The concept of a universal Social Security benefit, where all retirees receive the same flat payment, isn’t a new idea. But this proposal recently resurfaced and gained attention for its potential to be a long-term fix for the solvency of the Social Security program.

Proponents of this strategy see it as a way to avoid raising taxes and avoid cutting benefits to mid-and lower-income retirees. At the very least, Universal Social Security benefits certainly would be a departure from the current structure of the program.

You Pay Into the System – and Social Security Benefits Are Relative to Your Earnings

Since the inception of Social Security, there has been a direct connection between the amount of taxes paid in and the benefit received. If you paid a lot in Social Security payroll taxes throughout your working career, your eventual benefit would be higher than someone who didn’t pay in as much.

This connection is what separates Social Security from a traditional welfare program. People feel like they have earned their benefit because they spent years contributing to the system. You have an earnings record that is directly connected to the benefits you receive

Related article: Are Social Security Payments Guaranteed?

There’s a lot of perceived ownership with the current system. But this system is in serious trouble.

Social Security Has to Change, But the Question Is How

In a little over a decade, Social Security will not have enough funding to support the number of people receiving benefits. The Social Security Administration will have no choice but to cut benefits by 25% across the board unless there are some serious changes made to the program.

The Social Security program is massive, which means those changes must happen before we get to the 11th hour. Otherwise, like a ship steering around an iceberg, there just won’t be enough time to maneuver.

This means that the necessary changes will likely fall on the Biden Administration.

While the administration has tossed around ideas for various proposals, none of them will provide a long-term fix for financing the Social Security program.

Using a universal Social Security benefit, however, has the potential to be that long-term fix we need. Providing a flat payment amount for all retirees can solve the massive problems facing this program.

Why Universal Social Security Benefits Can Fix a Broken System

At first glance, it would seem that a plan to increase benefits for low-income earners and reduce them for upper-income earners falls right into the playbook of the most liberal of politicians.

But it might surprise you to learn this universal Social Security proposal comes from The Heritage Foundation, which is generally thought of as a right-leaning, conservative organization.

In their analysis, The Heritage Foundation found that not only would a gradual shift to a flat payment system nearly erase the Social Security shortfall, but payroll taxes could actually be reduced for workers!

However, this change requires a reframing of how we currently think of the Social Security system.

When the program was first introduced in the 1930s, it was a safety net against poverty in old age. Many older people were literally penniless, with those over 55 facing destitution in their remaining years. One-third to one-half were dependent on family or friends for support.

The Social Security system was created to help these older Americans buy food and other necessities. If you look at the current statistics provided by the Social Security Administration, this original intent of the system is still carried out for lower-income individuals.

But what’s changed is the fact that there are individuals who receive Social Security benefits who simply don’t need that income.

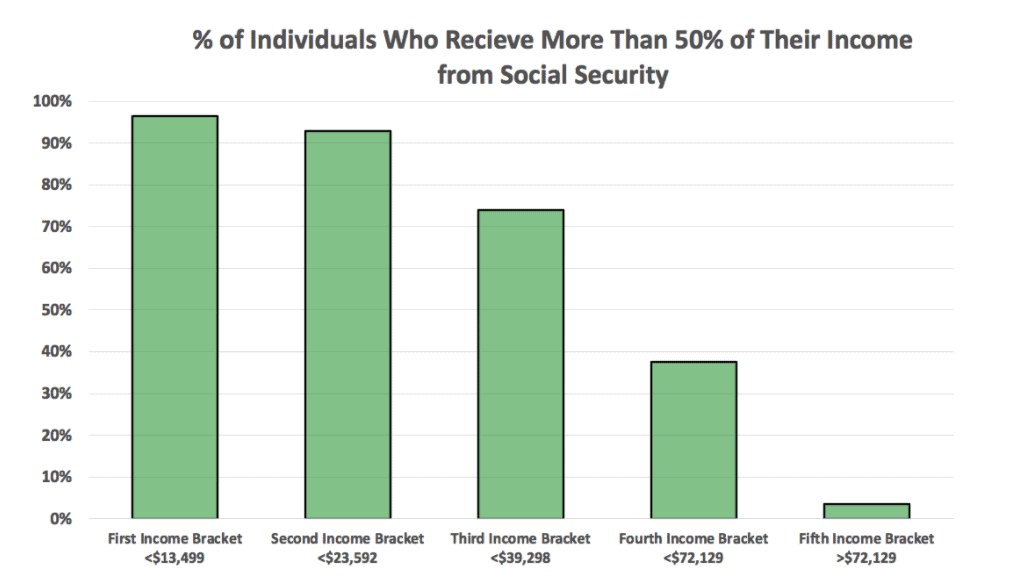

According to the SSA’s most recent Income of the Aged publication, there is a big difference in the groups who depend on Social Security income. This report breaks individuals over the age of 65 down into 5 income groups.

In the first income group (those with the lowest incomes), more than 96% of individuals report receiving at least half of their income from Social Security.

In the fifth income group (those with the highest incomes) only 3.6% of individuals report receiving half of their income from Social Security.

SOURCE: https://www.ssa.gov/policy/docs/statcomps/income_pop55/2014/sect09.html#table9.a4

But even though the higher-income groups report less dependence on their benefits for monthly income, it’s these individuals who receive the highest amount in benefits from Social Security due to their higher earnings in their working years.

It’s not too much of a stretch to say a system that gives higher benefits to those who depend on it the least is no longer protecting against poverty.

Not only is the system as it is today not serving its original purpose, but there are also additional studies that suggest programs like Social Security eliminate or reduce many of the traditional reasons that motivate households to save. Individuals may be incentivized to think, “Why save for retirement when I have Social Security to fall back on?”

Universal Social Security, or a flat benefit amount for all recipients, would be a reversion back to the intent of the program: to provide supplemental income for the lowest-income individuals in retirement to prevent older Americans from going hungry or homeless.

Meanwhile, higher-income individuals would still be eligible for a benefit payment. But they would be less incentivized to rely so heavily on the system and instead may boost their own savings rates during their working years, and the connection between paying payroll taxes and entitlement to benefits still remains.

How Universal Social Security with a Flat Benefit Payment Could Work

The thousand-foot view is that the Social Security system would very gradually move from the current system to a universal payment where benefits would increase for low-income earners and be reduced for higher-income earners.

This move wouldn’t happen overnight. In fact, it would take several decades to be fully implemented.

According to a recent plan from The Heritage Foundation, it wouldn’t have any impact on anyone who was already 62 or older. And for those who weren’t 62 by 2021, there would be changes but they would be very small.

This plan would take 32 years for full implementation, which means that those who would feel the full effect are 30 years old or younger in 2021.

This gradual phase-in would allow plenty of time for individuals to do the required retirement planning to ensure they have sufficient income after they stop working — while providing the needed revenue to continue paying benefits as promised.

It would also offer some certainty for generations of young savers who, as it stands today, do not believe that Social Security will be there for them in any form.

Before we get into the details of this plan, it will help to cover a quick view of how retirement benefits are calculated.

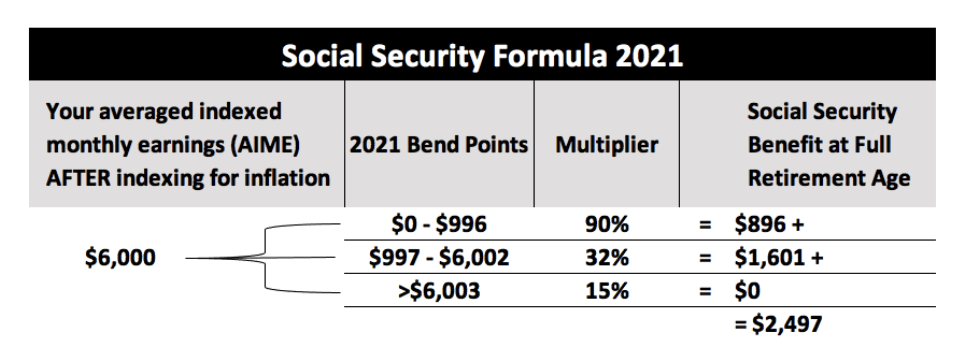

The Social Security administration adjusts your historical earnings for the inflation that occurred over your working years. This inflation adjustment goes through age 59; earnings at 60 and beyond are used at face value.

Then, the Administration takes the total of your highest 35 years of earnings and divides that by 420 (the number of months in 35 years). The result of this calculation is your Average Indexed Monthly Earnings, or AIME.

Once your AIME is calculated, the SSA uses their formula to calculate your primary insurance amount, or PIA. This is accomplished by calculating your AIME through three separate bands which are in effect in the year you attain age 62:

- For AIME that falls within the first band, you multiply by 90%. That is the first part of your benefit.

- For AIME that falls within the second band, you multiply by 32%. That is the second part of your benefit.

- For AIME that is greater than the maximum of the second band, you multiply by 15%. This is the third part of your benefit.

The sum of these three bands is your benefit amount at full retirement age (FRA).

In the chart below I’ve illustrated how the formula works for someone who turns 62 in 2021 with an average inflation-adjusted earnings (AIME) of $6,000 per month.

The switch to a universal Social Security benefit would simply change this formula to produce a flat benefit to all retirees, as long as their historical earnings were high enough to fill up the first bracket.

The formula bend points would gradually change as follows:

- Increase the first band by 1% per year until it reaches 112%

- Decrease the second band by 1% per year until it reaches 0%

- Decrease the third band by .5% per year until it reaches 0%

With this formula, an individual with lifetime monthly earnings of $1,000 would receive the same benefit as the person with lifetime monthly earnings of $10,000.

Mid- to higher-range income individuals would not get the same “return” on their payroll taxes as they did in the old system. But that’s the likely outcome of any plan to save Social Security.

Whether it is increased payroll taxes, means testing, or any of the other proposed solutions, those with mid-to higher-range incomes need to prepare for less generous treatment from Social Security at some point in the future.

In this same proposal from The Heritage Foundation, they also point out that implementing a universal, flat Social Security benefit could reduce payroll taxes from the current 12.4% to 10.1%! That would amount to nearly an extra $1,600 per year in take-home pay for median income households.

Compare that to continuing the current benefit payment schedule, which would require the payroll tax to rise from 12.4% today to 15.7% in 2035 — and to exceed 17% by 2080.

Would Universal Social Security Fix The System?

A switch to a universal Social Security system wouldn’t fix the entire funding issue with Social Security. But it would help us make a lot of progress toward a solution that works.

The analysis of the universal benefit indicates that switching to a flat payment would fix 84% of the solvency issue. And remember, this plan doesn’t require tax increases or unplanned benefit cuts. If this solution can be coupled with other reforms such as indexing the retirement ages to life expectancy, the problem could be completely solved.

This is one proposal that I’ll continue to monitor closely. If a proposal like this makes progress I’ll be talking about it on my YouTube channel, so join the other 322,000 subscribers to know as soon as I publish a new video.

Also…remember…THIS IS YOUR RETIREMENT. Continue to learn about how to make the most out of it by using the resources like the Retirement Planning cheat sheet I’ve created. This is where I’ve taken the retirement plan contribution limits, income limits, tax tables, and lots of other important things and break it all down to just one page.

[…] I’m willing to acknowledge that a payroll tax increase is likely in the days ahead. The political winds are blowing too hard in that direction. But I don’t like it, and think there are some other great solutions like the one I discussed in my article on Universal Social Security. […]