“Devin, they told me I can’t file for Social Security at 62!”

My client, Cheryl, was a little upset. She’d just returned from a trip to the Social Security office where she’d been told that she could not collect benefits as soon as she turned 62.

Cheryl did exactly what she thought she was supposed to do. Her birthday was July 3, so she went into the Social Security office in May and met with a claims representative.

The claims rep finished her filing process and told Cheryl that she should expect her first check on the second Wednesday in September.

What?!

If my client turned 62 in July, why would it take two months to get her first check?

It’s because of a weird rule that says you have to be 62 for at least a full calendar month before you’re eligible for benefits. In Cheryl’s case, she wouldn’t receive a benefit until September because she was not actually eligible for benefits until August.

The Social Security Administration Has a Funky Rule About How Old You Really Are

This rule doesn’t mean that everyone has to wait until the month after their 62nd birthday to be eligible for benefits. The Social Security rules follow the English common law that says a person attains an age on the day before their birthday.

For example, if your birthday is June 18, then your “effective” birthday is June 17. If you’re born on the first day of the month, the Social Security Administration deems you to have changed ages on the last day of the prior month. If you’re born on the second day of the month, your effective birthday is the first day of the month.

The birthdays that occur on the first and second day of the month are notable because you can be born on these days and still qualify for benefits in the month you attain age 62. For everyone born after the first or second of each month, they’ll have to wait until the calendar month is up before they are eligible for benefits.

Thankfully, this “throughout the month” rule doesn’t work the same when you attain full retirement age. You’re eligible for an unreduced benefit beginning in the month you turn full retirement age regardless of the day of the month.

How Day of Birth Affects Benefit Reduction

Calculating how much your benefit will be reduced for early filing can also get a little tricky when trying to file as soon as you turn 62.

Those born after the second day of the month won’t be eligible for benefits until the following month, but the SSA still views your age as 62 and 1 month — thus slightly increasing your benefit payment. Those born on the second day of the month are eligible in that month for an unreduced benefit.

The weird part of the rule is for those who are born on the first of the month. They’re deemed to have turned 62 on the last day of the prior month. Therefore, the Social Security Administration actually counts those people as 62 and 1 month in the month they attain age 62.

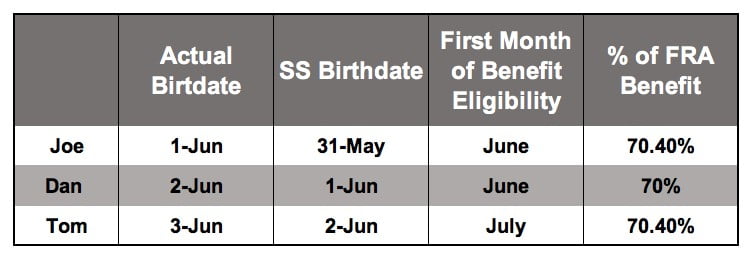

Here’s an example of three individuals to help make sense of these weird rules around and definitions of birthdays:

Joe was born on June 1. Dan was born on June 2. Tom was born on June 3 They all had identical earnings and each has the same full retirement age benefit.

With that full retirement age benefit being $2,000, here’s when they would be eligible for their age 62 benefit and how it would be calculated.

Joe, who was born on June 1, has an effective birthday of May 31. He would be entitled to benefits in June because of the rule that pushes his birthday to the previous month. The benefit would also be equal to the amount he could receive if he filed at 62 and 1 month.

Dan, who was born on June 2, has an effective birthday of June 1 according to the SSA. And by their rules, he’d also be entitled to benefits in June. His benefit would be paid to him as if he filed at 62 and 0 months.

Tom, who was born on June 3, has an effective birthday of June 2 — and he would have to wait until July to receive benefit eligibility. However, since he was technically 62 and 1 month old, his benefit would be adjusted accordingly.

How Early Should You File Before the First Check?

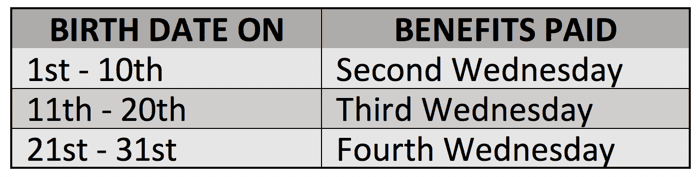

When planning your retirement income, the first thing to know about Social Security benefits is that they are paid one month in arrears.

This means if you’re eligible for benefits beginning in June, you won’t receive your first check until July. The day of the month is dependent on your date of birth:

- If you were born between the first and the 10th, you’ll receive your check on the second Wednesday of the month.

- If you were born between the 11th and 20th, you’ll receive your check on the third Wednesday of the month.

- If you were born after the 21st of the month you’ll receive your check on the fourth Wednesday of the month.

Because you receive your payments one month in arrears — and to avoid other snags that could come up — file at least 90 days before you want your Social Security checks to start.

Now that you have this information, I hope you won’t be surprised like Cheryl. The “day before” rule on birthdays is strange, but it’s a rule you need to know to effectively plan your retirement income.

Questions or Comments?

If you still have questions, or would like to leave a comment, you could use the comments section below, but what may be a better option is to join my FREE Facebook members group. It’s very active and has some really smart people who love to answer any questions you may have about Social Security. From time to time I’ll even drop in to add my thoughts, too. Also…if you haven’t already, you should join the 100,000+ subscribers on my YouTube channel!

Little Unknown not mentioned in the article… I chose to retire early (62), My birthday is on the first. I filled on the 13th. Had I filled between the 1st and 5th of that month…I would have received my first check that very month (2nd Wed), instead of haning to wait for the following month. (This came direct from the SS agent) So, if your BDate falls on the first, get you butt in and file asap!

I was born on December 1, 1957. Social Security told me I will get my first check in January. I told them I read about a rule stating that Social Security looks at people born on the first of the month as if they were born in the month before (November for me) and I would therefore get my first check in December. They said I’m wrong. Am I not understanding the rule??

I am 66 and 9 months years old and receiving a Federal Government Pension under CSRS with not enough Social Security earnings on my own (short of 7 quarters), my pension is almost triple than what my spouse’s Social Security benefits base on her own earnings. Am I eligible for spouse benefits?

My birthday is jan. 29, 1956. I filed back in may of 2018. I retired on sept. 1, 2018 and they told me i would get my first check in october.

Hi; My twin and I came to this country in 1981. We went to college for higher education. During one of the classes, the professor was bragging of how the Social Security was so effeciant. He also added that no two people had the same SS#. Being new in this country, we didn’t know how the system worked. We both were issues the same numbers under different names. Our name are one letter different from each other. Same mode name and last name and of course same date of birth. We went to the SS Office and the lady asked… Read more »

Why would Congress enact legislation that not only take all survivor benefits earned from a sole survivor who struggled to raise two children and mentor step children after the death, the deceased was in the process of applying for social security benefits but died prior to receiving a benefit, under the Windfall Elimination Plan; and, back to back reduce benefits earned under social security to short of half, using the Government Pension Offset for workers who put in the extra hours as a worker and paid into a retirement plan? This being said, under their definition of double dipping for… Read more »

If my birthday is August 4, when would I collect check and is it the 70.40% ?