Increasing the full retirement age for Social Security retirement benefits is one of the most common proposals made to help save Social Security. The idea is that by requiring people to be older before they officially hit the full retirement age, there will be less of a burden on the system and therefore keep Social Security solvent for more generations to come.

Whatever you might think of this proposed change, one thing is for sure: Something needs to be done about Social Security.

We are now within 15 years of having benefits cut in order to prevent the program’s trust funds from running dry. Most projections suggest that benefits will have to be cut by around 25% if nothing else is done. Most people simply cannot afford to see a benefit reduction like this!

The Cost of Cutting Social Security Benefits for Retirees

Think about this for a minute. In 2020, the average monthly Social Security benefit was $1,542. If that was cut by 25%…the average benefit would go down to $1,157.

In 2022, the federal poverty guideline was $1,132. If there is an across-the-board cut to Social Security benefits that reduces monthly income by 25%, the average recipient’s benefit will be just $25 away from that poverty line.

Needless to say, something needs to be done to avoid cutting Social Security benefits for today’s retirees.

While both political parties in the Federal government have suggested multiple fixes in an effort to ensure these cuts don’t happen, the wheels of change move painfully slow.

So far, we’ve only heard suggestions. No one has successfully brought an actual proposal to the floor in Congress for a vote.

One Party’s Favored Solution: Increasing the Full Retirement Age for Social Security

In all of these proposals that have been suggested, two foundational components continue to come up over and over:

- Democrats tend to favor increasing the taxable earnings cap

- Republicans tend to advocate for increasing the full retirement age required to receive your full Social Security benefit.

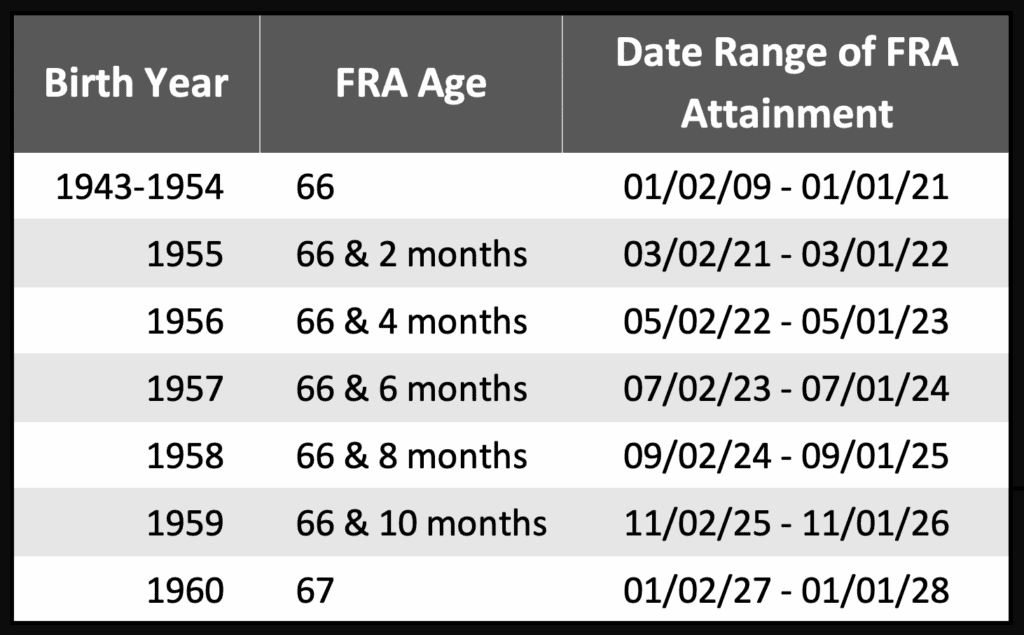

At first glance, the argument for increasing the full retirement age for Social Security makes perfect sense. The FRA hasn’t been adjusted since the 1983 amendments and the system needs to adjust for increasing life expectancies.

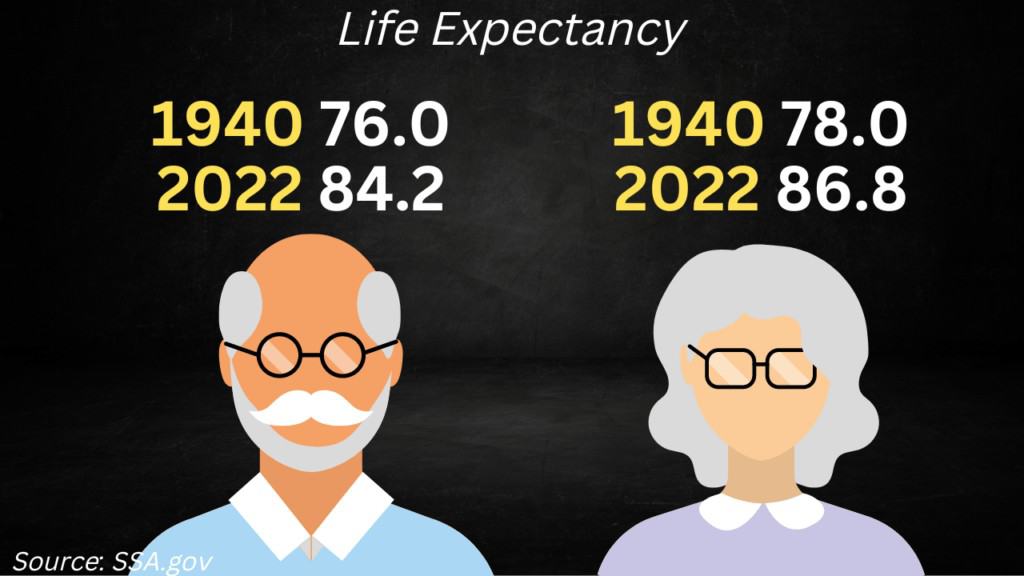

In 1940, life expectancy for a 65-year-old man was 76 years; for women, it was 78 years. Since that time, life expectancy has risen to 84.2 years for men and 86.8 for women.

With individuals living longer, Social Security must make many more payments to each person than in the past. The program’s promise to provide retired workers with a certain monthly benefit for the rest of their lives is significantly more expensive today than the same commitment made to recipients in 1940.

Based on that information alone, it seems as if raising the FRA is a sound, reasonable plan. But as with every other proposal, there may be a few unintended consequences.

The Downside of Increasing the Full Retirement Age

If the FRA is increased, the benefit amount for those who file early would be cut. This is simply because there would be more months between when you file for benefits and your full retirement age.

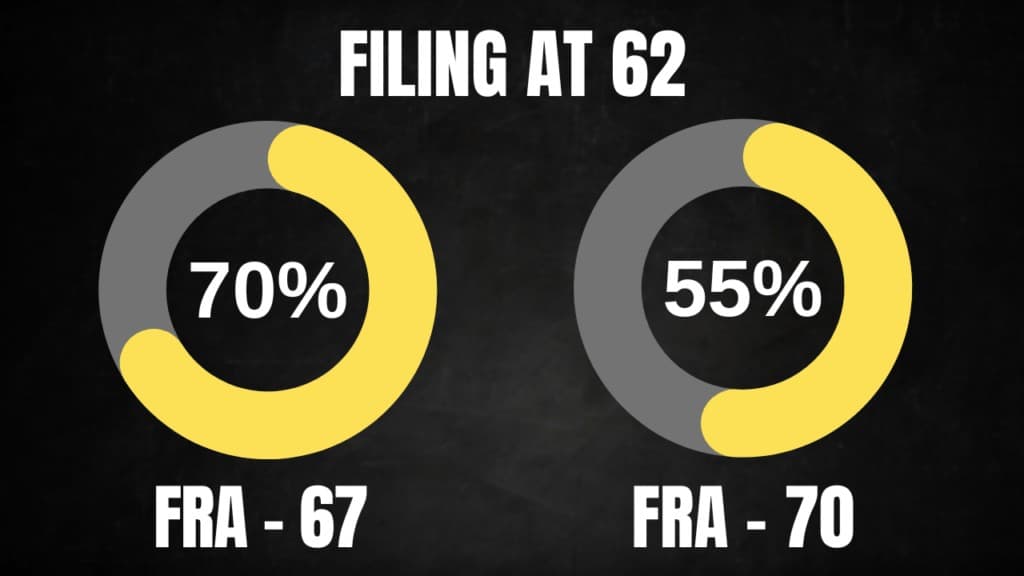

If an individual wants to file as early as possible at 62 and their FRA is 67, for example, there are 60 months between when they filed and when they’d reach full retirement age. But increasing the FRA by just one year, to 68, means there would be 72 months between when you filed and when you’d reach full retirement age. Push FRA out to 70, and there are 96 months.

This increase in months between earliest eligibility and FRA matter, even if there are just 12 additional months. Monthly reductions are calculated on a monthly basis, so the more months between the earliest date you can file and the date you reach FRA, the more your benefit gets reduced.

If your FRA is 67, and you file at 62, you’ll receive 70% of your FRA benefit amount. If the FRA is raised to 68, however, you’d only receive about 65% of your FRA benefit if you filed at 62. If the FRA is raised to 70, individuals filing at 62 would receive 55% of their FRA benefit.

Currently, benefits are reduced as follows:

- .555% Monthly Decrease – During the 36-month period prior to FRA

- .417% Monthly Decrease – Greater than 36 months prior to FRA

Imagine that an individual’s FRA benefit is $2,000. If their FRA is 67, they would receive $1,400 per month if they filed at 62.

If the FRA was increased to 70, the same individual would only receive a benefit of $1,100 if they filed at 62. That means missing out on $300 per month or $3,600 per year.

Would Increasing FRA Change How People File for Social Security Benefits?

One of the big questions here is whether the filing behaviors would change if the full retirement age was increased.

Currently, about 33% of all retirees file at 62, the earliest age possible. If the increased penalties didn’t change this behavior and people continued to file at the earliest age possible, we’d see more seniors with household incomes under the poverty line and possibly a further drain on other government programs to help meet their needs.

Could the Earliest Eligibility Change, Too?

Some have suggested that the fix for this is to increase the minimum age of eligibility to around 65. This scenario could incentivize more people to file for disability benefits instead — because they’re not reduced based on the age at which you file.

If you file at 62 for disability benefits through Social Security, you’ll receive the same approximate amount for your monthly benefits as you would if you filed for retirement benefits at your FRA.

Nearly half of all workers leave work earlier than they expected. Of those who left earlier than expected, two-thirds of those individuals do so for health reasons.

Currently, if an individual leaves work at 62 for health reasons, they may choose to simply file for retirement benefits even if they are only going to get 70% of their FRA benefit.

But if the FRA increases, and now they are faced with the decision to file for retirement benefits at 55% of their full benefit or disability insurance benefits at 100% of their full benefit, I would expect those applications to skyrocket. If the SSA saw a big uptick in the number of disability cases, it could easily dampen the cost-saving effect of having increased the FRA.

Would Increasing the Full Retirement Age Be Fair?

Those opposed to the idea of increasing the FRA say that though raising the full retirement age for Social Security affects everyone equally in a rough sense, it affects incomes unequally.

This is because those with a low income tend to depend on the income from Social Security more than those with a high income. This is one of the reasons that opponents to the proposal reject the idea of raising FRA as a standalone plan.

My opinion is that the FRA will eventually be increased as part of the overall solution to shore up the Social Security trust fund. How much it will increase is likely the only question that remains.

I suspect that it will only be raised by a small amount and will take several years to get there because the fix isn’t as easy or straightforward as it may first seem on the surface.

This is one issue we’ll need to continue to monitor — and you can do so with the help of my YouTube channel. I cover new proposals and changes as they’re made, so join the other 400,000 subscribers to know as soon as I publish a new video.

Also…remember…THIS IS YOUR RETIREMENT. Continue to learn about how to make the most out of it by using the resources like the Retirement Planning cheat sheet I’ve created. This is where I’ve taken the retirement plan contribution limits, income limits, tax tables, and lots of other important things and break it all down to just one page.