NOTE: The Social Security Fairness Act was signed into law on January 5, 2025. As a result, the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) have been repealed. This article reflects information prior to the repeal and may no longer be applicable.

If you have a pension from a job where you did not pay Social Security taxes, your benefit may be reduced by the Windfall Elimination Provision (WEP).

How do you know if you’ll be impacted? Don’t expect it to be on your Social Security benefits statement.

This may surprise you but your Social Security statement does not reflect any reduction in benefits due to this provision. The Social Security Administration will wait until you file to tell you how much the reduction is if you qualify for both Social Security and a non covered pension.

Understanding if a reduction in benefits will apply to you, and how much that will be, does not have to wait until you file for Social Security. You can find out today. It starts by understanding the mechanics of the Windfall Elimination Provision.

The Social Security Amendments of 1983 introduced the Windfall Elimination Provision (WEP) as part of an effort to keep individuals from “double dipping.” This was defined as receiving both a pension from a job where they did not pay Social Security taxes and a Social Security benefit.

This new provision began to reduce Social Security benefits for those who worked in a job in which:

1) They did not pay Social Security taxes

and

2) Qualified for a pension from that job

and

3) Worked at another job where they qualified for Social Security benefits.

Teachers are one of the most common groups to be impacted by this rule but it often includes other public sector workers like firefighters, police officers and numerous other state, county and local employees.

Public Servants and Social Security

In the beginning, Social Security didn’t cover any public sector employees. However, over the years, many states dropped their own pension plans and adopted coverage agreements with the Social Security Administration. However, there are still several states who do not participate in Social Security. Instead, they have their own state-run pension plan. For workers in these states, the rules for collecting a non-covered government pension and Social Security can be confusing and maddening.

That’s especially true if you’ve paid into the Social Security system for enough quarters to qualify for a benefit. It’s quite common too. Many individuals find themself in this situation for a variety of reasons. For example, Firefighters often work second jobs where they pay social security tax. Police Officers will often retire at an early age and move on to another “covered” job. Many teachers came to education as a second career, after they’d spent years working in a job where Social Security taxes were withheld.

Windfall Elimination Provision Mechanics

The Windfall Elimination Provision (WEP) is simply a recalculation of your Social Security benefit if you also have a pension from “non-covered” work (no Social Security taxes paid). The normal Social Security calculation formula is substituted with a new calculation that results in a lower benefit amount.

Covering the topic exhaustively would require a multipage essay, but the necessary components of the WEP can be distilled to a few simple points:

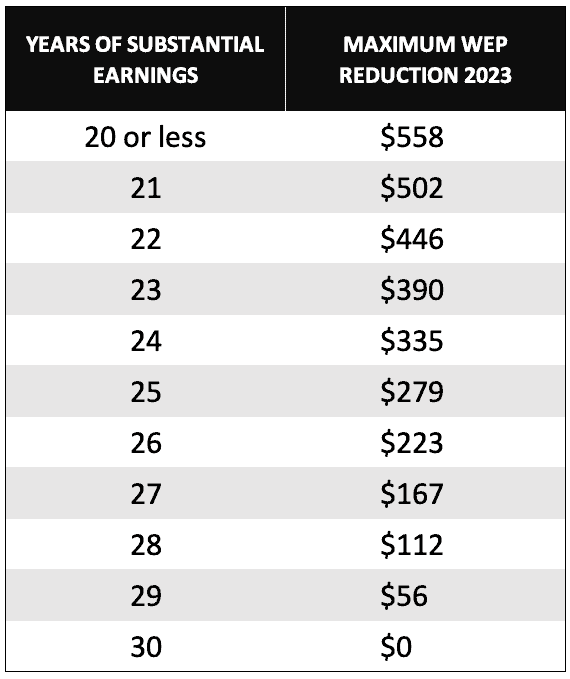

- The maximum Social Security reduction will never be greater than one-half of your pension amount. For those filing at full retirement age, this reduction is capped at a monthly reduction of $558 (for 2023).

- If you have more than 20 years of substantial covered earnings (where you paid Social Security tax), the impact of the WEP begins to diminish. At 30 years of substantial covered earnings, the WEP does not apply.

Source: Devin Carroll, Data: Social Security Administration

This phase-out of the WEP reduction offers an incredible planning opportunity if you have worked at a job where you paid Social Security tax. For example, if you worked as an engineer for 20 years before you began teaching, you may be able to do enough part time work between now and when you retire to completely eliminate the monthly WEP reduction. This phase-out of the WEP reduction offers a great planning opportunity if you have worked at a job where you paid Social Security tax.

Would it be worth it to work a little more to get full Social Security benefits? If you consider how much more in benefits you could receive over your retirement lifetime, it could be worth $100,000 or more in extra income over a 20-year retirement! Obviously, not everyone has the option of accumulating enough years to wipe out the big monthly WEP reduction. But for those who do, or can get close, it’s worth taking a closer look.

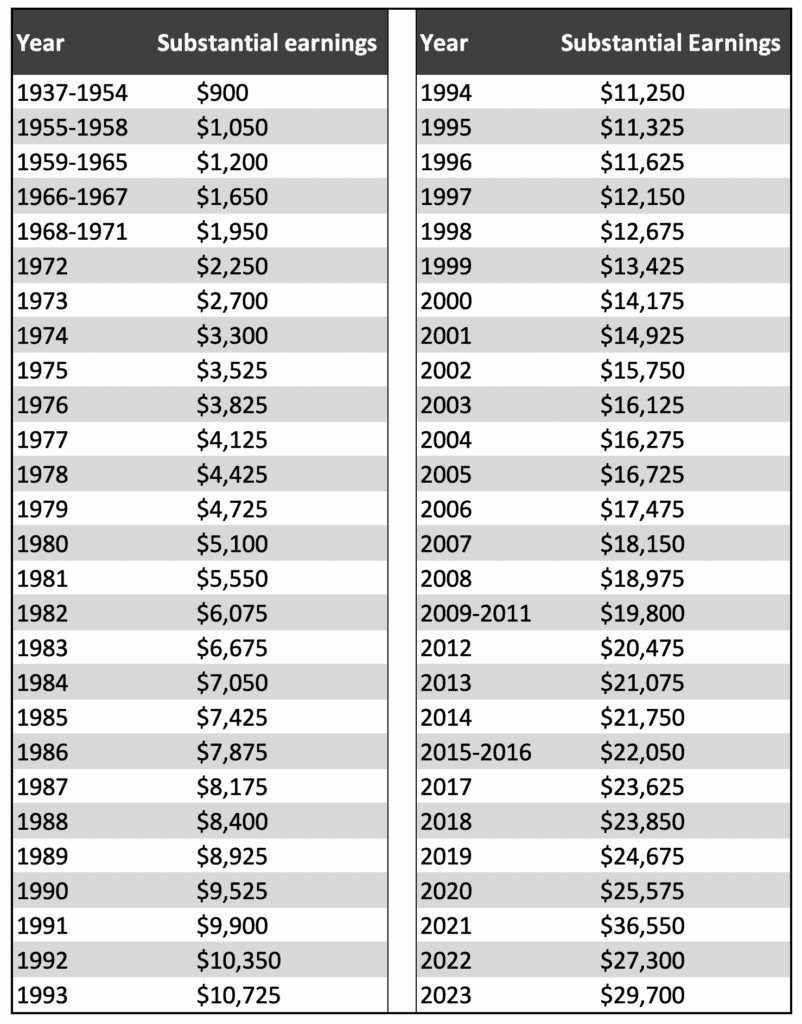

Below is a chart of the substantial earnings by year which would be required to sidestep the WEP.

For more information, see the Social Security Administration’s WEP Benefit Calculator.

How the WEP is Calculated

When Social Security benefits are calculated, the SSA inflates your historical earnings, takes your highest 35 years of earnings and divides by 420 (the number of months in 35 years). This gives them the inflation-adjusted average indexed monthly earnings that are then applied to the formula which is made up of income brackets. The result of this formula is your primary insurance amount (PIA) which is also known as your full retirement age benefit.

If you have a pension from work where no SS was paid, your benefits are calculated on an alternate formula. The result of this alternate formula is a lower benefit amount.

At first glance, this alternate formula looks nearly identical to the ‘normal’ formula. However, upon closer inspection, you’ll notice that the earnings in the first bracket are credited to your final Social Security benefit at 40% instead of the 90% found in the normal formula.

When WEP Application Ends

There are a few circumstances where the application of the Windfall Elimination Provision will end. The result is a recalculation of benefits using the ‘normal’ calculation formula.

Here’s the section of the SSA website that discusses the circumstances of this recalculation.

5. When WEP application ends

The WEP computation is no longer used when:

- the entitlement to the pension payment ceases or the proration of a lump sum payment based on a specified period ends,

- the NH dies (in the month of the NH’s death, the PIA is recalculated without applying WEP), or

- the NH becomes eligible for the WEP exemption by earning 30 YOCs. (The system will automatically identify additional YOCs and consider a recomputation for WEP.)

The most notable point is when an individual who is subject to the WEP dies. In this case, the survivor’s benefit is recalculated without the WEP.

For example, before Dave became a Texas teacher he worked for a large retailer for 19 years. Because of his teacher’s pension his SS benefit was subject to the alternate WEP calculation. What should have been a $1,500 SS benefit became a $1,100 benefit. Unfortunately, Dave died at 70. His wife fully expected to receive his $1,100 SS benefit as her widow’s benefit, but instead she found out that her benefit would be closer to $1,500. This was because the WEP penalty was removed when Dave died.

Effect of Filing Early or Filing Later

So what happens if you file early? Your benefit amount is reduced due to your age, but does the WEP penalty decrease as well? The same question could be asked if you wait until beyond your full retirement age to file. Will your penalty amount increase? The Social Security Administration has a page where they discuss this, but it is not clearly written (no surprise).

Here’s what happens to your Windfall Elimination Provision penalty if you file before or after your full retirement age.

The Windfall Elimination Provision reduces your benefit amount before it is reduced or increased due to early retirement or delayed retirement credits. It is this WEP-reduced benefit that is increased, or decreased, due to filing age.

Don’t leave without getting your FREE copy of my latest guide: Top 10 Questions and Answers on the Windfall Elimination Provision. You CAN simplify these rules and get every dime in benefits you deserve! Simply click here http://www.devincarroll.me/top10WEPSSI.

If you still have questions, you could leave a comment below, but what may be an even greater help is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. Also…if you haven’t already, you should join the 400,000 subscribers on my YouTube channel!

My state pension is a 401k style. I am unsure about how much I would withdraw from it at retirement. It could be paid as a lump sum but then the federal taxes kick in. How will WEP be calculated if my withdraw from the account varies year to year?

I am receiving a civil service pension for 10 years. Currently I have been working the last 4 under social security. Will I be subject to the WEP penalty when I get my 40 quarters and request benefits?

Are there any groups lobbying to stop this unfair penalty? If we clearly worked and earned this money why shouldn’t we receive it? I would like to know how we can eliminate WEP.

I am a retired Texas teacher. Before I retired I got half of my exhusbands Soc Security. As soon As I started collecting TRS retirement I had to stop collect his. I did have 40 quarters so I do get one-third of my own. Why can’t I get one-third of his?? Will WEP be eliminated?

Hi there. I got married to my American husband in 2011 and we are living in U.S.A.. This year, I became eligible to receive a spousal pension, and I’m thinking of applying for it soon. I had been working in Japan for about 16 years, but have not worked in the U.S. because I did not get a work visa. Since this year, I have began receiving the Japanese pension of 55,000 yen or $500 per month. If I apply for a spousal pension now, I will receive $919 per month. Is the WEP applied to me? I would appreciate… Read more »

My husband was a teacher for 31 years in Texas. He was in the military and retail for 14 years prior to becoming a teacher. His social security benefits are $600.00 a month. Is he able to collect SS as my spouse? I collect $1,950 a month.

Well, I found out too late that when I withdrew my contributions to my teachers retirement in Missouri, and only my contributions, that the WEP was applied to my Social Security because I became elegible to retire before I withdrew my own contributions… it has cost me plenty… it seems very unethical ..I paid 20% in federal taxes on that money, 10% of state taxes, and now it’s costing me $400 a month in my Social Security benefit.

Ty 4thr info

I retired at 59 as a police officer in Massachusetts, but had enough prior employment to earn Social Security which began at age 62. My annual statement stated that I would receive $550/month, but my actual payment was $252/month, well under the 50% cap mentioned in this article.

Does the WEP deduction get adjusted over time as a person files for SS benefit but continues working and accumulating more years of substantial income?

I’m trying to find out information for my aunt. It is complicated. She was a government employee who did not contribute to Social Security. She left this job and took her pension in cash around 1988. Then she went back to a government job and paid into social security for 10 years. She has been collecting Social Security for several years now. She is 66. Her husband passed (he paid into Social Security for the correct number of years – he was collecting social security before he passed) and we are delayed in getting any information from social security on… Read more »

so Daniel, do I have this correct? that if I paid in to ss for 41 yrs I will be exempt from the WEP? Those years were 1980-2021. Teaching full time. (but in 2 different states, Md. and Ma,)would really appreciate your feedback.

If I paid into SS for 41 years of teaching 1980-present does it matter that 22 yrs were in Md. which is NOT a WEP state?

Now that I’m teaching in Ma. and retiring from Ma. will I still have to pay the WEP on all 41 years?

can I get half of mt spouses benefit as I currently get a very small amount because of the wep or am I disqualified because of wep

Wow unbelievable. Tracy here From Austria I want to say a very big thanks and appreciation to DR. AKERECO of all spell casters worldwide for bringing back my husband who left me and the kids for almost six months within the space of two days after following all instructions given to me. I am very much grateful for restoring peace in my marital home, and I pray God almighty gives you the strength and wisdom to continue helping more people having similar relationships and marital problems like mine. For help you can contact him now through his email and mobile… Read more »

Thank you so much Dr Steven for helping me to get my ex wife back. My wife that left me few months ago just came back to me last night crying for me to take her back. dr.steven is a true and real Psychics He brought back my wife” Here’s his content if you have any problem. Email him at: DrStevenspell@outlook.com or Whats-app him: +2347055392475 . thank you so much for helping me out thank you.

Greetings to every one that is reading this testimony. I have been rejected by my husband after three(3) years of marriage just because another woman had a spell on him and he left me and the kid to suffer. one day when i was reading through the web, i saw a post on how this spell caster on this address(dr.okpodosolutionhome@gmail.com), have help a woman to get back her husband and i gave him a reply to his address and he told me that a woman had a spell on my husband and he told me that he will help me and… Read more »

I’m 66, I did 19 CSRS and 18 FRS I got hit with WEP does working a small PT job to eliminate one zero and one temporary job back in the 70s help a little. Would the larger amount say $20 dollars then be hit with about 34,% WEP? If I do this pt job two years I eliminate two small year wages. Say $299 and $55 PT Christmas help. And earn $5.599 and $6,099 will that still help to eliminate one zero and two low earning years?

Are there any individuals in Brownsville Texas that can assist with some of my questions that I can call?

I retired from DoD in 1992 at age 57. In 1983 when WEP became effective I had already achieved 40 quarters of

SS earnings. When I applied for SS at age 62 WEP drastically reduced my SS earnings. Is there any chance that I should have been exempt because of being qualified before WEP legislation took place?

So I have a disabled family member who always worked full time minimum/low wage jobs well over 30 years in social security however he never met the substantial earnings threshold. Because of how the WEP reduction hits his small state pension he’s eligible for Medicaid and foodstamps. The substantial earnings threshold also hurts women who are forced to take “mom jobs” due to childcare which is a true real life burden. There needs to be legal action of sorts to make this draconian 1983 Reagen era provision brought to the light. If there was such a thing as universal childcare… Read more »

It is an active site, but I rarely go through my comments here. Instead, I encourage my readers to go to my Facebook Group at https://www.facebook.com/groups/428684237572614/

Is this an active website to ask questions??

This is the best explanation for the WEP I have read.

If I move my member directed Ohio plan into a qualified retirement plan can I avoid the windfall?

I am 66 and have been receiving SS retirement benefits since age 62. This benefit has been subject to the WEP due to a small pension I receive from teaching in CT where

Public school teachers do not participate in Social security. I just filed for spousal benefits as my husband just retired. I find that although I am entitled to additional benefits on his account, I will receive only 1/3 of this amount bc of the GPO. I am being subject to both the WEP and the GPO at the same time! Is this even possible? Should I appeal?

I retired in 1998 and was horrified that my social security was much lower than my pension as I had paid to both and after reading this I understand. WHEN i RETURNED, i WAS NOT TOLD OF THE wINDFALL ACT OR HOW IT WOU LD AFFECT ME. iS THERE ANYTHING i CAN DO? i LIVE IN TEXAS. Has this got anything to do with my being charged for the Hospital part of the ins. under Social Security. Many people say that they do not.

Thank you for explaining this unfair ruling. All I ever wanted is what I have earned nothing more or less. Just give people what they have earned.

Thank you for a clear explanation of the WEP which I was shocked to learn about at retirement. It continues to gall me that teachers, firefighters, and police officers are so impacted by this loss of hundreds of dollars after retirement.

I believe the original target was well-paid members of Congress and that there is a bill to repeal all or part of WEP that is still in committee.

Will teachers, firefighters, and police officers ever get fairly reimbursed?

I am 66 yrs old. I immigrated to USA and worked as a teacher for 13 yrs. I am currently receiving a small pension from Calstrs. I need to work for one more quarter in order to qualify for SSA benefit. The total number of years I work will be 23 yrs. There is really no ‘ double dipping’ here. If I loose 50% of my SS benefit because of WEP, my total retirement income will be less than $2000 per month, after SSA deducts payment for Medicare Part B. Is there any provision in WEP for people with this… Read more »

I just saw your article. I am already 64 and collecting small Calstrs subject to WEP. At 66, will just have 20 years’ substantial earnings, so really no reduction till then. Did I fail by not retiring at 62? Is it too late to get any WEP reduction at 64? Because if it is, I am stuck working till at least 67, struggling to make substantial earnings every year, because my job was just eliminated by Medicare changes.

My husband recently started working as a paraeducator in Florida. He barely makes an income from it (pretty much minimum wage) and there is no pension available for this job. They made him sign a WEP agreement when he started the job, but when I examined his paychecks, the school district is taking money from his paycheck for Social Security. So confused….it looks like he is paying SS, so why did he sign the WEP form when hired?? Please answer. Thanks.

I want to know if my husband dies, can I receive any of his social security benefits. I was a part time teacher because of my kids. I only make a 800$ pension and 200 social. I would have to go on welfare and loose my house if I don’t get any of his.

Politicians and Bureaucrats don’t need guns to rob us, they use laws written so obscurely and not advertised that when they hit you it like a thief in the night. I am dealing with Agent Orange and the VA after serving as an infantry troop in the 1st, 2nd and 5th ranked most heavily sprayed areas of Viet Nam (Aspen Institute study). Not a dime for me and my extended family until I have cancer, which unfortunately everyone of my platoon mates have. Then I need too depend on the “Health Care” from the VA. Good grief. I just found… Read more »

I don’t understand the horror to this. If you don’t pay SS taxes for 30 years yet get a pension from where you actually worked, it washes and probably will get more than SS would pay. That’s why we pay such high taxes to compensate for the city employees getting 100% of their salary when they retire. Although I think that’s changing to a more reasonable amount. What am I not seeing here. Why should you get both???

Hello, very good information. My wife is a UK citizen but has lived and worked in the US for the past 20 years. She is entitled to pensions in both the UK and in the US, including Social Security. Her UK pensions would obviously qualify as “non covered” pensions, as there was no contribution to US social security. So I have a few questions: 1) is she subject to the WEP on her Social Security benefit? 2) If so, when calculating the WEP “penalty” does it include every type of pension? In other words, she is entitled to a state… Read more »

If at least 21 of those years met the definition of “substantial earnings” you should absolutely file a Form 561 and ask the Administration to review the record. You can compare your earnings with the list of substantial earnings on page 2 of the SSA piece found here. https://www.ssa.gov/pubs/EN-05-10045.pdf

When I applied for social security my benefit was reduced from $700 to $350 because of the WEP. I just looked at my earnings history and have actually paid social security taxes for 35 years as I usually had part-time income while I worked for the city as well as my employment prior to and after that career. Would it do any good to have them reevaluate my benefits?

Can the Windfall Elimination Provision reduce the amount of social security benefits by more than the amount of a government pension? Example: You work in the private sector with 24 years of “substantial earnings” and have social security benefits of $2000 per month. Then, you work a part-time government job that doesn’t withhold social security, and you are required to contribute $2000 per year to the pension program. You leave that job after 5 years and receive a lump sum from that plan of your contribution of $10,000 plus interest of $500. That $10,500 divided by 20 years (a guess… Read more »

Do both the WEP and the GPO come into play when spousal benefits would be higher than the individual’s own social security benefit? Ex: Firefighter retires and has worked sufficient quarters outside of firefighting job to qualify for social security on his own. However, his spousal benefit under his wife’s social security would be considerably higher than his own social security benefit. The windfall elimination provision applies to his own social security benefit as explained above. When considering the spousal benefit, is this where the government pension offset (GPO) comes into play?

“While the Social Security Administration is fond of saying that the maximum WEP penalty is $428 (for 2016)”, it is really based on the year you reach 62. If you turn 62 in 2011 the maximum WEP penalty is $374.5. It is not based on the year you apply for social security.

I just received a letter today, that my benefits have been cut by $412.00!! I qualify for retirement, but I am still working as a teacher, and can’t afford to retire. Do they have the right to cut my benefits before I receive my pension? That sucks!!!

Thank you for the article. It helps.

I have looked everywhere and can’t find information that i need. My husband gets social security, and i have an strs retirement as well as a very small social security check due to wep. If my husband dies before i do, can i receive his social security (significantly higher than my ss) instead of mine with a wep offset and still collect my strs pension? He will get half my pension and his full ss if i die first but we are confused about what will happen with ss for me if he dies first.

Clear as MUD.😞

Thank you for making this so clear.

However, since I live outside the US for the past 18 years I receive a pension from my Israeli employer’s fund and am not clear how the SSA relates to this.

On my 1040’s over those years, my salary was within the 75K exclusion, so I paid no US social security on that.

Will my benefits now be affected?

Paragraph five should be updated to state that some federal employees are subject to the Windfall Elimination Provision, too.

I worked in India in an Indian government job from 1971 to year 1993 before migrating to US in 1996. I am getting pension from Indian government for that job since 1993.

I have been working in US since 1996 and contributing to social security since 1996.

Will my Social security be reduced due to WEP?

I am subject to WEP, and I collect SS under my own earnings. When my ex husband dies, I will then collect under his earnings, assuming that I am still alive. Will the WEP rule apply then??

I wish I had read this 5 years ago. I started survivor benefits 6 years ago. 5 years ago I started drawing TRS. I had no clue until yesterday that I was not entitled to both. My debt is over $30,000. I have been reporting and paying IRS on both but it wasn’t until I applied to change to my own SS that I was told of this.

In order for the offset to apply, the ‘non-covered’ pension must come from YOUR work. Being a beneficiary on a pension alone will not trigger the offsets.