In April of 2021, Ways and Means Committee Chairman Richard Neal, (D-Mass.), reintroduced the Public Servants Protection and Fairness Act of 2021. This legislation was originally presented to Congress in 2019, but died without receiving a vote. But now that the balance of power has shifted in both houses of Congress, this proposal has a much higher likelihood of passage.

The goal of this Act is to provide an equitable Social Security formula for individuals with noncovered employment and to provide relief for individuals currently affected by Social Security’s Windfall Elimination Provision (also known as the WEP).

Repealing the WEP with a new formula should help ease the difficulty that individuals with noncovered pensions face when planning for retirement. Although it’s not widely known, the annual Social Security benefit estimate does not include the WEP penalty in the estimated benefit. Furthermore, most Social Security technicians – let alone financial advisors – fail to understand the nuances of how the WEP is applied. They cannot explain it adequately, and although they may be trying to help, too often only add to the confusion.

There’s no reason we need to keep going this way. It’s past time for this outdated rule to be reformed.

To better understand the legislation on the table and how it would impact your Social Security benefits, it helps to start with a quick recap of how the WEP works today, what would change, and why reform has been a long time coming.

Understanding the Windfall Elimination Provision As Is Today

The WEP rule reduces Social Security benefits for those who worked in a job in which:

- They did not pay Social Security taxes, and

- They qualified for a pension from that job, and

- They worked at another job where they qualified for Social Security benefits.

Teachers are one of the most common groups to be impacted by this rule, but it often includes other public sector workers like firefighters, police officers, and numerous other state, county, and local employees.

What the Windfall Elimination Provision Repeal Looks Like Now

In a press release, Representative Neal explained why he introduced a new piece of legislation to repeal the existing Windfall Elimination Provision:

“Originally, the WEP was intended to equalize the Social Security benefit formula for workers with similar earnings histories, both inside and outside of the Social Security system. However, in practice, it unfairly penalizes many public employees. The much-needed reforms in this bill provide meaningful WEP relief to current retirees and public employees while treating all workers fairly.”

This is certainly not the first serious effort to reform the WEP, but this could have a better chance of success than its predecessors.

In the past, most of the reform bills died a fairly quick death. The topic of WEP repeal or reform makes for good election-year campaign speeches. Once the election is over, however, the bills struggle to get the necessary traction and bipartisan support for passage.

The closest any WEP reform legislation has gotten in the past few years was when Representatives Kevin Brady (R-TX) and Richard Neal (D-MA) co-sponsored the Equal Treatment of Public Servants Act of 2015 (H.R. 711). Ultimately, the House Committee on Ways and Means postponed its consideration of that proposal due to concerns raised by the 175,000-member National Active and Retired Federal Employees Association (also known as NARFE).

While there may still be roadblocks to The Public Servants Protection and Fairness Act of 2021, objections from NARFE won’t be one of them. The group already offered their support of this bill, releasing a statement to say they wanted to “express support for – and thank you for preparing to introduce – the Public Servants Protection and Fairness Act of 2021.”

There are multiple other national, state, and local employee organizations that have also officially backed this round of legislation, as well. But only time will tell if this support helps turn the Public Servants Protection and Fairness Act into actual law.

Before that happens, anyone impacted by the WEP, and therefore, its potential repeal, needs to understand how this potential change could look.

What the Public Servants Protection and Fairness Act Includes

The Public Servants Protection and Fairness Act of 2021 has three main components:

- The introduction of the Public Servant Protection (PSP) formula

- $150 per month benefit increase for everyone current affected by the WEP

- Improvement of Social Security statements to show the effect of the PSP formula

Let’s cover these individually.

The Public Servant Protection (PSP) Formula

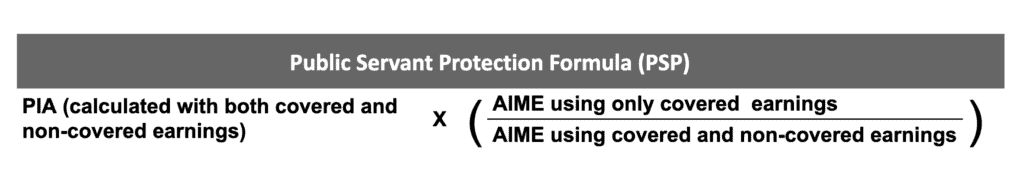

The cornerstone of the Public Servants Protection and Fairness Act of 2021 is the introduction of the Public Servant Protection (PSP) formula. The mechanics of the PSP formula are meant to pay Social Security benefits in proportion to the share of an individual’s earnings that were covered for Social Security purposes.

Here are a few of the most notable features of the proposed PSP formula:

- Individuals would have a benefit level computed both under the current WEP provision, and in addition, a benefit level computed under the new PSP provision. The benefit level provided would be the higher of these two computations.

- The PSP would become effective in 2023 for individuals who receive a pension based on non-covered earnings.

- On average, benefits would be $75 per month higher under PSP than WEP.

- Those with a foreign pension would continue to use the WEP formula.

- The PSP would not apply to those not receiving a pension from non-covered earnings or to those with 30 years of substantial earnings. This is one of the key differences from the Public Servant Fairness Formula (PSF) which has been the WEP replacement formula in prior reform proposals.

In order to fully understand how the PSP formula will change a benefit calculation, it helps to recap how benefits are currently calculated.

The Social Security Administration currently adjusts your historical covered earnings for the inflation that occurred over your working years. This inflation adjustment goes through age 59; earnings at 60 and beyond are used at face value.

Then, the Administration takes the total of your highest 35 years of covered earnings and divides that by 420 (which is the number of months in 35 years). The result of this calculation is your Average Indexed Monthly Earnings or AIME.

Once your AIME is calculated, the SSA uses its formula to calculate your primary insurance amount, or PIA. This is accomplished by calculating your covered AIME through three separate bands which are in effect in the year you attain age 62:

- For AIME that falls within the first band, you multiply by 90%. That is the first part of your benefit. (If you have a pension from non-covered work, this multiplier is generally 40% due to the WEP.)

- For AIME that falls within the second band, you multiply by 32%. That is the second part of your benefit.

- For AIME that is greater than the maximum of the second band, you multiply by 15%. This is the third part of your benefit.

The sum of these three bands is your PIA or retirement benefit amount at full retirement age (FRA).

The new PSP formula would continue to work off of this same framework, with a few small differences.

First, your PIA would be calculated using both covered and non-covered earnings (instead of only using covered earnings). Then, in addition to calculating your AIME based solely on covered earnings, your AIME would also be calculated using both covered and non-covered earnings.

Using these two AIME calculations would allow the SSA to determine the ratio of covered to non-covered earnings for purposes of awarding Social Security benefits in proportion to the share of an individual’s earnings that were covered.

This entire PSP calculation would be accomplished by a simple two-step process:

- Calculate the PIA using both covered and non-covered earnings with the normal (non-WEP) formula (using 90% as the first multiplier).

- Multiply PIA by the ratio of AIME with all covered and non-covered earnings, to AIME with covered earnings only.

An Example of the PSP Formula in Action

We can see how this would work in the real world by walking through an example with real numbers together. Let’s assume your PIA is $2,500. You have an AIME using covered earnings of $4,000, and an AIME using both covered and noncovered earnings of $6,000.

The ratio between those two AIME numbers is .66. The PSP formula then multiplies the PIA by that ratio. In this case, it would be $2,500 x .66 = $1,650 as your actual benefit amount.

Using the WEP formula, an individual with a $4,000 covered AIME would receive a benefit of $1,359, or $291 less per month with the current rules.

Author’s note: It is not immediately apparent if the new AIME calculation (using both covered and non-covered earnings) would be based upon the high 35 years of earnings or ALL years of earnings. Hopefully, we’ll receive clarification on this in the days ahead.

Benefit Increase for Those Currently Affected by the WEP

Current retirees and those eligible for Social Security benefits before 2023 who are affected by the WEP, will receive a benefit increase of $150 per month under the proposed changes.

These additional payments will begin nine months after enactment of the bill and will continue each month for as long as the eligible individuals are receiving Social Security benefits.

Individuals will receive this increased payment as long as their WEP reduction is at least $150. If their WEP reduction is less than $150, the increased payment will equal the amount of reduction.

Showing Estimated Benefits with PSP Calculation on Statements

Currently, Social Security statements do not reflect a benefit reduction due to the WEP. This results in serious retirement planning mistakes by individuals who plan their post-work income based on their estimated benefits in their Social Security statement.

If the Public Servants Protection and Fairness Act of 2021 becomes law, the Social Security Administration will be required to show noncovered as well as covered earnings records, and to use the new PSP formula for calculating the projected benefits for workers likely to be subject to this formula. This will result in much more accurate benefit projections and confidence in retirement planning.

As new reform proposals make their way through the legislative process, I’ll be here to keep you informed and tell you what you need to know.

Don’t leave without getting your FREE copy of my latest guide: Top 10 Questions and Answers on the Windfall Elimination Provision. In this guide, I go over more detail on the WEP and answer questions like:

- Can I avoid the WEP by taking a lump sum from my pension?

- What about 457 accounts?

- Does my pension affect my spouse’s Social Security?

You CAN simplify the WEP rules and get every dime in benefits you deserve! Simply click here to download today.

In addition, I’d highly encourage you to check out some of the additional resources I’ve created that will deepen your knowledge on the WEP.

- The Best Explanation of the Windfall Elimination Provision

- Subject to the WEP? Your Social Security Statement is Wrong!

- How To Calculate The WEP & GPO With Mixed Earnings Under The Same Retirement Plan

- Social Security and Lump Sum Pensions: What Public Servants Should Know

- How the Government Pension Offset and Windfall Elimination Provision Affects Dually Entitled Spouses

Also…if you haven’t already, you should join the 328,000+ subscribers on my YouTube channel! See you there!

RESOURCES:

Text of Bill

https://waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/Text%20-%20Public%20Servants%20Protection%20and%20Fairness%20Act%20of%202021.pdf which refers to Sec. 215. [42 U.S.C. 415] COMPUTATION OF PRIMARY INSURANCE AMOUNT

https://www.ssa.gov/OP_Home/ssact/title02/0215.htm

Letter from the SSA to Rep Neal https://waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/ActuaryLetter_20210401.pdf

House Ways and Means press release

House Ways and Means Committee section by section summary

Thinkadvisor Article covering this https://www.thinkadvisor.com/2021/04/07/bill-would-boost-social-security-for-some-public-workers/?fbclid=IwAR0Jz31CY2xRs9qsU2PSuGAnfsPKe9llt8UamL1n0uGDXXwAUTb62Y55lFk

An older look at how the new formula would work

It really is aggravating that government intrusion into our lives financially has gotten to this point. I received no help from a dead beat dad and paid for my high school education and then while a public servant had to pay child support that kept me at minimum wage. Tuition was paid to my high school because my parents no longer lived in the school district I had decided to graduate with the people I knew. Then when I remarried the ex spouse of my current wife was not held to the same standard I was. Now after 30+ years… Read more »

Due to my age while working for DOD I was eligible for and received my full Social Security entitlement pay. I had worked at various jobs before and after serving in the U.S. Army and while working my way through college and while paying into Social Security. I subsequently worked for and retired after 30+ years of federal service under the CSRS plan. I’ve been penalized for retiring and have lost nearly $40,0000 in lost Social Security Pay. In addition, the paltry cost-of-living pay increases for Social Security have only given me the net sum increase of $6 PER MONTH… Read more »

Unless it effected you, you cannot truly know how hurtful this WEP has been, all of us worked low paying jobs to be of service, picking up part time employ to make it come close to working.

Never knew about the WEP time bomb. Can’t buy out of it, can’t work longer, but if a survivor, you need not worry, doesn’t apply. Forty cents on the dollar. Repeal this unfair rule. It’s hurt no one should have to endure.

Thanks for this information, Devin. Every year, both the House & Senate put forth bills to repeal GPO/WEP. This year, they are HR82 & S1302. Every year, they get a large number of cosponsors, but they never seem to go to a vote by either the House or Senate. Nearly every president has promised to sign these bills into law if they make it to their desk. In your opinion, do these yearly repeal efforts stand a chance of getting all the way to the president’s desk or are they just put out there to make public servants (working class… Read more »

Personally, I feel that WEP and GPO should not be reformed, but repealed so that those who have accumulated social security earnings can receive their full earnings. These two provisions treat the public workers different from other workers who have a pension or retirement plan with other entities other than the government. These non-public workers will get their full social security earnings, even though, they have a retirement or pension plan too. Let us get this corrected so that fairness can prevail. I do not understand how our politicians do not want to repeal the WEP and GPO. What is… Read more »

i have been penalized now for 22 years (264 ss payments) about half of my EARNED social security because i have a modest law enforcement pension. i would liked to have seen a civil suit filed because they retroactively took away from me what they orginally had promised.

From what I’ve read so far, the new formula will NOT apply to those with a foreign pension. They will still be covered under the current WEP calculation.

Are you saying that this new bill will NOT in any way or form change anything for non-covered time having paid in and receiving social security from a foreign country having an social security agreement with the USA (e.g. Germany&USA)?

I read your comments that the WEP calculation for this will NOT change?

I see that the public servants can have hope! Great! But people working abroad for a part of their lives are not included in this reform, right? Still, a part of our foreign benefit will be grabbed by SSA.

Will we receive the $ 150 too? I doubt. What SSA will take away from us will still finance other people. Unless I do miss something?