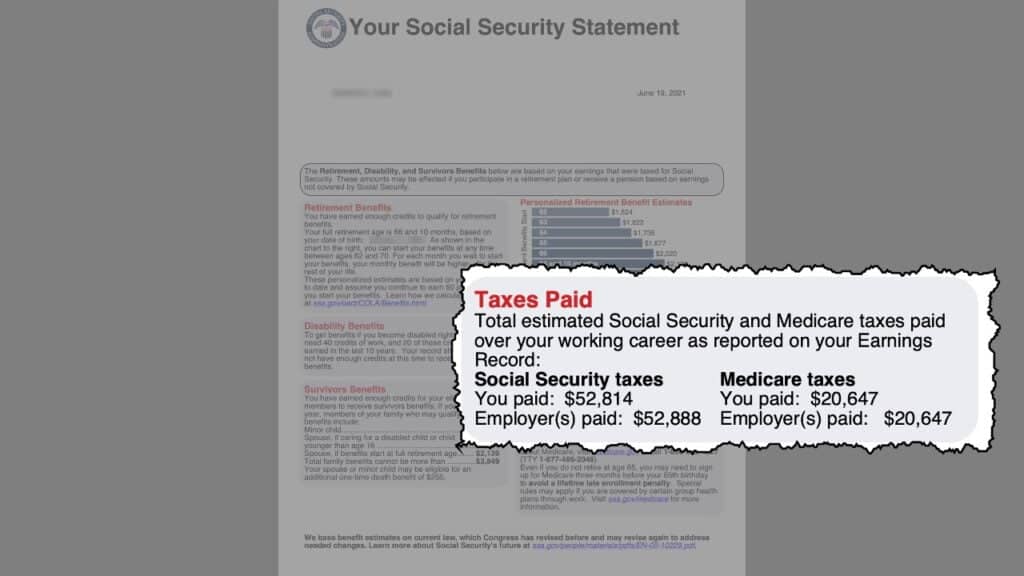

The next shaded box on the new Social Security statements shows what you’ve paid in Social Security and Medicare taxes. This information is great, especially for those who don’t think Social Security is a screaming good deal.

This shows that if this particular individual whose statement we’re looking at filed for Social Security benefits at 62, they’ll get the $52,814 they paid in taxes back in only 35 months. And that’s with a reduced benefit because they filed early!

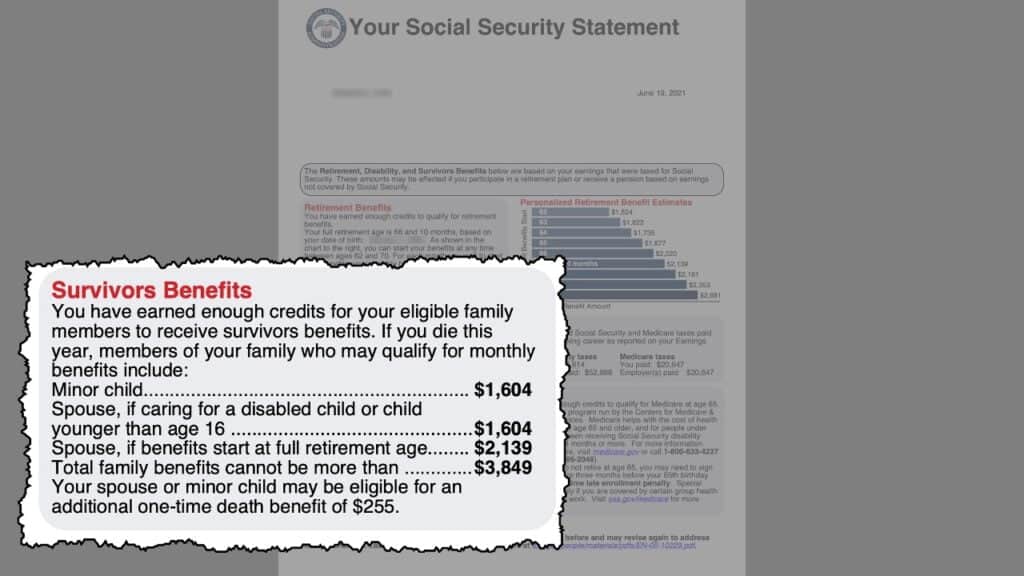

The next section covers various survivors benefits. It first shows that your minor child could receive 75% of your full retirement age benefit and then also shows that your spouse who is caring for that child could also receive 75%.

Then it shows the survivor benefit available to a spouse if he or she waits until full retirement age, and finally it lists the total dollar amount of benefits that can be paid out to all beneficiaries if you die:

Other Information Included on Page One of the New Social Security Statement

The last shaded box on page one of the new Social Security statement has information on Medicare. This is where you’ll be able to quickly see if you have enough credits to qualify for the program and it lists the contact information that is specific to Medicare:

And at the bottom of page one, they have the same warning as they included on the old version of the statement. This reminds us that Congress can change the Social Security program – and that means your benefits estimate that you see today may not be the actual benefit you receive at a later date:

The Big Change on the New Statements: More Information and Clarity About How Social Security Benefits Work

We can now turn to page two of the new Social Security statement, and this includes a big change that I think is extremely important.

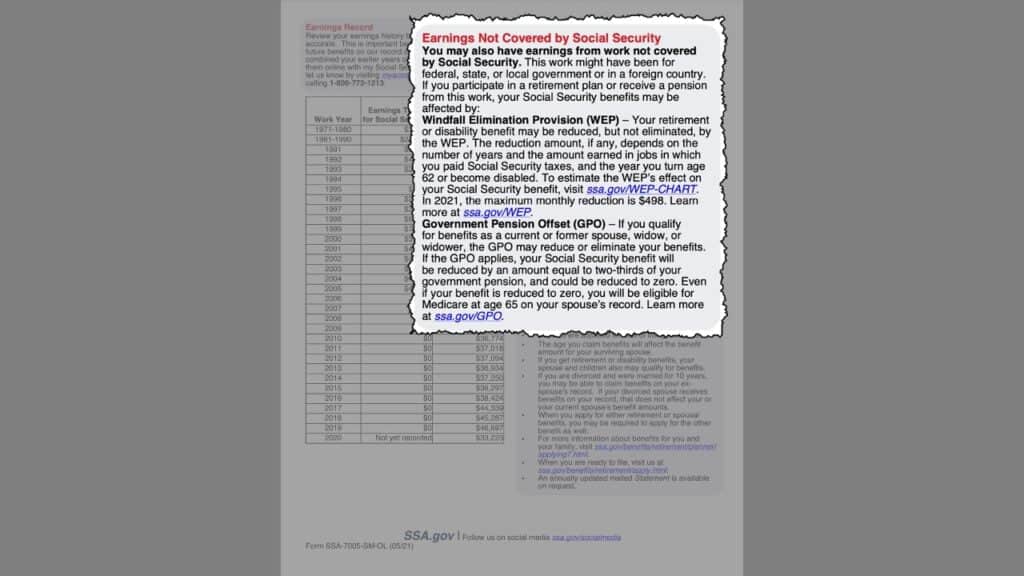

That comes a little farther down the page, but let’s keep working through this in order. The first thing you’ll find on the second page is an information box titled “Earnings Not Covered by Social Security”.

Underneath, in bold, it says “You may have earnings from work not covered by Social Security.” The remaining text discusses the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

Those are the two provisions relevant to the warning on the very top of the first page of the new Social Security statement, where it reminds us that benefits estimates may not be correct if you have a pension from a job where you did not pay Social Security taxes.

In this example, the individual’s statement we’re viewing did have earnings from work that was not covered by Social Security – so it seems that this warning may only be there in bold for those in this particular situation.

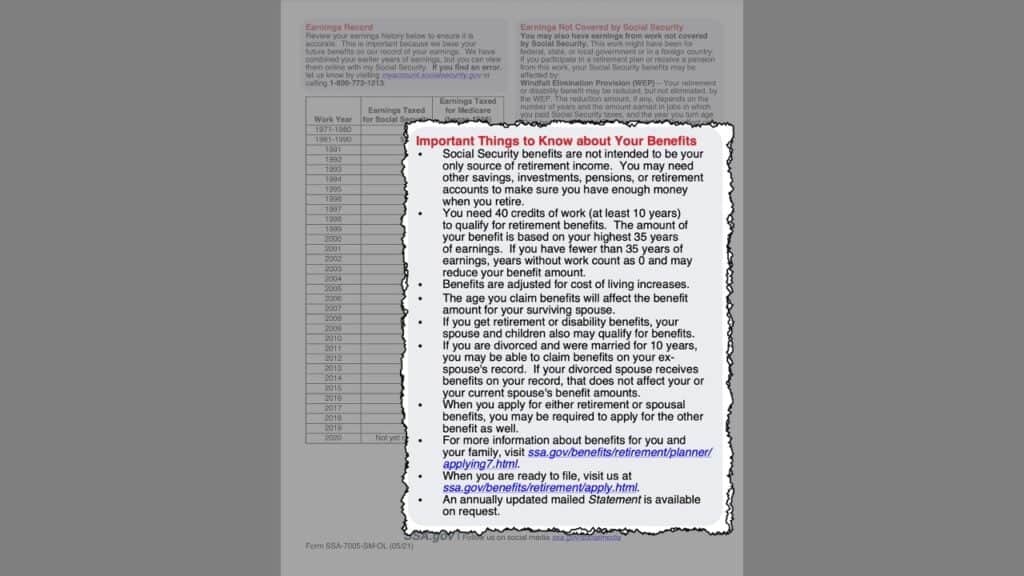

Next comes the change I really like on this new statement. It’s a callout box titled “Important Things to Know about Your Benefits.

At first, this seems like generic information and perhaps not all that useful. However, I think they’ve done a great job of condensing down some really important information into just a few bullet points:

The first point is that Social Security is not intended to be your only source of income. This language was also on the old statement and I think is a great reminder that needs to be included as a disclaimer on everything related to Social Security benefits.

The next bullet point says “You need 40 credits of work (at least 10 years)to qualify for retirement benefits. The amount of your benefit is based on your highest 35 years of earnings. If you have fewer than 35 years of earnings, years without work count as 0 and may reduce your benefit amount.”

This language is not on the old statement, so I’m glad to see it included here. I think this is a great summary of how many years are used in the calculation of your monthly benefit.

The next bullet point says that benefits are adjusted for cost of living increases. No big surprise there. But the point that follows is fantastic, explaining that the age at which you claim your benefits “will affect the benefit amount for your surviving spouse.”

This is one of the reminders that I’m constantly harping on. When you are deciding when to file for benefits, you have to take into account how your decision will impact a spouse who may outlive you… and so many people forget to include this factor in their decision-making!

Other important reminders that are included here are the fact that your spouse and children also may qualify for benefits if you receive retirement or disability benefits. There’s also language that discusses benefits for divorced spouses.

As the new statement explains, “If you are divorced and were married for 10 years, you may be able to claim benefits on your ex- spouse’s record. If your divorced spouse receives benefits on your record, that does not affect your or your current spouse’s benefit amounts.”

I find that the subject of divorced spouse benefits are often misunderstood. Butin two sentences, the new Social Security statement answers several very common questions on Social Security for divorced spouses.

The last notable bullet point here is a note on deemed filing that says, “When you apply for either retirement or spousal benefits, you may be required to apply for the other benefit as well.”

This is a reminder that, for most of us, filing for one benefit and then later switching to another benefit is no longer an option. Notice that this does not say anything about survivors benefits. If you are eligible for survivors benefits, you can file for one benefit and later switch to another.

The New Statement’s Updated Information on Your Earnings Record

Information around your earnings record may represent the biggest change of all on the new Social Security benefits statements. However, this is one deviation from the old form that I don’t think is very helpful.

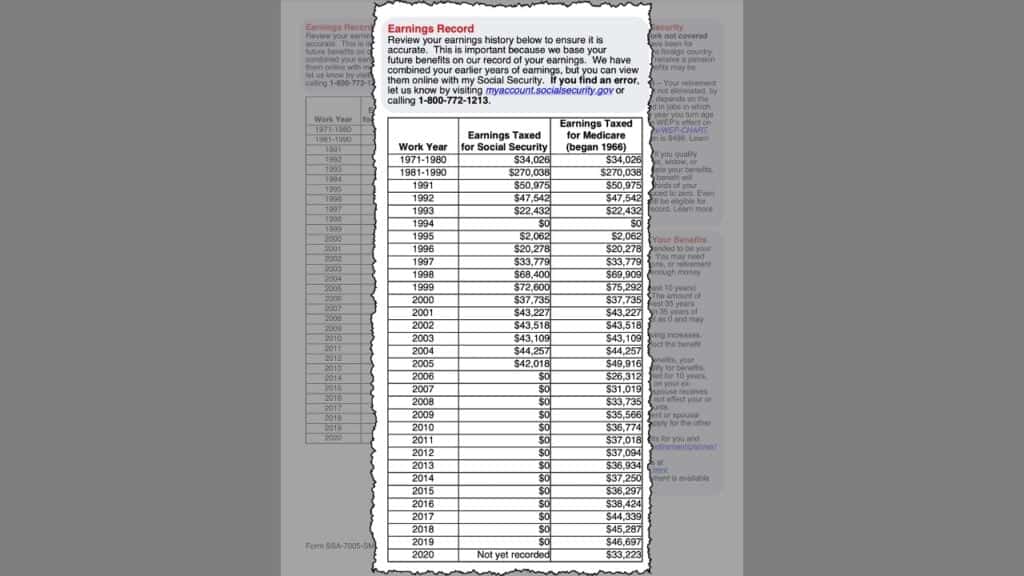

The new statement may make it a little harder to check your historical earnings for accuracy:

I understand this new format is done for the sake of brevity, but I’m afraid it may make it easier to have a mistake in your earnings record and not catch it.

The old statements showed your earnings on a year-by-year basis. The new statement consolidates your older historical earnings into 10-year blocks and only shows the sum of earnings from those 10 years.

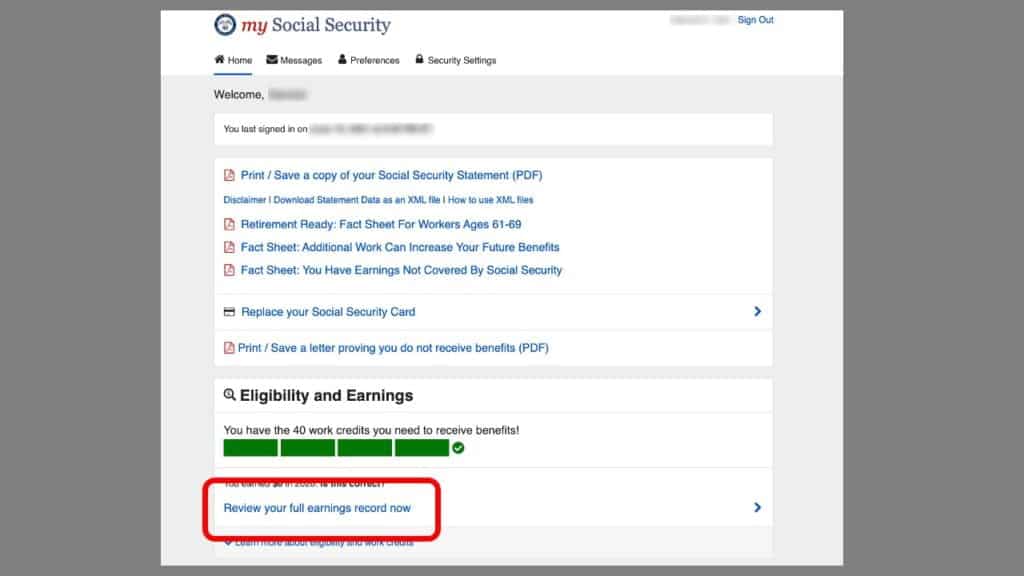

If you want to see your full record, on a year-by-year basis, you have to go back to your mySSA account. Once you log in, you’ll see a link towards the bottom of the home screen that says “review your full earnings now.”

So you can still access this information, and again, I understand the reason behind the change; it makes the statements more concise which can be beneficial. Still,I wish the Social Security Administration could have found a way to show a complete earnings history in the earnings section of the statement.

So there you have it: that’s your walkthrough of the new Social Security statement that you should receive sometime in 2021 (if you haven’t seen the updated version already). Remember, this won’t come to your mailbox. Make sure to log into your mySSA account to get your statements moving forward

And before we leave, just a note that Social Security is one single, little part of your retirement. It’s an important piece to get right, but there’s a lot of other factors and variables to consider as well.

If you want some help from me and my team on helping you with all the pieces of your retirement journey…